Bottom-Fishing: Tectonic Metals

At a time where Russia is annexing four provinces of Ukraine and threatening the rest of the world to use nuclear force to defend these “new territories”, shortages are everywhere from energy to food to materials and inflation isn’t under control yet, the stock markets are waiting for the Fed to pivot on their hawkish interest rate policies. A recent, misguided tax proposal in the UK led to financial chaos over there, forcing the Bank of England to step up with dovish measures to save UK pension funds among others in a robust intervention. Lots of gold bulls viewed this as a central bank pivot, assuming the Fed and other central banks being likely to follow suit, but I view this as an isolated, local incident with no global fallout on rate policies.

In the meantime, the share price of Tectonic Metals (TECT:TSX-V; TETOF:OTCQB; T15B:FSE) is hovering at steady, rock-bottom levels for some time now despite facing fairly serious summer doldrums which sent down the sector quite significantly since Q1. Management hasn’t been sitting on their hands though. After drilling commenced in July 2022 at the Flanders/Alder/Flume targets, part of their district-scale Seventymile project in Alaska, Tectonic reported assays of nine holes, with interesting results and one standing out in particular, as hole 002 returned 1.53m @59.4 g/t Au. The company also announced the commencement of metallurgical testing at their very interesting (and Quinton Hennigh’s favorite) Flat Gold Project that follows up on historic work, suggesting gold at this property could very well be free milling which is cost effective. On the administrative front, Tectonic announced the recent appointment of a new CFO, and considering the quality and experience of the new hire I view this as an improvement on already high standards.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Tectonic’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Tectonic or Tectonic’s management. Tectonic Metals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

After raising C$2.3M @ C$0.06 and incurring quite a bit of additional dilution as 32M new shares were issued (plus 2y, C$0.10 half warrants) to the likes of Crescat Capital and Doyon, the two largest shareholders, Tectonic was set to start exploration on their projects. The proceeds from this raise went into the drilling program conducted at Seventymile and metallurgical work being undertaken at Flat, followed by an inaugural exploration program this fall. On October 3, 2022, the company announced changes in personnel as their former CFO Xavier Wenzel was replaced by Oliver Foeste, who will also assume the duties of Corporate secretary.

Mr. Foeste isn’t new to the business, as he is the founder and Managing Partner of Invictus Accounting Group LLP and has significant executive, director, finance, and public company compliance experience across a number of industry sectors including mining. Prior to Invictus, Mr. Foeste was in senior finance and accounting roles at TSX, TSXV, and NYSE listed issuers, and earned his CPA at Deloitte and a boutique tax advisory firm. Foeste’s firm Invictus has an impressive client list, which includes Teck, SSR Mining, Newmont, Trevali, Alexco, Skeena Resources just to name a few. Running a public company is a complex administrative endeavour and Mr. Foeste’s skillset and professional experience are both more than well-suited to his new role at Tectonic.

Mr. Foeste comes in at uncertain times, as the markets haven’t been forgiving to a lot of juniors, but Tectonic managed to hold on to 5-6c levels since the financing closed, which is a testament to the support of big shareholders according to CEO Tony Reda: “Tectonic’s strength has always been in its people, not only those who work for us in the office and the field, but those who support us with their hard-earned money. We are very conscious of the responsibility this implies and are entirely focused on turning this capital into a discovery that ultimately transitions into a mine.”

Share price 3 year time frame (Source: tmxmoney.com)

I view these levels as strong support, hence the “bottom-fishing” in the title, and with the backing of Crescat and Doyon it seems there is no shortage of cash for exploration anytime soon, which in turn increases chances at success, especially at the types of prospective projects owned by Tectonic which all have lots of potential and scale.

