Kenorland Minerals Intersects 1.77m @ 117.86g/t Au At R2 West Target At Regnault, Healy First Results In, Chicobi Drilling Commences, Options Out Separation Lithium Project

Kenorland Minerals (KLD.V)(3WQO.FSE) keeps expanding and finding new mineralized structures at their Regnault target, part of their Frotet project in Quebec, part of the 20/80 JV with Sumitomo where Kenorland is the operator. After announcing the second 25 holes batch of their 57 hole - 17,792m 2021 summer-fall program, it is clear that Regnault contains a considerable gold system, spread out over multiple vein structures. A recently completed 2022 winter drill program at Regnault, with assays pending, indicated the discovery of additional veins. Management was happy with the results and developments, as CEO Zach Flood commented:

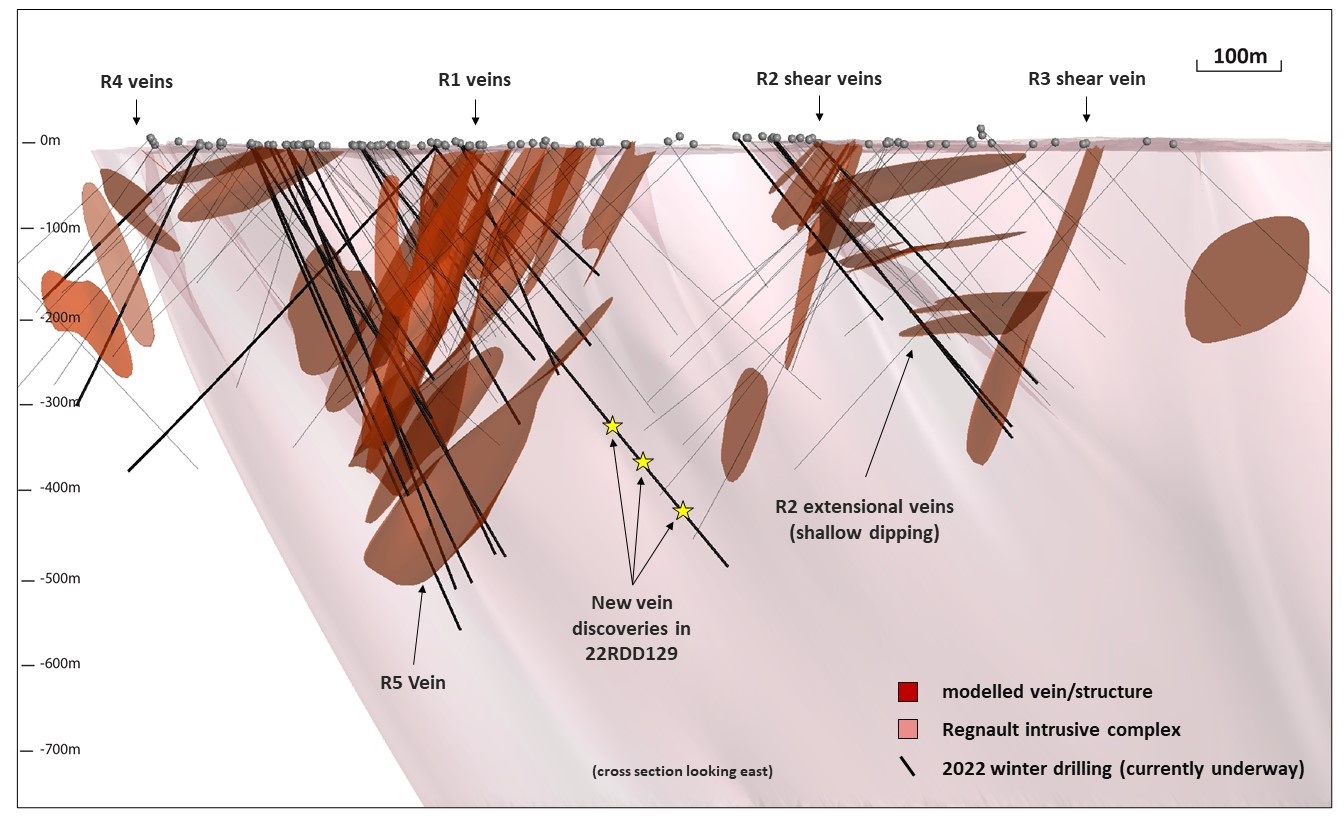

“The last remaining results from the 2021 drill program continue to demonstrate the exceptional high-grade nature of the Regnault gold system, including the most significant intercept at R2 to date. We have also completed the 2022 winter drill program which concludes the fiscal 2021 budget cycle. On this program we pushed drilling southward well beyond the R1 veins and intersected a series of additional parallel shear veins at depth. The significance of this development cannot be understated as it confirms the potential for additional vein discoveries within the intrusive complex. We anticipate the 2022 fiscal budget to be finalised towards the end of the month and we look forward to continuing our advancement of this remarkable gold discovery.”

