Aztec Minerals Intercepts 167.2m @ 1.0g/t Au Oxide Gold At Cervantes Project

After completing the first 26 holes of their Phase 2 RC drill program at the California target, part of their Cervantes gold-copper project in Sonora, Mexico on January 26, 2022, Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) doesn’t seem to suffer a lot from the common and extensive lab delays, and continues to release excellent drill results after the first hole was returned just over a week ago. Back then the result was a 88.4m @ 1.1g/t Au intercept, and more recently they announced an even more impressive 167.2m @ 1.0g/t Au, as part of a batch of 3 holes.

These results are already very good for a standard open pit deposit, but in this case Aztec is drilling out heap leachable mineralization as it is targeting the oxide cap of a potential porphyry, and heap leach operations have far better economics. A follow -up drill program is anticipated in a few months. As a reminder, the Cervantes oxides aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold oxide project in Arizona for August this year, also enabling them to go after large porphyry/CRD potential at depth at both projects.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The releasing of strong drill results didn’t go unnoticed for investors, as there was significant volume right after the two most recent news releases, resulting in a healthy recovery:

Share price 1 year time frame (Source tmxmoney.com)

And these are only the first 4 drill results, with many more to come. When all assays are announced, I expect the markets to have more awareness about Aztec for sure. The cash position is estimated at C$1M at the moment, and management is looking to raise more one to two months from now, also depending on drill results and general sentiment. For now, let’s have a closer look at the current drill results coming out of the California target.

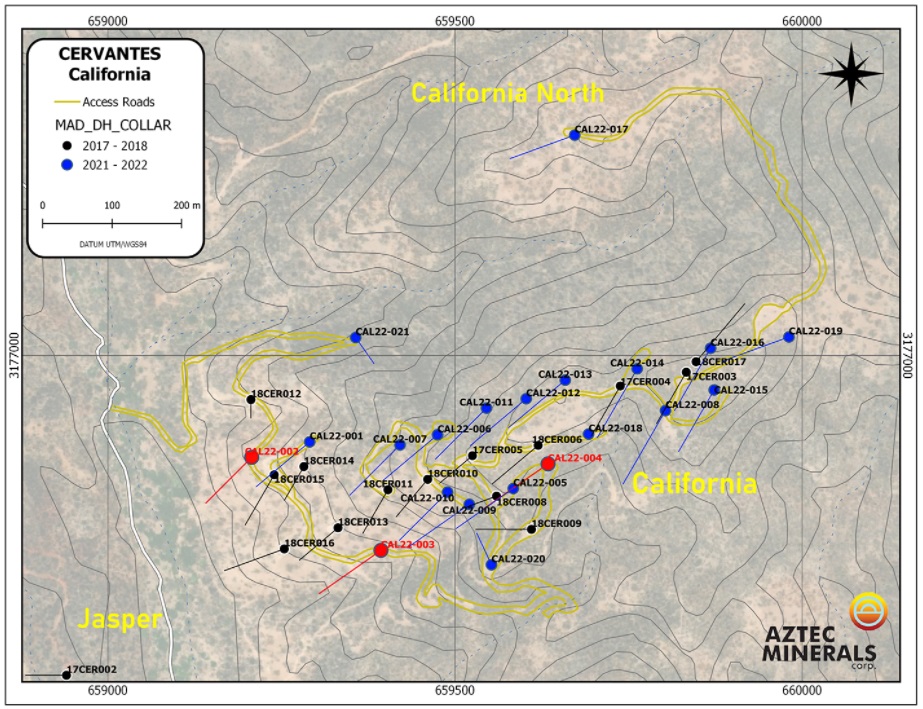

The California target is located on a ridge, and is only a small part of the Cervantes project. 17 holes have been drilled in 2017-2018, with lots of economic intercepts, causing me to guesstimate resource potential on these holes alone at about 600koz Au. These earlier holes, and the recently drilled ones can be seen here on this map:

As can be seen, most holes are step-outs to the north, parallel to the earlier drilled holes. The red holes are the ones reported in the last news release, holes 002, 003 and 004. Hole 001 was reported a week before this, and is located directly right of 002.

