Avrupa Minerals Commences Drilling Again At Alvalade VMS Project In Portugal, Options Out Slivova Gold Project

After raising C$1.25M in March this year, and acquiring several early stage copper-zinc and gold projects in Finland, Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) didn’t have spectacular news to report this summer, as it had to wait on Sandfire (new owner of JV partner MATSA) scheduling/financing covenants for further exploration and upgrade of the Alvalade copper-zinc VMS project in Portugal. MATSA completed the work on their other drilling programs in Portugal at the end of August. Sandfire was then able to secure the necessary funds, and confirmed a budget for the project, allowing the JV to make plans for the next round of drilling.

The Finnish projects first need to be permitted for exploration, which is a detailed and thorough undertaking in Finland. On August 26, 2022, Avrupa announced the submission of the exploration license application for the Kangasjärvi VMS Project after carrying out several geophysical surveys and a detailed compilation of historic drilling in the general area of the old Kangasjärvi zinc mine and potential extensions. This follows the earlier submission of the exploration license application for the Kolima VMS project. As the permitting process moves forward, the company will continue to work on defining drill targets within both application areas, in order to be ready to drill when the licenses are issued by the Finnish Mining Bureau. In addition, Avrupa is working on two other exploration license applications and continues to review other possible opportunities in Finland.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Avrupa Minerals didn’t come out of the summer unscathed, after rampant inflation and shortages causing the Fed and the other central banks worldwide to hike rates at speeds not entirely expected by the markets. As a consequence, the US Dollar index went from strength to strength, metal prices went down, and mining stocks went down with them:

Share price, 1 year time frame (Source: tmxmoney.com)

When the share price of Avrupa hit C$0.025, it almost completely nullified the 4 to 1 roll back from December 2020, which obviously isn’t something you want to see as an existing shareholder, and quite a few looked for other opportunities or trimmed their positions. For new investors these lows are an absolute bargain of course, as fundamentals didn’t change but actually improved further, for a super tiny market cap of just C$1.3M. Even listed shells with no assets at all cost more, and Avrupa not only has C$0.3M in cash at the moment, but also a fully-funded JV with Sandfire (market cap of A$2B), a newly-optioned project in Kosovo, and a string of newly-acquired, prospective Finnish projects in a region that has seen quite a bit of exploration success lately. Let’s see where these projects stand at the moment.

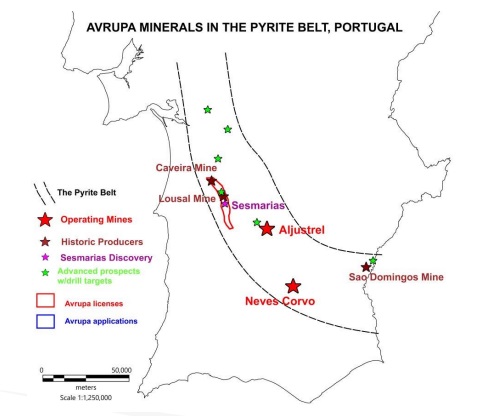

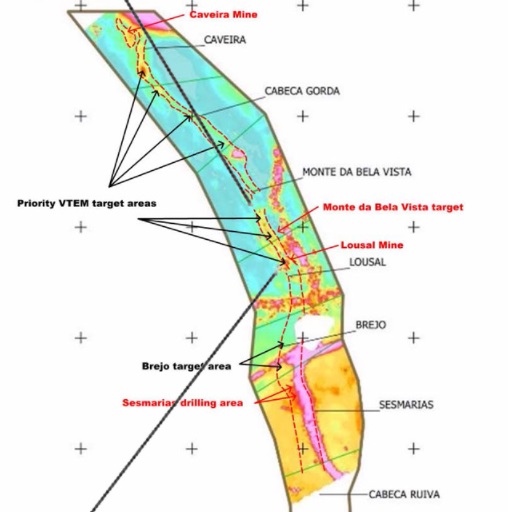

Avrupa Minerals recently commenced drilling (on September 14th, to be precise) together with JV partner Sandfire MATSA at their flagship Alvalade Project in Portugal. Until now, they completed 17 drill holes for 8,900m at main target Sesmarias North, and 614m at Caveira (which did not return any economic results, unfortunately). This new phase of drilling (9th overall, with 10-12 holes planned) will initially target anomalies located between the historic Lousal and Caveira Mines, over a strike length of approximately 11 kilometers, for a total of about 6,000m of diamond drilling.

