Kenorland Minerals Provides 2023 Exploration Update

Ice drilling at Regnault target, Frotet project, Quebec

As we seem to be at a pivotal point in the economy, with the Federal Reserve contemplating a halt in rate hikes, and potentially a more dovish stance for the second half of this year as a recession seems to be coming our way, sending the gold price to all-time highs recently, Kenorland Minerals (KLD.V)(3WQO.FSE) keeps establishing itself as the best prospect generator out there in my view, focusing on Tier I discoveries, working with just major producers. After a series of news releases came out discussing smaller developments since my last article, it is time now to condense this all into one comprehensive update on the company.

Unfortunately, the share price remains stable around the C$0.70-0.80 levels (equal to the last pre IPO round), with brief spikes to C$0.85 as Kenorland stock continues to be supported by many, for example the likes of Sumitomo, all the big Quebec funds, Sprott Global, Commodity Capital, Euro Pacific and last but not least Rick Rule himself.

Share price 3 year period (Source: tmxmoney.com)

Although Kenorland is doing fine, with C$18M in the treasury, planned exploration expenditures of C$33M, and a large portfolio of active projects, the company seems to have a hard time breaking out of the current trading range, despite record gold prices and copper prices doing well, as Kenorland is focusing on projects containing these two metals. I asked CEO Zach Flood why he thinks this is happening, and where he sees potential catalysts to create share price appreciation for investors. He stated, “The markets give little to no value to very early-stage exploration, however now that our portfolio is maturing, and discoveries are being made, we may see more action in the stock. Other catalysts could also include a broader recognition that the Regnault gold discovery is something that could have very significant economic potential, meaning it has qualities that could help it become a producing mine in the future. It’s worth noting that Kenorland has become a profitable entity with significant taxes owing this year and nearly a total of C$100M in expenditures applied to a properties by the end of the year (since inception). The company has historically raised C$29M (including NTW raises) and currently we have more than that in cash + shares. From a shareholder perspective, there isn’t a more efficient use of proceeds in the early stage exploration space. The project pipeline is now maturing (from grassroots turning into drill targets), so I believe we are at a stage where things will begin to get more interesting, and perhaps with more upside ”

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

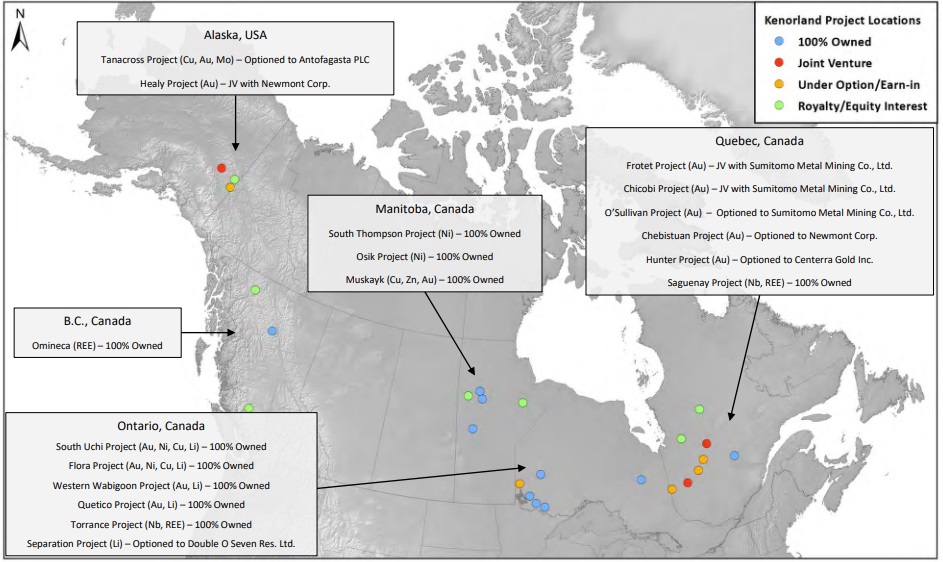

As the portfolio of assets of Kenorland is increasing, the way of presentation by the company is changing too. The amount of information per project has been limited, with more focus on general exploration strategy, and several maps with projects are provided:

I recognize this development with another prospect generator called Globex Mining (GMX.TO), which has over 200 projects and can’t possibly describe each project in its presentation. Although simplification seems time-saving and more clear, it also makes it harder for investors to value projects, and in turn value the company as a whole. Therefore I asked CEO Flood what his opinion on this is, and how he wants to convey the value of Kenorland to new investors. He stated: “Most of the significant shareholders are invested in Kenorland because they value a team of highly skilled and experienced explorationists who can make real discoveries. It is about the team and the strategy, along with the disciplined way we have managed the company from a financial perspective. In early-stage exploration, projects will come and go, targets will be tested and very few, if any, will result in economic discoveries. The real value comes when a large economic discovery is made and recognized and until that happens, it’s a matter of survival and preservation of the share structure. The value in Kenorland is being able to navigate the risks associated with early-stage exploration.”

To sum up the various projects and ongoing exploration, I followed the latest news release per project, and added pictures, additional information and questions for CEO Flood whenever suitable:

2023 Exploration Programs

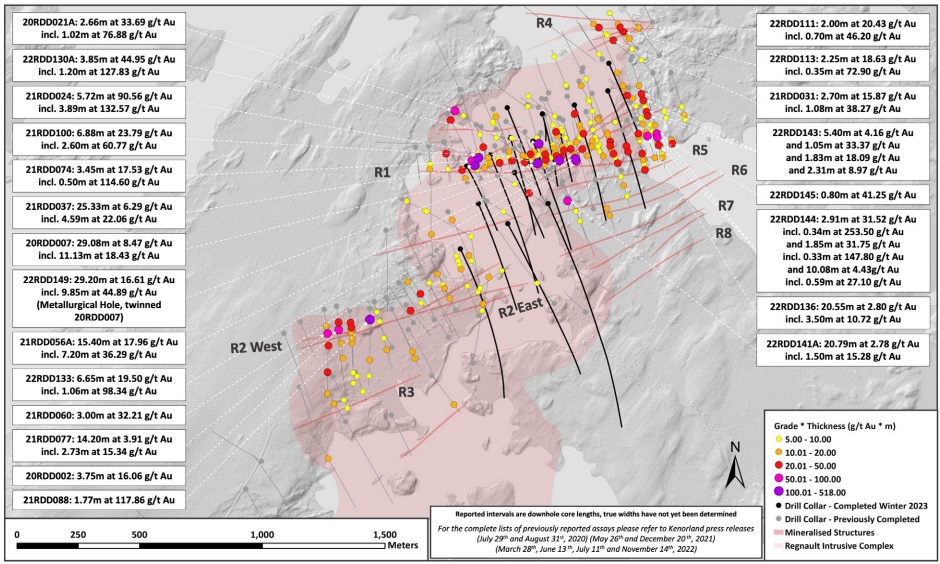

Frotet Project, Quebec: The 2023 Winter drill program at the Regnault gold discovery has reached completion with a total of 13,360 meters over 15 drill holes. A combination of unseasonably warm weather delaying ice construction and slow drill production resulted in less meters being drilled than originally planned, which was an amount of 22,000m over 25 holes. Complete drill results are expected to be released towards the end of the second quarter or early in the third quarter, which is also a delay of 3 months, due to the aforementioned reason of unusual warm weather.

Looking forward, the 2023 Summer exploration program is scheduled to commence in July and will include up to 10,000m of diamond drilling along with various detailed geochemical surveys surrounding the Regnault area.

As the original program included 11,000m of step-out drilling expanding the vein discoveries along the R5, R6, R7 and R8 structures, 8500m was designed to “infill” a 450m gap between R5-R6-R7-R8 and R2-R3, and 2500m was planned to target an untested zone to the south of Regnault, and just 13,360m was completed, not entirely clearly visualized for me in the presentation regarding the planned drilling, I was curious to find out what was drilled, and what will be done in the summer. CEO Flood elaborated: “There was a combined strategy of infill, stepouts, and deeper drilling to find new structures. A big focus was the center of the system between R5, 6, 7, 8 and the R2/R3. This was a big gap in drilling so we focussed a lot of drilling in there. The deeper drilling was also targeting new parallel vein structures, similar to how we found the R5, R6, 7, 8 etc, the deepest hole we drilled was just over 1600m (drilled at 65 degrees I believe). This summer is still in the works in terms of planning, but it might focus more of infill at Regnault, along with detailed geochemical surveys including till and lake sediment sampling, to advanced ‘brownfields’ targets within the area surrounding Regnault. We believe there is still significant discovery potential in the area and look forward to advancing these targets, which will then likely be drill tested next winter.”

