Aztec Minerals Intersects 152.4m @ 0.87g/t Au At Cervantes Project, 1Moz Au Threshold Could Be Within Reach

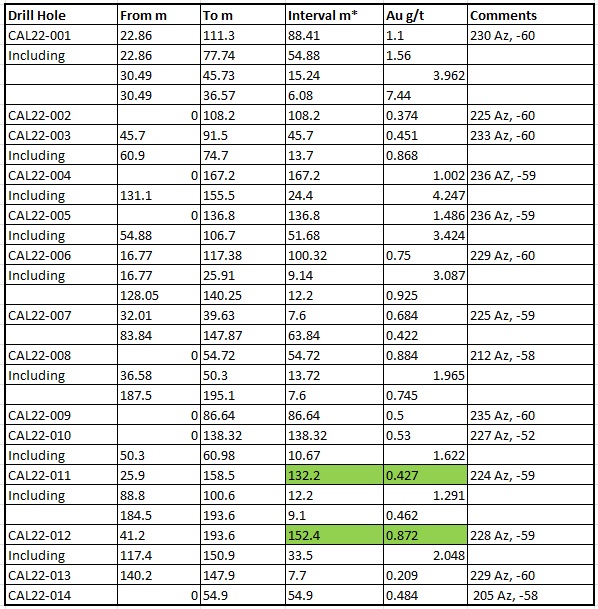

There seems to be no stopping of Aztec Minerals Corp. (AZT: TSX-V, OTCQB: AZZTF) as it keeps reeling in very good drill results from the California Zone at their majority owned and operated (65/35 JV with Kootenay Silver) Cervantes gold project in Sonora, Mexico. Earlier intercepts of 167.2m @ 1.0g/t Au, 136.8m @ 1.49g/t Au 138.3m @ 0.58g/t Au and 88.4m @ 1.1g/t Au were already excellent, and the currently reported batch of drill results added significantly to the northern center side of the mineralized envelope. Three out of the reported four holes returned pretty economic results again, with the highlight being 152.4m @ 0.87g/t Au. Keep in mind most of the mineralization is oxidized, and at least in my view it seems more and more likely Aztec Minerals is surpassing the 1Moz Au resource number now.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The 2021-2022 Phase 2 RC drill program aimed at the California target at Cervantes has now been completed, for a total of 26 holes with 4,649m drilled, assays of 14 holes reported, 4 holes were drilled at the Purisima target with limited success so these were not reported, with the balance of assays of 8 holes pending. The latest highlights are:

- 0.43 g/t Au over 132.2m in mineralized quartz feldspar porphyry and hydrothermal breccias in CAL22-011, including 12.2m of 1.29 g/t Au located at the northern edge of the central portion of the mineralized zone;

- 0.87 g/t Au over 152.4m in mineralized porphyries and hydrothermal breccias in CAL22-012 including 33.5m of 2.05 g/t Au located at the northern edge of the central portion of the mineralized zone;

- 0.48 g/t Au over 54.9 m in mineralized porphyries and hydrothermal breccias in CAL22-014, located at the northern edge of the eastern portion of the mineralized zone

