Avrupa Minerals Prepares For Drilling At Finland Projects, Plans to Add Second Rig At Alvalade

Although the markets are giving back some of the recent gains after the Fed indicated we aren’t done yet with the high inflation, combined with the slow escalation of the Russia invasion of the Ukraine and the strange incident with the shooting down of the Chinese spy balloon hovering over the US, sentiment for metals and miners seems to be in a recovering trend after a disastrous H2 of 2022. Especially, lithium shortages became so severe that the lithium carbonate equivalent price ten-folded compared to a few years ago, this had its effect on everything lithium-related and this, in turn, affected lots of juniors in a positive way.

Sentiment at the latest conferences was pretty positive as a result, which was good to see for a change. Profit taking in the lithium sphere is ongoing since, but considering the continuing shortages and extremely high lithium product prices, I expect this to be short-lived. Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) doesn’t have a lithium project of course, but is focused on its flagship Alvalade copper-zinc VMS project in Portugal JV-ed with Sandfire/MATSA, and several optioned gold/copper/zinc exploration projects in Finland. Let’s see what the current status is for the project portfolio of Avrupa, as quite a bit of real action appears to be in the pipeline for this year.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

First of all, the markets seem to be cautious about Avrupa these days, and rightly so as it didn’t produce much actionable news flow last year, which was of course lethal when overall sentiment was against juniors in the second half of last year to begin with. The chart shows this all too well unfortunately:

Share price, 1 year time frame (Source: tmxmoney.com)

It will be clear that at a market cap of just C$1.6M, Avrupa is trading at rock bottom levels, as tax loss selling didn’t even have the slightest impact in December, traditionally your month to pick up tax loss bargains. With the backing of the likes of Pacific Opportunity Capital (owned by Chairman Mark Brown) and European institutional Fruchtexpress it seems as if the 3c range acts as support. As mentioned earlier, one could view Avrupa as a cheap, debt-free shell, if it wasn’t for real assets like Alvalade and the Finnish assets. On top of that it also has the small but economic (100koz @ 4.8g/t Au) Slivova gold-silver deposit in Kosovo, where a new partner West Tethyan Resources is doing comprehensive due diligence in order to find out if they can develop the project into production at a time of relatively high gold prices (around US$1900/oz).

Let’s have a look at Alvalade first. It was good to see drilling to commence again in September 2022 after a 6-month delay, caused by the Sandfire-MATSA takeover, as a junior needs news flow regarding drill results.

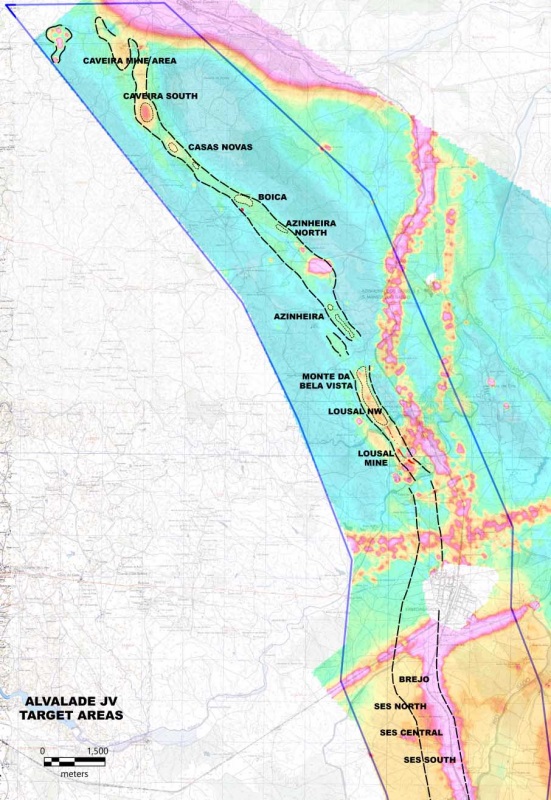

Another positive was a much needed second drill rig probably being added soon after some delays, as it will increase the amount of drill results. The JV will be drilling eight to nine more holes across the Alvalade license during the first half of 2023, accounting for another 4,000 to 6000m. It was also a pleasant surprise to see the JV expanding exploration across the entire license now after the takeover of MATSA, as they will be targeting from north to south Casas Novas, Azinheira, Monte da Bela Vista, Lousal North West, and potential extensions to the Sesmarias massive sulfide deposit, as well as promising satellite targets.

