Introduction

I am more than happy to inform you about the adventurous world of junior mining, and I have set up this website handling this topic during the summer of 2015, as I strongly believed we were approaching a bottom in commodity prices, and fortunately I was right, and it was a very interesting time for investors to develop an interest in mining stocks. A lot has happened since, and it will probably be clear that mining stocks aren't exactly for the risk-averse investor. Everybody has his or her own reasons to be intrigued by this niche sector in investing, from being intrigued by gold to treasure hunting, but most people I talk to in the industry are interested in it because of the realistic chance to experience (extremely) high returns, and the phenomenon "multi bagger" once in a while. This is a stock that could multiply 5, 10, 20 or even 100 times in an timeframe of just months to a few years. As will be clear, those opportunities can't exist without a sometimes very high risk/reward ratio, and often most of your money will be lost searching for those multi baggers.

Finding multi baggers isn't easy and cannot happen without luck, but I am convinced one can increase the odds by being better informed. I am providing some insights and information in/about the mining industry, macro trends and individual stocks, and this should hopefully provide you with useful information.

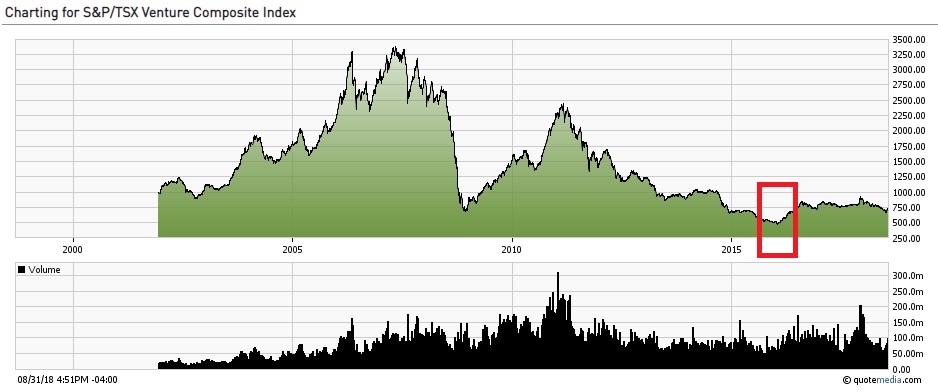

The timing of the start of this website has proven to be pivotal a few years from now, as the home of junior mining, the TSX Venture appeared to be at all time lows in 2015, with sentiments and pricing for commodities was at multi year lows as well (iron ore, copper, oil, uranium, precious metals, etc.).

TSX Venture; 10 year period

No one knows for sure when and if prices of commodities will fully recover to the levels of pre-2011, but it is a fact less and less metals and minerals are found as the low hanging fruit is already gone, and less and less capital is spent on exploration and startup of new projects and mines, which is an unsustainable situation as will be discussed in a moment.

Grades in general are decreasing, discoveries are decreasing, and exploration costs are rising per unit of commodity found (although mining and drilling costs are falling since 2013 because of the current harsh economic environment for commodities).

Nevertheless, there is a widespread fundamental belief among anyone investing in mining companies, that this situation can't go on forever. The world population keeps on growing and modernizing, the BRICS are developing further to mature economies, and Europe, the US and Japan aren't going away soon either. At the same time, capital investments in commodities have been falling, not only in exploration but also in production, as giants like BHP, Rio Tinto, Exxon, Shell etc are cutting spending and divesting less profitable assets, in the end inevitably causing supply issues in the coming years when stockpiles will deplete. This could take a while for some commodities like oil or iron ore, as a fierce competition has taken place here for a race to the bottom it seems, amidst lagging demand. But this can't go on forever as only a few companies are profitable at such prices.

