Banyan Gold Increasing Powerline Deposit Mineralization At Aurmac

As the Yukon as a mining and exploration jurisdiction is becoming more and more attractive, it is also home to one of the, if not the, hottest gold exploration story at the moment (Snowline Gold, SGD.CSE), which certainly helps numerous other explorers in the region. Banyan Gold (TSXV:BYN)(OTCQB:BYAGF) is one of them, as it still seems to be operating under the radar, quietly expanding an already delineated 4Moz Inferred gold deposit at their Aurmac project in the Yukon, located nearby the ramping up Eagle Gold Mine, owned by Victoria Gold. The latest drill results at the Powerline deposit, the main deposit of Aurmac, indicate good continuation of mineralization, and the company is gradually expanding the mineralized footprint by carefully stepping out in all directions.

On the macro side of things, it seems the world economy will be suffering from high inflation for at least a few more aggressive rate hikes by central banks worldwide, until inflation is contained at 3-4% annual levels. As a recession is widely expected to take place in Q1 2023, it is anticipated that demand will falter and prices will go down as a consequence, potentially invoking a pivot from the central banks, with the Fed leading the pack. As interest rates are anticipated to peak around 5%, a period with no rate hikes will probably send the USD lower, which in turn will likely have a positive effect on metal prices, which are all quoted in USD of course. Although I don’t consider the USD a fundamental inverse driver of the gold price, it might very well prove to be a powerful sentiment driver this time, as we might encounter an interesting combination of a lower USD, negative real interest rates and gold as a fear trade, with geopolitical tensions ongoing and lots of bubbles about to collapse. Time will tell.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Banyan Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Banyan or Banyan’s management. Banyan Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

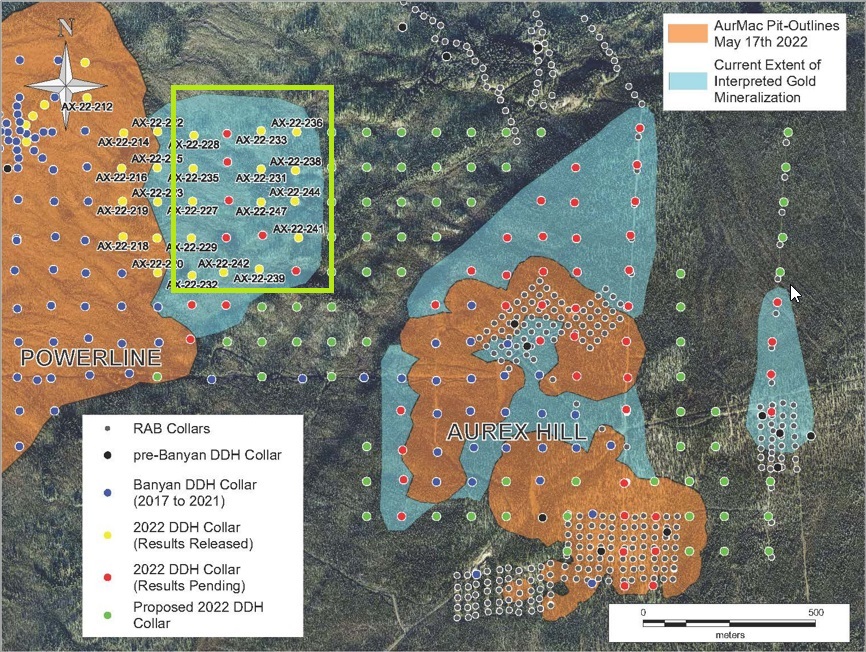

Banyan started its 2022 exploration program on January 26, 2022, and is aiming for 60,000m in total (240holes). 200 drill holes and over 49,000 m of drilling has been completed so far, with a focus on expansion of the near surface mineralization around the Powerline and Aurex Hill Zones, also testing the potential to connect the mineralization footprint of both.

