PDAC 2024: First Signs Of A Bull Market?

The Prospectors & Developers Association of Canada (PDAC) was well attended this year, with 26,926 attendees coming to Toronto from all over the world, for the best business, investment and networking opportunities in the mineral exploration and mining industry. This was a significant improvement over last year, when 23,819 participants visited the largest mining conference on the planet. With more than 1,100 exhibitors, including governments, companies and leading experts from around the world, PDAC 2024 was one of the largest events in the association’s history anyway. The weather was pleasant, with temperatures around 5-12C and lots of sun all week, with the outlier being the first day of the Red Cloud event, which saw an unforecasted drop to -1C and a bit of snow. I mention the Toronto weather separately as it can vary so much, and can be very harsh at times. As I am from The Netherlands, I am not used to Niagara Falls freezing temperatures at all, and prefer this for sure.

Last year’s PDAC sentiment was revolving around an anticipated upcoming recession and high inflation, potentially followed by a commodity bull market. We haven’t seen a recession yet, despite very mixed economic indicators, and we are still facing higher than targeted inflation (2%), after the most aggressive rate hiking sequence ever. The current high gold and copper prices might indicate the first signs of a long awaited commodity bull market, although highly inflated opex and capex neutralized most high metal prices so far.

When listening to many participants at this year’s PDAC, the general feeling seems to be if metal prices keep rising, and costs maintain current levels or even start dropping, the coveted bull market could commence, especially with many long-lasting shortages forecasted due to extensive underinvestments. It was a good thing to hear on many occasions, that juniors managed to raise much more money during PDAC than normal, likely supported by the recently achieved all-time high gold price, and copper reaching 7 month highs.

As always, the PDAC President made an official concluding statement at the end of the conference:

“PDAC 2024 carried forward the Convention’s 92-year legacy, serving as the premier venue for unveiling new trends, technological innovations, and industry discussions,” said PDAC President Ray Goldie. “Once again, PDAC was proud to showcase a rich array of programming including capital markets, Indigenous relations, student and early career development, and sustainability.

Canada is poised to lead the green transition as the supplier of choice for responsibly sourced critical minerals. It is imperative we bolster our critical mineral wealth, and we cannot ignore the foundations of our mineral industry. PDAC’s closing call to our federal government is that it must renew the Mineral Exploration Tax Credit that is set to expire this month.”

Much more interesting was the interview Goldie did with Investing News Network. He dubbed critical minerals as the main topic, followed by solving funding problems by juniors. He sees royalty companies and family offices starting to step in, where equity markets were before. The story about his involvement with the relocation of the convention from the Royal York to the Metro Convention Center makes you realize that Goldie isn’t completely new to the scene. He also mentioned the strategic plan of PDAC: the three purposes of the organization are giving members access to capital, access to land and access to skills. It seems PDAC is in good hands.

To get an impression of the level of keynote speakers: they included Jakob Stausholm, CEO, Rio Tinto; Michael Stanley, Mining Lead, The World Bank; Denise Johnson, Group President, Resource Industries Caterpillar Inc. and Wojtek Wodzicki, the Lundin Group Vicuña Exploration Team.

A household subject for my PDAC review is probing the sentiment on the exhibitor floor:

Michael Fox, Editor of Prospector News:

“I had a very good PDAC, it was extremely busy, I managed to put together a lot of people to talk business this year, more than the last few years, and secured some new clients. I found the sentiment as being cautiously optimistic. I suspect that a gold price over $2100 had a lot to do with that. I did however notice a lack of news coming out and more practically a lack of M&A activity. So, we as an industry still have a long way go to go before we have a healthy market again.”

Jason Weber, President & CEO of Silver North Resources (client):

“Of course the PDAC is now a week of conferences with the Red Cloud Pre-PDAC gathering Thursday-Friday, the Metals Investor Forum Friday-Saturday and then PDAC proper starting on Sunday through to Wednesday afternoon. It was great to escape the cold temperatures (and snow!) in Vancouver for the balmy Toronto temperatures but it makes for a long week. I was quite curious to see what the mood was going to be at PDAC after such a dismal fall and winter in the junior markets and no January-March uptick that we can often count on (and usually ends right around the conference). Although we are optimists at heart in this business, the mood was in fact cautiously optimistic this time around, being bolstered by the strong performance of gold and silver on the Friday before the conference and continued the following week during the show (further highlighted by the number of financings launched during PDAC).