As you will probably remember, I often focused on the Lousal Mine in earlier articles as being potentially being low hanging fruit with 30Mt of estimated historic remaining resources. After bringing this up again with management, as I noticed the JV was targeting other targets more to the north instead of earlier mentioned Lousal Mine targets, it appears there are several reasons, for now, not to drill at the old mine itself. The most important one is that the Lousal Mine has been converted into a mining museum these days, and much of the area has been reclaimed now, and would cause difficulties to explore and mine again. Another reason are the very complex underground workings, making drilling pretty challenging, as underground cavities often cause drills to be lost. It can be done of course, by using larger diameter drills and pipes first, followed by smaller diameter drills, but in the case of the Lousal Mine this would provide quite an expensive and time-consuming affair according to management. According to CEO Kuhn, JV partner management is highly motivated to cover the exploration potential around the entire Alvalade license, as the initial phase of the license expires in June, and the renewal application must be filed by mid-April. The renewal comes with a size reduction required by Portuguese mining law, and the JV needs to determine which portions of the license can be removed.

Since drilling at Alvalade restarted in September, the JV completed three exploration holes, totaling 1,946m, aiming at VTEM geophysical targets along trend. Recent drilling includes two holes in the Lousal NW sector and one in the Azinheira sector. All three drill holes intercepted the targeted volcano-sulfide horizon, with narrow zones of thin-bedded to semi-massive sulfide mineralization present. Sampling results are forthcoming, and are expected to indicate possible proximity to massive sulfide mineralization in the strongly folded and faulted black shale host rocks, as found at the Lousal Mine and the Sesmarias target. The JV is currently drilling a fourth hole more to the north, located in the Casas Novas sector. Two rounds of follow-up surface geophysics in the Lousal NW and Monte da Bela Vista target areas are now complete. A third hole is planned in the Lousal NW area to test the more detailed electromagnetic anomalism, spatially related surface geochemical anomalies, and favorable geology.

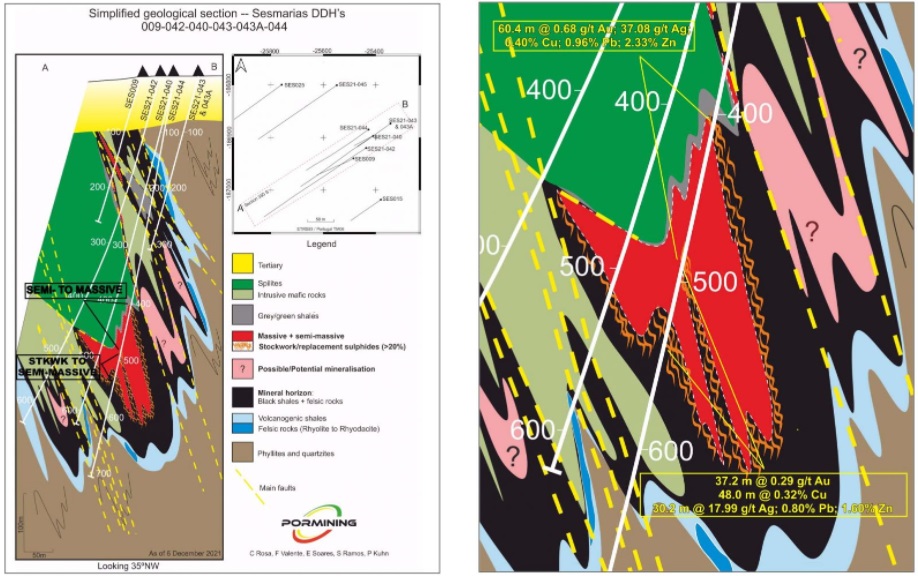

Overall, Avrupa and Sandfire/MATSA completed 20 drill holes for a total of 11,460m at Alvalade, for 8,900m at main target Sesmarias North (which outlined an estimated 15-18Mt mineralized envelope so far), 614m at Caveira (which did not return any economic results unfortunately), and the aforementioned 1,946m at Lousal NW and Monte da Bela Vista, with assays pending. And, as noted, the JV also intends to drill a further six to eight holes in the coming months.

