Drilling Underway For Blue Sky Uranium; Drill Results Ivana Targets Expected Soon, Lawsuit Dismissed

Where the Federal Reserve has been spooking the markets by more aggressive interest rates than expected lately, leading to a temporary consolidation, general sentiment seems to be picking up again after digesting the Fed scare, despite the new omicron COVID-19 variant developing around the globe, seemingly creating the new pandemic normal now. Blue Sky Uranium (TSXV: BSK; US-OTC: BKUCF) hasn’t been fazed, as the company diligently continues to advance their flagship Amarillo Grande uranium project in Argentina.

As most metals are experiencing shortages now, partly caused by COVID-19 based supply chain disruptions, the Sprott Physical Uranium Trust, with their investment mandate to buy more than US$1.3B in uranium oxide on the spot markets and other sources, seems to be determined to let the spot price hover in a trading range of US$42-48/lb U3O8 at the moment, probably awaiting the moment utilities start buying long term contracts:

On a sidenote, all moves of the uranium oxide spot price are represented nicely on this up to date chart provided by Tradingview, taken from my website. The Sprott Trust seems to have the power to corner the uranium spot market singlehandedly, but Sprott denies this, as he points at lots of uranium mines currently on care and maintenance, for example the McArthur River Mine from Cameco. What he fails to mention is that most of these mines aren’t switched on in days, as Cameco estimates a 12-18 months ramp-up period for McArthur River. Besides this, it seems the McArthur River Mine probably could encounter difficulties when trying to reopen again, as the mine is technically challenging according to fund manager Warren Irwin. Of course he has his own agenda, but I have heard these views from others as well.

Notwithstanding this, there are many other mines waiting to open who could fill the void of a McArthur River Mine, especially the Kazakh ISR mines, which already provide a substantial part of annual uranium oxide production globally, and could reportedly bolt on new production fairly easily. The best undeveloped deposit of the moment, Arrow, owned by NexGen Energy, will not be able to step in, as it probably is at least 3 years from production as they are in the midst of permitting, and construction of their project plus ramp-up takes at least 2 years in my view. As nuclear energy as a way to provide baselode power isn’t going anywhere soon, as solar and wind are simply not sufficient, and the development of new utilities is ongoing, even supported by the development of smaller type reactors now, fundamentals look robust for the short, middle and long term. For now, the entire industry is waiting when utilities start buying again, and viewing Sprott’s actions, this could be in the cards soon. Blue Sky Uranium is working hard to be ready for this bull market, with one drill program at its Ivana deposit underway now, and winning a law suit against them. In this update the current state of affairs will be discussed with CEO Cacos.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

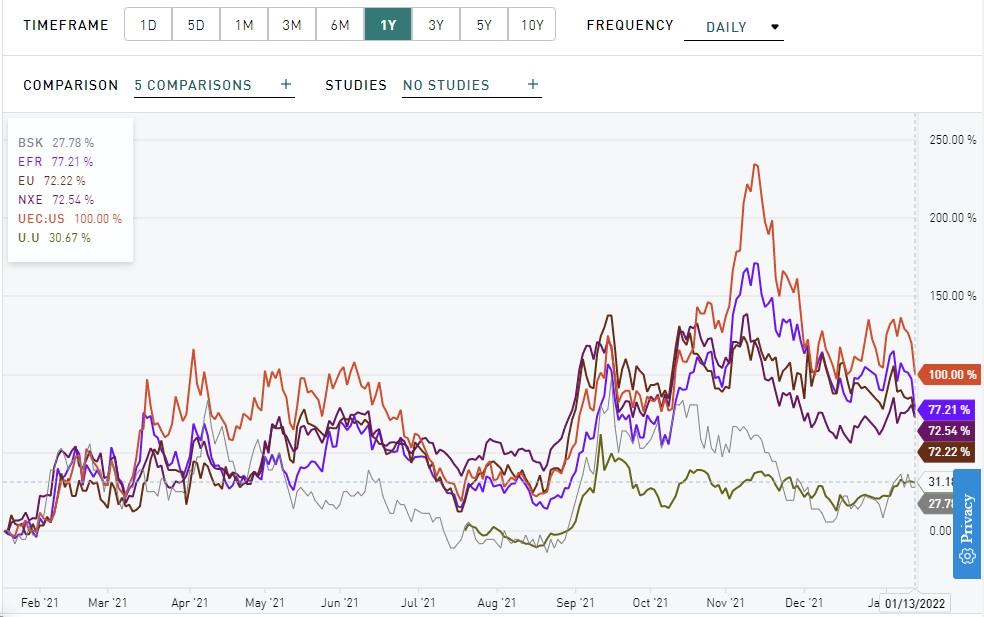

As can be seen below, the share price of Blue Sky Uranium follows more or less the movements of the uranium spot price:

