Gamechanger For Vior: Raising C$21.8M PP With Osisko Mining, Institutional Funds And Family Offices

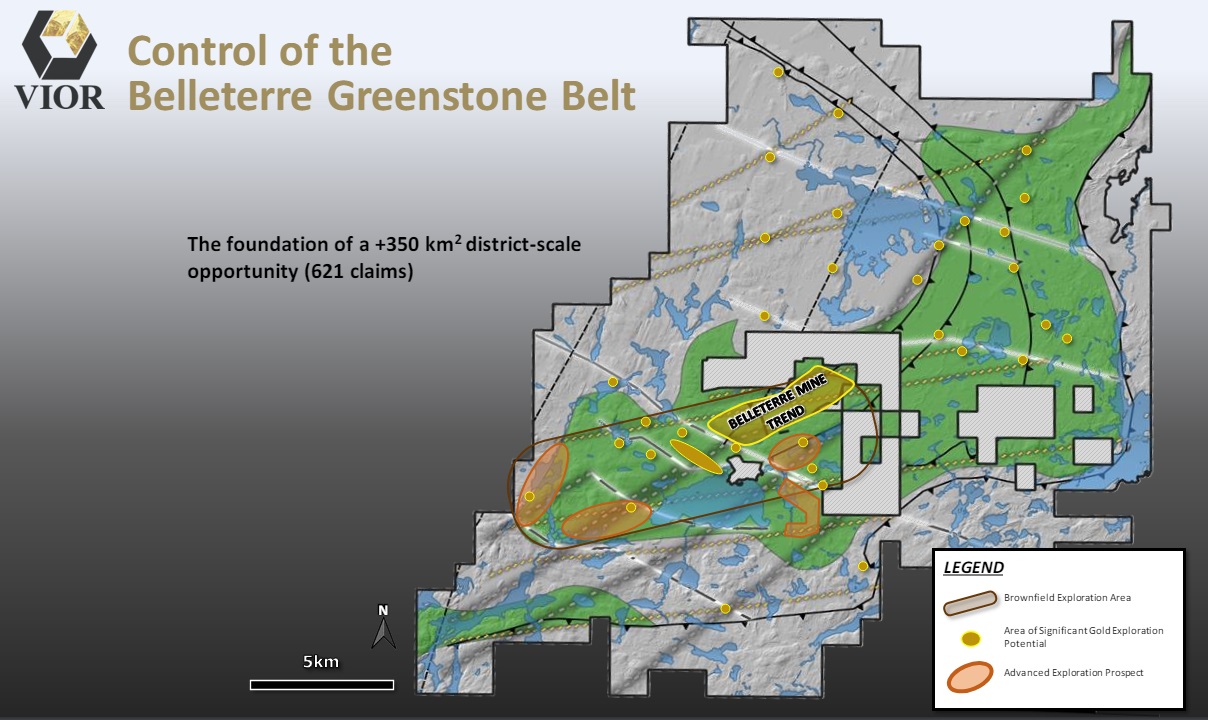

In a time where the world seems to get increasingly used to the Russia and Israel conflicts, China antics on trade and Taiwan, and a Federal Reserve preparing for rate cuts beginning in June, the gold price has broken out pretty violently, and printed a new high over US$2,400/oz, and maintains these lofty levels so far. Gold equities with ounces to their names, producers and developers, finally seem to react to this type of action, now it is time for explorers being last in line to follow suit. One of them is Vior (TSXV:VIO)(FRA:VL51), which just closed a combined colossal financing of C$21.8M (market cap before first closing was C$14M) with the likes of existing backers (Osisko Mining, Quebec institutional funds) but also many new and highly respected institutional funds, high net worths and family offices. In short, lots of institutions are entering now, and despite the significant dilution, it is good to see most of the shares are ending up in pretty strong hands. With district scale prospective projects in its portfolio (flagship Belleterre Gold Project and the Skyfall Nickel Project, both located in Quebec, a very safe jurisdiction) and a small free float this should bode well for the near future, as exploration plans are being prepared at the moment.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