I have been waiting for this a long time as readers know, as I consider the estimated remaining historic resource of about 30Mt low-hanging fruit par excellence, and I never quite understood why a large outfit like MATSA not just simply sent a few rigs to Lousal in order to at least verify these tonnes, combined with the compiling of historic drill data which has already been completed by Avrupa and MATSA. The JV is also reprocessing VTEM data, and will conduct an airborne gravity survey around November of this year. The exploration budget for Alvalade has been set at around C$2M.

Reportedly they had issues arranging drill rigs, but nowadays with Sandfire at the helm at MATSA, the focus has finally switched from Sesmarias to Lousal and other targets. The first drill hole targets potential mineralization located 300-400 meters northwest of the last reported mineralization in the Lousal Mine.

Following this Lousal Northwest hole, depending on results, further testing is expected in the Lousal area, as well as targets at the Monte da Bela Vista prospect drilled by Avrupa in 2012-2014, new targets in the Caveira Mine vicinity, and several strong VTEM geophysical anomalies located between Monte da Bela Vista and the south end of the Caveira Mine mineralized zones. Management expects these targets to be VMS targets, part of a typical VMS cluster, as these appear all over the world, thus forming a potential district-scale VMS project.

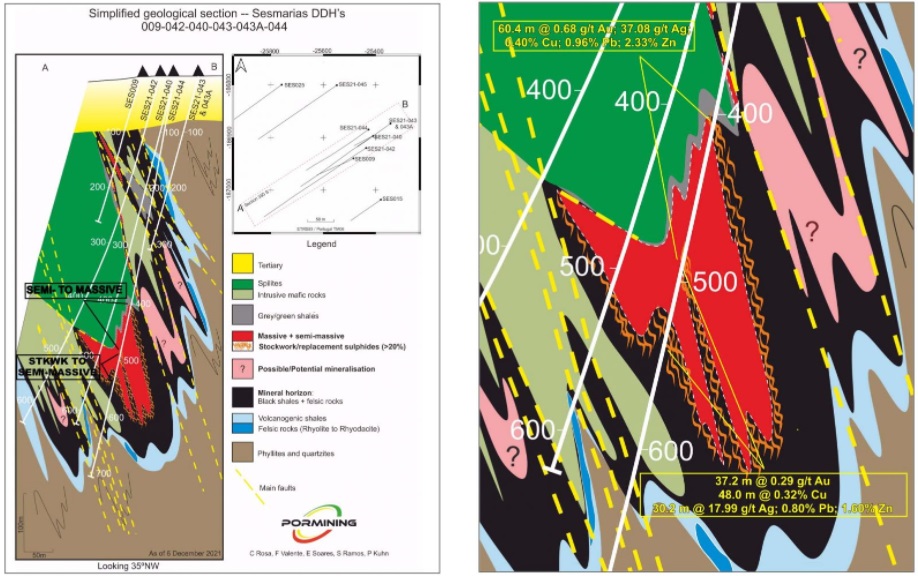

Once the drill rig is available for return to Sesmarias, or a second rig becomes available, further exploratory drilling is planned within the Central and Southern sectors of the known Sesmarias mineralization, in total estimated by my to contain about 18Mt at the moment. Previous, wide-spaced drilling by Avrupa demonstrated the presence of robust massive sulfide mineralization over a further strike length of +1,200 meters through the central and southern sectors at Sesmarias. As mentioned before, the mineralization at Sesmarias is pretty complex with a lot of folding, but the prize could be significant as well, as it could contain over 30Mt on its own:

Since the Sesmarias mineralization is complex, the JV needs to drill a lot of fences to delineate a proper resource. But first up is the brownfields program at Lousal.

It was good to see that Sandfire MATSA remained committed to the JV at the Alvalade Project, as they have 2 other rigs working for them in Spain on a couple of unannounced discoveries according to CEO Kuhn. He commented, “These projects have better grades than Sesmarias, so from their point of view it is understandable to prioritize them first. The drilling company provides excellent work at a highly favorable price. Part of that is volume, part is how they deal with labor and consumable costs. MATSA has been successful by being financially prudent in all aspects of their work, even with small things, as I have observed over the past two years. With drilling, if they can save 20 euros per meter, then they will do so. Over the course of 10,000 meters that we have drilled, that’s a fair amount of money, enough for 4-5 extra drill holes.”