Silver North did not have a booth at the Investors Exchange at the convention but did at the Metals Investment Forum. We spoke on the last panel of the day with John Kaiser and had a great response from investors, shareholders and technical people discussing our Haldane and Tim silver projects in the Yukon, even continuing as most of the other booths were torn down. That was very positive for us and is an indication that perhaps the tide is turning when it comes to discovery-stage silver exploration projects. Only time will tell, but there certainly was a sense that we might be coming off the bottom in the junior markets, and we have been faked by false starts many times in the last few years. That said, I think that there was a sense that we may have been seeing some real capitulation and that the bottom is in now.

We also had some very productive discussions with groups during PDAC that have projects available. My sense is that the difficult markets have forced companies to narrow their focus and trim their project portfolios because of the difficulties in raising capital to keep and explore them. We reviewed some surprisingly good projects that would complement our existing projects, and I have a feeling that the asking prices are fairly reasonable. Another sign that we are at or nearing a bottom perhaps.”

Zach Flood, President & CEO of Kenorland Minerals (client):

“I mostly had meetings outside of the conference this year. Sentiment was cautiously optimistic with gold price on the rise. Juniors are still struggling for capital. Majors are very active looking for good exploration projects.”

Ken Brinsden, President & CEO of Patriot Battery Metals:

“We could feel a perking up of enthusiasm and hope from investors around lithium in the recent months. We have also seen a big increase in the interest from strategic players in the battery supply chain industry to entertain discussions. We have seen the Japanese company Mitsubishi signed a JV deal with Frontier. There were a lot of Korean and Japanese groups in attendance at PDAC. EV sales are still maintaining their upwards trajectory and the worries that China will dominate the industry are very real. We believe we can play a key role in the Western world supply chain of battery materials.

What we are witnessing is a rapid improvement in the knowledge and understanding level of investors and market participants about the lithium industry and EV supply chain. The questions are getting a lot more precise and the differentiation of our main property, Corvette, compared to others, is better understood. Size and grade matter, of course, but crystal sizes, quality of rock for potential processing, quality of potential partnerships are all things that come up in conversations and create a distinct appeal for Patriot.”

Mark Saxon, President & CEO of T2 Metals:

“I headed to PDAC with fairly modest expectations. The broader market was testing all-time highs while the junior market was near all-time lows and little money had been raised. There are typically many no-shows during tough times, with empty booths the sign of capitulation. I was pleasantly surprised by the event however. Aisles were busy, booths were full, conversations weren’t too full of gloom, and most importantly I met quite few younger or less traditional mining people taking a fresh approach towards mining, exploration or marketing. My son joined me for the first time, and it was great to share a real PDAC vibe, even if my threats of the annual record-breaking blizzard were misplaced.

We were fortunate in T2 Metals (TWO.V) as we reported strong gold and copper results in the weeks leading into PDAC, and we sit within a group of companies that are all attracting interest. Our flow of foot traffic was constant and I’m sitting on a big pile of business cards needing follow ups. Investor interest switched from lithium & nickel to copper, gold & uranium, and it was great to see T2 Metals getting recognized for having acquired and progressed a strong copper-dominant project portfolio. I came away with an up-trending share price and a positive feel for 2024 for those companies with the technical team, project and mindset for real exploration.”

Greg Ferron, President & CEO of PTX Metals (client):

“My main observations are as follows:

Industry

• Strong government and industry support and growing interest (meaning real industry automobile, technology) for battery metals in Canada and globally. These groups generally focus on a theme to create jobs, politics, environmental, community such as First Nations and infrastructure, and take a long-term view. We are in the early stages of this transition and it’s great to see. They will probably invest big and play the long game, which will benefit the mining industry over many cycles.

• Finally, mining seems to get some respect for its importance, and improving ESG practices.

• In terms of the market, look at the big cap stocks in resources and mining. Inflows are starting the past 3 months with positive or flat performance from Teck, Barrick, Lundin, Suncor, AEM, TRP, AGI, Rio, BHP, AGI. We could very well be in the early stages of a major commodities and bull market for mining sector which could potentially run 5-10 years before leveling off to a more substantial and sustainable sector.

• Discoveries, robust orebodies, and hot metals still rule the sector.

• The junior mining sector needs a period of consolidation which could start in 2024.