It must have been a while since I saw a junior explorer with a C$10-15M market cap raising more than its entire market cap in one go, but that is exactly what Vior has just done. Trading at C$0.135 (market cap of C$14M) when announcing the up to C$20M offering at C$0.125 (NFT) and C$0.225 (FT) on March 20, 2024, Vior stunned the markets. Both NFT and FT have a half 2 year warrant priced at C$0.21. The “main” financing was quickly closed on March 28, 2024, with C$6.23M issued in NFT, and C$13.1M in FT shares, with Osisko Mining picking up 16.56M shares (C$2.07M ) plus an additional 19.84M shares (C$2.48M) as subscription receipts and subject to shareholder approval. This best efforts private placement was led by Eight Capital, together with PI, Canaccord, Red Cloud, Cormark and Leede Jones Gable. The agents didn’t work for nothing as the aggregate fees accounted for C$735k and 3.36M broker warrants priced at C$0.21, equaling 3.7%. This first financing was followed by an additional non-brokered PP closing of C$2.5M with the same NFT terms, and was meant to accommodate several institutional funds and HNWs that couldn’t arrange their participation in time for the deadline of the first C$19.3M. With a grand total of C$21.8M, this financing is a resounding success for Vior.

CEO Mark Fedosiewich was understandably very pleased with the results, and stated, "We are pleased to announce this second finance closing with several institutional funds and high net worth individuals, who were not able to meet the tight closing window of the original March 28, 2024 financing. These combined closings, totalling $21.83M, reinforce the confidence and commitment that well-heeled investors have demonstrated in the Vior team and our flagship Belleterre Gold Project. We are well underway in the permitting for the initial 60,000 metres of drilling, and we anticipate that drills will be turning sometime in June. We look forward to a very busy and exciting news-filled year ahead".

These impressive financings don’t come without massive dilution of course. With the number of outstanding shares currently at 213.0M, Vior is planning to roll back 3 to 1, after closing of the Subscription Receipts financing in early June that would add another 19.84M shares bringing the total share count to 232.86M. After the roll back, the new share structure would represent 77.62M shares outstanding. The dilution for existing shareholders is pretty significant, but I don’t think many shareholders would object too much, as this pile of cash, coming from mostly institutional backers and Osisko Mining, is a total gamechanger for the company. Gone are the days they had to beg for money for small drill programs, and the difficulty in generating consistently interesting results. Vior has become somewhat of an exploration powerhouse now, almost an exploration arm of Osisko Mining regarding Belleterre Gold. And we all know when Osisko has set its sights on a project, it doesn’t let go anytime soon.

Some of the Osisko proceeds are placed into escrow, on the condition that Osisko gets approval from Vior shareholders, to officially become a control person (necessary as Osisko would hold approx. 21.8% (coming from 13.8%) of outstanding shares undiluted after this approval, and approx. 28% (coming from 14.6%) on a partially diluted basis with all warrants exercised). This will be decided on at a special meeting for shareholders on May 31, 2024, but there is no doubt in my mind that the majority of shareholders will approve this. Osisko is already a big backer of Vior for years, and their teams have been working together diligently on Vior’s flagship Belleterre Gold Project.

As a consequence, Osisko Mining will have the right to nominate two representatives to the Board of Directors. Another part of recent dealmaking involves a royalty option agreement, where Osisko can acquire a 2% NSR on Belleterre for C$5M. Osisko has to pay Vior C$250k for this option, and this agreement will be finalized after Osisko becomes a control person after the aforementioned shareholder meeting in May.