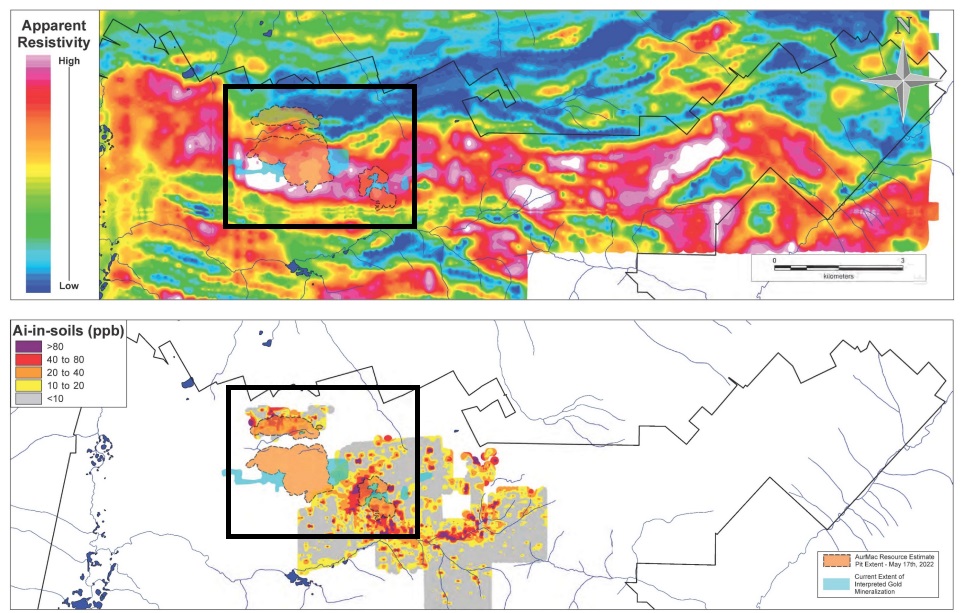

Approximately 10% of the overall 2022 drilling will be focused on high priority regional targets on the AurMac Property and Nitra Property, outside of the Airstrip, Powerline and Aurex Hill Deposits, which will be designed to highlight the larger gold mineralization potential of the AurMac Property. Airstrip, Powerline and Aurex Hill are localized in the black square below, but soil sampling and surveys imply a much larger target:

Drilling of regional targets is starting to the east the last week of August and into September and drilling on Nitra will begin in mid-September, and results are expected around Q1-2023. The ongoing 2022 drill program has 4 drill rigs operating, and is generating lots of results. Two batches were announced since the last update on October 12, 2022, and September 6, 2022, and both will be discussed briefly here.

The October assay highlights include:

- 177.9 m @ 0.47 g/t Au from 24.4 m in DDH AX-22-251

- Including 27.1 m @ 1.50 g/t Au from 97.2 m

- 114.1 m @ 0.52 g/t Au from 167.8 m in DDH AX-22-252

- Including 30.4m @ 0.69 g/t Au from 206.4 m

- Including 26.1 m @ 1.01 g/t Au from 255.8 m

- 40.5 m @ 0.86 g/t Au from 183.0 m in DDH AX-22-22-257

- 31.8 m @ 1.80 g/t Au from 56.4 m in DDH AX-22-258

- 28.2 m @ 0.89 g/t Au from 59.8 m in DDH AX-22-272

- 145.8 m @ 0.52 g/t Au from surface (12.6 m) in DDH AX-22-277

- Including 45.7m @ 0.88 g/t Au from surface (12.6 m)