PTX Metals

• More specific to home, PTX Metals Inc (PTX:CSE) (PANXF:OTCQB) recently acquired a historic copper nickel and PGE (dominant metals) and cobalt resource drilled by Inco, and was located within the existing boundary of its district scale W2 project in Ontario. The transaction will prove to be transformational for the company.

• An estimated USD$2.5 billion of in situ value on the historic resource area (14.6 Mt Cu Ni PGE). This excludes the 60 holes outside the resource area to the NE along 10km of strike.

• This is the first time any company has had the whole 250 km2 package together under one roof with the historic Inco resource blocks and extension to the NE that runs about 10 km.

• We are drilling now.

• Significant expansion potential at depth and step out along strike and new targets.

• The company also has several gold and uranium assets.”

Scott Berdahl, President & CEO of Snowline Gold:

"We had a busy run at this year’s show – at our booth, at the core shack, at various corporate presentations including the Tombstone Gold Belt breakfast, and at meetings all over downtown Toronto. It was great to see gold hitting record prices at the convention, and that brought with it a lot of enthusiasm and energy, but despite the optimism there still seems to be a sense of waiting—particularly waiting for gold equities to take meaningful steps towards the gains seen in the price of the physical metal. We’re still not seeing a huge influx of generalist investors, and it remains a difficult market for a lot of issues. At Snowline we have been fortunate to have kept a strong treasury, and while there is growing awareness of and interest in our story, I got the sense that there is a lot of capital in the wings that could come into the space if the gold price holds or if other tailwinds appear."

Mark Brown, President of Pacific Opportunity Capital:

“Well as an investor at PDAC, there were all sorts of ups and downs – Nickel and Lithium were on the down side while Uranium and Gold (and Silver!) were on the upside. Since most people look at these prices for sentiment it is important but the key is that high prices just get funding for exploration so discoveries can be made and that is what really brings in more capital to the sector. The suppliers, public companies and investors at PDAC were all very busy this year with lots of hard work to be done to bring the shine back to our whole modern mining sector. It was also great to see many younger faces at the conferences, keen to make a difference in supplying the green energy transition and new technology companies with always important metals.”

Brett Richards, President & CEO of Goldshore Resources (client):

“I think PDAC was as it always is – “Subtle Sunday” / “organized confusion” on Monday / and Tuesday-Wednesday student and senior citizen day(s) and overall, it is a good conference to take meetings, as everyone in our sector is in one city at the same time, so that has to be good – right ?

We meet – we speak – we catch up with people of days gone by and we look for new ideas.

But does it add shareholder value – no. Does it bring new orders to the mining services companies – not likely.

Is it a platform for social engagement, country/region promotion and overall marketing a brand – absolutely – but is there value in it ? It is a difficult argument to make pro or con – it is an event you have to go to, but wonder how is this helping my organization raise money (when there is no money) / create liquidity (when there is no money) – oh, but yes, it is “creating awareness” – so that must be worth spending $12-15,000 of shareholder money – as one has to get a booth spot and 3 people’s flights, hotels and any food and drinks not covered by all of the free events of banks and suppliers.

As was the BMO conference, I think the thematic is still copper, copper and more copper please. Gold played a close second, given the rally it went on during the week – but gold is only attractive to people over the age of 55 and PDAC’s demographic is about 2/3 in that age band, so gold was probably talked about more than usual, because we are all waiting for our “Day at the Races” and our “Night at the Opera”, when gold explodes towards $3,000 / oz or even higher. But I have to say that waiting continually feels like Annie – The Movie: ”Tomorrow – tomorrow – we love ya – tomorrow, you’re always a day away !”

Millennials don’t invest in gold – they invest in ADD trading environments like crypto and algo trading on high volume stocks for small margins, but consistent gains. Probably no one under 35 has ever heard of Warren Buffet, let alone learned what the fundamentals for good, sound investing for the long term mean.

I can’t help but think that over the last 3 years, these conferences are simply a means to promote a self-fulfilling prophecy – a rally / a bull run / stronger wind in our sails / momentum investing, use whatever adjective, metaphor or description you want; the sheer fact is that there are no new pools of capital being deployed into natural resources – full stop!

We can have a $3,000 / oz gold price and a $10/lb copper price – but if there is no correlation to mining sector valuations – there is no reason to get excited.