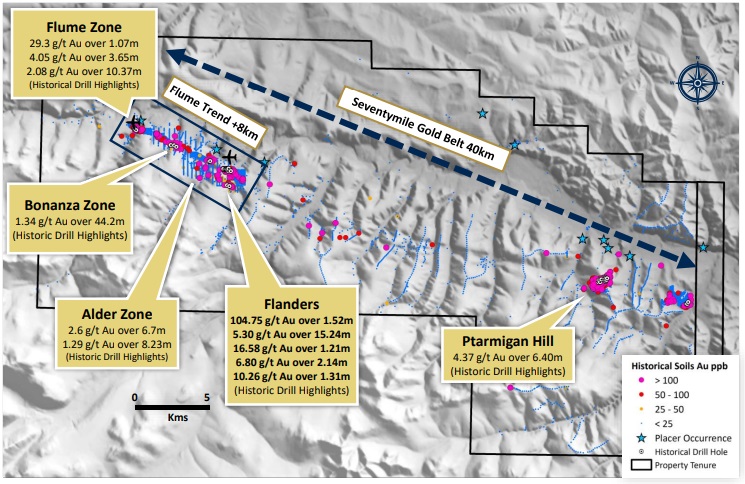

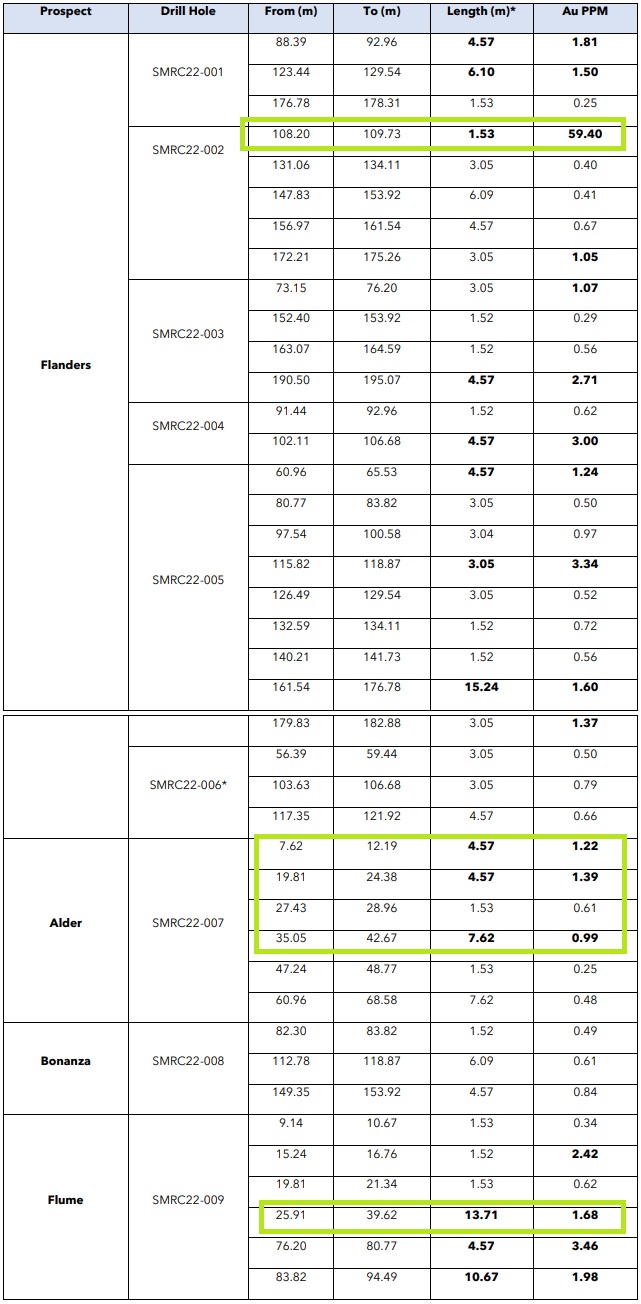

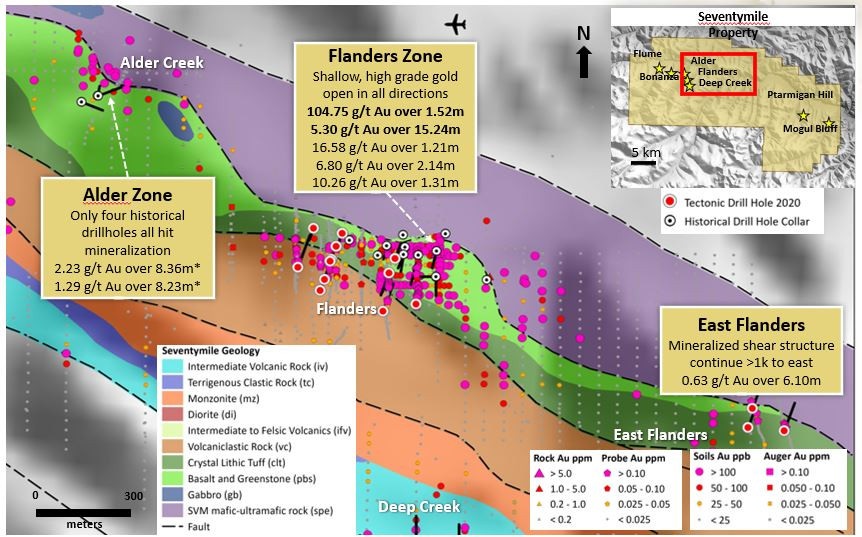

Tectonic Metals started drilling at Seventymile in July and completed their nine hole RC drill program over 1,412m at the end of August. Most of the drilling was focused on the Flanders target, with a few other holes were drilled at the Alder, Bonanza and Flume prospects. Global locations can be seen below, with recent drill results more or less confirming and expanding the impressive historic drill results indicated on the map as well:

Highlight results of the recent RC drill program were hole 002 with 1.53m @ 59.4g/t Au from 108m, hole 007 with 4.57m @ 1.22g/t Au from 7.6m, 4.57m @ 1.39g/t Au from 19.8m and 7.6m @ 0.99g/t Au from 35m, and hole 009 with 13.7m @ 1.68m from 25.9m. As can be seen below, every hole hit mineralization, with multiple intercepts of stacked vein systems.

CEO Tony Reda was happy with the results: "The results of the targeted 2022 RC drill program validate Tectonic's exploration rationale of targeting the high iron basalt in proximity to structural contacts as the preferential site for gold mineralization along the >8km