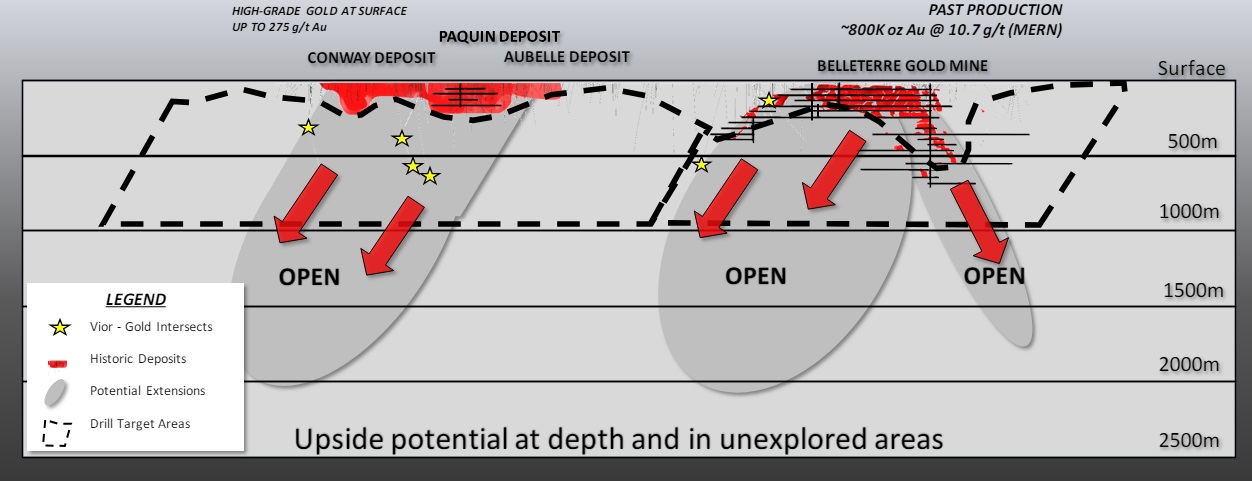

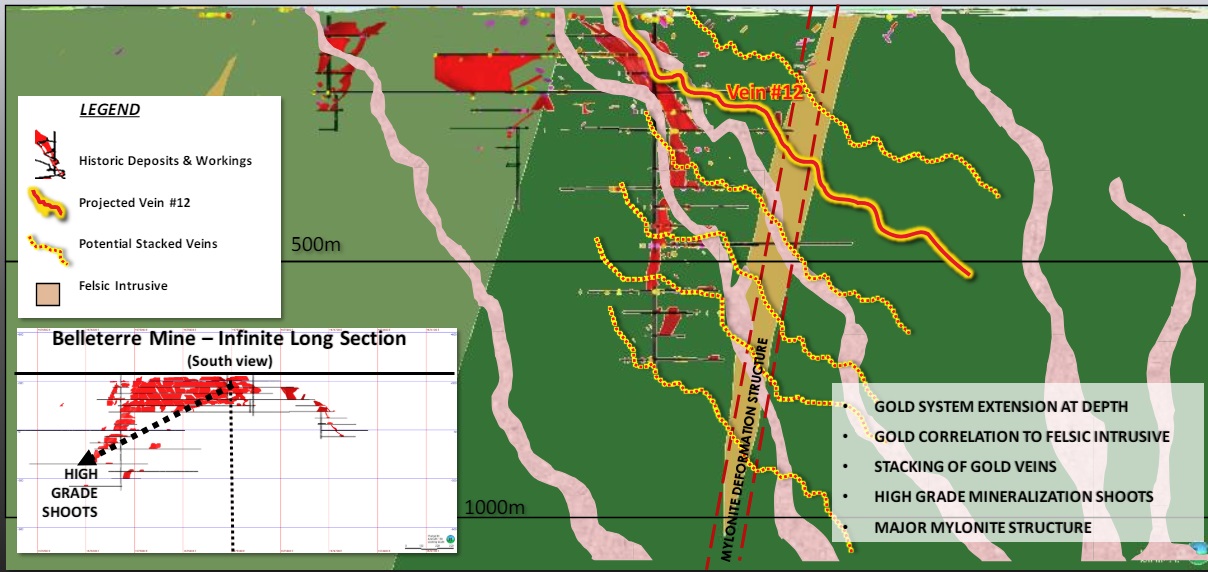

For drilling at the Belleterre Gold Project, CEO Fedosiewich explained that he was aiming to begin the 60,000m drill program for approximately 120 holes sometime mid-to-late June. There is a new drill permit procedure initiated in Quebec this year, taking Osisko Mining about 7 solid weeks, and involving more discussion with stakeholders including First Nations. Vior has already started this procedure for their drill permits at Belleterre, has excellent relations with First Nations, and is allowing for about 8 to 10 weeks in total.