I will get excited when large, trillion dollar pools of fixed income / treasuries / bonds and other yielding products search for yield – and shift to higher risk and higher return investments; and by default, some of it will naturally come into natural resources.

When will it happen? Not until interest rates are so unattractive as an asset class – that money managers look to alternatives. Will we see it this year – who knows, maybe, but I doubt it. However, I caveat my statement with this: “We are in the midst of an early rally based on macro-economic fundamentals, like we have never witnessed in 50 years. It is early, and until capital flows into the sector – nothing is going to change. But the “wildcard” is the US election. The “Trumpian Spin Doctor” or the “Biden-omics Marathon Man” – both are going to exacerbate US deficits and compound the $34.5T US debt – with brand new QE to kick start the US economy / continued printing of currency, the continued over-spending on infrastructure and military, it is 2000-2020 all over again – wash, rinse, repeat – which is good for the US economy, but also good for gold, as markets know the trajectory of this plane takeoff! However, it loses altitude when the US Treasury has a problem finding financiers of their credit card spending spree. It is not a matter of “if” – it is a matter of “when”. The US have a problem – and people should listen to Jeff Daniels - as it feels like the US is losing its 250 year dominance to dictators, autocracy and megalomaniacs; of which one of the candidates seems like he wants to rule like one himself.

So was my PDAC experience rewarding, fulfilling and full of shareholder value ? Not really – it is why we don’t have a booth, as it is just another conference of meeting people who always hope for better days.”

Simon Dyakowski, President & CEO of Aztec Minerals (client):

“This PDAC was well attended and the turnaround in gold pricing on Friday March 1st, due to weakness in the US Dollar, created a noticeable buzz as the conference got underway on Sunday. The sentiment in the conference reminded me of early smart money positioning ahead of a broader sentiment improvement among the general investing public. It will be interesting to compare the attendance statistics from this PDAC to PDAC 2025.”

Rob McEwen, Executive Chairman & Chief Owner of McEwen Mining:

“The only area that I feel stood out was Saudi Arabia’s strong push to promote exploration, development and mining in the Kingdom. I believe that it could become a serious contender for attracting industry talent and expertise. They offer advantages that many other jurisdictions in the world do not, starting with access to large capital pools available at low cost, short permitting period, 100% property title, low cost power, relatively low cost labour, no indigenous issues, low cost sea transport, partial reimbursement of certain exploration and development expenses, coupled with an extensive geological database for the country with targets in a region of the world with a long history of mining in a very prospective geological region. The Kingdom has decided to make mining the 3rd pillar of their economy behind oil and gas and chemicals. From my point of view, what they are offering something better to encourage mining than any other country in the world is doing today.”

Mark Fedosiewich, President & CEO Vior (client):

“Overall positive sentiment change right now is like a slow moving train, but this could rapidly speed up and soon. We have already noticed a modest uptick in positive sentiment at PDAC due to rising gold and copper prices. What really changes sentiment is never clear beforehand, and the narrative always comes after the fact. Fundamentals and the technical indicators for metals are slowly improving and several positive catalysts for improving precious metals prices may include debt & deficit issues/geopolitical concerns/inflation risks and lower interest rates, or a combination of many.

The disconnect between resource equities and metal prices appears to be caused by the higher all in production costs neutralizing the higher metal prices, so when high inflation and rising costs abate with lower interest rates, and metal prices remain at current levels or ideally higher, this could really kickstart a positive sentiment train and a powerful bull market in resource equities. We have been through an extended period of resource equities selling, with the final washout having seemingly completed this past tax loss season, and into the January-February period.

When a real change in sentiment occurs, it will first be noticed within the producers, then the developers, and lastly the junior explorers. There are still reasonable pools of capital available, especially outside of Canada (Australia, US, Middle East, Europe) but you need to convince the right people to unlock it. Capital markets in Canada are somewhat broken for now, due to the continued overwhelming interest in tech & crypto, however, this could quickly change when some money flows begin to return to the resource and precious metals space.”

Until a few weeks ago, general mining sentiment was pretty negative. Usually there is a build-up after New Year towards the PDAC, supported by lots of positive news releases and accompanying marketing efforts, often followed by a sensational drop in share prices of (junior) miners after the PDAC, frequently dubbed the “PDAC curse”. This time things look a bit different, as mining metal bellwethers gold and copper only started rising weeks ago, seemingly in anticipation of a weaker dollar, shortages and lowering inflation. There wasn’t much of a PDAC buildup this year, and more and more people seem to believe in an upcoming bull market now, especially with lower inflation and rate cuts expected in H2, 2024.