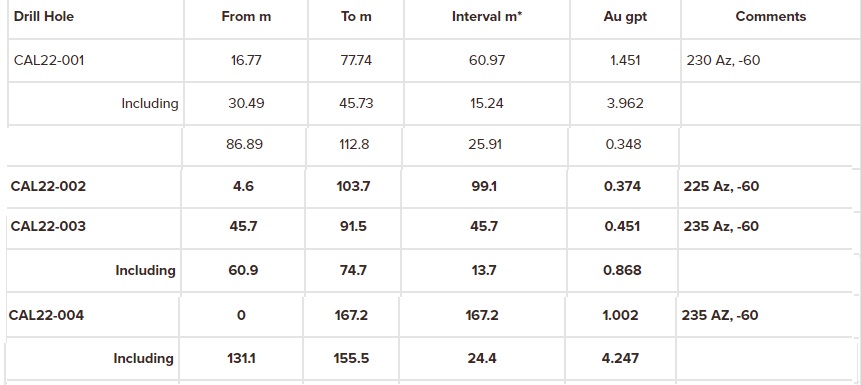

The following table shows the complete results:

These results are very impressive, especially considering the grade, which is often much higher than the 2017-2018 holes nearby. For example, close to standout hole 004 we can find hole 18CER006, which intercepted 170m @ 0.42g/t Au. Another remarkable example is hole 001 which is located close to 18CER014, returning 98.5m @ 0.41g/t Au, which is considerably less than 61m @ 1.45g/t Au. Management doesn’t have an explanation for this, but it certainly is intriguing, and these holes alone have the potential to add another 100koz Au to my guesstimate.

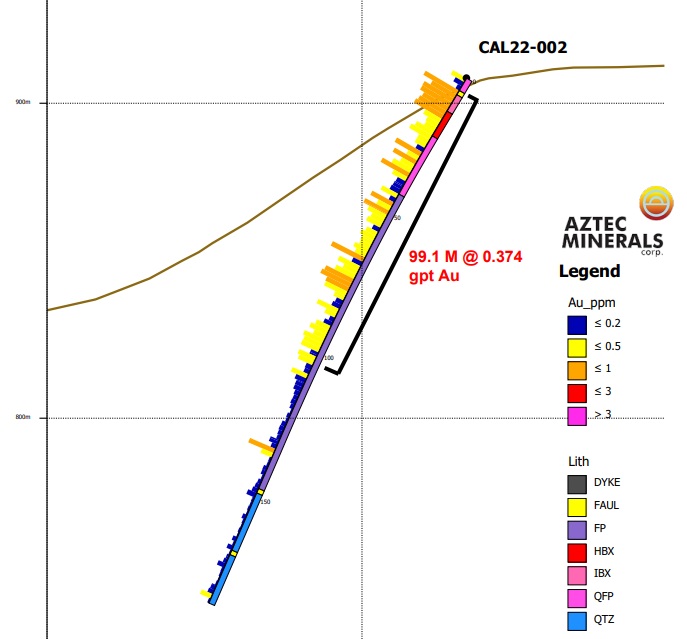

Keep in mind true width is often smaller, as most holes have been drilled under an angle following the slopes of the ridges, as can be seen for this section of hole 003 for example:

If the remaining assays could emulate the 2017-2018 results, or even improve on them like the recent ones did, there is not too much doubt in my mind Aztec could be closing in on a 1Moz Au mineralized envelope. A good thing is that most of the intersected mineralization is oxidized according to the geologists, with only the bottom end representing transitional ore. As recoveries for this type of ore are also good for this project (bottle roll heap leach test gold recoveries 77.9%), management doesn’t mind too much.

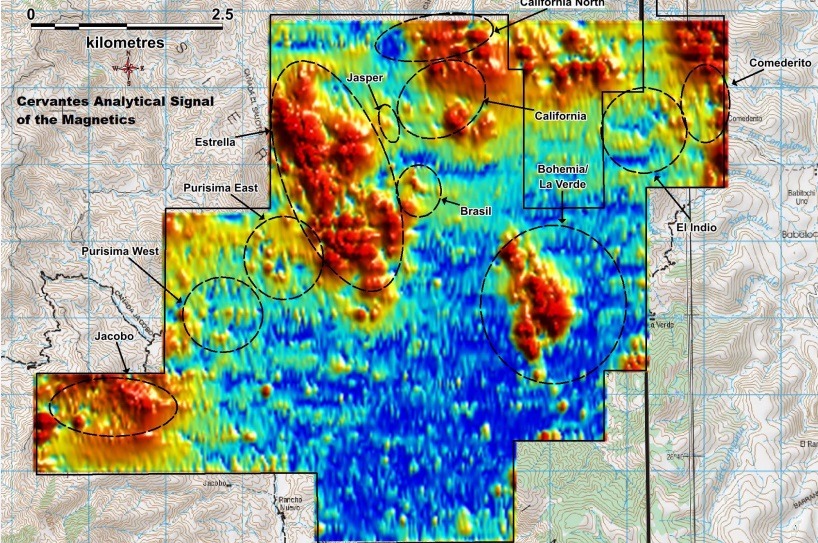

Besides going after more oxides, let’s not forget Aztec is also hunting large porphyry targets at depth at Cervantes. Two holes of 500m depth have been completed at California to test the large IP chargeability anomaly at depth. The balance of the Phase 2 program tested an IP chargeability anomaly at California Norte, and an outcrop at the Jasper target. The remaining results are expected in the coming weeks.

