Gold Terra Completes First 8 Holes To Expand Yellorex North

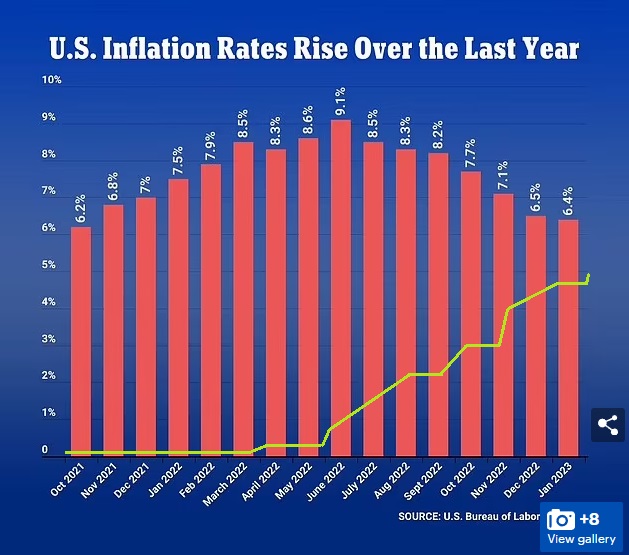

In a world where the Fed might be contemplating a 50 basispoint raise instead of the earlier communicated 25 points, because of persistent, higher than expected inflation, but macro economic fundamentals remain strong, the stock markets are side ranging as a result. We could be entering 6% rates by June if high inflation doesn’t cool off, and I doubt if this is enough to get inflation back to the desired 2% levels, as Fed rates stand at 4.5-4.75% now, but inflation decreased only by -2.7%. I have drawn up the rate increase trajectory in a US inflation chart coming from the US Bureau of Labor Statistics:

A dangerous development I am already seeing in Europe (my home base) is the development of a so-called wage-price spiral, with lots of sectors increasing salaries to repair loss of purchasing power. This isn’t positive as it fans inflation further as it enables people to buy at higher prices.

In the meantime lots of sectors like food, supermarkets, DYI, lots of retail and energy are raking in record profits at the cost of the average consumer who can buy less and less for their currencies, as I am very suspicious about those sectors using high commodity prices as an excuse to increase their overall pricing in an opaque way to ridiculous levels. For example meat and fish pricing in my country (Netherlands) has increased 50-100% YOY, you can’t tell me that farmer salaries, animal food, preparation, packaging, storage, transport and supermarkets had to increase with 50-100% to justify this Zimbabwean-style price increase. This is an extreme example, but many products and services have seen price increases that defy imagination for western countries.

Governments really have to look into this as I see this as bordering on criminal. Fortunately certain initiatives around this (price controls for energy) are being conducted at the moment in Europe, but it should be researched far more widespread. A free market is fine, but within limits and certainly not leading to potential system failure. I am not under the impression that the slowly but locally escalating Russia invasion has a profound impact on the entire world economy anymore as it has become business as usual, neither does the China involvement. The US Dollar is slowly recovering again (although I don’t understand why it broke down on ever increasing rates, but I am no economist), and as a potential consequence gold didn’t break through the US$2000/oz threshold, and is on its way to US$1800/oz again, causing problems for gold related stock charts. Gold Terra Resource (TSXV:YGT)(OTCQX:YGTFF) (FRA:TXO) is no exception in this regard, but since they are decently cashed up they can continue with their winter drilling program at the Con Mine Option, drilling their Campbell Shear targets. A new phase of drilling is underway, with the first 8 holes being completed, and assays are expected sometime in March.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