An important part if not the most important part of earlier analysis is the back-of-the-envelope estimate on the Regnault deposit, so I will just quote it here again for your convenience:

“Regarding my back of the envelope estimate for the hypothetical Regnault resource, the combination of these models showed much more insight for me, and made it easier to estimate mineralization. As a reminder, the R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be calculated as one zone. This results in an updated, very global back-of-the-envelope estimate on the R1 structure, and arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at an average guesstimated grade of 6g/t Au, this would mean a hypothetical 870koz Au. The length of the mineralized envelope is actually a few hundred meters longer as the mentioned 1050m strike length in the news release, as the envelope is bent upwards towards the surface, so therefore I assume 1100m envelope length for R1.

The R2 back-of-the-envelope guesstimate stands unchanged at 900 x 200 x 2 x 2.75 = 990kt, at an average guesstimated grade of 8g/t Au this remains a hypothetical 255koz Au. For the R3 structure we have more visual information now, so the envelope could be estimated at 600 x 200 x 4 x 2.75 = 1.3Mt, at an average estimated grade of 7g/t this results in a hypothetical 294koz Au. The R4 structure to the north seems to be consisting of fairly narrow veins as well, 200m long and 225m deep, however not continuous from surface but separate vein structures, so the combined mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 10g/t Au this could imply a hypothetical 36koz Au. This results in a total hypothetical estimate for R1-R4 of 1.46Moz Au.

For the R5-R8 vein the data has become more complex with significant variation in average grades, even with additional structures indicated in between these veins, so I will try to estimate numbers per vein. For the R5 vein, the envelope is estimated at 700 x 75 x 5 x 2.75 = 722kt, at an average estimated grade of 10g/t this results in a hypothetical 233koz Au. For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated at 800 x 75 x 6 x 2.75 = 990kt, at an average estimated grade of 8g/t this results in a hypothetical 255koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 650 x 50 x 7 x 2.75 = 625kt, at an average estimated grade of 8g/t this results in a hypothetical 161koz Au. For the R8 vein, the envelope is estimated at 650 x 80 x 3 x 2.75 = 429kt, at an average estimated grade of 8g/t this results in a hypothetical 111koz Au. These new veins result in a total, hypothetical number of 760koz Au. My overall estimate would come in at an hypothetical 2.22Moz Au for now, which is considerably more than my last estimate.”

For average grade I estimated 7-8g/t Au, let’s see how this all works out in the future.

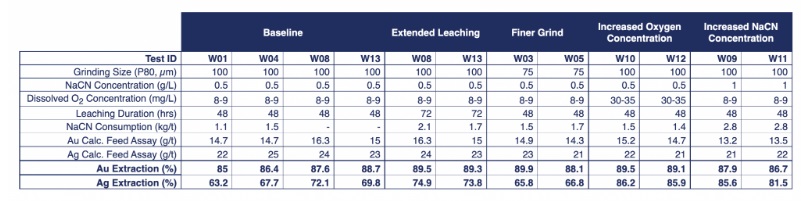

Earlier this year Kenorland announced promising preliminary metallurgical test work at Regnault, returning gold recoveries of 89.1-89.9%.

These results indicate that gold extraction is best improved with finer grinding and extended leaching, likely due to an increase in liberated gold grains and complete dissolution of coarse gold. In order to have good recoveries, the figure needs to improve to 92-94%, so some work needs to be done here. I asked if this will be achievable, and CEO Flood answered, “This was the most preliminary metallurgical work. There will be further detailed metallurgical studies and were confident these recoveries will improve as this work is completed.” As a reminder, the Frotet Project is currently held under an 20/80 joint venture with Sumitomo Metal Mining Canada Ltd.

