Gold Terra Setting Up For Deep Drilling At Con Mine; Partners With Midas Minerals For Lithium And Rare Earth Minerals

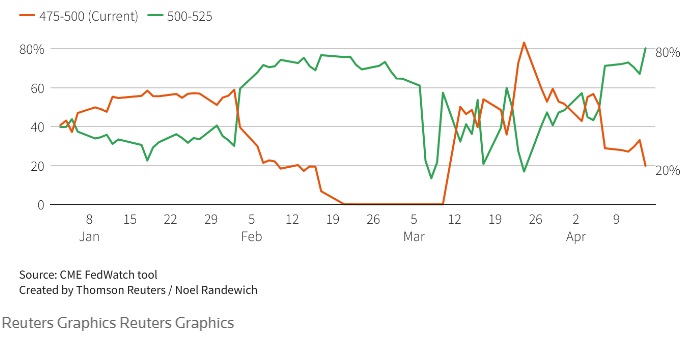

It is becoming harder and harder to navigate the economic environment these days. There are so many contradictory factors at play that nobody knows anything for sure these days. The Federal Reserve is contemplating one last rate hike in May on mixed but overall positive data coming in on Friday April 16, 2023, which might be followed by a pause and even rate cuts, in order to provide the economy with a “soft landing”.

Positive outliers were industrial production and capacity utilization, apparently convincing the Fed to go ahead with the 0.25% rate hike in May, despite lower than expected CPI and PPI numbers. The big elephant in the room remains inflation which is still at high levels, and likely to ramp up again when there would be rate cuts. Another puzzling metric were US wages, which are reportedly trending down, as in Europe we are in a full blown wage-price spiral at the moment.

Also in Europe core inflation is coming down although the ECB raised rates one more time recently, but for example food prices are still going through the roof, with supermarket holdings accounting for all-time record profits. The same goes for energy suppliers, and all of this is being paid for by the tax payer. I understand we are not in a communist society but it seems lots of businesses are abusing “COVID supply chain disruptions” and “Russia conflict” as a vague excuse to keep raising consumer prices to unrealistic and unsustainable highs. Some kind of government intervention seems necessary here as this just seems legal theft.

As a consequence of the Fed recently talking about a “mild recession”, and potential rate cuts coming up, the markets aren’t forgiving towards the US Dollar, which continues its downward trajectory after a brief stint upwards in February. This is good news for the price of gold, which trades above US$2,000 for some time now, and recently came very close to all-time highs (US$2,069.40/oz).