Of course, it isn’t a bad thing to be very prudent, but in my view, as a listed company like Avrupa, you need more advancement, with more and bigger news flow, as reflected by the chart nowadays. Let’s see if Sandfire could get more enthusiastic, potentially resulting into bigger exploration budgets and more drill rigs, providing Avrupa with more news and ultimately hopefully positive drill results.

Next up are the Finnish projects, acquired in March of this year. The goal was not to be too dependent on the glacial speed of MATSA at Alvalade, and have an exciting exploration project financed and managed by Avrupa itself. About a month ago, Avrupa submitted the Kangasjarvi exploration permit application to the local authorities, and Avrupa expects to have the permit in hand around Q1 or Q2 of 2023. As a reminder, Kangasjarvi was an historic zinc mine, and potentially part of a VMS project. Lots of data have been obtained for the project, including historic drilling, and a small historic, open pittable resource (300kt @ 5.4%Zn, of which 85kt already has been mined out) is present:

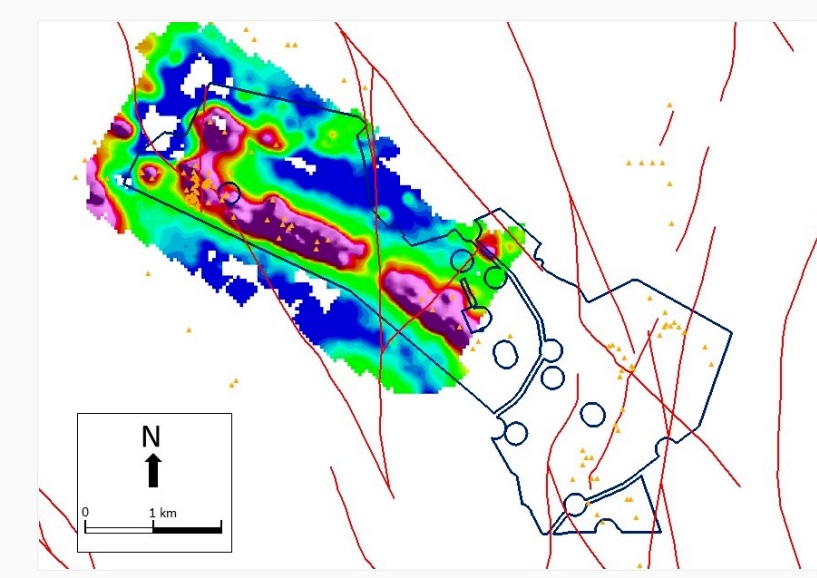

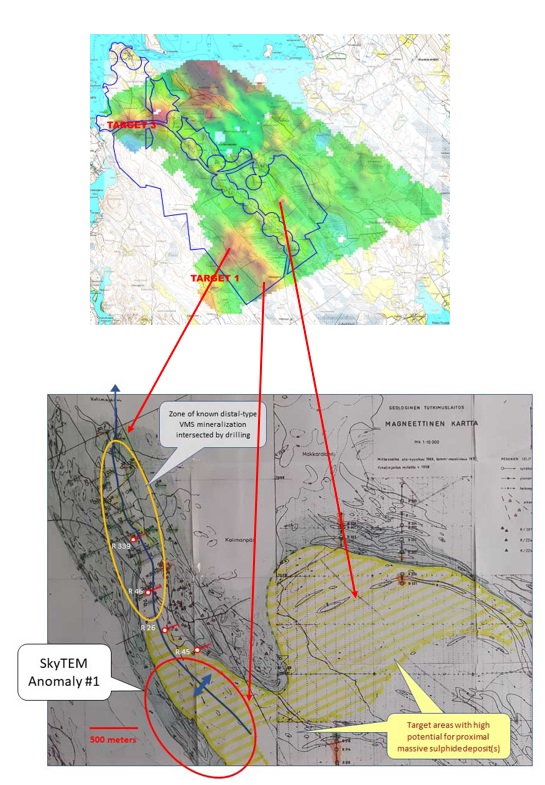

Avrupa also applied for an exploration permit at the nearby Kolima project, and both are located in the Pyhäsalmi VMS district in Central Finland. This permit is also expected around Q1 or Q2 of 2023. As a reminder, historic exploration efforts defined a 2000 x 200-400m zone with zinc mineralization, but also numerous boulders containing gold and copper are present, in typical VMS fashion and geology. A resource wasn’t defined despite 70 drill holes completed. The VTEM survey map below, combined with the prospect geology map, shows the two most important electromagnetic (EM) targets, related to Target 1.