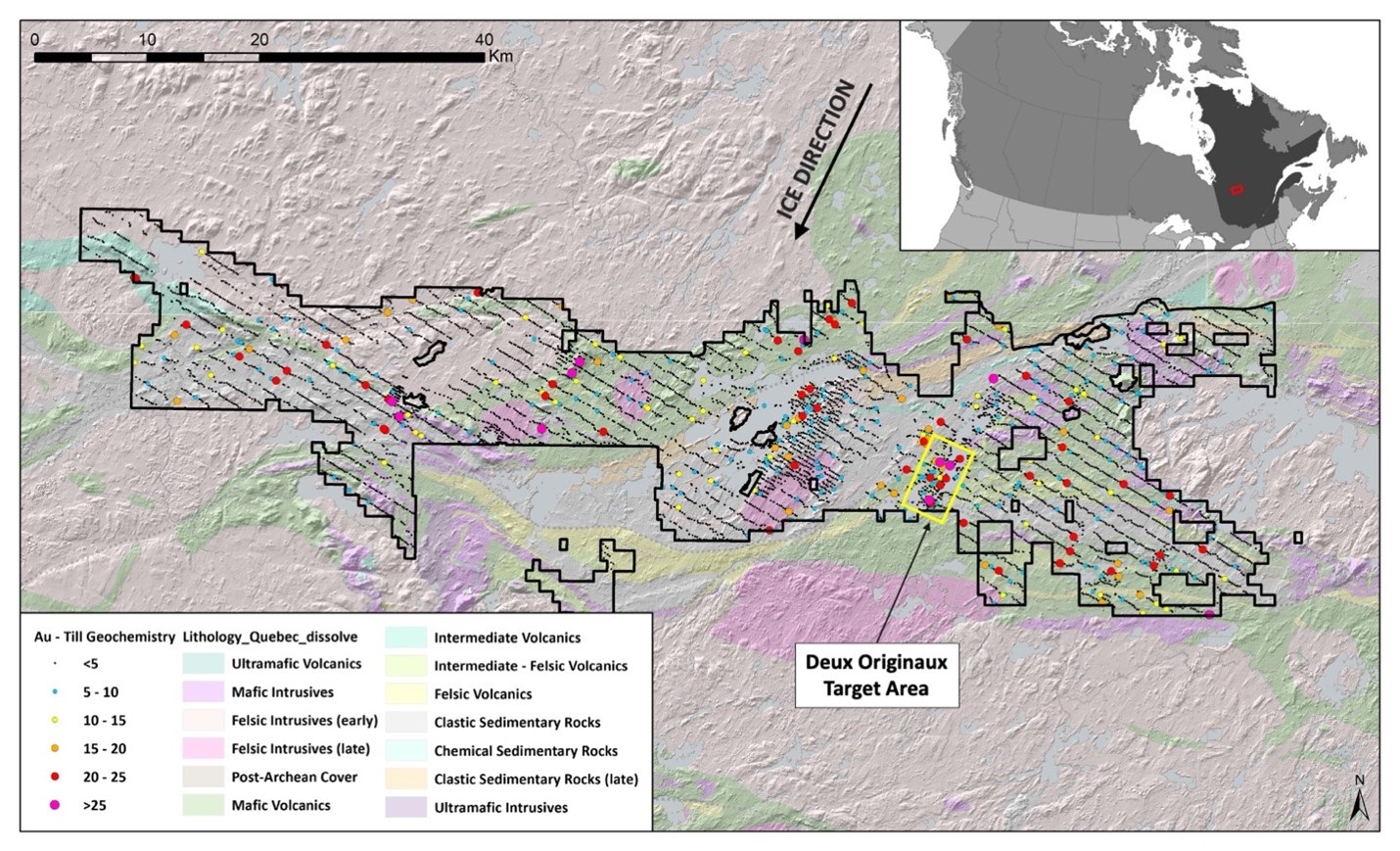

Chebistuan Project, Quebec: A maiden diamond drill program was recently completed at the Deux Orignaux target area. This target area was defined by gold and pathfinder element anomalism in glacial overburden identified following multiple phases of systematic geochemical surveys, beginning with a regional program in 2021 covering the entire 159,690-hectare property.