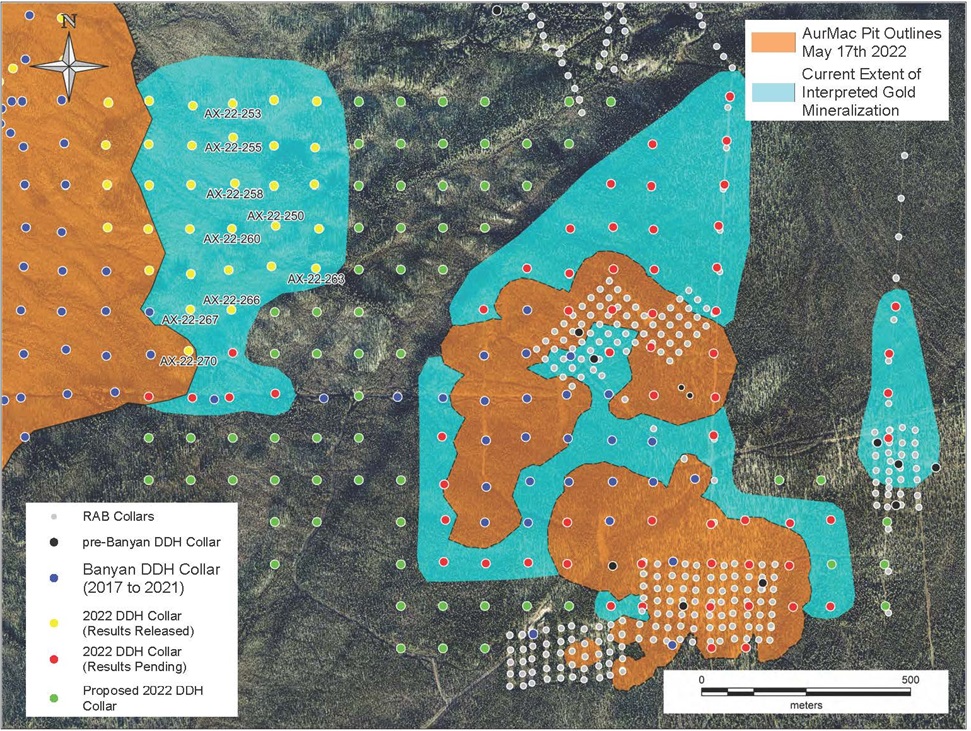

To put these results into context, the 2022 NI43-101 resource at AurMac stands at 3.99Moz @ 0.60g/t Au Inferred, so these highlights are in line with expectations, especially as these holes have been drilled closely to the collars included into the resource. Hole 258 actually was a good hit at Powerline a bit further out to the east, as can be seen below:

These results (yellow dots) to the east of Powerline could imply a back-of-the-envelope resource increase of 500x500x80x2.75t/m3 = 55Mt, based on an average grade of 0.55g/t Au this would be a hypothetical 973koz Au.