Let’s have a look at where these latest results and discoveries rank in the overall story of Regnault. Besides this, Kenorland also received assays back for their Healy project, commenced drilling at their Chicobi project, and very recently optioned out the Separation Lithium project.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

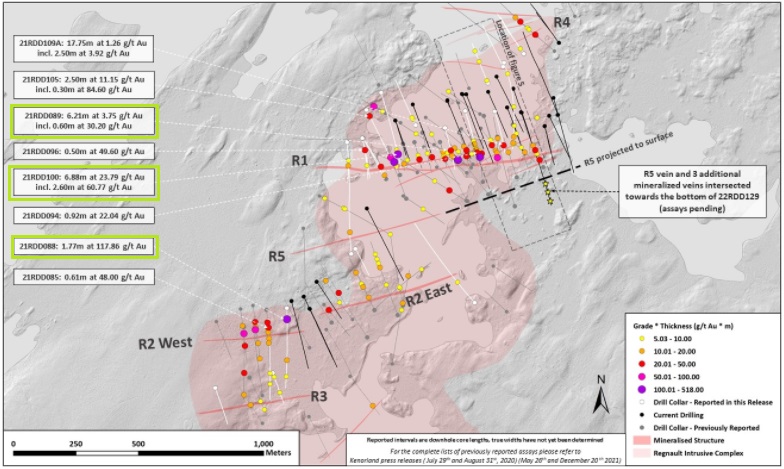

The current batch of 25 drillholes (7,968m) follows the previously reported batch of results of 32 drillholes (9,824m) of the 2021 summer-fall drill program completed in October 2021. This drill program was designed to systematically test along strike and down-dip extents of the R1, R2 East and R2 West mineralized structures at Regnault.

The recently completed winter drill program looked for new potential structures/mineralization, and although results are pending, the R3, R4 and R5 structures could be identified based on visual inspection of the core, which showed visual gold in several instances.

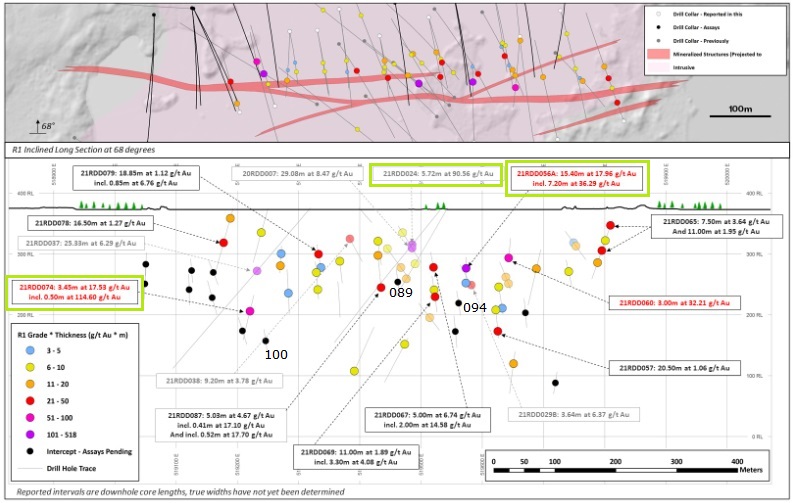

Along the R1 trend, highlights of the summer/fall program included:

• Hole 21RDD089 stepped 60m down-dip from on of the best holes at R1 to date 21RDD024 (5.72m at 90.56g/t Au) and intersected 6.21m at 3.75g/t Au from 140m incl. 0.60m at 30.20g/t Au.