Flume trend, host to four known mineralized zones all open along strike and at depth. This validation of our exploration model will give us the ability to focus, refine and vector our exploration efforts more efficiently going forward, both as we continue to expand the known mineralized zones and search for additional mineralized centres in areas of cover along the Flume trend."

Notwithstanding this, as the combination of grades and intercept lengths didn’t directly point towards very economic mineralization outside several highlights (recent and historic), it was no real surprise to me to hear from CEO Reda that Seventymile is no longer their flagship project.

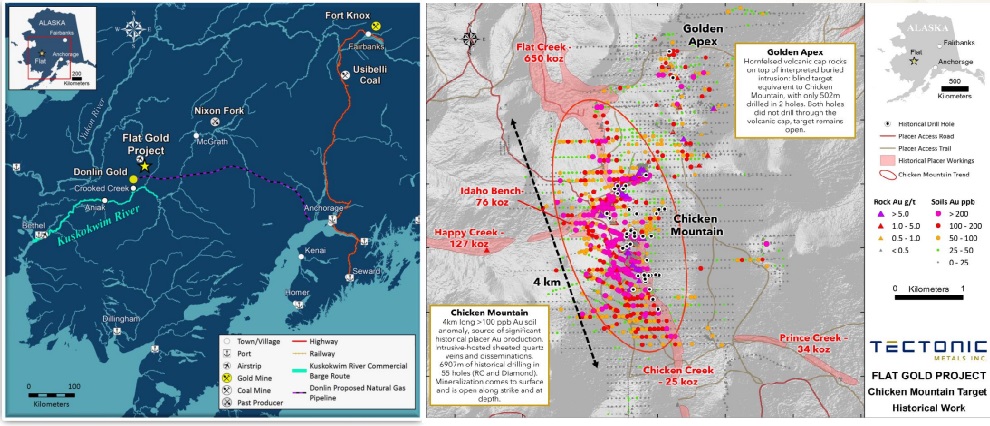

This title is reserved for another project nowadays. Tectonic also fully owns the Flat Gold Project, which is located 40km north and in the same mineral belt as the 39Moz @ 2.24g/t Au Donlin Gold Project, jointly owned and operated by Barrick and Novagold, who are spending $60M at Donlin this year. Flat is a 92,000-acre district-scale intrusion-hosted gold system with multi-million-ounce potential in the heart of Alaska’s fourth most prolific placer mining district.