Share price Blue Sky Uranium, 1 year timeframe (Source tmxmoney.com)

When comparing Blue Sky’s chart with peers, it is interesting to see that a more advanced stage and larger resource is able to generate more leverage and strength (grey chart is BSK.V):

Source: tmxmoney.com

As Blue Sky Uranium is working on expanding their resource at Ivana, this is exactly the reason the stock could rise more than its competitors, as it has considerable catching up to do. As a reminder, the 2019 PEA, based on the current 22.7M lbs U3O8 resource, shows a decent but relatively small post-tax NPV8 of US$135.2M, with a robust IRR of 29.3%, at US$50/lb U3O8. Management aims at expanding the resource from 22.7M lbs to 100Mlbs, and it is likely that such an increase will probably significantly improve economics and likely re-rate the stock.

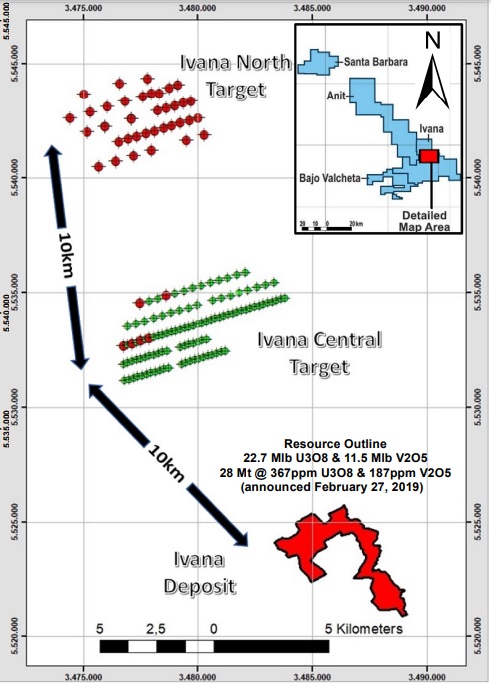

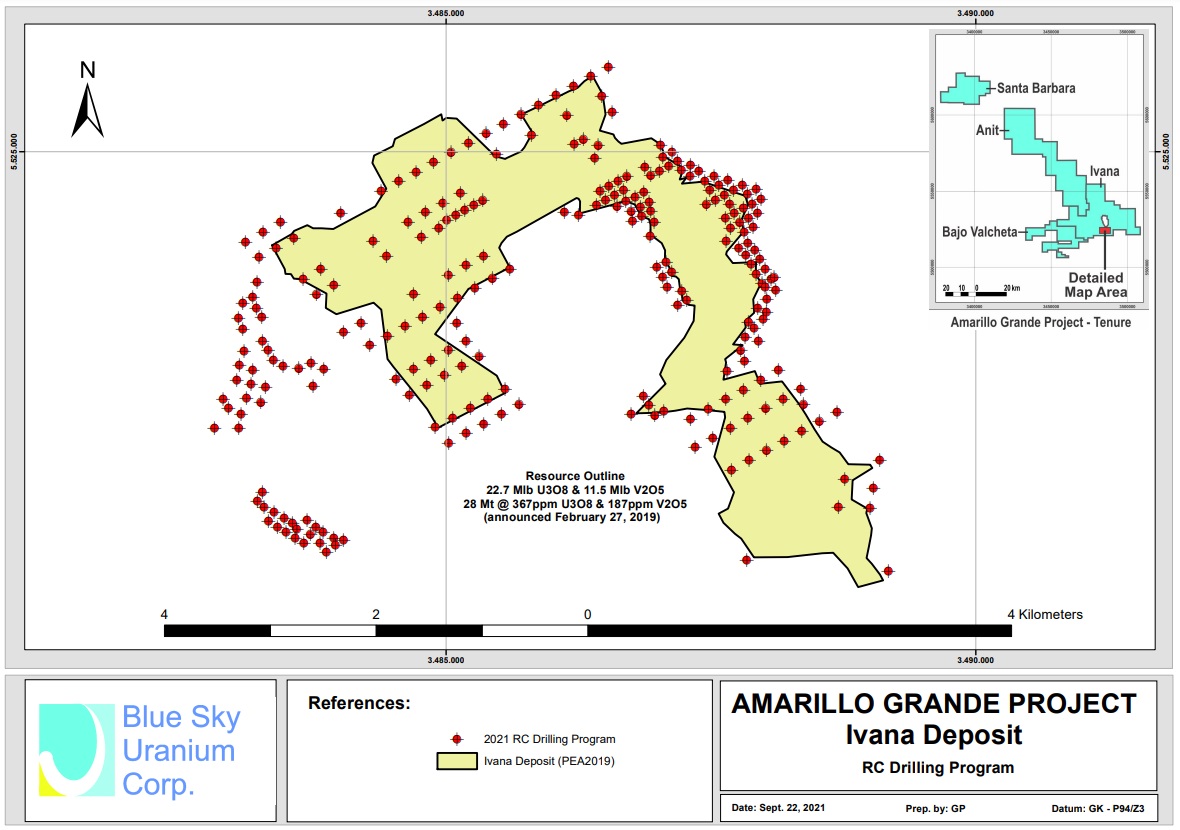

In order to achieve this, Blue Sky Uranium has one drill RC program underway at the moment, a 3,500 drill program to expand and infill the flagship Ivana deposit. The 4,500m