The PDAC is also the stage for various awards, to acknowledge impressive feats in the industry. Two of the most important awards are the Bill Dennis award and the Thayer Lindsley award.

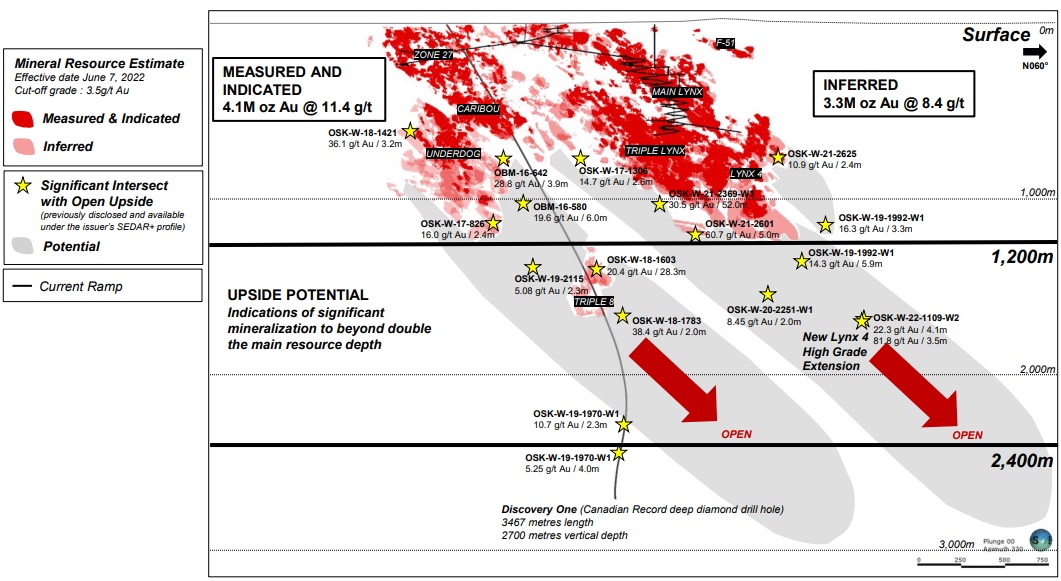

The Bill Dennis award, named for a former President of the association, honours individuals who have accomplished one or both of the following: made a significant Canadian mineral discovery; made an important contribution to the prospecting and/or exploration industry. The recipients for 2024 are: John Burzinski and the Osisko Mining Exploration Team for the discovery and ongoing expansion of the Windfall gold deposit in Quebec.

The Thayer Lindsley award recognizes an individual or a team of explorationists credited with a recent significant mineral discovery anywhere in the world. Recipients for 2024 are: the Lundin Group Vicuna Exploration Team for the discovery of the Vicuna district in the Central Andean copper province in Argentina and Chile.

The Bill Dennis Award: John Burzynski and the Osisko Mining Inc. Exploration Team

For the discovery and ongoing expansion of the Windfall deposit’s Lynx gold zone located in the Abitibi greenstone belt, Eeyou Istchee James Bay, Québec.

Discovered by John Burzynski and the Osisko Mining Inc. Exploration Team, the Windfall deposit stands as one of Quebec's most significant gold finds, both in terms of size and grade. It ranks among the premier discoveries not just in Canada, but globally over the past ten years.

In 2023, Osisko delivered a positive feasibility study on Windfall delivering 12.2Mt grading 8.1 g/t Au for 3.1 Moz Au of probable reserve. The study results outlined a robust project delivering an average of 306,000 oz Au/year of full production. The discovery of the Lynx zones at Windfall has resulted in an outstanding expansion of the previously known deposit in a volcanic belt not typically recognized as host of significant deposits and brought worldwide attention worldwide towards the emerging district.

The Lynx zones were discovered and expanded from 2016 through 2022. During that period Osisko executed an ambitious drilling campaign, ranked among the world’s largest, with up to 35 rigs operating concurrently on the site. This extensive effort, encompassing 1.8 million meters of drilling, marked a significant financial commitment to the district. Windfall's magnitude and ore grade have consistently grown since the discovery of Lynx in 2016, a testament to the success of their drilling initiative.

