Avrupa Minerals Closes Oversubscribed C$1.25M Private Placement

After announcing a strong and potentially game changing drill result (60.4m @ 2.25% CuEq) at Sesmarias on January 25, 2022, followed by a C$1M private placement on February 8, 2022, Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) managed to increase this amount, and raised C$1.25M on March 2, 2022. As JV partner MATSA (now part of Sandfire Resources) funds exploration at the Sesmarias massive sulfide target, part of their flagship Alvalade project in Portugal, Avrupa will use the proceeds to work on their own, recently acquired Finnish gold- and copper/zinc-focused properties.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Avrupa Minerals raised an oversubscribed total of C$1,250,000 from the issuance of the 16,666,667 units to fund the acquisition of four projects in Finland, for exploration expenditures on these properties, and for working capital. Each unit is comprised of one common share at C$0.075, and a full warrant. The warrant is valid for three years expiring February 28, 2025 and is exercisable at $0.125. Finder’s fees of 7.5% in cash and 7.5% in finder’s warrants were paid to eligible parties. All securities are subject to a four-month hold expiring on June 29, 2021.

CEO Paul Kuhn was happy to finally see a full treasury after a long time, and commented: “We are pleased with the continued strong support from our shareholders and from our new investors. With the funding, we expect to advance our new projects in Finland through the exploration licensing process, with the goal of selecting the best areas in each of the reservations for license application. We also expect to acquire and compile existing historic data, and continue with new project exploration work and starting the drill targeting process. We are also excited about the continuation of fully partner-funded drilling and exploration at Sesmarias and the rest of the Alvalade Project, and await guidance from our partner as to how the program will proceed. In addition, Avrupa continues to review further precious and base metal opportunities around Europe.”

It was good to see that MATSA wants to continue the JV at the Alvalade project, right after finally hitting the first long intercept at Sesmarias, but Avrupa is still waiting on guidance from the new MATSA owner Sandfire Resources. I’m also curious what the Finnish properties could have in store, as it is a prolific area with lots of successful exploration by other companies ongoing. Additional advantage in my view is the increased control Avrupa will have about exploration spending, by paying for this themselves, which will change into full control during Stage 2 of the earn-in, and of course will then be working towards full ownership.

During the private placement, the company also announced a shares-for-debt settlement. The amount accounted for is C$285k, and is intended to be settled with two insiders of the company, who have deferred salary and fee payments for the past several years, and also funded C$56k with loans to the company. The proposal involves the issuance of 3.8M shares @ C$0.075, with no warrants. The remaining amount of debt after this settlement will be settled in cash at a later date.

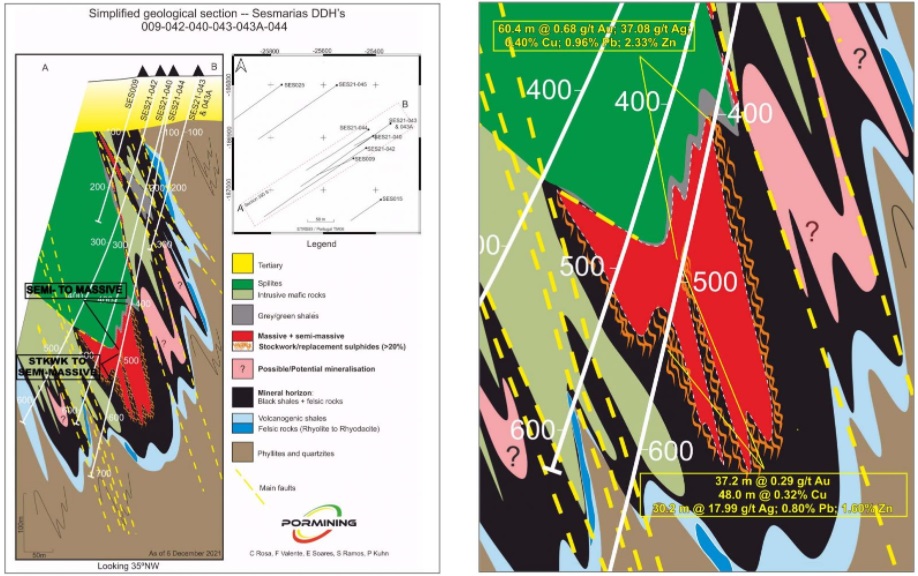

Regarding ongoing exploration, Avrupa Minerals has completed 17 drill holes now at Sesmarias North, totaling 8,900 m, The company also drilled a 614m scout hole at the Caveira target, which will be reported later during Q1. According to CEO Kuhn, the drill rig has been moved to another MATSA property in Portugal to complete required work, vis à vis their license commitments, and will drill 1-2 holes before presumably coming back to Sesmarias. Avrupa is waiting on guidance from MATSA and their new owners on how/when drilling will continue. As a reminder: game changing hole SES21-044 at Sesmarias was part of a fence, drilled at section 350S to the south, as can be seen here on this section:

Regarding holes SES21-041/042/43, these will also be reported later on during Q1.

Regarding the new acquisition in Finland, the company is about to close the transaction with the vendor, and has already actively worked on the data-in-hand for the Kolima reservation to fully identify lands wanted for the exploration license application. Avrupa expects to provide information on that in the coming weeks. The company plans to do further assessment investigations in order to properly identify the potential lands for exploration licenses in the other three reservations. These applications are not due until later in the year and into 2023.

Conclusion

It is good to see Avrupa Minerals having raised decent cash on their own after a long time of being dependent on JV partner MATSA, which isn’t operating particularly quickly as it uses a cautious approach on exploration, not generating a lot of news flow. This could all change when Avrupa manages to get the new Finland properties permitted for exploration, and with fresh C$1.25M cash in hand, it is able to set up decent exploration programs which should be able to provide additional and hopefully interesting news during the second half of this year. In the meantime, the company expects to continue drilling at Sesmarias after the present break, and since Avrupa finally hit serious mineralization in their last reported hole, things are looking much more promising in Portugal all of a sudden.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.