program at the Ivana North and Ivana Central targets plus two other nearby targets was delayed because of slow permitting, but these drill permits were finally granted in October of last year. A map from the October news release shows the North and Central drilling (red is completed drill holes, green planned):

At the time, 46 holes (1,870m) were completed, and according to VP Exploration Guillermo Pensado no more holes were completed at the time of writing. He also stated: “The drilling program was set into standby after that October press release, and it is expected to be resumed at Ivana Central after concluding the actual 3500m RC drilling program at the Ivana deposit.”

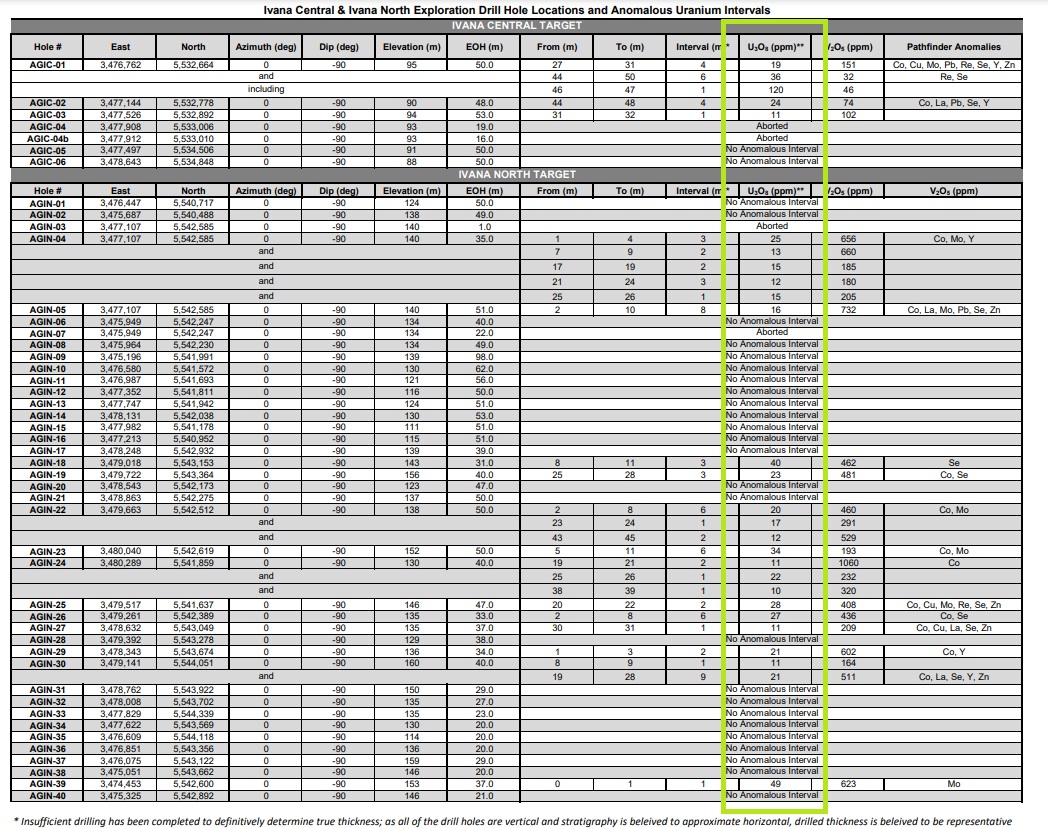

As results were reported for these first 46 holes, I was curious about the U3O8 intercepts. The resource has an average grade of 0.037% U3O8, which equals to 370ppm U3O8, so as the Ivana deposit is a thin mineralized layer stretched out over a large surface, economic intercepts should be in the 250-400ppm range, 1-10m long. Let’s have a look at the table of results:

All holes completed at Ivana North were assayed and presented in the table above, accompanied by a few results of Ivana Central. As can be seen, the drillers hit uranium oxide and vanadium oxide, but no intercepts came close to the necessary U3O8 grade range to be included in a potential Inferred resource unfortunately. Not all is lost for the Ivana North target, as CEO Cacos had this to say:

The discovery of a new deposit is the result of an exploration process that begins with prospecting holes as well as those already drilled, which may confirm or not the presence of a system and vectorize more exploration efforts. As an example, the initial drilling program at Ivana deposit hit its first potentially economic uranium grade intercept at hole 100; where all the previous lower grade intercepts had been used as the vectorizing tool along the exploration process.

It was interesting to read in the news release about the explanation of low uranium oxide mineralization, as primary mineralization seemed to have remobilized:

“Intervals with anomalous uranium range from 1 to 9 metres in thickness and display variable uranium/vanadium ratios, as observed for the Ivana deposit. This is interpreted to be a result of remobilization of primary mineralization with low vanadium into the near surface environment, where uranium precipitates as carnotite, a uranium vanadate mineral. This interpretation is supported by the results of the downhole radiometric probe survey. Radiometric response from the probe did not show direct correlation in all cases with analytical uranium content, a phenomena known as “disequilibrium”. Disequilibrium is known to occur where uranium has been remobilized geologically recently and, for example, precipitated as carnotite resulting in a weak, or no, radiometric response. It had previously been detected at Amarillo Grande in surface sampling work.”

At the question where the potential uranium mineralization might have been remobilized to, if there would be an attempt to chase it down by follow-up drilling, and if such remobilization could be explored by surface trenching before any drilling takes place, CEO Cacos answered as follows:

“This is a new area where mineralization was observed at different depths, in some cases at the same hole; for that reason we developed a drilling program with the capacity to prospect down to 50 metres in depth. The superficial uranium is a good indicator of a potential buried mineralization system, which may locate hundreds of metres of that uranium on surface. This was the case at Ivana deposit, where the initial holes were located based on superficial mineralization and finally the core of the deposit was located one hundred metres to the east.”