• Drillhole 21RDD094 stepped 80m down-dip from excellent hole 21RDD056A (15.4m at 17.96g/t Au*) and intersected 0.92m at 22.04g/t Au from 247m.

• Hole 21RDD100 which stepped 80m down-dip from 21RDD074 (3.45m at 17.53g/t Au*) and intersected the best hole from this batch, containing 6.88m at 23.79g/t Au from 349m, including 2.60m at 60.77g/t Au.

• Drillhole 21RDD105 returned 2.5m at 11.15g/t Au from 40m, including 0.30m at 84.60g/t Au near the top of the hole along a separate structure 200m north of R1 and 50m along strike from 20RDD021A (2.66m at 33.69g/t Au).

• Hole 21RDD109A stepped 75m down-dip of 21RDD032 (4.87m at 3.80g/t Au) and intersected 17.75m at 1.26g/t Au from 223m, including 2.50m at 3.92g/t Au.

These results confirm and gradually extend the mineralized zone over 950m of strike length, to depths of 350m, coming from 750m along strike and depths of 330m. The following long section of R1 indicates this structure:

This results in an updated, very global back-of-the-envelope estimate on the Regnault structures, with an average grade*thickness (or GT as Kenorland calls it) of 5*5 = 25, and arrive for R1 at 950 x 250 x 5 x 2.75 = 3.27Mt, at an average guesstimated grade of 5g/t Au this would mean a hypothetical 525koz Au. Mineralized structures transect both the multiphase Regnault intrusive complex and surrounding volcanic rocks and are defined by zones of moderate-strong strain, biotite-calcite ± silica-chlorite alteration and disseminated pyrite (locally ranging from 3-10%). High grade intercepts are characteristically shear-hosted, laminated quartz-carbonate-pyrite veins, often haloed by variably deformed extensional stockwork quartz veining locally containing up to 20% pyrite along with trace chalcopyrite, Au/Ag tellurides and visible gold.

Besides R1, results also came in for the R2 structure. At R2 West, hole 088 intersected a narrow but still impressive 1.77m @ 117.86g/t Au, and is a 80m step-out hole to the east of 082A which returned 1.6m @ 28.34g/t Au. Hole 085 returned 0.6m @ 48g/t Au 30m up-dip of 082A. Mineralization for the R2 structure has a strike length of 950m now, and extends to 350m depth, and this could indicate a back of the envelope guesstimate of 700 x 200 x 2 x 2.75 = 770kt, at an average guesstimated grade of 9g/t Au is a hypothetical 223koz Au, bringing the total guesstimated mineralized envelope to 748koz Au. Not included are the R3, R4 and R5 vein structures, so in my view Kenorland could already be approaching 1Moz Au here.

Mineralization is found in stacked, shallow north-dipping extensional type quartz veins (R2 West) and steeply north-dipping shear hosted quartz-carbonate veins (R2 East). General mineralization for current structures appears to be differently oriented (shallow and steeply dipping, some stacked, some individual) vein stockworks, which appears to be quite complex (although Regnault is not as complex as most, the veins are relatively consistent in terms of strike and dip.):

Holes like 22RDD129 (included in the winter drill program, assays expected back in 2 months) indicate the potential of new veins at depth, so the Regnault vein structures could run much deeper, somewhat comparable to the nearby Troilus deposits which I have discussed in another article about Kenorland. It seems by the schematic models provided in the news release as if the mineralized veins run outside the intrusive complex as well, so I asked if management is focused completely on the intrusive complex, or looks outside it as well. CEO Zach Flood answered, “We have found, and there is great potential for, gold mineralization in the volcanics surrounding the intrusive complex.”

As Flood indicated in the last interview I had with him that they continue to step-out along strike but their focus is really more on deeper step-outs down plunge of potential high grade shoots, and they are looking to drill more aggressive step-outs down dip, I was wondering how much deeper they are targeting for their next program (they drilled to 500m depth during the winter program), and what kind of percentage will be aimed at infill, and what at step-outs at depth. According to CEO Flood, “The next phase of exploration will be focused on wide spaced step-outs along the new vein discoveries to the south of, and parallel to, the R1 trend, including R5 and the three additional veins we discovered with hole RDD129. We will also see step-outs along R4 to the north, the R2 trend, as well as testing entirely new targets to the south of R3.”