The maiden drill program included 2,170m of diamond drilling over seven holes testing across structural targets defined by detailed magnetic and induced polarization (IP) surveys completed last year. Results from the drill program are expected to be released towards the end of the second quarter. As 3,500m of drilling was originally planned, I asked CEO Flood what caused the difference. He answered:”We ran into similar issues that we saw at Regnault; warm weather delayed ice construction and drill production was slower than expected.” The Chebistuan Project is held under an earn-in agreement with Newmont.

O’Sullivan Project, Quebec: Kenorland recently completed detailed electromagnetic (EM), IP, and drone (UAV) magnetic surveys covering the Pusticamica North target area. The target area was delineated by coherent gold-in-till anomalism along the northern shore of Lac Pusticamica which coincides with strong deformation along a major felsic intrusive-volcanic contact. Summer 2023 planned exploration work includes a lake sediment geochemical survey, detailed mapping and a regional airborne versatile time domain electromagnetic (VTEM) survey. The geophysical and geochemical surveys, which cover a large portion of the target area beneath a lake, will assist in future drill targeting. The O’Sullivan Project is held under an earn-in agreement with Sumitomo Metal Mining Canada Ltd.

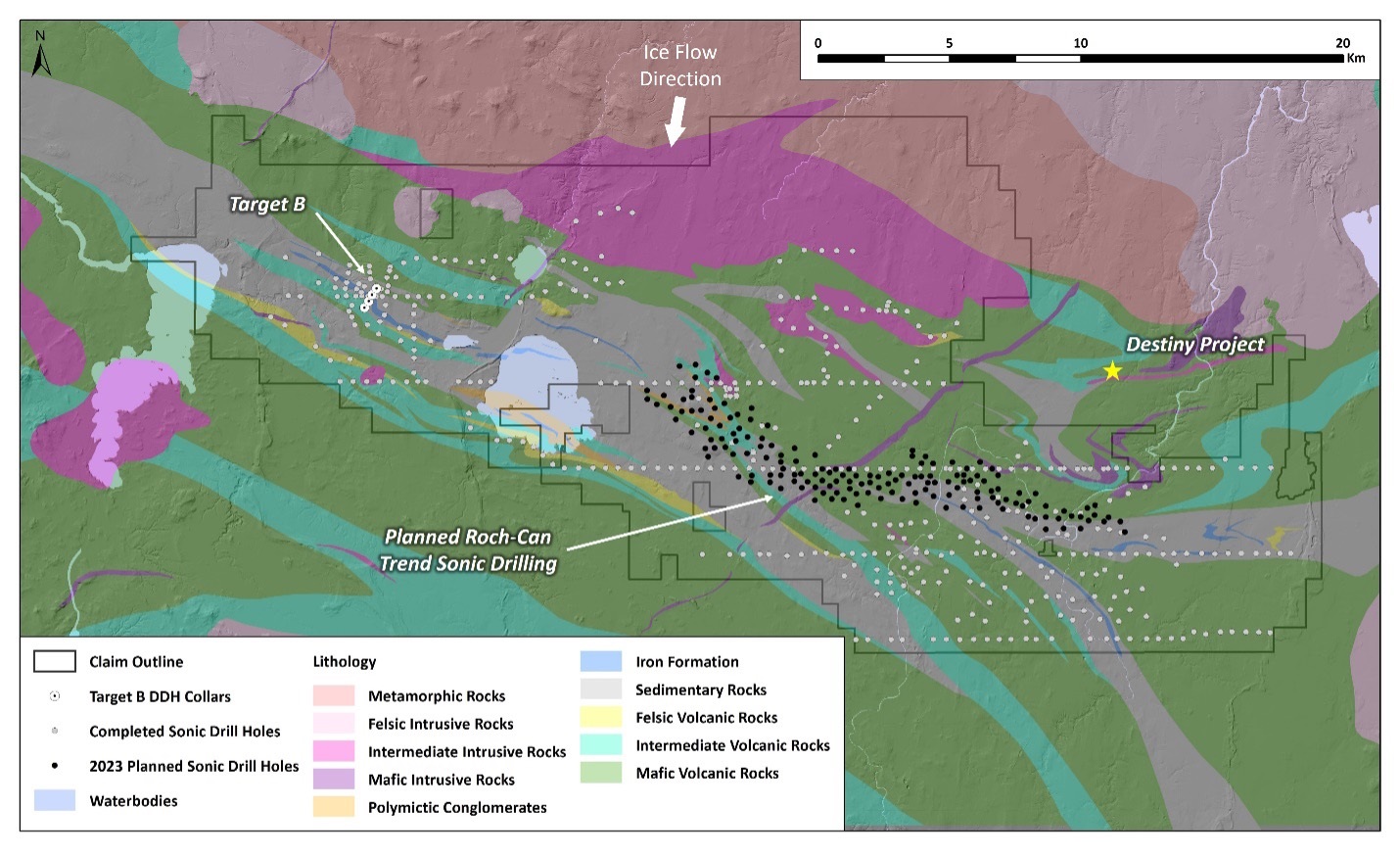

Chicobi Project, Quebec: Land access and permitting is well underway for the next phase of sonic drilling (drill-for-till geochemical sampling) along the Roch-Can trend. The Roch-Can trend is located along a major first order structure within the Chicobi Deformation Zone (CDZ) which transects the Abitibi greenstone belt.