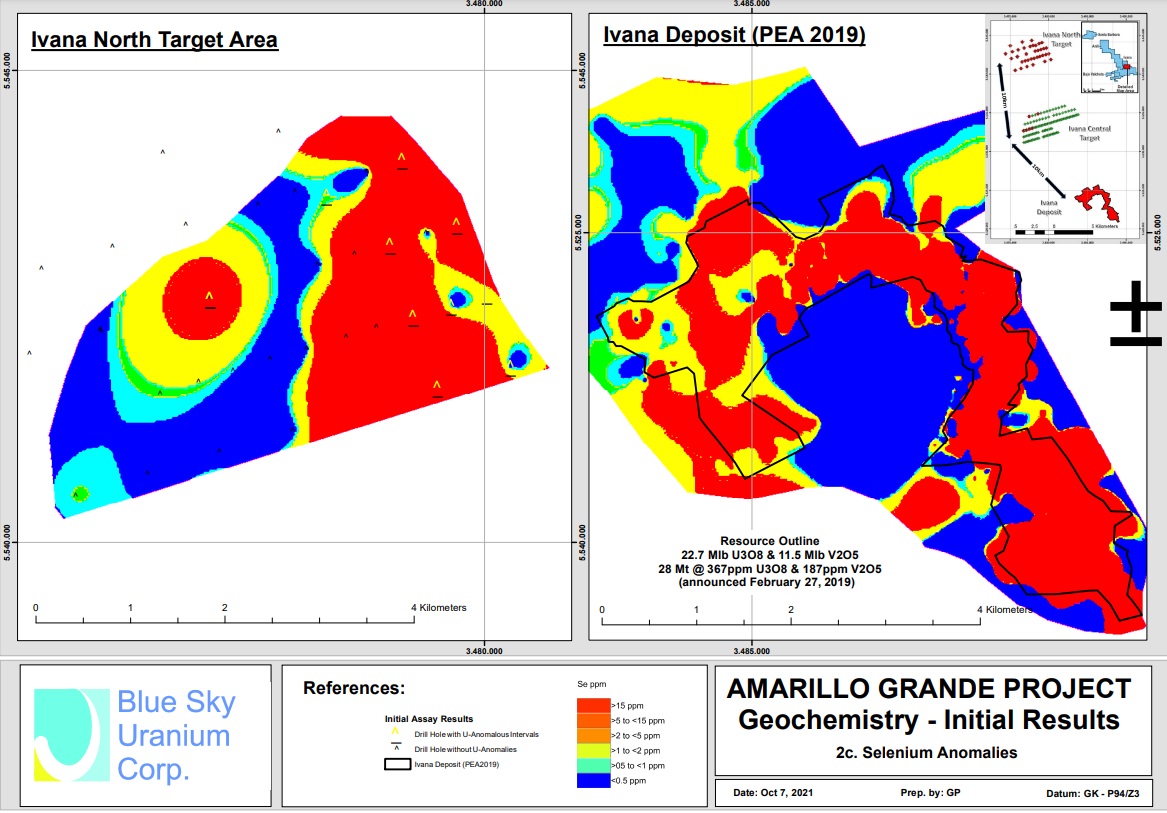

The news release also described the importance of certain pathfinder elements, especially molybdenum, selenium, lanthanum and yttrium. For example, the following map showed the relation between selenium and uranium:

The analogy with the Ivana deposit itself worked out beautifully, the only issue was that the encountered uranium oxide grades were much lower. I wondered how the geologists measured the pathfinder minerals, was this soil sampling? And as the selenium presence seemed to extend well beyond the target boundaries, why not enlarging the target? CEO Cacos answered:

“The use of pathfinder elements for exploration is very well-known tool used by all the explorationist at any commodity. Geo´s need to reduce their targeting areas from large potential zones using indirect or direct studies, as the definition of subtle pathfinder geochemistry anomalies. In our case every sample has a 45 elements assay associated, for those elements recognized as related to the geological model under exploration. The pathfinder tool is used with geological interpretation, geophysical data and the experience gained in the district as a batch of information to vectorize the follow up exploration.”

The company’s strategy has been to deploy an initial 1,500 metres of drilling at each of the Ivana North and Ivana Central targets, followed by 1,500 metres of follow-up detailed drilling to better define areas with the best results at both targets. As Ivana North has already seen 1,500m of drilling, and as the maps of the Ivana deposit seem to indicate a width varying from roughly 500m to 1500m, I wondered why a grid spacing of just 1,000m was done at Ivana North, but also a fencing with even much smaller spacing of 200-500m at Ivana Central, as the size of the property could probably warrant a larger grid spacing for step-outs of even 1,500-2,000m first before further finetuning, considering Blue Sky is hunting large scale REDOX front deposits, and potential mineralization is usually stretched out a few meters under the surface, potentially for many kilometers on end like at Ivana. CEO Cacos had this to comment:

“The area is huge, but the surface area that deposits occupy is relatively small. Using the Ivana deposit as our best local model for exploration, the deposit width actually ranges from 200 to 500 metres; therefore, drilling patterns over that 500m may pass over a deposit without been detected. The exploration programs need to be understood as the construction, where all the information gathered since the beginning will represent part of the exploration puzzle. Exploration requires strategies based on comprehensive work based on good quality data, high professional assessment, patience, and systematic work; and some luck.”

As a reminder, on September 28, 2021, the company announced the launch of a 3,500m reverse circulation (RC) drill program, in order to expand and upgrade the Ivana Deposit. The program includes about 260 shallow holes, as the mineralization is situated near surface (at -1m to -25m depth so far):

The goal is to test the zone west of the current Ivana deposit where 2018 sampling returned strong results. Some infill drilling of this deposit will also be completed, in order to upgrade categories of the mineral resource estimate, necessary for engineering work for the PFS. According to CEO Cacos, he expects the first drill results to be announced very soon, within the next couple of weeks.