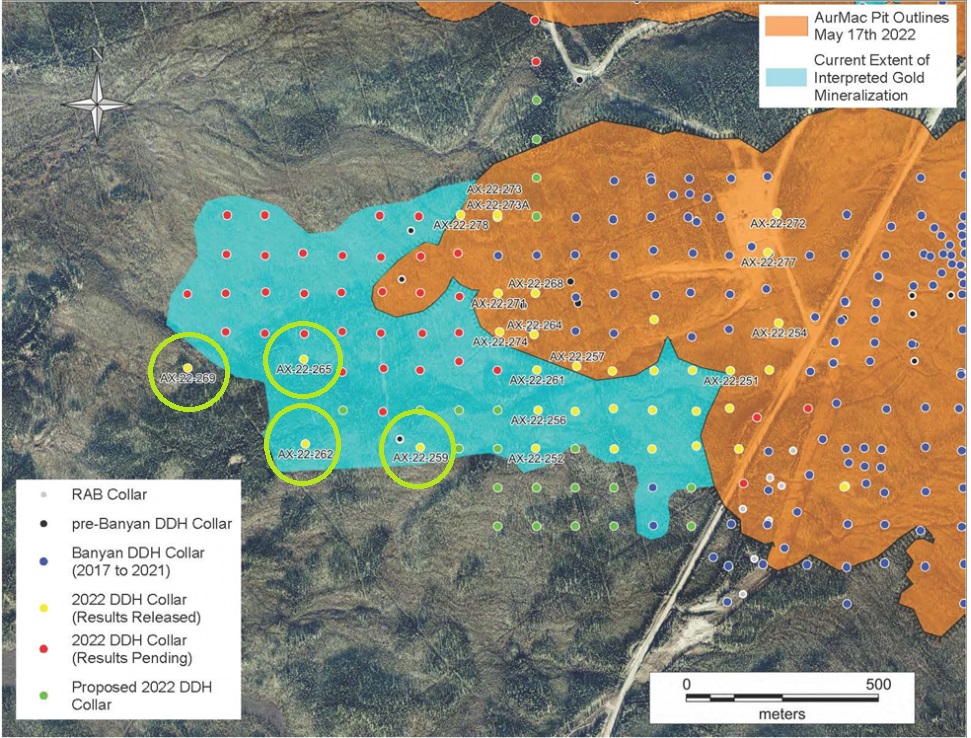

The majority of results to the west of Powerline were solid as well, although a number of holes drilled at or near the visualized limits of the mineralized envelope didn’t return very economic results. 4 of these holes are shown below within green circles:

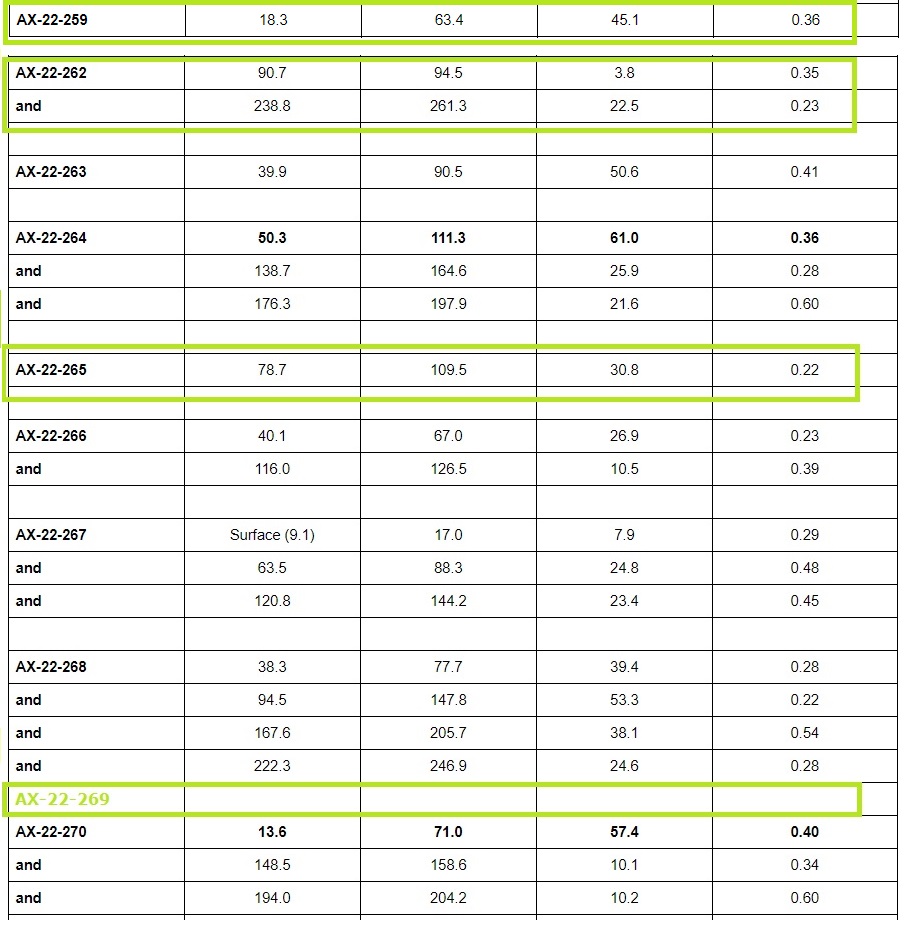

The assay results of these 4 holes are shown in the table below in green:

As can be seen, hole 269 didn’t return any anomalous gold, but was the step-out hole furthest to the west at Powerline. As I wondered what CEO Christie made of these particular results, and as I was curious about the drilling strategy the company would follow now in that area, I asked her a few questions. She answered:

“We think the mineralization goes west strongly, there will be a Southern Boundary, but we could just be seeing an area that has weaker mineralization in some of those holes and with 100 m step outs, the grade could also be there but not just where we drilled. On Aurex Hill, you will notice we are drilling almost an additional 500m south following up on what we see in the core. There will be edges, but there could also be internal variability. All the holes add ounces and all contribute to us understanding what is controlling the mineralization. We are very focused on AurexHill to Powerline connection drilling right now. We think we will drill north and west of 269, we think there is a bend in where the mineralization is west of 269. This will likely be in the spring as it is quite swampy in that area and best to drill when completely frozen.”