Limited historical drilling and previously completed sonic drill holes have identified an alteration corridor spanning 17 kilometers in strike length and broadly associated with Au-Zn-Ag anomalism within the bedrock and glacial overburden. The two phase (summer and winter) sonic drill-for-till program is planned to commence in the third quarter of this year. The Chicobi Project is currently held under a 49/51 joint venture with Sumitomo Metal Mining Canada Ltd.

Hunter Project, Quebec: Following an initial property-wide drill-for-till sonic program, completed in 2022, the company is currently carrying out a detailed drone magnetic survey along with land access and permitting efforts in preparation for a follow-up detailed sonic drill program covering priority target areas identified from the initial regional program. The follow-up sonic drill program is expected to commence during the third quarter. The Hunter Project is currently held under an earn-in agreement with a subsidiary of Centerra Gold.

South Uchi Project, Ontario: Following the termination of the earn-in agreement with Barrick Gold Corp., planning for the next phase of exploration at the 100% owned South Uchi Project is well underway. Priority target areas for follow-up exploration include a significant large-scale and high-tenor coincident Ni-Cu-Co glacial till geochemical anomaly along with multiple discrete Li-Cs-Ta (LCT) geochemical targets. Future exploration will focus on the discovery of both nickel-copper sulphide systems as well as lithium bearing pegmatite systems.

Separation Rapids Project, Ontario: In 2022, the company completed a regional till geochemical survey, focused on LCT pegmatite systems, covering a large portion of the 46,362-hectare property. Results from the 1,183 till samples collected identified three priority target areas defined by anomalous and coincident lithium and cesium in till. A detailed follow-up geochemical survey and prospecting, covering all three priority target areas, is planned for this summer. The Separation Rapids Project is currently held under an option agreement with Double O Seven Mining Ltd., a private B.C. corporation.