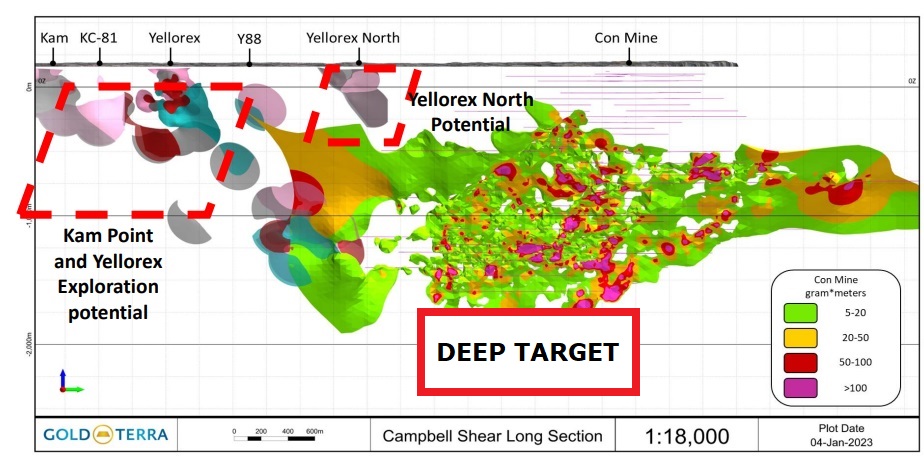

It was good to see Gold Terra announcing their 2023 drill program on December 1, 2022, just over a week after closing their C$3.78M non-brokered private placement. C$2.4M of this round was budgeted for the ongoing 8,000m drill program, that commenced on January 18, 2023. Interesting tidbits of information (at least for me) were the mentioning of the retirement of the founder Joe Campbell, plus a deeper target in the main plunge of the Con deposit, where previous mining was stopped in high-grade shoots below 1900m, where the Robertson shaft is located, more on this later.

I asked Chairman & CEO Gerald Panneton about Campbell, as I found it remarkable as he has been around for so long, and why retire when he could be so close to a major discovery here. Panneton explained: “Joe is 65 years old, and his wife retired earlier in the fall of 2022. They want to spend more time together after a very hectic working life, and Joe stays involved as a senior technical advisor, while keeping all of his shares.” That was good to hear for sure.

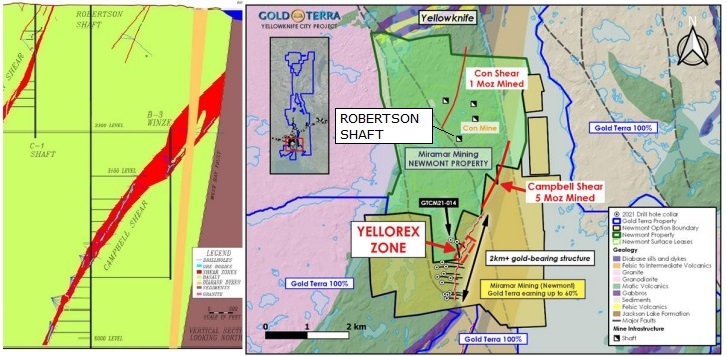

The Robertson shaft can be observed below relative to the Campbell Shear:

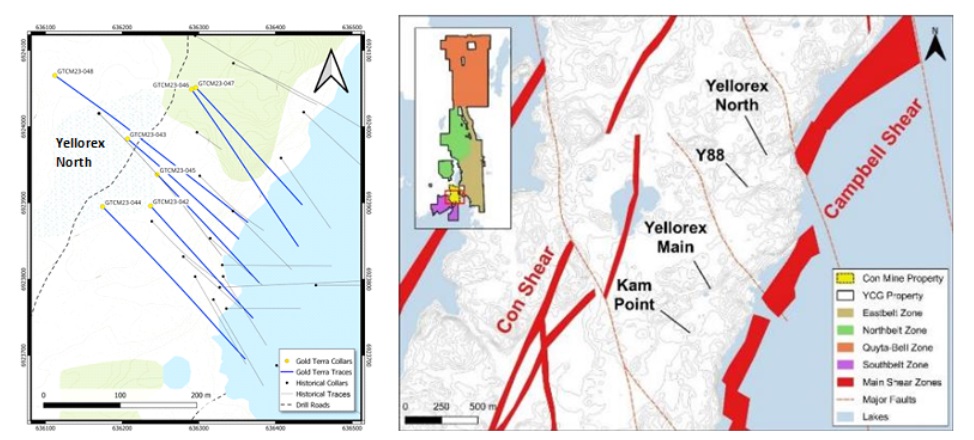

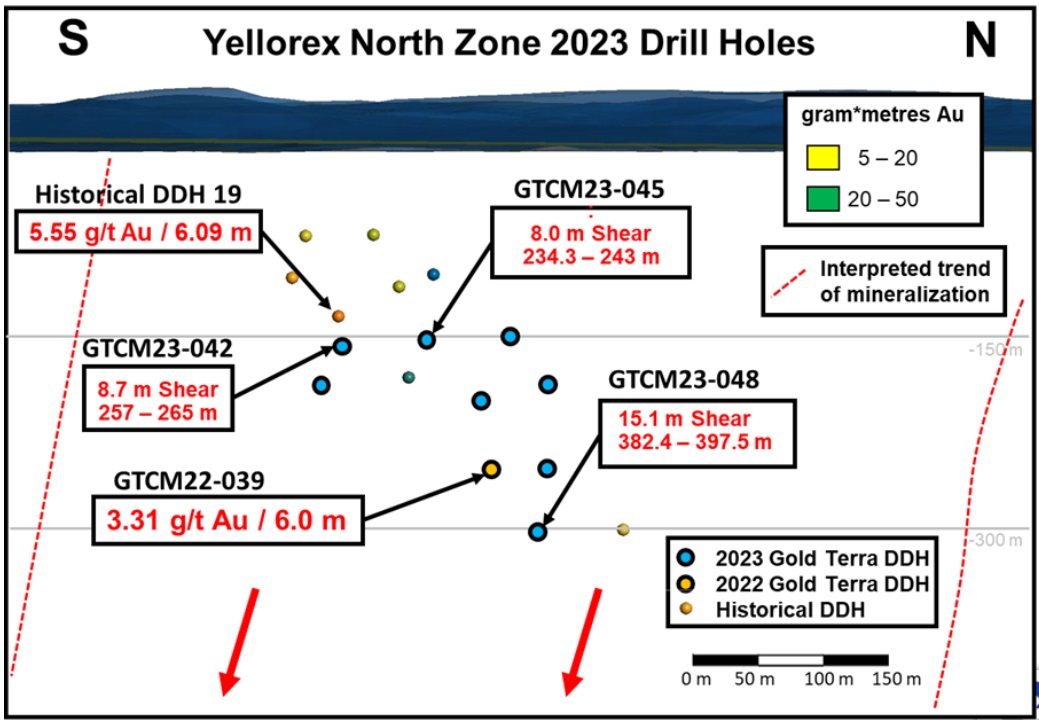

The current drilling targeted the Yellorex North zone, where the first 8 holes all hit the targeted Campbell Shear, for a total of 3076.53m drilled. This Shear is characterized by typical smokey quartz veining with strong sericite alteration, often in addition to strong pyrite, arsenopyrite, stibnite and sometimes sphalerite mineralization. The intercepted quartz zones were hit at 234m-382m depth, and the intercepts had lengths of 4 to 8.70m. Chairman & CEO Gerald Panneton was pleased with the outcome:

"We are extremely pleased with the Yellorex North drilling as all eight holes have hit the targeted Campbell Shear with the drill core showing significant intersections of multi-metre veining and sulphide mineralization. The objective of the winter drill program is to expand the current near-surface mineral resources on the CMO, and the initial visual observations of the core indicate that we are on track. The Campbell Shear structure is our highest priority target as the Con Mine produced more than 5 million ounces of high-grade gold (16 g/t Au).”

I wondered if 3 highlighted drill hole assays were sufficient for Panneton, but he assured me that the exploration drilling for the Con deposit hit 1 good hole out of 5, so a ratio of 3 out of 8 which seems likely here, is actually a very good ratio.

