Aztec Minerals Arranges C$3M Strategic Investment With Alamos Gold

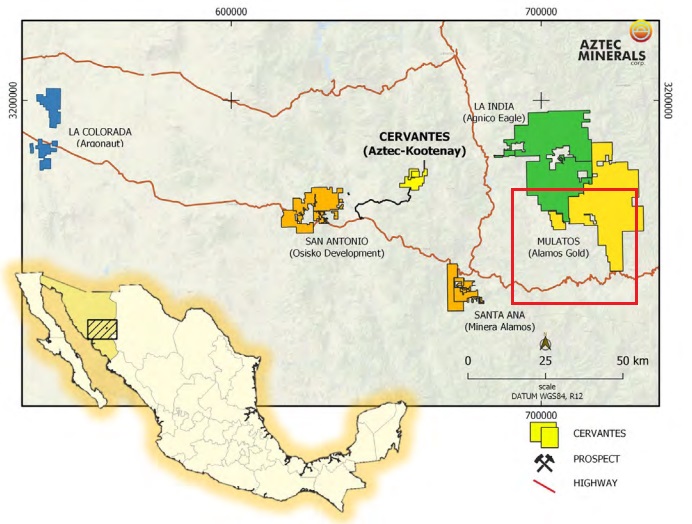

Just after releasing intriguing drill results at Cervantes, Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) announced a C$3M non-brokered private placement with Alamos Gold, which can be called intriguing for sure as well. Alamas Gold is operating Mulatos, one of the largest heap leach gold mines in Mexico, not that far away from Cervantes. Although Mulatos still has about 10 years of reserves, and there do not yet appear to be any direct synergies between the Cervantes project and Mulatos operation, it still is a stamp of approval and a sign of strong interest in what Aztec Minerals is accomplishing at the moment.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

It is not every day that you see a mid tier producer like Alamos Gold Inc. (TSX:AGI; NYSE: AGI) (“Alamos”) indicating that it intends to purchase securities to obtain a 9.9% interest in a small exploration junior like Aztec Minerals, so the news release on May 16, 2022 definitely surprised the markets. I already contemplated a financing coming soon in my latest update, but I didn’t expect this for sure, and definitely not this soon. Well done by CEO Simon Dyakowski. I asked him to provide some background story to this financing as far he could disclose, but unfortunately he couldn’t share too much info as the deal hasn’t closed yet: ”Aztec is in a fortunate position to be able to finance in a tough market because of our strong exploration results in the Winter 2022 RC drilling Campaign at Cervantes. We are excited at the prospect of welcoming Alamos Gold as a large strategic shareholder of Aztec. The investment will allow Aztec to advance exploration at the Cervantes Project over the late Spring and into the Summer. ”

The non-brokered private placement would involve the issuing of up to 10M units at a price of C$0.30 per unit for gross proceeds of up to C$3.0M. Each unit consists of one common share and one warrant exercisable to purchase an additional common share at an exercise price of CAD$0.40 for a two-year period following the closing of the private placement. As the Aztec shares were trading around C$0.26 when this was announced, the shares would be issued at a premium, which is rare these days with lots of negative sentiment everywhere due to the Fed rate antics, reacting on multi-decade high inflation, fueled further by commodity shortages, initiated by COVID-19 which halted investments for almost 2 years, and exacerbated by the ongoing Russia-Ukraine conflict. Besides the premium, Alamos was able to negotiate a full warrant, which is something you don’t see very often anymore, but it seems only fair after paying the premium.

Aztec Minerals intends to use the net proceeds of the PP to conduct exploration work on its Cervantes Porphyry gold-copper project in Sonora, Mexico and its Tombstone Epithermal gold-silver & CRD silver-lead-zinc-copper-gold project in Arizona, USA, as well for general working capital purposes. As a reminder, management is contemplating a 5,000m follow up drill program at Cervantes in the second quarter, not only will the near surface heap leachable mineralization be explored, but a stronger diamond drill rig will finally be utilized to drill at depth for large porphyry targets, indicated by a large IP chargeability anomaly. Aztec is also carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte and Jasper, and is expanding surface sampling and mapping on the property in general, in order to continue the 2021 phase 1 surface program.

The last drill program has been completed, containing 26 holes with 4,649m drilled, and Aztec has still 4 more holes to report, located at the California Zone, and final assays for hole JAS22-001 and the remaining holes are expected over the coming weeks.

As another reminder, the exciting thing here is of course, that the Cervantes oxides already seem to account for an estimated 1Moz heap leachable gold, but aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold-silver oxide project (subject to a 75/25 JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. With the financing cash, this enables Aztec to continue its exploration activities.

Conclusion

Although I already contemplated a financing sooner or later, this latest announcement surprised me and investors, by the speed and the involved party. It is always good to see a mid tier like Alamos Gold taking a strategic interest of 9.9% in a junior. For me it is a stamp of approval by a company, which knows better than any other type of investor out there what the mineralized potential could be at Cervantes. There probably is a good reason they want to sit front row from now on. Besides this: keep in mind Cervantes isn’t the only project, and both Cervantes and Tombstone have near surface oxides plus deep porphyry/CRD potential.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.