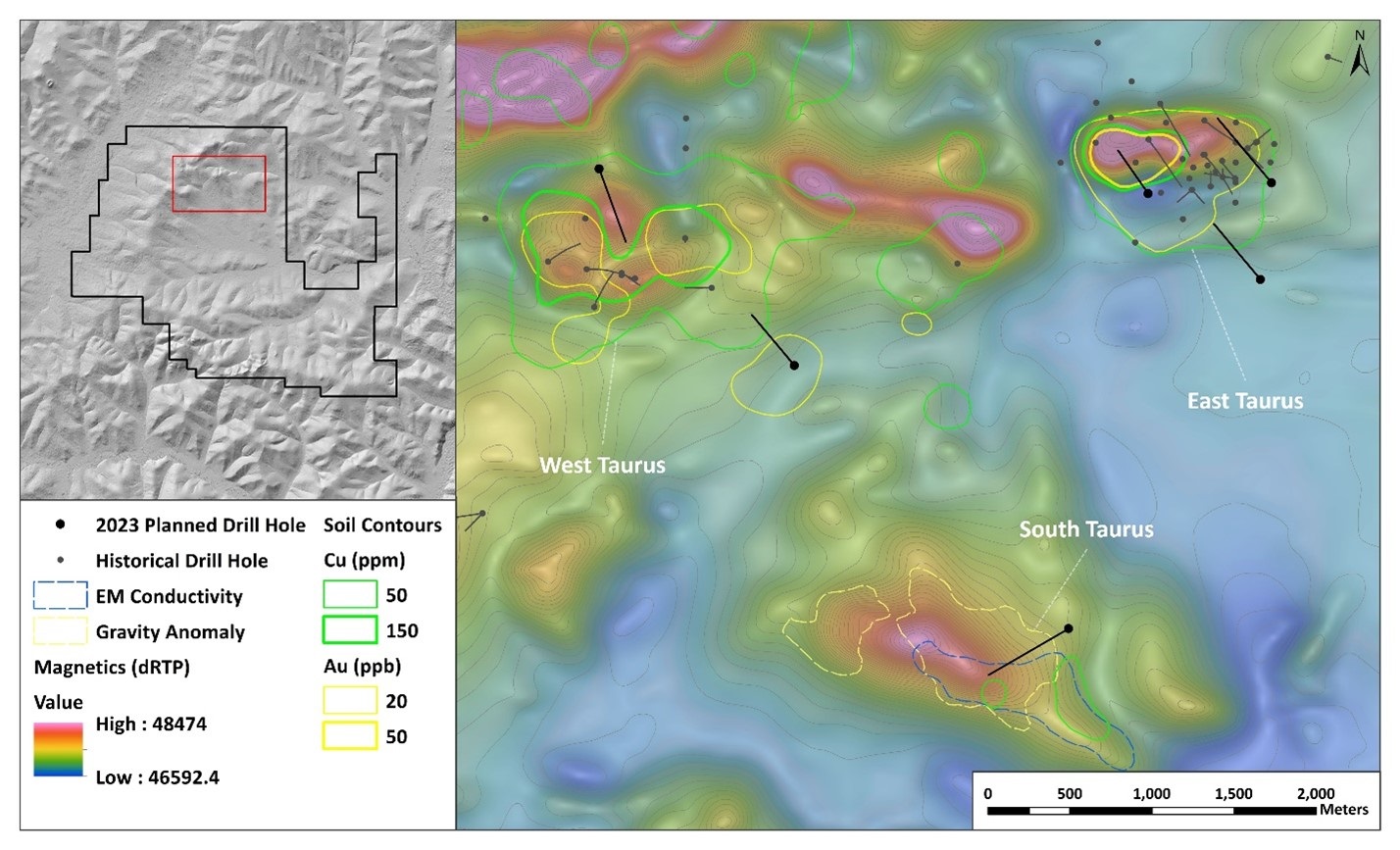

Tanacross Project, Alaska: The recently approved 2023 exploration budget and program includes 4,500m of diamond drilling scheduled to commence in June. Drilling will focus on three target areas; East Taurus, West Taurus, and South Taurus.

This drill program follows the surface work completed last summer, including the collection of 800 infill soil samples along with detailed IP and MT surveys covering the West Taurus-McCord Creek-East Taurus trend, as well as detailed extremely low frequency electromagnetic surveying (ELF-EM) and ground gravity surveys over the South Taurus anomaly. The Tanacross Project is currently held under an earn-in agreement with Antofagasta Minerals S.A.

Healy Project, Alaska: The company intends to carry out an ELF-EM survey covering the kilometer-scale Healy gold system during the summer in order to refine drill targets for future exploration. The Healy Project is currently held under joint venture with Newmont Corporation.

Recent Generative Activities

Muskayk Project, Manitoba: In November 2022, the company staked 300 mining claims covering 39,522 hectares in the Rusty Lake Greenstone Belt (RLGB) of Manitoba. The RLGB hosts the 70Mt Ruttan VMS deposit with historical production of 1.5Mlbs of copper and 1.7Mlbs of zinc. The RLGB has seen very limited modern exploration and no significant large-scale geochemical surveys. Given the low exploration maturity and proven endowment, the Muskayk Project compliments the company’s existing exploration portfolio. Community engagement is currently underway along with planning for an initial regional geochemical survey.