Remarkably, their program featured Canada's longest diamond drill hole, stretching beyond 3,400 meters. Preliminary data shows the deposit could extend beyond a depth of 2,800 meters. Combined with recent exploratory results in adjacent areas, there is compelling evidence pointing to a more expansive deposit. This underscores Windfall's potential to cement its place among Canada's elite long-life, high-grade gold deposits.

On May 2, 2023, Osisko announced a 50/50 Joint Venture on the Windfall Gold Project with Gold Fields for cash payment totaling more than C$600M. Combined with work and capex commitments, this represents an investment of C$1.2B at Windfall, fully funding Osisko to mine production and validating the quality and robustness of the deposit.

In my view it is a good, high grade deposit, although the amount of drilling (1.8M meters for just a 7.4Moz Au M&I and Inf resource, 3Moz Au converted into reserves) seems like an inefficient spending of exploration dollars. The market cap of Osisko Mining (C$1.06B at the time of writing) seems rich as well, since Osisko only owns 50% of Windfall after a 50/50 JV with Goldfields, although Windfall is fully financed to production now, with Osisko paying for 50% of capex, enabled by the Goldfields payments. At a gold price of US$2,000/oz Au, the after tax NPV5 for the entire project is US$1.275B, meaning the NPV8 likely drops below US$1B. Certainly when taking into account the date of the FS (Nov 2022), which means at least a 20-25% increase in opex and capex since then. There is no doubt in my mind Windfall will be profitable, but I’m not sure the valuation of Osisko Mining is justified, as they are valued at being into commercial production at the moment. There is still a few years to go for that, and many things can and will go wrong when constructing and ramping up. Let’s wait for the permits first, although Quebec is known to be supportive.

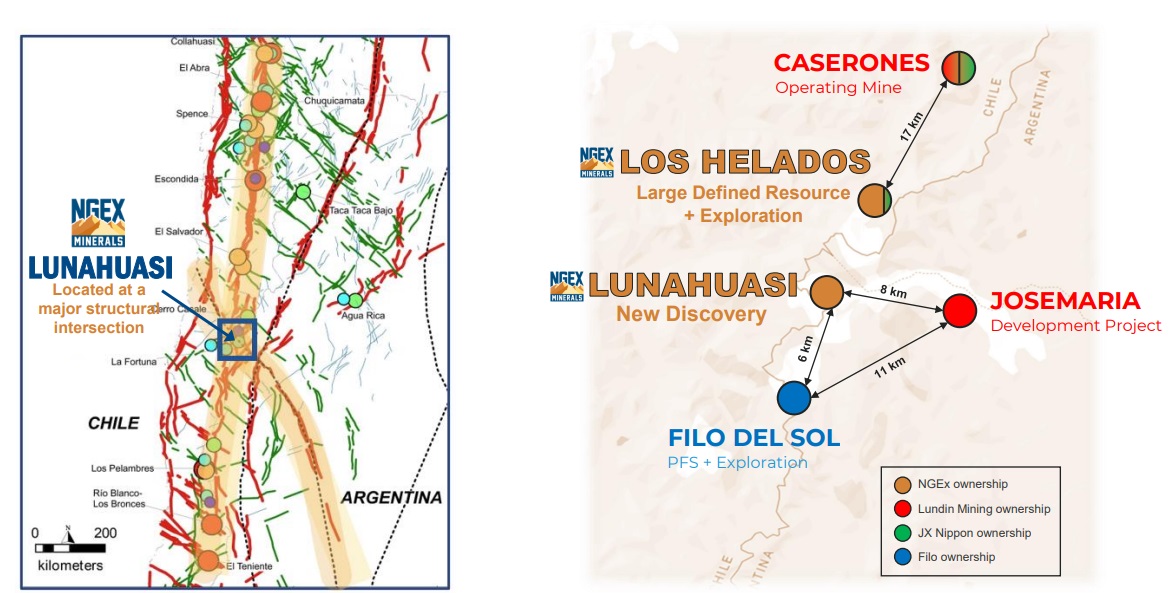

The Thayer Lindsley Award: The Lundin Group Vicuña Exploration Team

For the discovery of the Vicuña district in the Central Andean copper province in Argentina and Chile.