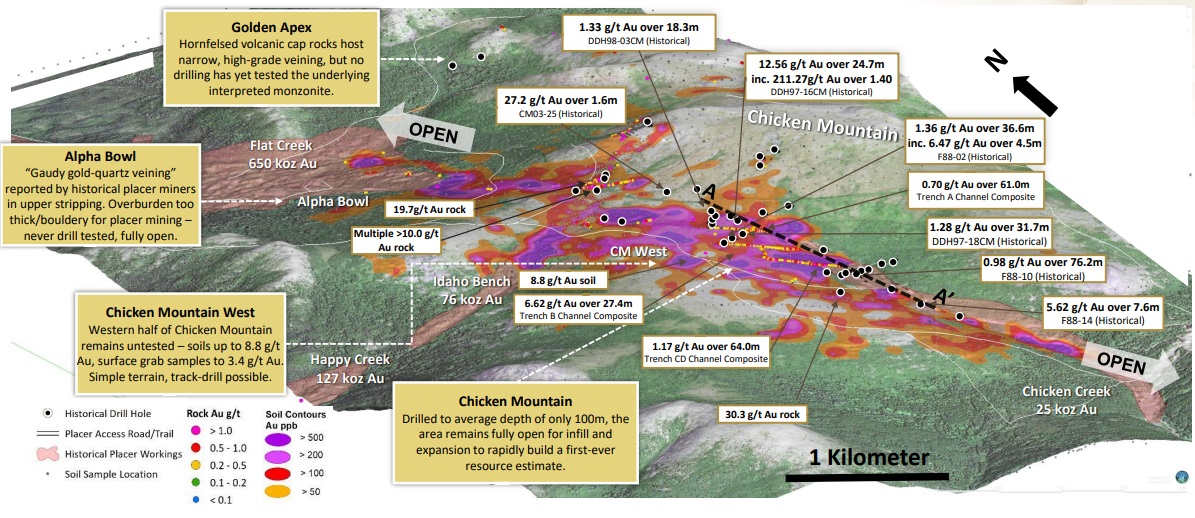

The priority target, Chicken Mountain, hosts a robust 4km long gold-in-soil anomaly where all 55 drill holes hit gold mineralization to a drill depth of only 100 metres vertical; mineralization remains open along strike and at depth. According to historical published reports, Chicken Mountain is the likely source of the majority of the historic 1.4Moz of placer gold mined in the area. Historic drilling from 1997 in55 holes all intercepted mineralization, and returned pretty interesting highlights, like 12.5g/t Au over 24.7m, 1.36g/t Au over 36.6m and 1.28g/t Au 31.7m with many intercepts starting from surface. When extrapolating very generally to a back-of-the-envelope mineralized envelope, potential is there for a 1500x200x30x2.75t/m3 = 25Mt target, containing an estimated 800koz Au at an assumed 1g/t Au. And this is just assuming a g*m number of 30 on average.

When looking at the sampling map, the actual underlying target is much bigger, to the tune of a very globally estimated 4000x700 (on average) x30x2.75t/m3 = 230Mt, so you can do your own math on this if Tectonic gets lucky. As always before getting too euphoric, just sampling results, even combined with favorable geophysics mean not that much, as drill results often fail to prove up economic mineralization, but in this case the sampling results combined with historic drilling is pointing towards the right direction for sure. Another target called Golden Apex, which has seen two historic drill holes that never reached their target drill depth, also appears promising and may be another Chicken Mountain according to management.

Historic metallurgical work indicates an oxidized profile up to 200m depth (drilling didn’t go deeper and the average drill depth for the project is 100m), and the same 1990 report reports that the ore is not refractory. According to management, the significance of metallurgical work to unlocking the potential of Flat cannot be understated. Tectonic has undertaken a potentially game-changing metallurgical program that follows up on the preliminary results of the 1990 metallurgical report prepared for Fairbanks Gold, Robert Friedland’s vehicle that previously explored the property before focusing their energies on their discovery at Fort Knox, now the Fort Knox Mine owned by Kinross. If confirmed, the prospect that the gold at Flat is free milling (meaning the gold can be recovered without resorting to pressure leaching or other chemical treatment) suggests a lower cost path to production. Free-milling/heap leachable open-pit deposits are coveted by majors, and even more so in a Tier One jurisdiction. The 1.4Moz of historic placer gold that has been taken out of the creeks around the Chicken Mountain target also supports the notion that the gold may be free-milling.

Usually, a soil sample of over 20ppb is already enough to identify drill targets, but as represented in the map above, the yellow/orange zones already indicate sampling up to 200ppb, and the purple zones over 500ppb, so it is understandable that management is very excited about this project. And not just them, Quinton Hennigh stated in an interview at Beaver Creek with CEO Reda that his main interest in Tectonic actually became the Flat project after learning about it. So after hearing this, I wondered if Tectonic needed drill permits for Flat, and if already granted, when drilling could start here, and how many meters are planned. CEO Reda answered that drilling is a top priority as the historical results and exploration targets are some of the best he has seen in his career, but first Tectonic has to complete their met work testing before drill targeting can be done.