Note that Target 3 is located north of the geological map. Target 1 has two sectors.

Avrupa is also working on two further applications, one a newly-acquired massive sulfide target on previously-known mineralization in the Pyhäsalmi District, and the other a shear zone-related gold target, located near Gold Line Resources’ Oijarvi project, north of the Pyhäsalmi District. For the time being, work around the Pielavesi reservation is on hold due to local social opposition.

I’m curious what the Finnish properties could have in store, as it is a prolific area with Boliden operating a major mine plus holding massive amounts of exploration lands around the country, along with lots of ongoing exploration by other companies, like Gold Line Resources (GLDL.V)/EMX Royalty (EMX.V). Finland is also the home of the flagship projects of Rupert Resources (RUP.V), Mawson Gold (MAW.TO) and Aurion Resources (AU.V), and the various discoveries and drill results definitely and firmly put Finland on the radar as a go-to exploration jurisdiction. Additional advantage in my view is the increased control Avrupa has about exploration spending, by paying for this themselves, changing into full control during Stage 2 of the earn-in, and of course will then be working towards full ownership.

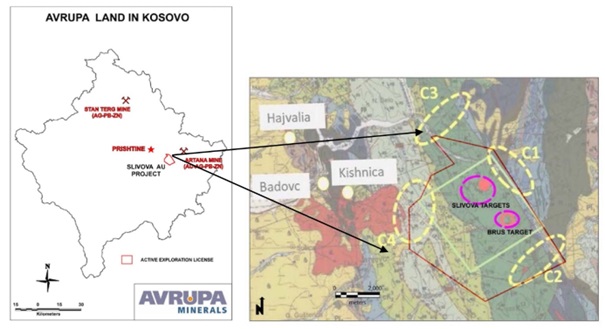

Last but not least was the long-awaited news about the former Slivovo gold project in Kosovo, which took ages to be returned to Avrupa by the Kosovo Mining Bureau. Avrupa announced on September 7, 2022 that it entered into an option agreement with Western Tethyan Resources (WTR), a subsidiary of AIM listed Ariana Resources, to earn up to 85% of the (now called) Slivova Gold project, with the aim of taking it into production, giving Avrupa the option to participate in capex funding pro rata or being diluted to a 1% NSR. CEO Kuhn was happy to see action at last:

“We are excited to begin working with Western Tethyan Resources to advance the new Slivova Gold Project. Previously we identified a NI 43-101 indicated mineral resource at Slivova of 640,000 mt @ 4.8 g/t gold and 14.68 g/t silver, or approximately 98,700 ounces of gold and 302,000 ounces of silver (1). While the Project has been on hold since 2018, we now see a clear path for advancement at Slivova. The new 7-year exploration license is double the size of the original permit, and includes a number of new targets that may enhance the mineral inventory. WTR and Ariana Resources have a great deal of exploration experience in the greater Mediterranean Basin, and Ariana is a highly successful mine builder and operator.”

There is a due diligence period that lasts 6 months into March 2023, and 4 earn-in stages up to a construction decision. WTR has to pay Avrupa €70k in cash if the dd period is closed successfully, and another €30k in cash at the start of Stage 1 of the earn-in. Besides this, WTR has exploration commitments to the tune of €1.9M, and the obligation to complete an EIS, FS and mining license application for 85% of the project. This is followed by success payments to Byrnecut International, accounting for €375k and 850 gold ounces in total during first 3 years of commercial production.