It was interesting to hear Banyan not giving up on drilling further west of Powerline because of a potential fold or bend in mineralized zones, causing them to miss at hole 269. We will have to wait until Q2 2023 before any results will be announced, hopefully confirming this theory.

A back-of-the-envelope estimate on the western part of Powerline resulted in a global 500x250x60x2.75t/m3 = 20.6Mt, and based on an average estimated grade of 0.40g/t Au this would mean 266koz Au hypothetically added for now, bringing the hypothetical newly added ounces to well over 1.2Moz Au, taking the hypothetical total for Aurmac to 5.2Moz Au. According to CEO Christie, the next resource update is planned for in 2023, after receipt of the bulk of 2022 drill assay results.

Let’s have a quick look into the earlier reported (September 6, 2022) batch from the same program. Highlights were:

- 131.0 m @ 0.41 g/t Au in AX-22-217

- 45.0 m @ 1.07 g/t Au in AX-22-221

- 175.8 m @ 0.57 g/t Au in AX-22-224

- 48.7 m @ 0.61 g/t Au in AX-22-229

- 55.4 m @ 0.49 g/t Au in AX-22-230

- 185.8 m @ 0.43 g/t Au from surface in AX-22-231

- 109.7 m @ 0.40 g/t Au in AX-22-234

- 96.0 m @ 0.56 g/t Au from surface in AX-235

- 51.7 m @ 0.61 g/t Au in AX-22-240

- 68.8 m @ 0.82 g/t Au in AX-22-243

- 114.7 m @ 0.40 g/t Au in AX-22-246

These highlighted intercepts were also closer to the already established resource at Powerline. The results more to the east towards Aurex Hill were somewhat lower grade.

These results, confined by the green rectangle by yours truly, are summed up in columns going from west to east and specified below, to give more insights in mineralized zones:

228: 49.1m @ 0.35g/t Au and 96m @ 0.56g/t Au

235: 14m @ 0.54g/t Au

227: 175m @ 0.24g/t Au

229: 9.4m @ 0.43g/t Au and 3m @ 0.63g/t Au and 48.7m @ 0.61g/t Au

242: 45.8m @ 026g/t Au and 23.6m @ 0.21g/t Au and 29.5m @ 0.41g/t Au

239: 38.1m @ 0.25g/t Au and 29.7m @ 0.43g/t Au and 12.6m @ 0.9g/t Au

233: 6.1m @ 0.47g/t Au and 40.4m @ 0.29g/t Au

231: 185.8m @ 0.43g/t Au

247: 111.9m @ 0.35g/t Au and 21.3m @ 0.23gt/t Au

236: 6.1m @ 0.94g/t Au and 7.6m @ 1g/t Au

238: 39.2m @ 0.33g/t Au and 37.1m @ 0.30g/t Au

244: 99.1m @ 0.27g/t Au

241: 46.5m @ 0.21g/t Au and 44.2m @ 0.23g/t Au

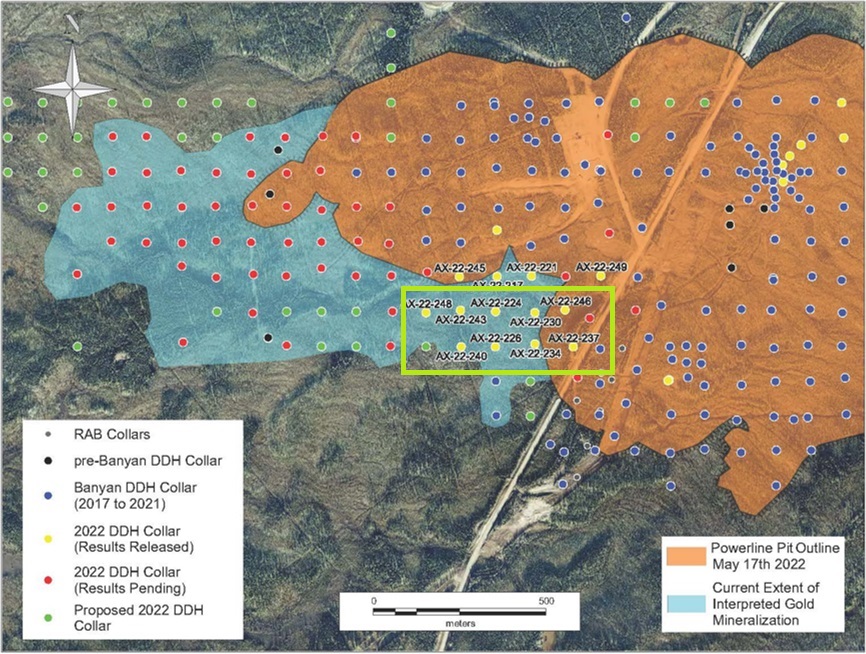

For the western extension of Powerline I selected the following results:

224: 175.8m @ 0.57g/t Au

226: 9.2m @ 0.21g/t Au and 102.1m @ 0.35g/t Au

230: 78.8m @ 0.39g/t Au and 55.4m @ 0.49g/t Au

234: 109.7m @ 0.40

237: 101.9m @ 0.25g/t Au

240: 122.6m @ 0.39g/t Au

243: 68.8m @ 0.82g/t Au and 52.2m @ 0.53g/t Au

246: 111.9m @ 0.40g/t Au and 5.9m @ 0.67g/t Au

248: 220.6m @ 0.23g/t Au

Although there were many long intercepts, the average grade tends to be a bit lower overall compared to the NI43-101 resource. I don’t consider this to be an issue at all, as the ore is heap leachable, and this recovery method can handle grades below 0.30-0.35g/t Au, certainly with the current gold prices. CEO Christie was happy with the incoming results from October and September:

“These latest assay results from the ongoing 2022 diamond drill program continue to systematically increase the mineralized footprint with consistent intersections of on/near-surface gold mineralization in and around the Powerline Deposit on the AurMac Property,” Tara Christie, President & CEO of Banyan stated. “With four drills currently operating, Banyan remains well positioned to provide a resource update in 2023, after the 2022 assays have been received and the AurMac geological model updated.”

According to management, analytical results from these latest twenty-nine (29) 2022 drill holes are consistent with previous exploration drill results at the Powerline Deposit and the areal extent of interpreted gold mineralization from near/on-surface continues to be expanded and validated with each successive batch of assay results received.

As a reminder, Banyan Gold has an option agreement with Victoria Gold on Aurmac, already owning 51%, and has already completed all exploration expenditures to earn 100%. By deliberately not forming the JV yet, which was possible at 51% ownership, it saves the additional time, legal and accounting costs of managing a JV, and according to management it is most likely that Banyan is on the path to earning into a 100% ownership. Banyan Gold retains this option by paying Victoria Gold C$2M in shares or cash for the underlying Aurex property and a further C$2.6M in shares or cash for the underlying McQuesten property, and complete a PEA by 2025. The PEA should be relatively straight forward given the comparable Eagle Gold Mine was recently built and provides actual operating costs for heap leach in this jurisdiction, so this will likely be achieved way ahead of schedule. On top of this, Victoria will be granted a 6% NSR on both properties. These two 6% royalties can be reduced to 1% regarding gold by paying C$7M per royalty.