The eight holes were drilled near surface on Yellorex North as this represents the best underexplored target in the area. The target area is very close to existing underground mining infrastructure and tested only by one hole in 2022, returning 6m @ 3.3g/t from 306m, and 5m @ 2.18g/t Au from 324m.

Drilling will continue over a 2-kilometre stretch along the Campbell Shear south of the Con Mine as follows:

• Three to four holes on the Kam North and Con81 zones

• One hole to test the down-dip depth extension the Yellorex Deposit

• Another 2,000 -3,000 metres is anticipated as follow-up to areas of interest.

A second drill capable of drilling 2,500 metres depth down the hole, will be moving to the target site and is expected to start drilling in March, once the planning of the target is completed. The objective is to drill the high-grade gold shoots beneath the Con Mine workings, at approximately -2000 metres vertical:

I wasn’t even aware they wanted to drill this deep, as the Con mineralization predominantly starts around 800-1,000m depth. Obviously I am excited about this drill hole, as I am convinced that any significant mineralization could be found at depth. I wondered if the existing historic 600koz resource was delineated close to the deep drill target, and if Gold Terra had other clues why to target so deep, which is also difficult to hit as you have to avoid the old workings. Chairman & CEO Panneton answered: “The remaining 650,000 left at the Con Mine as per the dec 31st 2002 Miramar reserves reporting is located in different area, so the full potential of the deposit below the existing working is tremendous as per extension of the Mine at depth.”

As it will be a very deep hole, and such a powerful drill rig can drill up to 100m a day, it will take about 3 to 4 weeks to drill this hole. My take is that assays can be expected about 30-40 days later, so it will be in April. The current available funds are sufficient to take them to the full 8,000m of the ongoing program.

Gold Terra has completed more than 23,000m to date of diamond drilling on the Campbell Shear and 6,011 metres on the Mispickel, and is looking to complete the balance of the current 8,000m winter drill program (about 5,000m) on the Campbell Shear.

As a reminder, Gold Terra is spending a minimum of C$8M in exploration expenditures over a period of four years when earning in on their Con Mine property deal with Newmont, also including all exploration expenditures incurred to date, the company has spent C$7.2M to date, and as such is well underway. Gold Terra has also agreed to complete a mineral resource estimate containing a minimum of 1.5M oz Au in all categories, consisting of a minimum of 40% of a measured and indicated resource and not more than a 60% inferred resource; obtain all necessary regulatory approvals for the purchase and transfer of MNML's assets and liabilities to Gold Terra; and post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing. This cash bond will cost Gold Terra approximately C$9M. Finally, Gold Terra has to make a final cash payment of C$8M to Newmont. Once Gold Terra completed the option, and outlines 5+Moz Au, Newmont has 18 months for a one-time back-in right for 51%, subject to 3x expenditures and paying US$30/oz Au, which could imply a nice paycheck of at least C$250M in cash assuming Gold Terra gets there.

Gold Terra’s exploration ventures are backstopped by solid resources, as there are 1.2Moz Au Inferred OP/UG resource for Sam Otto, Crestaurum, Barney and Mispickel, a 542koz @ 6.96g/t Au Ind & Inf resource for Yellorex/Kam Point, and a historic 600koz Au resource at depth at the former Con Mine. The deep drill hole took a long time to target and prepare, but we are getting very close now for witnessing a first try in order to discover what is down there.

Conclusion

It was good to see the robust hit ratio for the first 8 holes of the ongoing winter drill program at the Con Mine Option, covering important parts of the Campbell Shear. I am curious to see what the assays will tell us, and I am even more curious what the deep drill hole which targets mineralization below the Con deposit could return. As it will be a 2,000m+ drill hole, it will be well into April until the assays will be back from the labs. Two more months from now, let’s hope the world economy doesn’t sink into a recession by then as the signals are mixed at the moment, so Gold Terra could announce any potentially exciting news in the right sentiment for an effective re-rating, which surely would be well-deserved. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.