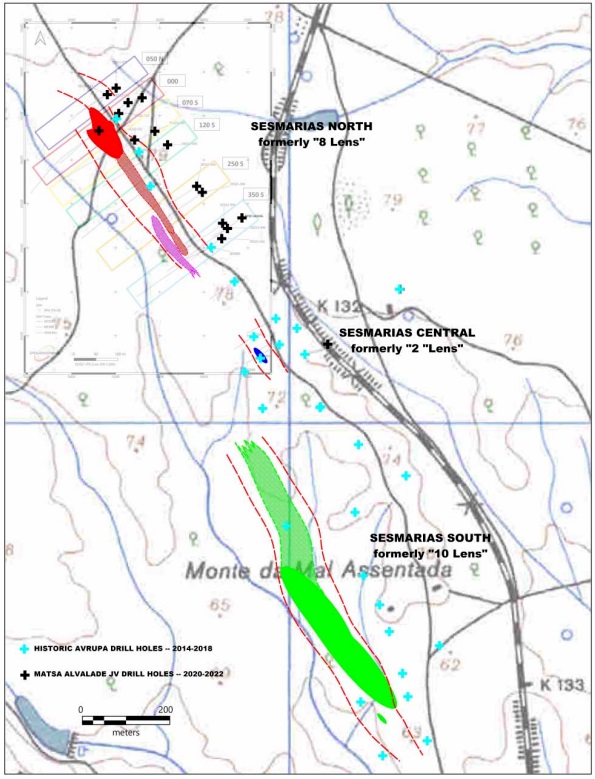

The Avrupa/Sandfire-MATSA JV isn’t done drilling at Sesmarias yet. They drilled only about 400m of strike length to date with mineralization open to the north, and previous, wide-spaced drilling outlined a further +1,200m to the south. Mineralization is potentially open to both the north and south, and Avrupa expects to drill at least two or three further holes in the present phase to look for extensions in the Brejo area, just north of Sesmarias, and south of the Sesmarias South sector for potential increase in that direction. If time and budget allow, the JV may drill to the east of the Sesmarias Central sector in the area of an “off-hole” geophysical anomaly discovered in 2014.

Sandfire/MATSA isn’t exactly being as frugal as MATSA it seems, and outlined a €1.4-1.7M 2023 budget for Alvalade, which translates into C$2-2.46M. This budget will also include further re-processing of the VTEM data and an airborne gravity survey to cover the entire license. Results from the gravity survey are expected before the end of February. However, since the Sesmarias mineralization is complex as shown below, the JV also needs to drill a lot of fences to delineate a proper resource, and continues to look for the higher copper grade portions of the deposit.

I wondered if CEO Paul Kuhn could elaborate more on the various Alvalade priorities and end goals of Sandfire/MATSA. He stated that right now, the priority is to move ahead and complete the property-wide exploration work in the coming months in order to provide a proper renewal application for the Alvalade license. This involves an impressive amount of geophysical surveying and the present phase of exploration drilling.

After discussing Alvalade at length, let’s have a brief look at Avrupa’s project in Kosovo, as the company is aiming at reactivating their Slivova gold-silver project over there. There is a due diligence period in place for Western Tethyan Resources (WTR) that lasts 6 months to February 28, 2023, and then 4 earn-in stages up to a construction decision, so Avrupa can expect a closing of the dd period within the next couple of weeks. WTR has to pay Avrupa in that case €70k in cash if the dd period is indeed closed successfully, and another €30k in cash at the start of Stage 1 of the earn-in. Besides this, WTR has exploration commitments to the tune of €1.9M, and the obligation to complete an EIS, FS and mining license application for 85% of the project. This is followed by success payments to Byrnecut International, accounting for €375k and 850 gold ounces in total during first 3 years of commercial production. Another €70-100k in cash is always welcome of course, and let’s see if WTR can create some more value for Avrupa here over time.

Besides the Portuguese flagship Alvalade project and the briefly discussed Slivova project, Avrupa has been branching out into Finnish gold- and base metal projects, in order to create more news flow of their own, and to see if they can tap into current enthusiasm for gold projects in Finland (Rupert, Aurion, Mawson, Boliden, EMX and others).

Avrupa has three exploration license applications in process, and a fourth application has just been submitted. The first two applications, Kolima and Kangasjärvi, covering copper- and zinc-bearing massive sulfide mineralization and targets in the Pyhäsalmi base metal district, are in advanced application status, with public, town hall-style meetings and stakeholder comment periods completed. Management awaits a decision in the latter part of Q1 2023. As a reminder, Kangasjärvi was an historic zinc mine, and potentially part of a VMS project. Lots of data have been obtained for the project, including historic drilling, and a small historic, open pittable resource (300kt @ 5.4%Zn, of which 85kt already has been mined out) is present.

Regarding Kolima, historic exploration efforts defined a 2000 x 200-400m zone with zinc mineralization, but also numerous boulders containing zinc and copper are present, in typical VMS fashion and geology. A resource wasn’t defined despite 70 drill holes completed. A VTEM survey indicated two important electromagnetic (EM) targets, which are primary drill targets, which will be drilled as soon as the permits are granted.

Conclusion

After a long and painstakingly thorough exploration permitting process in Finland it seems Avrupa is very close to receiving their exploration permits for at least 2 projects now. As Finland as a mining jurisdiction received a lot of acclaim lately, I’m curious if Avrupa will be successful in exploring their base metal prospects. With the Sandfire/MATSA JV in the process of adding a second drill, and targeting many more target areas this year, it seems news flow could finally shift gears at Alvalade. After a quiet 2022 for the company, in a year suffering from a bear market until late December, it might hopefully all come together for Avrupa this year, as mining sentiment seems to be improving on metal shortages across the board, causing high price levels. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.