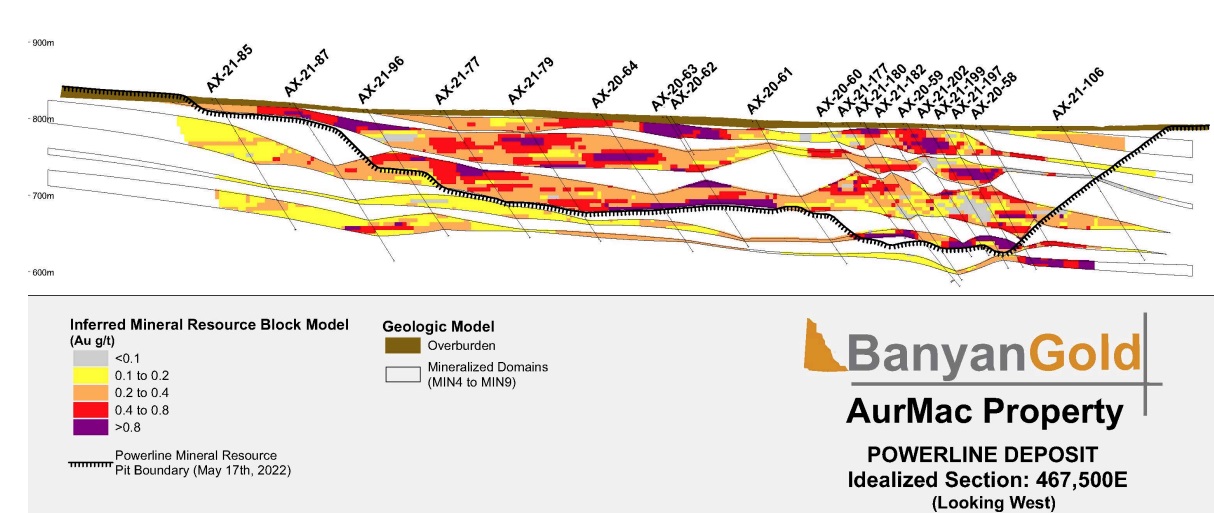

The NI43-101 report uses a ore to waste strip ratio of 1 : 0.34 for the Powerline deposit which is extremely low, as usually a strip ratio is represented by waste to ore figures, with waste usually coming up higher than ore. As can be seen, the main Powerline deposit is a collection of stacked layers, running almost horizontally, and well beyond current pit resource outlines. Another good aspect is the presence of higher grade gold near surface, enabling starter pits with extreme returns on investment, which is always a positive for mine financiers. Management sees lots of exploration potential, and has high hopes of expanding Aurmac with a target of to 6-7Moz Au after this 60,000 m of drilling , which would make this a real Tier I asset. A consolidation with the Eagle Gold Mine, or with someone purchasing both seems logical, creating a Tier I gold district with lots of synergy potential.

In my view the economic potential of Aurmac is legit, as calculations from an earlier article estimate the hypothetical, solid and conservative after-tax NPV5 at US$517M @ US$1500 gold and IRR of 30.6% for a 2Moz Au production scenario (which is increasingly conservative with new ounces being proven up as we speak), also indicating why I think Aurmac is a very robust project. All things considered, I like the prospects of Banyan Gold, especially since their exploration- and economic upside, low risk jurisdiction and nearby Victoria Gold who just paved the way for them regarding permitting and infrastructure.

Conclusion

It will hopefully be clear by now, that Banyan Gold is something special, as it is pursuing a real shot at a potentially very economic 6-7Moz heap leachable gold deposit in the Yukon. According to my calculations based on the latest drill results, it seems Banyan could be looking at another potential 1.2Moz Au, bringing the pro forma hypothetical resource already at 5.2Moz Au, albeit at a slightly lower overall grade. Aurmac has Tier I written all over it, and either as a stand alone operation or consolidated with the adjacent Eagle Gold Mine, creating a potential 11-12Moz+ Au monster, my guess is Banyan will not be around anymore shortly after mining permits are granted, and potentially taken out even sooner. For now, management aims at growing Aurmac as large as possible, and when sentiment turns, Banyan is at least in my view one of the gold juniors with the lowest risk 5 bagger potential around.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Banyan Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.banyangold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.