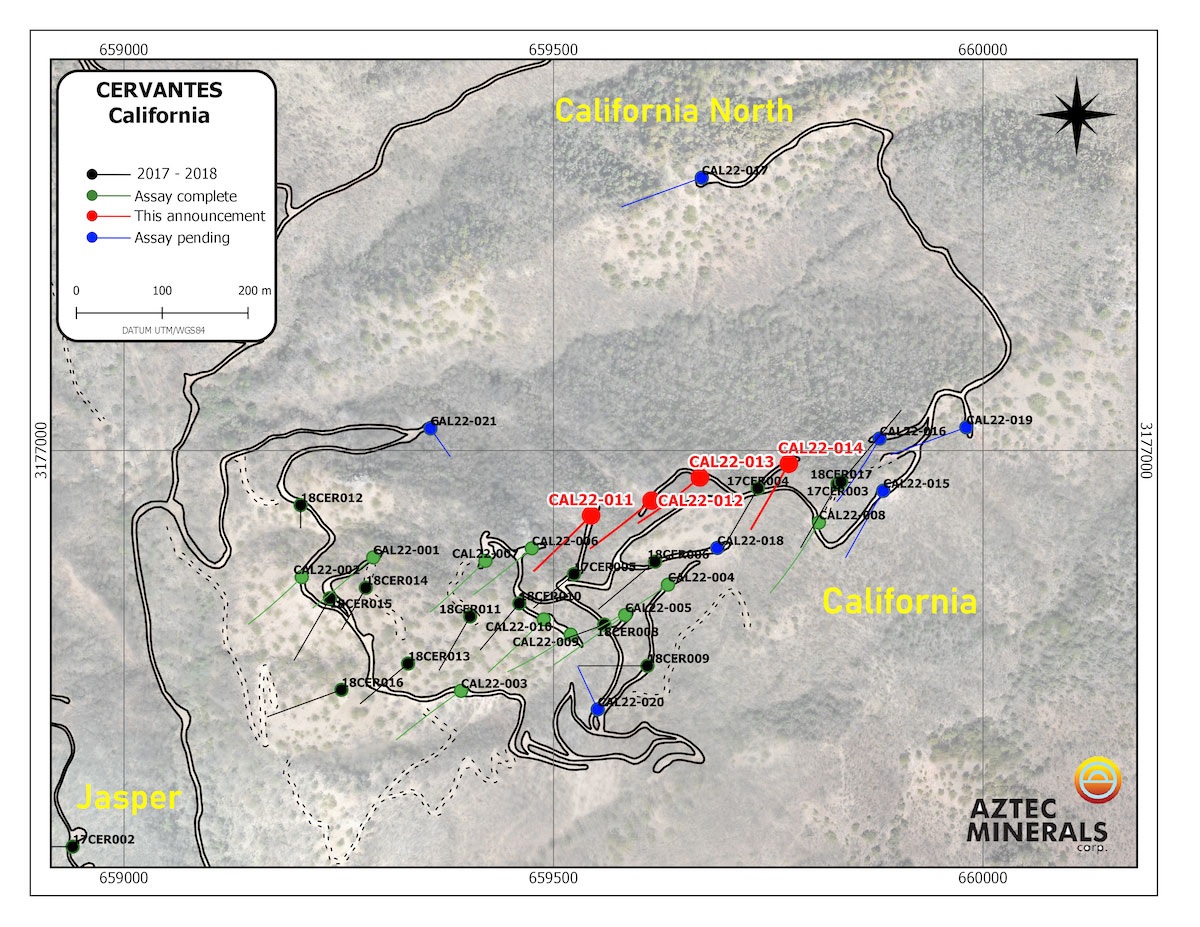

Hole CAL22-013 actually was, strange as it is as it was close to stellar hole CAL22-012, by far the lowest reported intercept so far, with 7.7m @ 0.209g/t Au. I don’t mind one outlier amidst a barrage of super holes though. Keep in mind, reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks and related hydrothermal breccias. The plan map of the California drill program can be seen here:

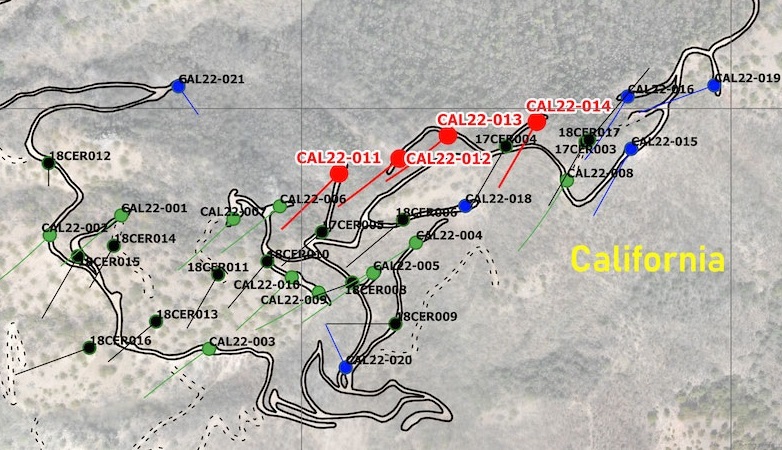

With a bit of zooming in on drill collars for better visibility:

The most important takeaway here is the fact that holes 011 and 012 are located about 100m north and east of the nearest reported holes so far. As such they represent an entire step-out zone to the north, adding considerable tonnage according to my back-of-the-envelope calculations. One way or the other, mineralization drops off notably towards hole 013, so I will take this into account when doing my guesstimates. All reported results from the Phase II program so far can be found in the following table below:

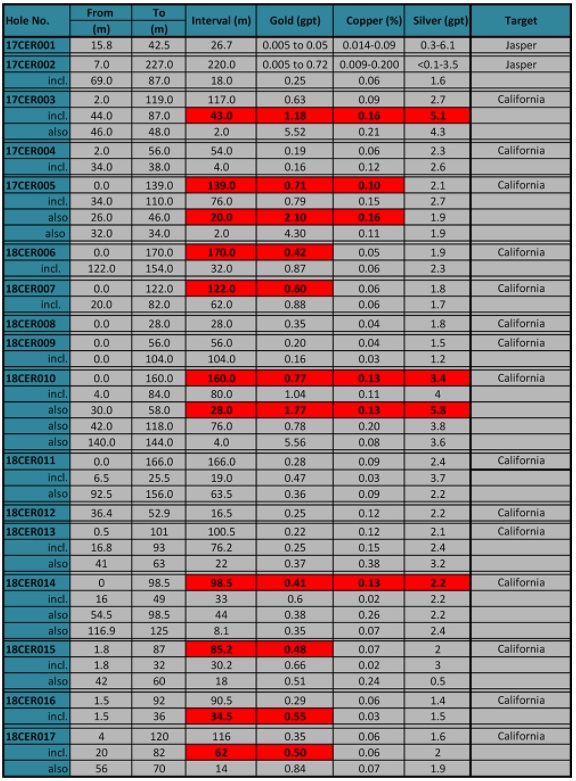

Again for your convenience, here is the table of the Phase I program again, provided by Aztec, for comparison:

As holes CAL22-005, 18CER005 and 18CER006 have generated results comparable to CAL22-11 and CAL22-012, I consider this zone more or less continuous. Since hole CAL22-013 hardly returned anything comparable to all other results, and nearby hole 18CER-004 had very low grade as well, it is justified to use a conservative approach when estimating and have mineralization drop off gradually from CAL22-12 to CAL22-13. Fortunately grades and lengths pick up again when going more to the east, with CAL22-14, 18CER-003 and 18CER-017. A slightly overall wider and thicker mineralized hypothetical envelope of 800x275x85x2.7=50.5Mt can be estimated now, and using an estimated average grade of 0.6g/t Au we would arrive at a hypothetical 974koz Au, which is very close to the very important 1Moz Au threshold, which would put Aztec firmly on the radar of mid tier producers. If the remaining holes return intercepts alongside my estimated average range of 85m @ 0.60g/t Au or better, then the envelope could increase to a hypothetical 900x300x85x2.7=61.9Mt, generating a potential 1.195Moz Au.

As management is contemplating a 5,000m follow up combination drill program of RC and diamond drilling at California in May/June, not only will the near surface heap leachable mineralization be explored, but the diamond drilling will be utilized to drill at depth for large porphyry targets, indicated by a large IP chargeability anomaly. Aztec is also carrying out channel sampling and geologic mapping of the new drill roads at the moment at California, California Norte and Jasper, and is expanding surface sampling and mapping on the property in general, in order to continue the 2021 phase 1 surface program.

As a reminder, the Cervantes oxides aren’t the only thing Aztec is looking to explore, as it is also planning a drill program for their Tombstone gold-silver oxide project (subject to a 75/25 JV with Aztec as the operator) in Arizona for the summer, also enabling them to go after large porphyry/CRD potential at depth at both projects. A diamond drill program is planned for the summer of this year, again contingent on available funds. This upcoming Phase 3 drill program will be designed to target deeper epithermal gold-silver mineralization below the Contention pit, and the coveted deep CRD silver-lead-zinc-copper-gold mineralization in Paleozoic limestones underlying the Bisbee Sediments. It seems with the California drill results continuing to confirm and exceed expectations, and likely indicating a 1Moz Au heap leachable resource, Aztec is captivating the markets, with volumes not seen in a long time:

Share price 6 month time frame (Source: tmxmoney.com)

With a gold price closing in on US$2,000/oz Au again, investors seem to become more and more convinced of the Aztec Minerals story. As such, I believe there will be plenty of interest for the upcoming round of financing.

Conclusion

As an investor, you can’t really ask for more regarding an exploration junior like Aztec Minerals. Almost all assayed drill holes at the California target at Cervantes are returning pretty to very economic results, and the continuity is amazing. So far only only 2 holes out of a combined total of 31 holes (Phase I and II) weren’t economic, which is rare. According to my estimates, Aztec could be very close to the magical 1Moz Au resource number now. Since the strip ratio is extremely low overall (maybe even less than 1), and lots of intercepts are well over 100m long, I expect California to be very economic. All superlatives aside, we still have to take into account that Aztec has 3 more opportunities for significant deposits: California at depth (porphyry), Tombstone oxides, and this second project also has a target at depth (CRD type mineralization). Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.