The lack of financing activities also caused the sector to weed out bad companies on the Canadian boards, not being able to raise cash anymore or go bankrupt because of inefficient operations:

Notable examples of going into administration for various reasons are Allied Nevada, Northland, Talvivaara, London Mining, Midway Gold, African Minerals, Rubicon, and others in coal had a hard time as well during the war on coal in the US. I don't consider this a negative thing, as for example badly run companies can't waste good investment money anymore, good money that should go to good projects/companies. It's also a very healthy cleanup of inactive "explorers", where executives only use raised cash to pay for their salaries and all sorts of expenses, the socalled "lifestyle" companies, of which a cleanup is most needed and stalled for years, covered up by high commodity pricing and overly enthusiastic sentiment.

In my view it can't hurt to allocate a small part (5-10%) of available funds into junior mining stocks which provide the most leverage to rising metal prices, although I'm not a registered investment advisor. Fortunately I called the 2015 bottom, and the following trend reversal can't continue forever, but individual junior mining stocks can prove to be profitable, even in a bear market, and therefore my continuing interest in these stocks.

Investing in junior mining stocks isn't without risks.There are lots of critically flawed mining stocks out on the market, capable of generating huge losses in a relatively short period of time. As investing in junior mining is a very risky endeavor, often described as THE most risky sector in investing, even more so than biotech, I hope you are familiar with the very volatile nature of junior mining stocks, and are able to sleep well at night when your trades go against you. This will happen more than once, but try to avoid holding at all costs "because you need strong hands", "because either you believe in the story or not", "this is clearly oversold" or likewise points of view, as things like this can happen easily.

The socalled strong hands are exactly what will cost you the most money, together with "believe in your conviction" or "unable to part with long term holdings" in mining investments. It is all about constant monitoring, knowing what's going on regarding metal prices, company level, politics, macro economic, FX, etcetc on a daily basis, and act on it on any given day and time if necessary. Even if this would mean terminating your entire portfolio instantly. Simply buy and hold for years is almost a guarantee for you to lose money in this sector, as the odds of an exploration target making it into the ranks of producing mines is estimated on 1 out of 1000, according to Brent Cook, a household name in the mining universe.

A promising junior can change into a bust overnight when expectations on exploration disappoint, and vice versa. Fully financed, successful developers, aka the most derisked category before producers can still experience more or less fatal trouble during construction (Colossus, Robex, NWM, Largo, Midway, Baja, Carpathian, Luna, MBAC, Rubicon, Red Eagle, etcetc) and its market cap can diminish to practically zero, go bankrupt or needs a very dilutive re-financing before you know it. On the other hand, others with potentially good projects can lurk around for years, slowly progressing or waiting endlessly for permits or higher metal prices, and all of a sudden things click and markets take care of dramatic reratings. It is this dynamic character of mining stocks what makes this sector so appealing to me, the risk/reward ratio is very symmetric in a lot of cases but if you know what you are doing, chances on profits are very reasonable and no Vegas at all.

Now that I provided you with something of a general image of junior miner investing, it's time to get a bit more specific. The entire site is meant to provide information on junior miner investing in a structured way, so I have designed it accordingly.

The Homepage shows a number of the best blog rss feeds in the mining space (completely unrelated to me), and a number of the best news rss feeds as well (also completely unrelated to me), which I found to be informative. I need to stress that I don't endorse stockpicks coming from these blogs/news feeds, but the research/analysis/reasoning could be useful.

As I need sponsors to pay the bills, there will be sponsoring companies. The writing of sponsored content on this site will coexist peacefully with ongoing research which provides for independent analysis and important industry/market developments. My own feed of sponsored/unsponsored content can be found on top of the Homepage feeds, just below the menus, in a green background. Every article I write can be found in the Analysis menu, under the relevant submenu. For example an article on Reservoir Minerals can be found under the Copper submenu. In each submenu you can find information on the relevant commodity, and articles on junior mining companies which are focused on this commodity. A company will be categorized for a certain commodity as over 50% of gross metal value/cash flow is accounted for by that specific commodity, by a resource estimate or an economic study.