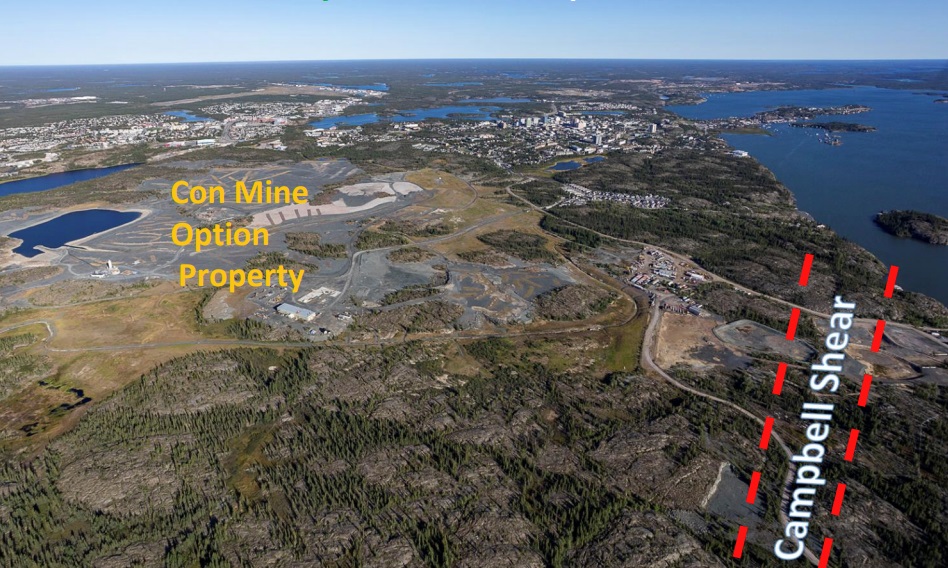

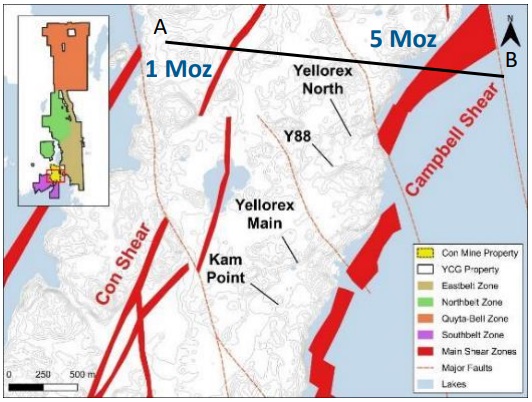

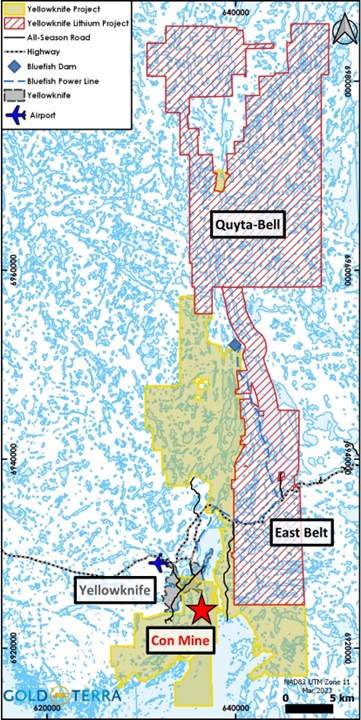

Gold Terra Resource (TSXV:YGT)(OTCQX:YGTFF) (FRA:TXO) as a gold developer and explorer is of course ideally suited to profit from this renewed gold sentiment. With their ongoing drill program at the Con Mine Option Property as part of their Yellowknife project in the Northwest Territories the goal is to prove up a significant gold resource, fit for further development in conjunction with the already delineated resource at the other satellite deposits such as Crestaurum which has an average grade of 6 g/t Au as an open pit, to a combined 1.2 Moz of Inferred resources. It was also good to see Gold Terra optioning out their non-core asset of lithium- and rare earth rights to Midas Minerals as part of their Yellowknife project, outside the gold corridor, which appears to have lots of pegmatite showings as well.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

On April 11, Gold Terra announced the completion of 13 diamond drill holes (5,769m) on the Con Mine Option Property (CMO), as part of the C$2.4M - 8,000m drill program, which commenced on January 18, 2023. Drilling was done to a depth of 600m, at Yellorex North, Yellorex at depth and Kam Point, with assays pending:

As the cores already showed lots of veining and sulphide mineralization, CEO Gerald Panneton was pleased with the preliminary outcomes:

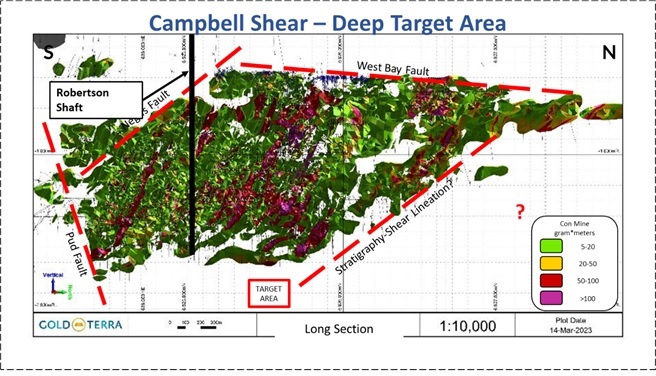

"Phase 1 of the winter drilling program has been successful as all holes have hit the targeted Campbell Shear and show significant intersections of visible multi-meter veining and sulphide mineralization. With 10 holes drilled in the Yellorex North area, we are confident that the results will warrant further drilling in 2023. We are now preparing for a deep drill hole targeting gold mineralization at depth below the historic Con Mine workings. The Campbell Shear structure is our highest priority target as the Con Mine produced historically more than 5 million ounces of high-grade gold (16 g/t Au). We expect to have results for the remaining Phase 1 drill holes in the coming weeks."