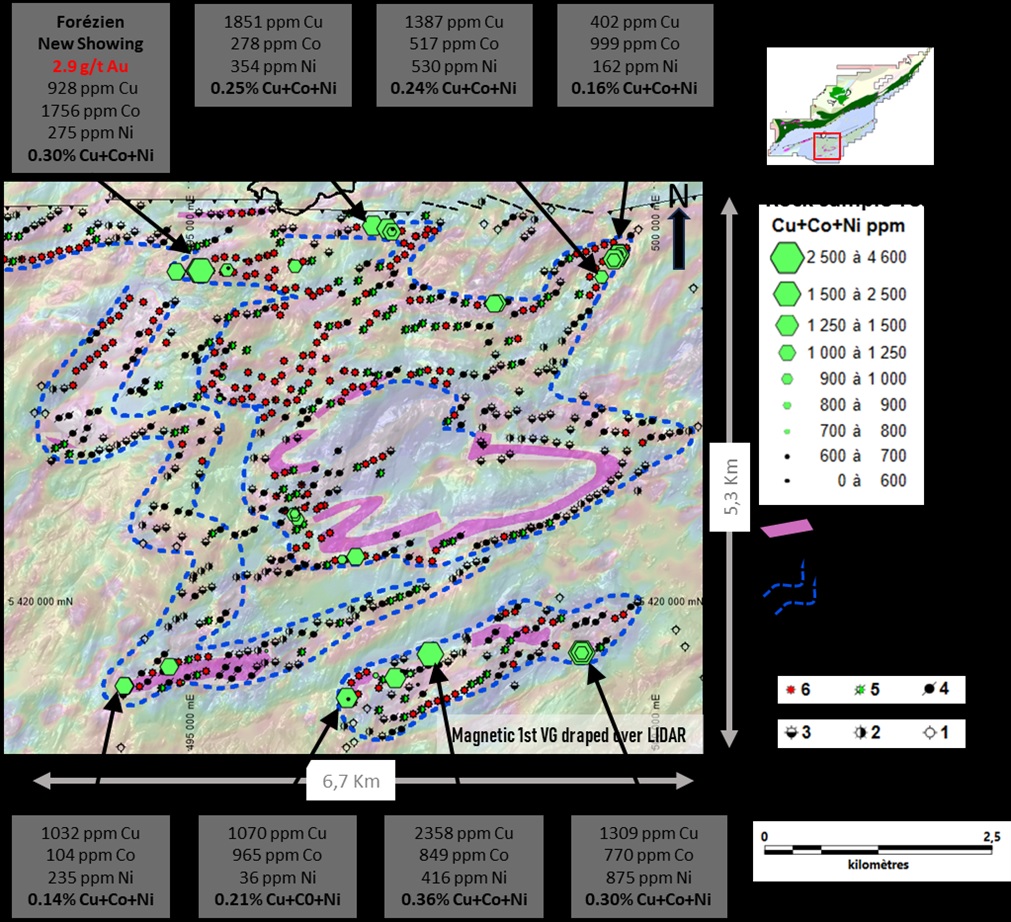

That's about it for for recent news about Belleterre. As Vior also completed their 2023 field program at their second district-scale project Skyfall, generating encouraging sampling results last month:

Management is looking forward to another 4 to 6 week field program, beginning Spring and into Summer 2024 in order to generate good drill targets. Work will focus on stripping and trenching of multiple recognized nickel prospects, including the Forézien showing, and surrounding area. Regional exploration will continue with Beep Mat™ prospecting on the VTEM™ Plus conductors that have not yet been assessed. Overall, three metalliferous environments will be assessed for the following:

- magmatic Ni, Co, Cu and platinum group elements (PGE) mineralization within ultramafic rocks;

- the possible remobilization of these same primary mineralizations within adjacent metasediments; and

- the possibility of hydrothermal-type Au, Co, Cu mineralization, also hosted in metasediments.

According to CEO Fedosiewich, drilling could begin in Q4 2024 and/or Q1 2025.

Since Vior has enough on their plate right now at Belleterre and Skyfall, management elected to divest their Foothills Phosphate project in Quebec. A 4 year option agreement to earn an 80% interest was signed with Niobay Metals in February, 2024, for C$400k in cash, a minimum of 5.5M shares of NioBay, and C$4M in exploration expenditures.

As a reminder, Vior also has an equity investment of 3.64M shares in Ridgeline Minerals Corp (TSXV:RDG), currently valued at rock-bottom prices, worth C$388k. Ridgeline is exploring 4 highly prospective gold/copper/silver projects in Nevada, ranging from Carlin type to CRD, and cooperating with Nevada Gold Mines on two projects ( US$30M earn-in on Swift, US$10M earn-in on Carlin-East, targeting high grade, Tier I >5Moz Au deposits).