South Thompson Project, Manitoba: The company has applied for mineral exploration licences covering 383,704 hectares along the southern extension of the Thompson Nickel Belt (TNB), which is largely covered by Phanerozoic cover sequences. Compilation and digitization of historical exploration data, including 300 drillholes, has been completed. Evaluation and interpretation of historical geophysical surveys, including airborne magnetics and electromagnetic surveys are underway. Further integration and interrogation of these datasets will be used for targeting and planning follow-up exploration including diamond drilling.

Western Ontario Portfolio: The company recently acquired, through map staking, three new project areas in western Ontario collectively covering 182,239 hectares (46,347 ha Flora Project and the 58,536 ha West Wabigoon Project in the Western Wabigoon sub-province, and the 77,356 ha Quetico Project spanning the Western Wabigoon, Quetico and Marmion sub-provinces). These projects all cover vast areas of prospective Archean greenstone belts with relatively low exploration maturity and are generally concealed by glacial overburden. Detailed compilation and digitization of historical exploration data is underway along with community engagement and planning for the initial phases of exploration.

Critical Minerals Portfolio: Over the last two years, the company has assembled a portfolio of projects focused on critical minerals including REE and Niobium. The 41,951-hectare Omineca Project is located 350km north of the Wicheeda REE deposit in British Columbia. The 12,119-hectare Torrance Project is located in the Kapuskasing Structural Zone in eastern Ontario and covers an interpreted and untested alkaline ring complex, prospective for carbonatite related rare earth and niobium mineralisation. The 91,123-hectare Saguenay Project is located in the Saguenay region of Quebec near the Niobec and Crevier niobium deposits. Detailed compilation, digitization, and program planning is underway at each of these project areas.

Equity interests: Kenorland holds C$14.07M in equity interests and private holdings, of which about C$10M is accounted for by a holding in LiFT Power, a lithium junior of which the CEO Francis McDonald is a founder of Kenorland and still an advisor. Needless to say this provides Kenorland with a front row seat on any developments.

Conclusion

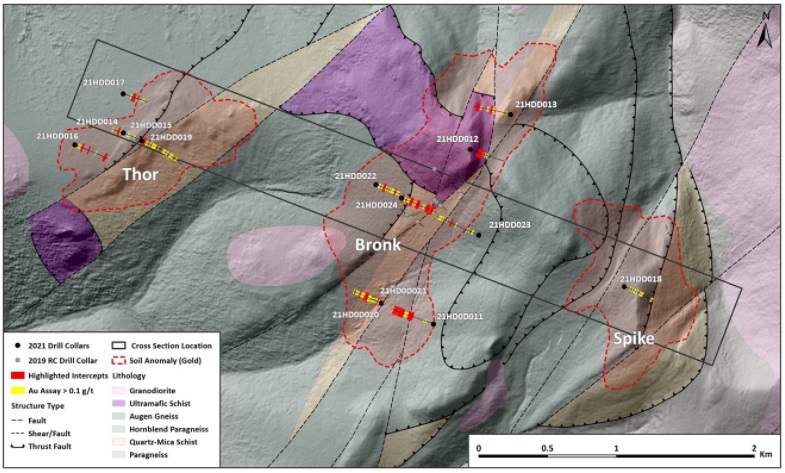

Kenorland is more and more shaping up as a profitable business in my view, optioning and JV-ing projects, sampling, drilling and killing them together with majors, looking for a genuine Tier I discovery in the process. Regnault might be one, but it will take a lot more drilling before the mineralized envelope, estimated by me at 2.2Moz @7-8g/t Au for now, would reach Tier I status (say over 5Moz Au). New drill results are expected in 2 months from now, let’s see if drilling was successful. As the company is the operator on many more projects, lots of newsflow and results can be expected, with Tanacross drilling as the second most important subject in my view. I still view an EMX type deal for Regnault with Sumitomo as a realistic option, and I see real potential for a deal looming when the (estimated) 3Moz Au threshold is reached, as Sumitomo doesn’t need Tier I assets. As there might be a focus on more infill drilling at Regnault, this could hint towards this direction. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals, Globex Mining and LiFT Power. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.