The Research menu will be filled with information, predominantly coming from other sites, as real pros know much more about specific areas in mining than I will ever know. Nevertheless in the submenu My Guide I'll explain some principles I use when doing my own due diligence. My plan is to write a comprehensive guide somewhere in the future, possibly together with others. You can find some articles by gurus like Brent Cook in the submenu Articles, some maybe tough regulatory/technical/financial material under NI43-101, Resource estimates and Economic Studies, but also a mining glossary and other explanations under Mining Basics. You also get to see a quick guide how to use SEDAR for all official documents on a mining company, and see how to use the annual report of the Fraser Institute.

The Data menu will provide information through Excel tables. The Fraser Institute Survey of Mining table will show the rankings based on mining friendly policies only as I am not really interested in the geological potential for mining investments of a jurisdiction. For that I have a mining company doing its project, assumed to be profitable in the end. I just need the Survey to determine the political/mining friendly risk of a jurisdiction. The Corporate Tax table comes in handy when doing your own discounted cash flow calculations (I will explain this in My Guide and why you should be able to), and Stage Derisking is a personal attempt to capture risk perception of different stages of a mining project, and I even tried to diversify it to different commodities. This was derived from a likewise initiative by John Kaiser, who is a very knowledgeable analyst who maintains a very extensive database on junior mining companies as well.

The Charts menu will provide you with 5 year charts of the most common indexes and commodities. Services shows what I can do for investors and companies. Under About you can find information about me, of course this Introduction, but also the Disclaimer and References, presenting the corresponding sites of used pics. FAQ shows exactly that, the Search menu provides a standard searching option but also an advanced menu. The News/Blogs/Conference menus describe in a summarized way each featured news- or blog feed, or the conferences I deemed interesting.

The Links menu shows a lot of links I have found to be useful over time, and I summarized them in my own way. Contact contains a contact form to reach out to me, Testimonials shows some acclaim I received from various people linked to the mining industry, and Subscribe gives you another opportunity to subscribe yourself to my free newsletter, which will provide you with a variable number of articles on company analysis each month.

You are free to discuss everything with me or ask questions, I just try to answer you as good as I can. Always remember I am no registered investment advisor so always do your own due diligence and contact your own registered investment advisor. The articles I will provide will vary from a 5-8 pages Quick Analysis identifying some of the main characteristics/flaws/risks/catalysts of individual stocks, to Extensive Analysis research reports about individual stocks or more stocks at once, sometimes up to 15-20 pages or more. Methods used can vary from fundamental analysis (EV, FCF, DCF, resource potential, NAV, risks, management, local context, permitting, macro trends for metals/minerals, etcetc), to technical analysis.

Some basic rules I developed for myself, which could be useful although I'm not a registered investment advisor, and can be found in My Guide as well:

- as junior mining stocks are very risky in general, I am happy to allocate 5% or at most 10% of my available cash or portfolio into juniors. It must be cash which could be lost completely and still sleep well at night.

- when a trade goes against me for unknown reasons, without much perspective on a reversal of fortunes, depending on circumstances, my maximum drawdown varies from 15 to 25%. Money management is extremely important in junior mining, as losses can pile up easily into 75-90%.

- for speculative stocks in an run-up, I always try to never sell before a top, which is easier said than done of course. In junior mining a top is usually defined when volume is declining when forming a top, and the stock is going down more than 15-20% afterwards. I use the Level II order book when buying and selling mining stocks as it is important to look for volume based trends next to price action.

- I try to be extra careful about junior mining stocks with a US mainboard listing (OTC/NYSE) and US headquarter locations (especially Las Vegas), as they are often victims of shorters or short term speculators, more frequently than Canadian mining stocks.

I hope this website initiative will provide you with interesting and useful reading material, and more insights on my methods. It might be helpful if you like to do your own dd or just want to know more about investing in this interesting sector. I am open for comments, remarks or suggestions to always make this platform better.

This is it for now, and I hope you will enjoy using this site!

Regards,

The Critical Investor