As another important reminder, the underexplored Belleterre Gold Project is, aside from the majority of the claims already 100% owned by Vior, largely subject to 3 main Option agreements: with JAG Mines Ltd, 9293-0122 Quebec Inc. and Osisko Mining Inc. The Option with JAG allows Vior to acquire 100% of this specific land package for C$2.3M in cash and/or shares, and C$2M in exploration expenditures, over the course of 4 years, with C$2M of the C$2.3M in cash or shares scheduled for the last year, representing very little payment obligations until June 31, 2026. JAG holds the equivalent of a 1% NSR over the property.

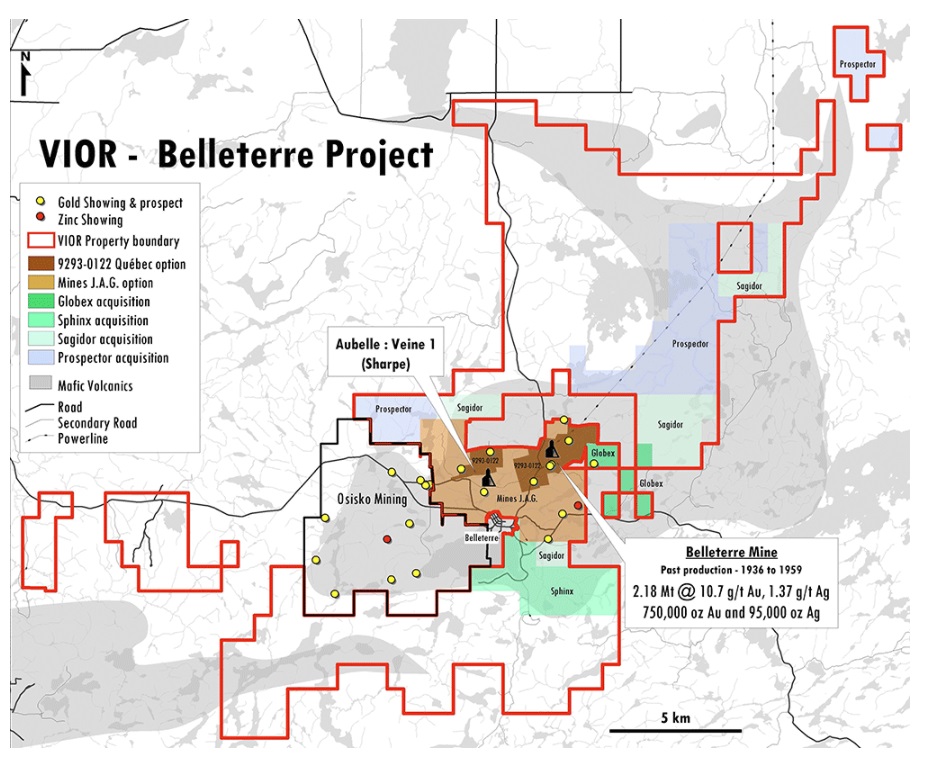

The purchase option with 9293-0122 Quebec Inc, which covers the Belleterre Gold Mine and its direct surroundings, allows Vior to purchase a 100% interest, by paying C$2.1M in cash and/or shares before 2025 year end or thereabouts, and with no exploration expenditures. There will be no royalty involved on these claims. This purchase option was arranged during the main consolidation acquisition phase for the Belleterre project, when numerous other claims were acquired from other parties. Most of these parties were granted a 1% NSR, and Globex was granted a 2% gross metal royalty. The various claims can be seen on this older map:

The option agreement with Osisko Mining allows Vior to acquire up to 75% of Osisko’s current interest in their Belleterre properties (see above at the map claims Osisko in black). 51% can be acquired by issuing C$225k in shares over 3 years and by incurring C$1.25M in exploration expenditures before August 2024. Vior has the right to acquire another 24% by incurring another C$1.75M in exploration expenditures within 3 years after exercising the 51% option. No royalty is part of this deal, unless the interest of one of the JV partners drops below 10%.

Conclusion

It is remarkable what a difference a rising gold price could make for junior explorers. It enabled Vior to raise a staggering C$21.8M, coming from lots of institutionals, funding up to 60,000m of drilling at their flagship Belleterre Gold Project in Quebec. These are different amounts from the previous, small 3,000m to 5,000m drill programs, and are moving more into the direction of typical Osisko Mining numbers, the company slated to become a control person after the upcoming special shareholder meeting in May. I consider recent developments a real gamechanger, as the large and prospective Belleterre project definitely needs significant drill programs to explore properly, which is being enabled now by this financing. Drilling at Belleterre is set to commence in June. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Vior Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.vior.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.