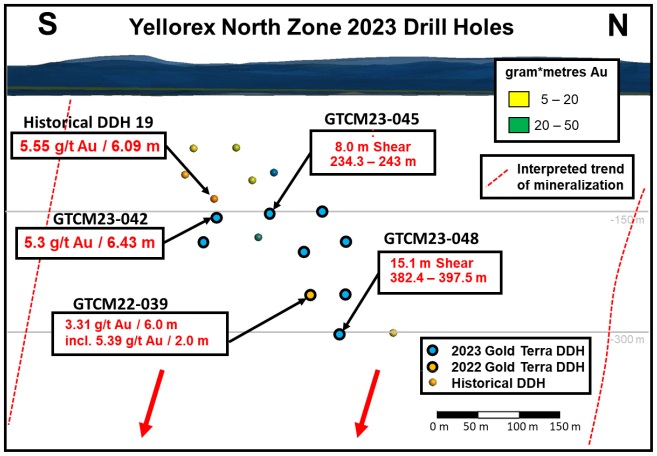

The assays of one hole were already received, and were disclosed on March 3, 2023: hole GTCM23-042 returned a solid 6.43m @ 5.3g/t Au at Yellorex North. Other highlights were:

Yellorex North drilling highlights:

- Hole GTCM23-045 intersected 107 metres of the Campbell Shear with 8 metres of good smoky veining, pyrite mineralization, and sericite alteration.

- Hole GTCM23-048 intersected 120 metres of the Campbell Shear; 15.1 metres of strong veining and strong sulphide mineralization.

- Hole GTCM23-053 intersected 111 metres of the Campbell Shear with strong mineralized zones with good alteration over almost 9 metres.

- Hole GTCM23-054 intersected 91.5 metres of the Campbell Shear with 4.5 meters of strong alteration, mineralization, moderate veining and 2 metres of moderate mineralized zones.

Kam Point Drilling:

- Hole GTCM23-050 intersected 145 metres of the Campbell Shear with up to five intersections of good mineralization.

- Hole GTCM23-051 intersected 183 metres of the Campbell Shear.

Yellorex Deposit:

- Hole GTCM23-052 was drilled to a depth of 710 metres and intersected 212 metres of the Campbell Shear with up to six intersections of good mineralization of variable width between 3 and 5 metres wide.

As the mineralized zones of the Campbell Shear seem to be predominantly about 2 - 15m thick/wide, I wondered how these long intercepts should be interpreted. Were these intercept lengths representing the distance between outside mineralized veins of the Campbell Shear? CEO Panneton explained: “The Campbell Shear is a major shear zone and locally up to several hundred metres wide. Mineralization is concentrated in relatively small, discrete lenses (1-20 metre widths), and these reported intercepts aren’t representing the maximum distance between veins but just the width of the Campbell Shear itself. Our drilling is well planned to intersect the shear in a perpendicular approach. Once you have intercepted more than 2-3 g/t gold, you know you have hit a mineralized lense, and you need more drilling to better define the amount of gold. “

I expect these holes to return results along the lines of hole 042, with the occasional outlier doubling or tripling the grade and/or length. It is good all holes hit mineralization as can be interpreted from visual inspections, and I’m curious what the assays will show us. Gold Terra is undertaking a deep drill program as well, and this has the majority of my attention, as this is where the big prize can be, since the Con deposit also had lots of high grade gold at significant depth. Per the news release:

“The deep drill hole program is designed to target high-grade gold zones below the northern end of the lowest mining levels of the historical Con Mine. Historical underground drill holes that were drilled below the lowest workings have intersected various high-grade gold zones in this area and very high-grade assays exist in many historical holes immediately above the target area. The objective is to expand these zones at depth. The initial hole is aiming to intersect the Campbell Shear 300 metres below the lowest working, or approximately 2,080 metres below surface. The opportunity will exist to wedge off the initial hole and target other high-grade zones in the area.”