The first 4 holes of the 26 hole program were actually drilled at the Purisiama East target, which had never seen drilling before. Unfortunately these holes didn’t return any economic mineralization. According to CEO Dyakowski this target will not see more drilling this year as a consequence.

The program was designed to better define the open pit, heap leach gold potential of the porphyry oxide cap at California, evaluate the potential for deeper copper-gold porphyry sulfide mineralization underlying the oxide cap, test for north and west extensions of the California mineralization at California North and Jasper, and assess the breccia potential of Purisima East. Although not all results are in, based on handheld inspection of cores, management believes it might have done well on most goals except Purisima East. Breccia potential has been proven at California and California North, which is important as it indicates a widespread mineralization event.

Aztec will now carry out channel sampling and geologic mapping of the new drill roads at California, California Norte and Jasper, as well as to expand surface sampling and mapping on the property in general, in order to continue the 2021 phase 1 surface program. After this, all exploration results will likely be released, it will be most likely time to do another raise, and management expects to start drilling the Phase II 5,000m drill program somewhere in April-May.

As Aztec isn’t just advancing Cervantes, but is also advancing their Tombstone project in Arizona, I asked CEO Dyakowski what to expect here.

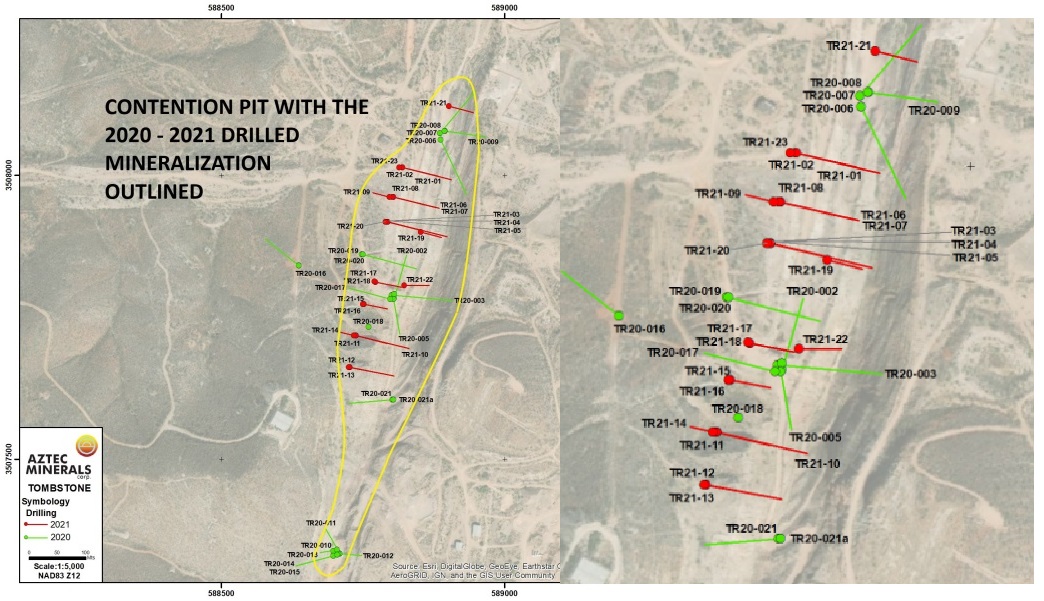

He answered that they have a 5,000m drill program planned for August of this year. This upcoming Phase 3 drill program will be designed to target deeper epithermal gold-silver mineralization below the Contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments.

Conclusion

The first drill results at the California target were pretty impressive, with hole 004 as absolute highlight, intercepting 167.2m @ 1.0g/t Au from surface. Considering this is almost all oxides, as Aztec is looking to delineate a heap leach deposit, this is an excellent intercept all around. For heap leaching a grade of 0.30-0.40g/t Au would already be economic, so the actually drilled grade over such a distance with no overburden is nothing short of sensational. Of course not all drill results were as good and I would be surprised as many of the upcoming ones would come close with these kind of numbers as well, but it certainly looks like Aztec has a very decent shot at delineating at least 1Moz Au at California. In my view, the same potential is present at their Tombstone project in Arizona, and both projects have geophysics completed on them, indicating large, deep targets for both, so in fact investors might be looking at 4 potential company makers. Still early days, but Aztec already has a good look on 2 of them. Stay tuned.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.