Avrupa Minerals Intercepts 60.4m @ 0.40% Cu, 2.33% Zn, 0.96% Pb, 0.68g/t Au And 37g/t Ag At Sesmarias North

Several weeks after Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) announced the acquisition of four exploration properties in Finland, the company was happy to finally announce a significant drill result at the Sesmarias target, part of their flagship Alvalade project in Portugal. As they were looking for large mineralized intercepts for almost two years now, scanning the complex folded structure stepping out hole by hole, management was delighted to finally hit a mineralized intercept of no less than 113.8m in total. Although Avrupa has been targeting 1% copper grades together with JV partner MATSA (in the process of being taken over by Sandfire Resources for US1.87B), I’m sure MATSA isn’t too disappointed with the resulting copper equivalent grades. Such long intercepts are capable of building serious tonnage as well, and this is exactly what drives production-focused outfits like MATSA (and Sandfire).

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

The reported results were coming from one deep hole, SES21-044, but it was an impressive intercept. Starting at 417.2m depth, there were various mineralized zones for each metal:

- 103.0m @ 0.51 g/t Au

- 96.0m @ 29.2 g/t Ag

- 113.8m @ 0.35% Cu

- 96.0m @ 0.86% Pb

- 96.0m @ 1.98% Zn

This included a 60.4m wide zone with slightly higher grade mineralization, grading 0.40% Copper, 0.68 g/t Gold, 37.08 g/t Silver, 0.96% Lead, and 2.33% Zn. Although CEO Paul Kuhn never likes equivalent grades, I do believe in this case it is necessary as just the copper or zinc grades aren’t sufficient, and there are just too many polymetallic by-credits. Used metal prices for my equivalent calculations are US$4.00/lb Cu, US$1.50/lb Zn, US$1.00/lb Pb, US$1780/oz Au and US$22/oz Ag. As a result, the 60.4m intercept comes in at 2.25% CuEq or 6.01 % ZnEq, and the 96.0m intercepts at 1.87 % CuEq or 5.00 % ZnEq, as these are the metals MATSA is targeting. Of course the recoveries for especially the precious metals aren’t as high as the base metals, and therefore the effective overall recovery will likely come in at around 75%, but such a resulting copper or zinc grade of 1.6% CuEq or 4.5% ZnEq is still economic at US$4.00/lb Cu or US$1.5/lb Zn. These grades sound low, but remember the metal value of 1.6% copper would be US$141/t ore, but opex for underground mines varies anywhere between US$40-80/t, so there is quite a bit of margin.

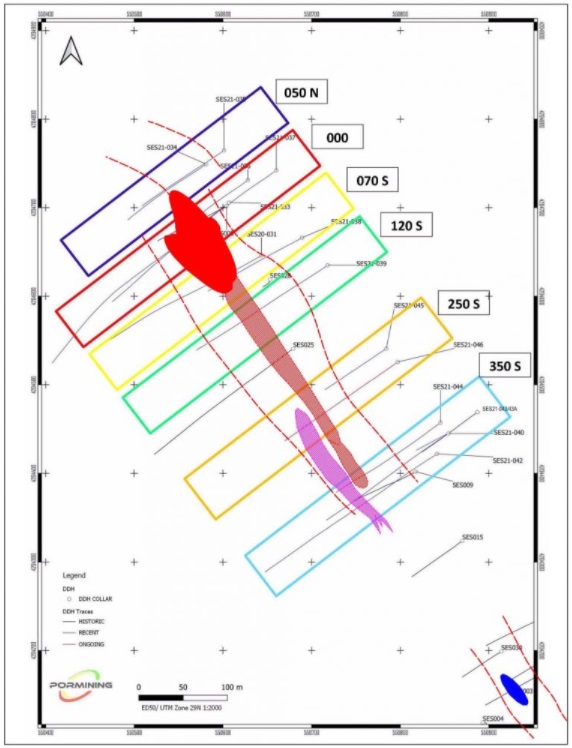

Avrupa Minerals has completed 16 drill holes now at Sesmarias North, totaling 8,150m, including 3 holes that were lost due to difficult downhole drilling conditions, and one scout hole. The company also drilled a 614m scout hole at the Caveira target, which will be reported later during Q1. As Avrupa is very methodologically exploring the Sesmarias target, because of its complex, folded structure, the reported hole SES21-044 was part of a fence, drilled at section 350S to the south, as can be seen here on this map:

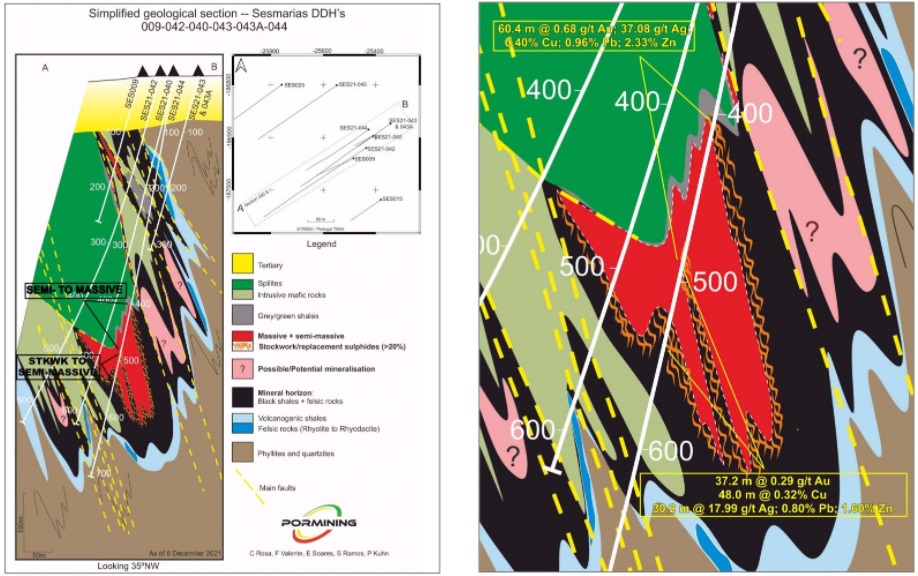

To get an impression about how complex the geology at depth really is, take a look at the following section 350S:

It truly is an amazing puzzle to solve, but it seems they are getting closer now, as there, in fact, are significant widths of mineralization. Management estimates this is an originally 30-40m wide zone, before folding, and there can be more folded mineralized zones as indicated in pink in the section above. Drill hole SES21-040 was already a nice indicator, as it returned 36.45m @ 0.72% Cu, 0.36 g/t Au, 21 g/t Ag, and 0.82% Pb from 479.4m (or 36.45m @ 1.29% CuEq), including 11.0m @ 1.05% Cu, 0.51 g/t Au, 39.2 g/t Ag, and 1.64% Pb. Regarding holes SES21-041/042/43, these will be reported later on during Q1.

Mineralization occurs predominantly in the upper part of massive sulfide body, but also in semi-massive sulfides and underlying stockwork. Now Avrupa and MATSA have a good look on the folding, they are moving the drill rig to section 250S, in order to drill SES21-046.

As hole SES21-044 hit along section 350S, the most southern section, Avrupa aims at testing all other sections to the east as well. If successful with likewise intercepts along strike, they could prove up at least a 500m long zone, 100m high and 40m wide, resulting in 8Mt using a specific gravity of 4t/m3 for massive sulfides for Sesmarias North. Keep in mind it is still early days here of course. I guesstimated the tonnage for the Sesmarias 10 Lens at 19-20Mt, so slowly but surely the JV is approaching decent numbers here, although the goal is 50Mt. At the question if MATSA already saw enough to extend the earn-in, Kuhn answered:

“For now, everyone is happy about the ongoing direction. There is still a lot to do at Sesmarias to test the entire known strike length of mineralization, which is at least 1.7 kilometers. And there are untested targets all the way up to the Caveira Mine, 16 km north of Sesmarias. We will wait and see what the new owner Sandfire wants to do.”

As usual, I always keep harassing CEO Kuhn about the status of the extremely useful reconstruction of old Lousal data, as the acquisition of the data is now complete and will be entered into a 3-D modeling program during January/February. He stated:

“Work will continue with the modeling program in the coming months, as we acquired a large amount of new data around the Lousal workings. We are already doing new field exploration based on some of the new data and also incorporating some of the information into ongoing targeting work at the Monte da Bela Vista area, located immediately adjacent to the north of the Lousal mine workings.”

Finally, now that Avrupa acquired the 4 Finnish properties, I wondered what the status is of the projects they are working on, in order to get the necessary exploration permits. Kuhn replied:

"The company is actively working on the data-in-hand for the Kolima reservation to fully identify lands wanted for the exploration license application. We will provide information on that in the near future. The company plans to do further assessment investigations in order to properly identify the potential lands for exploration licenses in the other three reservations. These applications are not due until later in the year.”

On a closing note, but pretty important nonetheless, according to Chairman Mark Brown, some additional funds are necessary to pay for exploration expenditures, so he is looking to do a raise soon.

Conclusion

Slowly or not, Avrupa finally seems to have hit enough mineralization to indicate decent tonnage, and this is exactly what JV partner MATSA is after. Both companies have a better idea now where to look for mineralized folded structures at depth, and this is exactly the strategy they will deploy from now on. New drill results are expected to come back from the lab after the present drill hole is completed on the 250 S section. In the meantime, Avrupa is working diligently at their exploration permits in Finland and will soon provide information for the Kolima Reservation. Let’s see what this tiny junior can accomplish after an upcoming raise is completed, and exploration in Finland can commence.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.