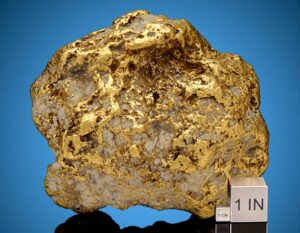

Analysis - Gold

Gold price 5 year chart

Gold. Source: Mining.com

Gold (chemical symbol: Au) is a precious metal, just like silver, platinum and palladium, and one of the most valuable and highly sought after on the

planet. Its main purpose is for investing or preservation of wealth, or a hedge against inflation. As small deposits with likewise small operations can already be profitable, gold juniors are

the most abundant among junior miners on the various exchanges, but certainly the Canadian TSX Venture and TSX.

Articles:

Feb 26, 2024 - KLD.V - Tags: Alaska, Copper, Explorer, Frotet, Gold, Kenorland Minerals, Prospect generator, Quebec, Regnault, Sumitomo, Zach Flood

Jan 20, 2024 - KLD.V - Tags: Alaska, Copper, Explorer, Frotet, Gold, Kenorland Minerals, Prospect generator, Quebec, Regnault, Sumitomo, Zach Flood

Coming soon

Market Data - 15m delayed

First Hand CEO Interviews, Site Visits, Presentations & Market Analysis:

Real-time knowledge sharing for global investors: CEO.CA

LINKS

© 2016-2021 CRITICALINVESTOR.EU All rights reserved.