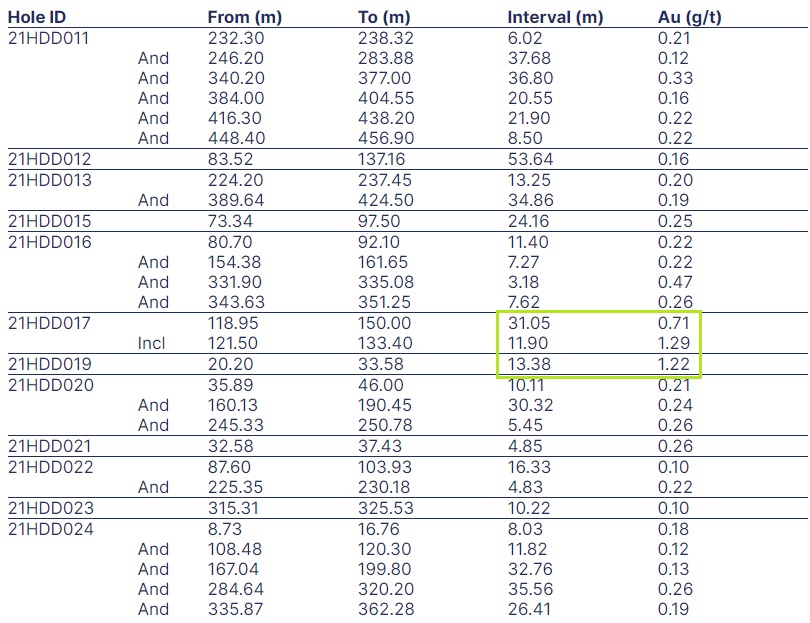

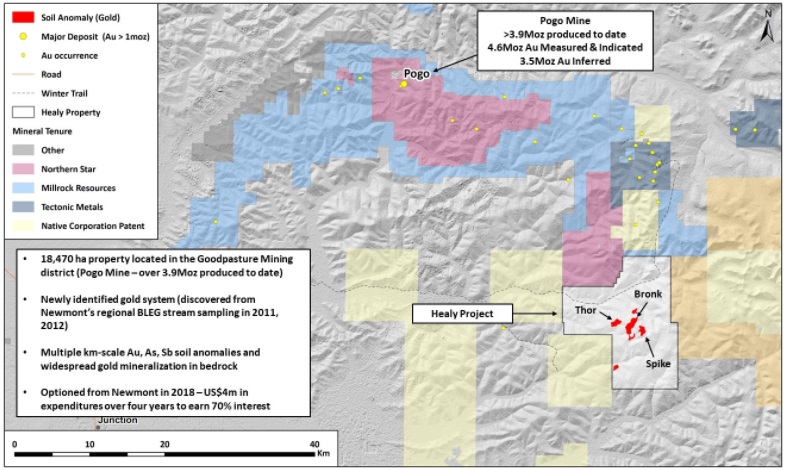

This wraps up the results from Regnault, let’s see what other projects Kenorland is working on these days. Regarding the Healy Project, Alaska (optioned from Newmont Corporation), a 5,200m maiden diamond drill program has been completed, and results were announced on April 1, 2022. A map indicating the three main targets can be seen here:

Results weren’t very impressive, but keep in mind it is still early days at Healy. The best intercept was drilled at the Thor target, coming from hole 019, returning 13.38m @ 1.22g/t Au from 20.2m. This was closely followed by 250m step-out hole 017, assaying 11.9m @ 1.29g/t Au from 118.9m. Although width and grade look similar, the depths vary considerably, and as Healy represents disseminated sulphide, vein-hosted sulphide and breccia-fill sulphide styles of mineralization, chances are that these two results aren’t relating to the same gold structure. Here is a complete table of results:

CEO Zach Flood wasn’t unhappy about this first round of drilling:

“The maiden diamond drill program confirmed the presence of a large-scale gold system at Healy evidenced by broad mineralisation encountered throughout the wide-spaced drilling across multiple target areas. While there are many indications that Healy represents a significant greenfields gold discovery within Alaska’s prolific Goodpaster Mining District, it will require additional drill testing to fully evaluate the economic potential. We will provide an update on our exploration plans going forward after we have completed a detailed review of the results and targets with Newmont Corporation, who currently holds a 30% participating interest in Healy.”