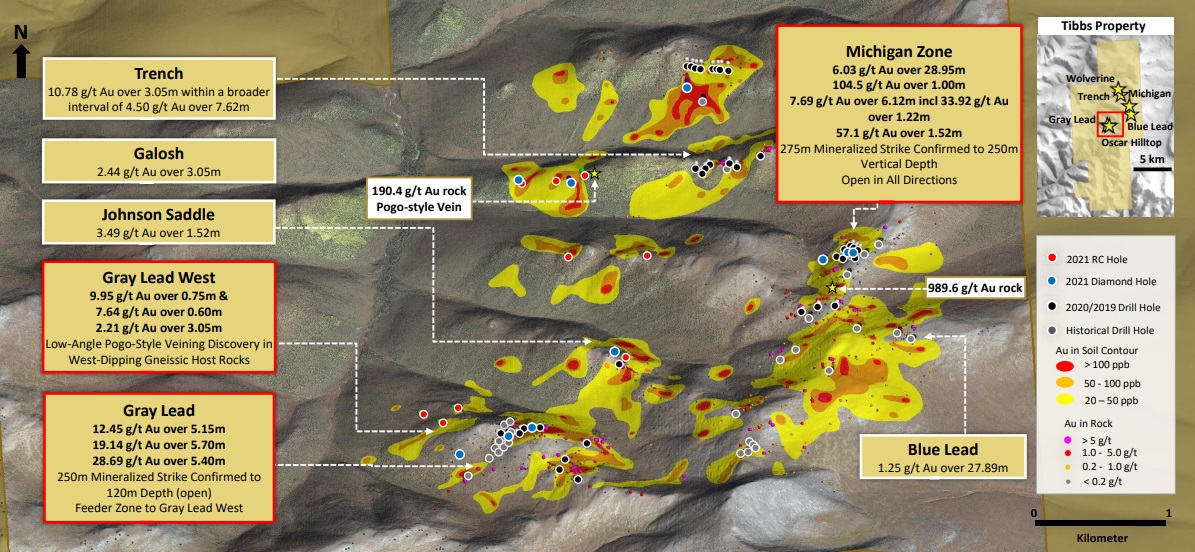

Finally, Tectonic’s third district-scale property is the fully owned 29,280-acre Tibbs Gold Project located 35km east of the 200koz Au per annum Pogo Gold Mine. High-grade gold mineralization at Tibbs occurs in steeply dipping veins, crossing multiple lower-grade low-angle veins similar to Pogo, which serves as a geologic analogy. Drill highlights from 2020 show 28.95m @ 6g/t Au, 5.3m @ 15.7g/t Au, 5.7m @ 19.1g/t Au, 1m @ 104.5g/t Au and 5.1m @ 12.45g/t Au. These are very substantial results indeed. Importantly, Tectonic validated the Pogo Exploration Model when they intercepted low-angle veining at Gray Lead West, an area where the host rock and geochemistry are identical to that found at Pogo. This discovery represents the final piece of the puzzle that confirms Tibbs as a Pogo analogue.

As a reminder, Phase II drilling already established a 1000m x 350m mineralized zone, where the majority of drill results returned grades over 5g/t Au, and within this high grade, steeply dipping veins with grades up to 127g/t Au. It is still early days, but if we would guesstimate an underground mineralized envelope of 1000x350x5mx2.75t/m3 density, this would result in 4.8Mt, and at an average grade of say 5g/t this could already result in a hypothetical 770koz Au. And keep in mind that this is only a small part of the entire project. There are no direct plans for Tibbs now, but any junior explorer would wish they had such a project as just a third priority project in my view.

Conclusion

Although Seventymile returned very decent drill results, the company is now looking at Flat as the flagship project going forward. After re-studying drill results and sampling, and hearing Quinton Hennigh commenting on it, it seems the Flat project definitely has more potential for now and all the hallmarks of a Tier I target. Tectonic will be doing a metallurgical test work program, followed up by a boots on the ground prospecting and trenching campaign this fall. It appears a bottoming in the bear market could be near, but with a treasury containing C$2M in cash, expect this junior to start drilling Flat asap whenever possible. Not just Quinton Hennigh and Crescat will be eagerly observing outcoming results as the upside potential coming from a current C$12M market cap is quite substantial to say the least.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Tectonic Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.tectonicmetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.