An open pit/underground deposit of about 100koz Au is obviously very small and not super economic at such grades, but doable, and personally I consider a €100k payment for this not expensive at all. Since the Euro is trading almost equal to the USD nowadays, a price of US$1/oz for a deposit is almost unheard of in these days of high gold prices. As Avrupa is not a mine builder, themselves, but an explorer, they had to find a solution for it, preferably generating some cash in the process which they could use for paying the bills anyway. When asked to elaborate some more on the transaction, CEO Kuhn didn’t disappoint and shared quite a bit of background information:

“It is true that €100K doesn’t sound like much, but it saves us from lots of work and eventually payments that we don’t want to do/cannot do ourselves. As such, it’s a good deal for Avrupa, as it allows us to work more in Finland and Portugal, and gives us an anchor to go look at some bigger targets in the neighborhood, without having to be in control of a small gold project. Don’t get me wrong, as I like the project a lot, it’s a gold project in our portfolio, and I think that there will be plenty of opportunity to expand it. We are not miners, but real explorers, and certainly should not attempt to “break our picks” trying to oversee an EIS, feasibility study, and a mine permit application, while building our portfolio elsewhere.

Regarding the name change of the project, it was previously called Slivovo, but the new license names it with its Albanian name, not its Serbian or English name. We own 100% of the license, and the new partner has to bring it to positive FS and a mining license application. They have 5 years to do this. Perhaps we were a bit easy on them, but I really want to advance the project to a mining solution. Ariana Resources is really the perfect group to do this and build a small mine. They have done this in Turkey already once, and they are on their way to do it again over there. The first mine has made them a pile of money. And believe me, they built a great little mine from a very challenging project. I know this because I worked on the target for both Tüprag (Eldorado subsidiary) and Newmont before it was sent onwards to Ariana.

The picture is bigger than just the €100K cash as mentioned, and I believe no one is going to pay more than that for this kind deposit, anyway. I recognize that the market is tough, and yet we just raised a bit of money without any dilution to the share structure. We probably spent no more than €120K, all in all, on the property over the years, so we got our money back, for the most part.

They do need to spend serious money for drilling to increase the size (there is realistic potential for doubling the resource), will have to do an EIS, produce a positive feasibility study and make application for the actual license. We include the cost of purchasing the land, as well. Maybe close to €3-5M to get all of that. There is quite a bit of potential in satellites for them as well. Also, we are removed from the possibility of spending €1.5 to 2M in royalties to the previous partner for being able to get the license back into our portfolio.

We spent three years trying to move the property. No one was willing to spend even €150k in upfront cash. The biggest problem, I believe, is that it is located in Kosovo. Most companies that have experience in Kosovo were working in the north, where it is more bureaucratic and not as easy to work as in the south. Other companies were swayed by various stories of difficulties that may have been more self-manufactured, rather than caused completely by the Kosovar authorities, and set the rest of us back by years. It is actually a fairly easy place to work, we have a positive history there, and a lot of support to get a mine constructed.”

It is always good to hear CEO Kuhn elaborating on things, as he really loves his job and can talk forever about Avrupa and their projects. There really seemed no other option for Avrupa than the current deal. On a side note, little deposits like this always get me fantasizing about taking them private, fund the limited capex with a small group of investors, and make a killing on huge dividends. In Eastern Europe I know of several of these ventures, and there is no doubt you can’t do this without having lots of local boots on the ground and very good relations with local governments, but proceedings seem to be impressive from what I hear. Notwithstanding this, I am looking forward to progress on Slivova, with the final €30k payment for Avrupa due on September 1, 2023.

Conclusion

It is good to see Sandfire MATSA finally having made up their mind after Sandfire acquired MATSA earlier this year, providing fresh budget for a new drill program at Alvalade. Drilling commenced very recently at Lousal, and since historic, remaining mineralization has been waiting there since the eighties, I have little doubt that results will be positive to say the least. Usually historic deposits only need 10-20% of verification drilling, and if old drill cores can be re-logged even less. Let’s see what priorities Sandfire has with Alvalade. In the meantime, the new Finnish exploration projects are advancing through permitting, and drilling is expected to start around Q1/Q2 2023 With the raised C$1.25M in March, there is still C$ 0.3M in the treasury, which will be sufficient for the rest of the year. At the moment, all exploration is fully funded in Portugal, Finland, and Kosovo. If the Slivova option deal works out, this will provide about C$125k of additional pocket money which is always helpful.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.