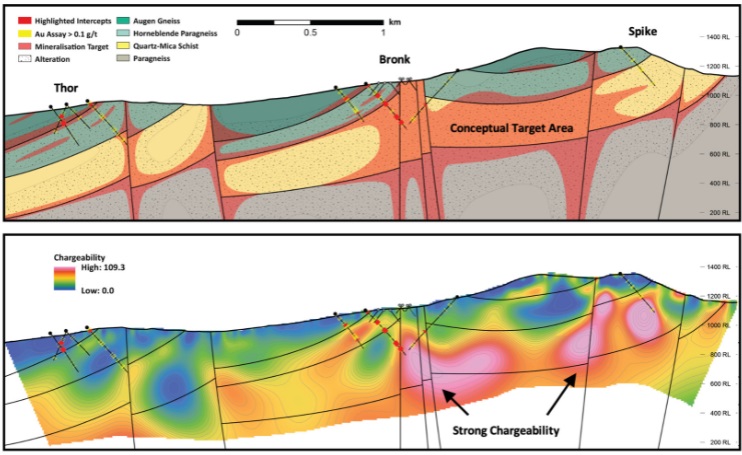

It would be great of course if Kenorland would find another Pogo (8Moz Au) or Naosi (1.5Moz Au) deposit, to name a few examples of major deposits in the region. After completing IP and MT surveys, management has high hopes of finding mineralization at depth, but this will require deep and costly drilling, as can be seen in these sections:

As there are strong and significant chargeability and conductivity anomalies at depth, and gold mineralization and alteration occurs over a 4 by 2km footprint, management anticipates the potential presence of an extensive gold system.

Another important project for Kenorland is Tanacross (Alaska). Extensive soil sampling program has been done, a 5km IP and MT survey was completed, and an airborne magnetics survey was flown over several targets. As surveys and consequent assays were delayed, and drilling put on hold, I was wondering if the assays were received from the labs. CEO Flood answered, “Yes, all assays have been received from the 2021 summer soil program. We have identified a very compelling target which we will provide more information on in the near future. There is a high likelihood we will be drilling the project this summer”.

Kenorland also completed a VTEM survey at the Hunter project in Quebec (optioned to Centerra Gold), and a LiDAR survey and mapping at South Uchi (optioned to Barrick). The current status on these projects is as follows: at Hunter a property-wide sonic drill-for-till program will be carried out in 2022. At South Uchi, Barrick will be following up on the 2021 property wide till geochemical survey with further exploration. More details on these projects will be presented in the coming weeks.

Since till sampling, boulder prospecting, and airborn magnetics has been completed at Deux Orignaux (Chebistuan) and crews prepared for the IP survey last time we spoke, I wondered if the IP survey already has been completed, and if further targeting is on its way. CEO Flood answered, “We are still waiting on the final IP data. Once we have that in hand and have completed our targeting, we will propose a program and budget to Newmont.”

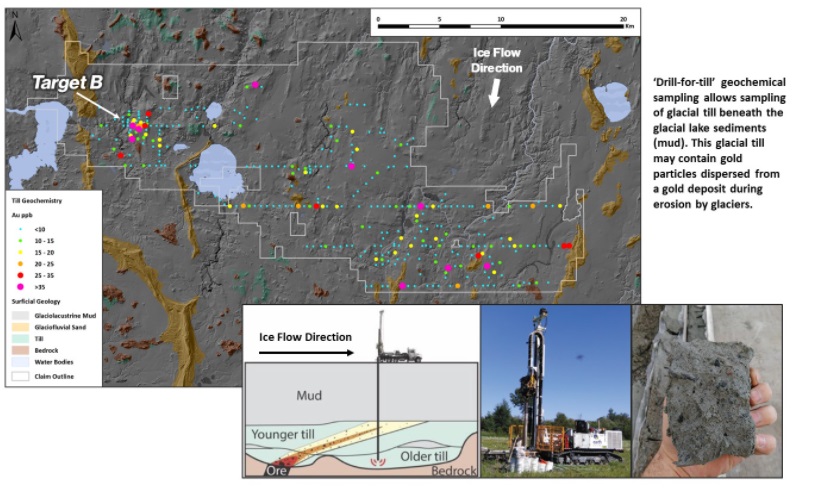

For Chicobi drone magnetics, IP and electromagnetics (EM) were completed in January, and targeting and permitting were completed in March, resulting in the commencing of drilling on April 4, 2022. Kenorland announced a small 2,000m diamond drill program over 4 holes, testing a 1.5 x 3km till anomaly.