The Lundin Group Vicuña Exploration Team, including Wojtek Wodzicki, Bob Carmichael, Diego Charchaflie, Patricio Jones, Martin Rode, and Alfredo Vitaller, have achieved groundbreaking discoveries over the span of more than two decades. Their feats don't just encompass the identification of three copper-gold porphyry deposits but the establishment of a new mineral district astride the Argentina-Chile border. This success, a first in the Central Andean copper province for several decades, is attributed to a science-driven approach, technical excellence, entrepreneurial spirit, and perseverance.

In the 1990s, the Lundin Group initiated geological and geochemical studies in the Vicuña belt, an area of the Andes that had, up until that point, remained relatively underexplored. Positioned between the renowned Maricunga and El Indio gold-silver belts, this region posed formidable challenges due to its high-altitude conditions ranging from 4500 to 5500 meters above sea level. However, undeterred, their continuous endeavors unveiled a series of copper-gold porphyry systems. These include the Filo del Sol's shallow oxide mineralization found in 2001, the Josemaría deposit in 2004, the Los Helados deposit in 2008, the deeper Aurora zone at Filo del Sol uncovered in 2020, and most recently, the initial stages of Lunahuasi (formerly known as Potro Cliffs) in 2023.

At present, Josemaría is navigating its way from engineering evaluations towards obtaining permits and, eventually, entering production. Meanwhile, the Los Helados resource's growth trajectory has been upward both in terms of size and grade, thanks to the 2022 discovery of hidden copper-rich breccias. The Aurora zone, with its remarkable high-grade drill intercepts, has garnered significant attention. Evidence of this is a notable intercept measuring 858 meters with 0.86% Cu, 0.7 g/t Au, and 48.1 g/t Ag, leading to 1.8% CuEq in FSDH41. Aurora's high-grade finds persist, with extensions northward in the pipeline, and Lunahuasi's preliminary outcomes promise high yields, as demonstrated by a 60 m intercept with 7.52% CuEq, of which 10 m boasts an impressive 18.00% CuEq in DPDH002. Collectively, the resources from Josemaría, Los Helados, and Filo del Sol amount to 38 billion lb Cu, 28 million oz Au, and 356 million oz Ag, with a definite potential for expansion.

Given the immense findings and potential, the Vicuña district is poised to ascend as a pivotal global hub for copper, gold, and silver production — a milestone of paramount importance for both Argentina and Chile. This remarkable achievement has been predicated on traditional, tried-and-tested field methods, emphasising detailed outcrop and drill-core observation and state-of-the-art interpretation using the latest geological concepts and models.

The potential for this district has been known for a long time, but the parent company NGEX Resources lagged for a long time due to its low graded deposits, not economic at the time. This all changed after 2016, when copper and gold prices started recovering, and Filo was spun out, followed by further spun-outs Josemaria and NGEX Minerals in 2019. This bet on rising copper prices has been a long wait for the Lundin family (NGEX Resources was founded in 2009), but it is finally paying off, as the three spin-outs Filo, Josemaria (acquired by Lundin Mining) and NGEX already generated C$4.9B in value, and this certainly isn’t the end of it as especially NGEX is drilling the very interesting high grade Lunahuasi discovery with absurd intercepts of 62m @ 6.98% CuEq and 184m @ 4.61% CuEq.

As these two projects/district plays are more advanced and established, they are likely to receive such prestigious awards. Two other discoveries I am following closely, which in my view are almost certain candidates for the shortlist of these awards, are less advanced but already embody the absolute top for their respective metals lithium and gold: Corvette, the hard rock lithium project owned by Patriot Battery Metals, and Rogue, the Yukon gold project owned by Snowline Gold.

Last but not least there are the parties and dinners in the late afternoons and evenings, the networking events like no other, with dozens to choose from, ranging from Ripley’s Aquarium to the Steam Whistle to of course the famous Fairmont Royal York Hotel.

This concludes my review of the latest PDAC conference, and I’m already looking forward to the next one, which will be organized March 2-5, 2025. See you there!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Silver North Resources, Kenorland Minerals, PTX Metals, Goldshore Resources, Aztec Minerals, Vior, NGEX Minerals, Patriot Battery Metals and Snowline Gold. Silver North Resources, Kenorland Minerals, PTX Metals, Goldshore Resources, Aztec Minerals, and Vior are sponsoring companies. All facts are to be checked by the reader. For more information go to the various company websites and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.