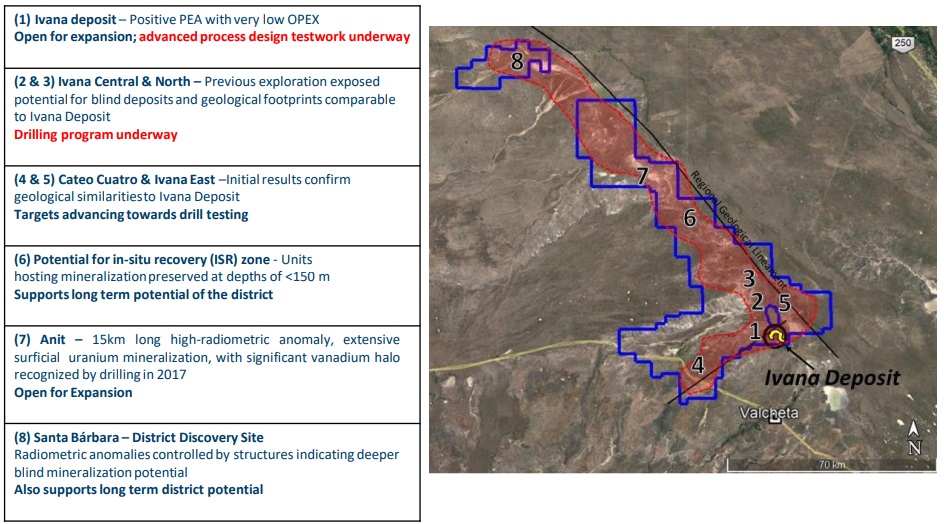

Besides the mentioned three target zones for the ongoing drill programs, there are several other targets at the Amarillo Grande project, which is substantial with an almost 60km strike length:

Right now, the focus on their exploration programs is on the Ivana Deposit(1), Central (2) and North (3). After these targets this will change towards the immediately surrounding targets: Ivana Cateo Cuatro (4), and, Ivana East (5). This is depending on drill results at each target, warranting potential follow up drilling or not, and market/uranium sentiment.

I also wondered what the status of the second phase testwork program was, targeting further process design tests for the Ivana deposit. As a reminder, based on 2018 testwork, the overall process plant recovery was already very solid at 85% for uranium and 53% for vanadium. Blue Sky shipped a bulk sample to the Saskatchewan Research Council where Chuck Edwards, a world-renown metallurgist and processing engineer, is carrying out advanced studies to improve recovery and cost. CEO Cacos had this to say about the progress of this testwork program:

“The test-work is properly advancing under the close supervision of our key person Chuck Edwards. The assessment is expected to be finished by Q2-2022.”

Besides exploration, resources and studies, permits are also part of every mining project, and can attract significant opposition of protesters. In this case, some environmentalists launched a lawsuit against Blue Sky Uranium and the Government of Rio Negro, in order to “assert environmental protection rights”, among other arguments, targeting their exploration efforts. As management already indicated in my last article about the company, they had nothing to fear, as the judge already dismissed the case. Fortunately, the Supreme Court also dismissed the subsequent appeal, making the ruling final as there were no further appeals filed. CEO Cacos was happy with the verdict:

“We are pleased to have this matter behind us and give our full attention to our ongoing exploration programs in accordance with all applicable laws and regulations. On behalf of the board, I thank our legal team and the support of our shareholders.”

The treasury currently stands at an estimated C$1.2M, which should be sufficient to continue with the two ongoing drill programs, part of permitting, met work and engineering, and commence working on the PFS. The company expects to go back to the markets to raise approximately C$3M in the next month or so. These funds will allow to complete the exploration work (and any follow up drilling), as well as pay for the baseline environmental studies that will be required for the upcoming Pre-Feasibility Study.

Conclusion

It was good to see that the appeal against Blue Sky Uranium and the Government of Rio Negro was dismissed, as the lawsuit was completely without merit. Although ESG is a good thing for mining as the environment needs to be protected from toxic waste spills, noise etc, such badly prepared cases only seem to function as self-serving delaying tactics for environmentalists, damaging their own cause more than it helps. In the meantime, the company finally got the first drill results from the 4,500m program back from the labs, and the Ivana North target didn’t generate economic results unfortunately. Notwithstanding this, management still sees potential for this target as the Ivana deposit took a lot of drilling before it was discovered, and there are many more targets to test in a very large area that hasn’t seen much exploration, so next up is the Ivana deposit itself that is drilled now, followed by the balance of the 4,500m program at Ivana Central. Let’s see what the next batch of drill results will bring us, as uranium oxide prices keep hovering over US$40/lb U3O8, levels we haven’t seen since 2014.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Blue Sky Uranium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.blueskyuranium.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.