Chicobi is another example of the deployment of extensive sonic “drill-for-till” sampling of glacial tills below cover, in this case clays. The results of these sampling programs have indicated a major contact between sedimentary rocks including iron formation and sericite-chloritoid altered mafic volcanic rocks. Drone based aeromagnetic and ground based induced polarization (IP) and electromagnetic (EM) geophysical surveys performed at Target B in November and December of 2021 have identified areas of strong chargeability and conductivity coincident and adjacent to a prominent jog in strongly magnetic sedimentary stratigraphy. An initial drill test totalling 2,000m of drilling along one fence is currently underway to test the strongest of the geochemical anomalism. The fence is designed to cross all favourable stratigraphic horizons and elevated chargeability, magnetic and conductive geophysical responses. As a reminder, the Chicobi Project is held under an earn-in option to JV agreement with Sumitomo where they have an option to earn up to 51% interest by funding C$4.9M in exploration expenditures. The 2,000m of drilling is expected to be completed half April, and results are expected to come back from the labs within 2-3 months.

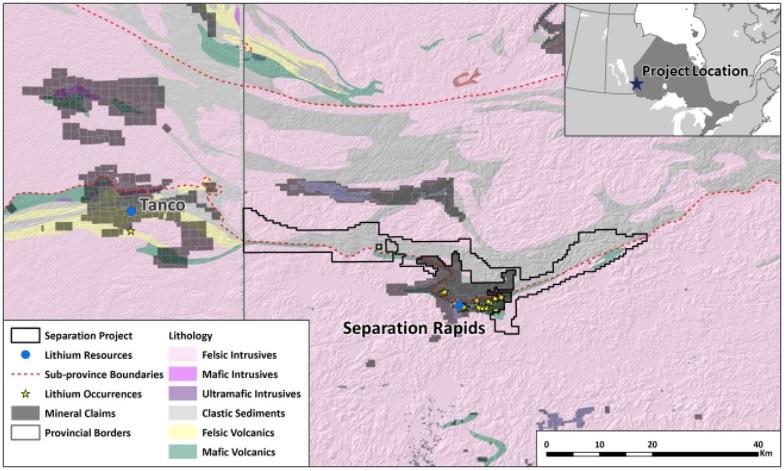

On a final note for projects, on April 8, 2022, Kenorland also optioned out their Separation Lithium project in Ontario to private Double O Seven Resources Ltd, with the option to acquire a 100% interest. The staking costs for Kenorland were C$100k, so the initial payment of C$100k already covers the acquisition cost for the company, and all else is risk-free upside. Such flipping of assets can be quite profitable, as total payments over 5 year would account for C$1.5M, Kenorland retains a 2.5% NSR, remains the operator and receives a 10% management fee of exploration expenditures.

The Separation Lithium project is on trend with the large Tanco Li-Cs-Ta pegmatite deposit (owned by Sinomine, a Chinese giant), but is also located directly to the north and east of Separation Rapids (Avalon Advanced Materials, AVL.TO).

The treasury currently stands at about C$8M, and the idea of management is to spend around $5M of this on exploration advancing their own projects including funding its joint venture commitment at Frotet, further exploration in Alaska, and additional generative exploration, including advancing projects in Manitoba. The revenue generated from its operations, including management fees as well as cash and equity received from partners, will more than cover its G&A.

Conclusion

The Regnault project seems to be shaping up to become quite a substantial gold system after the remaining second batch results came in, as my back-of-the-envelope guesstimate indicates potential up to 1Moz Au. Kenorland Minerals is still waiting for JV partner Sumitomo to approve their budget for another extensive drill program at Regnault, and this due any moment now. Results for the recently completed 10,000m program at Regnault are expected to come back in 2 months from now. Healy did disappoint me somewhat although it is still early days, it is a very large system and with lots of deep geophysical anomaly targets to drill. For now, Kenorland is focusing on drilling at Chicobi, let’s see if the successful reconaissance exploration can result in economic intercepts.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.