What somewhat surprised me was the very deep targeting without gradually going deeper from Yellorex levels, as I could remember a strategy going to 1,000m depth first, and deeper after this. I’m also wondering how such deep resources would be mined, does this involve dewatering of the existing Con Mine, as the deep target seems far away from Yellorex and Kam Point and much deeper? CEO Panneton has this to say about this:

“The Con Mine produced 5 Moz @ 16 g/t Au in a very confined area, that indicated that the down plunge of the deposit is the best target on the optioned property, and because of infrastructure already in place such as The Robertson Shaft to a current depth of 1,900 metres. Indeed, this shaft only needs to be dewatered, as it opens up the whole area below the Mine. The Robertson shaft is an existing access worth more than 2 years construction time, at a current cost of more than US$120M”.

The remaining historic 650koz Au reserves and M+I resource left at the Con Mine when the mine closed in 2003 is located above the 1,900m depth and represents a bonus, if the company could extend the deposit at depth. As it will be a very deep hole, and the drill rig can drill up to 30-50m a day, it will take about 2 months to drill this hole. Another month for the labs to return the assays will see results announced probably around the summer time of July for this hole.

As a reminder, Gold Terra is spending a minimum of C$8M in exploration expenditures over a period of four years when earning in on their Con Mine property deal with Newmont, also including all exploration expenditures incurred to date, the company has spent C$7.2M to date, and as such is well underway. As a requirement, Gold Terra has also agreed to:

- complete a mineral resource estimate containing a minimum of 1.5M oz Au in all categories, consisting of a minimum of 40% of a measured and/or indicated resource and not more than a 60% inferred resource;

- obtain all necessary regulatory approvals for the purchase and transfer of MNML's assets and liabilities to Gold Terra;

- and post a cash bond to reflect the status of the Con Mine reclamation plan at the time of closing. This current cash bond is currently C$9M.

- Finally, Gold Terra has to make a final cash payment of C$8M to Newmont. Once Gold Terra has completed the option, and outlines 5+Moz Au, Newmont has 18 months for a one-time back-in right for 51%, subject to 3x expenditures and paying US$30/oz Au, which could imply a nice paycheck of at least C$250M in cash assuming Gold Terra gets there.

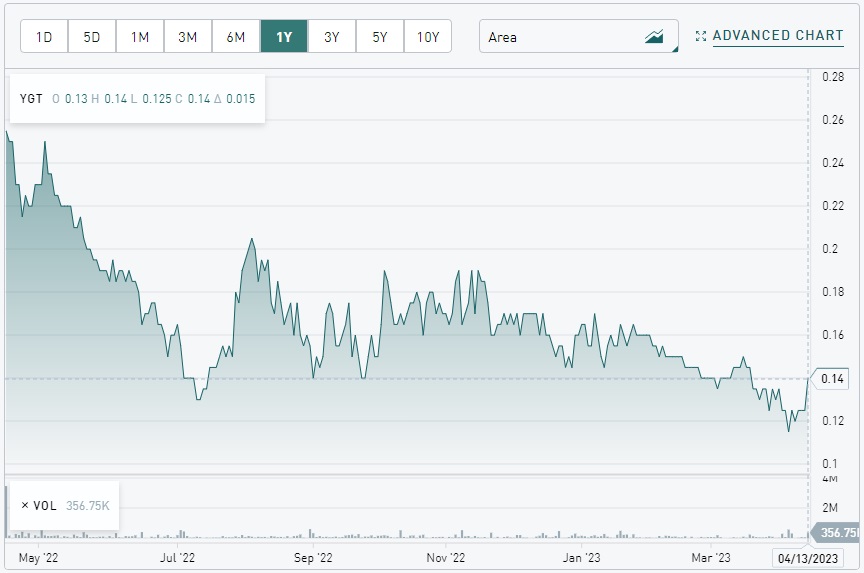

Gold Terra’s exploration ventures are backstopped by solid resources, as there are 1.2Moz Au Inferred OP/UG resource for Sam Otto, Crestaurum, Barney and Mispickel, a 542koz @ 7.6 g/t to 6.6 g/t Au Ind & Inf resource for Yellorex/Kam Point, and a historic 650koz Au @ 11-12 g/t Au reserves and resources at the former Con Mine. This backstop provides Gold Terra with back of the envelope 2.3Moz Au in total, which should be a solid base for a C$33.4M market cap just coming off a bottom:

Share price 1 year time frame (Source: tmxmoney.com)

Of course, this chart isn’t performing in line with many other gold juniors, which often saw considerable gains due to the rising gold price over the last few months. I feel that this story just needs a few high-grade hits along say 100g*m lines to come off this bottom. CEO Panneton had this to say about this:

“We are focused on one asset and control the major part of a prolific high grade gold camp. Focusing on the Campbell shear which produced 14 Moz over a 5 km strike length, is the first step to continue for the remaining 70 km of strike potential of the Yellowknife camp.”

Since the company holds a vast land package around Yellowknife on a Greenstone Belt, the company figured out that there was significant potential for LCT pegmatites and rare earths. According to CEO Panneton : “The idea behind the deal with Midas Minerals, is exposing Gold terra shareholders to a lithium discovery, leveraging our land package, and the known pegmatitic belt, without having to do any work or spending. If a major discovery is made by Midas Minerals, Gold terra shareholders, without having to invest a penny until a construction decision is made, will be benefitting from this deal.”

The Midas Minerals deal has the following highlighted terms:

- Gold Terra is to receive up to C$ 1.2 million over 3 years, 2.20 million shares of Midas, and retain a 1% Gross Revenue Royalty (GRR) after the 51% earn in.

- Midas Minerals has exclusivity to earn 51% interest in the first 3 years, and up to another 29% interest over the next following 2 years for up to 80% interest in the Critical Minerals rights over a 544.7 square kilometre portion of the Company's Yellowknife property (YP) (of the total 800km2)

- The Yellowknife Lithium Project (YLP) is located East and North in close proximity to Yellowknife, Northwest Territories, Canada.

- More than 100 LCT pegmatites are known in the region, including historic references to lithium and tantalum occurrences within the YLP tenure.

- Midas Minerals plans to commence exploration at YLP in June 2023 and expects to have initial drill targets identified by August 2023.

If Midas Minerals exercises the option to earn a 51% participating interest, then Midas Minerals can elect to earn an additional 29% participating interest by incurring by no later than September 30, 2028, an additional $5.0 million in exploration expenditures. If Midas Minerals does not elect to earn the additional 29% participating interest (after having earned the 51% participating interest), then Midas Minerals must transfer a 2% participating interest to Gold Terra (so that the participating interests between Gold Terra and Midas Minerals will be 51%/49%). If Midas Minerals earns the 80% participating interest, the interest of Gold Terra in the Critical Minerals joint venture will be fully carried until the Critical Minerals joint venture has approved a bankable feasibility study for the development of a Critical Minerals project on any part of the Quyta-Bell and Eastbelt Block of Gold Terra's holdings in Yellowknife, NWT.

This is an interesting deal for Gold Terra as the 2.2M shares are already worth over C$400k without any discovery, and the company also receives C$100k before June, and Midas has to spend C$250k on or before September 30th 2023. According to CEO Panneton, there will be a lot more spending on exploration before year end, so hopefully we get to see drilling by Midas, probably in somewhat better lithium sentiment by then, as recent (and likely self-inflicted) oversupply issues in China made investors pulling money out of lithium juniors recently, looking at renewed copper/precious metals sentiment.

Conclusion

It has been a long wait, but a powerful drill rig, capable of drilling 2,500m deep holes, is being set up now, and will finally be targeting deep mineralization soon at the Con Mine Option Property. Management already identified a high chance of success, by analyzing historic drill results that often showed high grade intercepts. As it will be a 2,300m hole, drilling will take about 2 months, and the assays could take another 3-4 weeks, so anticipate results of this deep hole being announced around the summer months. In the meantime, the company expects to receive the results of 12 drill holes from the winter program at the Campbell Shear, involving Yellorex and Kam Point. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.