Omai Gold Mines Increases Resources to 1.9Moz Au Indicated and 1.8Moz Au Inferred At Wenot/Gilt Creek

CEO Elaine Ellingham (middle) at Wenot drill rig

With the world economy slowly moving towards a recession it seems, with inflation, rate hikes, shortages and the Russia aggression far from being over, Omai Gold Mines (TSXV:OMG) decided not to back down and instead advanced their Omai gold project in Guyana, and reported a significant resource update on October 20, 2022.

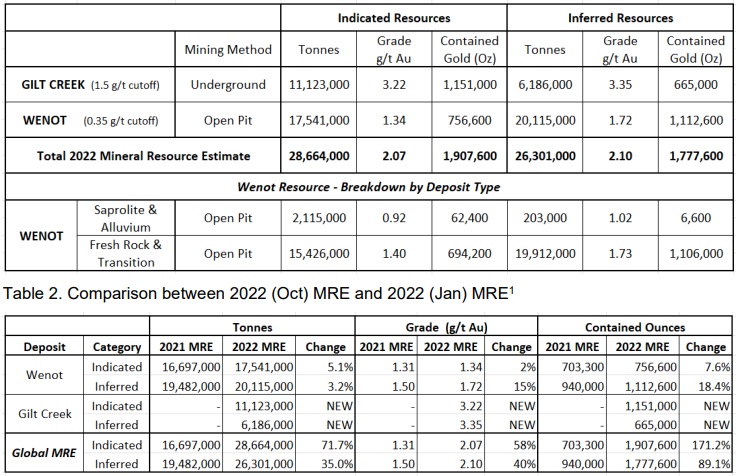

After having delineated a NI43-101 compliant resource estimate of 1.64Moz @ 1.4g/t Au Indicated and Inferred on January 4, 2022 on just Wenot, the new resource also included the nearby Gilt Creek deposit (formerly known as Fennell), which already contained a historic resource. The conversion of this resource generated a much higher figure (1.8Moz @3.26g/t Au vs a guesstimated 700-800koz @ 3.5-4g/t Au) than anticipated after discussing this with Omai management in my last article, so I was pleasantly surprised with the total number of 3.7Moz Au Ind and Inf. After digging a bit deeper into the numbers, it appeared that cut-offs were chosen somewhat on the positive side of things in my view, but still the resulting resource remains economic and fairly impressive for sure.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Although the markets with current, frothy sentiment at best didn’t exactly reward Omai Gold Mines for this new resource update, it was good to see the company sticking to the plan of advancing the project as fast as they could, creating intrinsic value for shareholders and potential investors. Something I especially appreciate was CEO Elaine Ellingham pushing for a ‘no-verification-drilling-required’ resource estimate for Gilt Creek with the regulators of the TSXV, as they had a very extensive collection of historic drill cores with collar locations and full down-hole survey data which were very well documented, along with original assay certificates and core photos. She succeeded, and this saved a budget for another costly 5-8 deep drill holes at Gilt Creek.

Without further ado, let’s have a look at the resource table, including a nice comparison between the January and October resource statement:

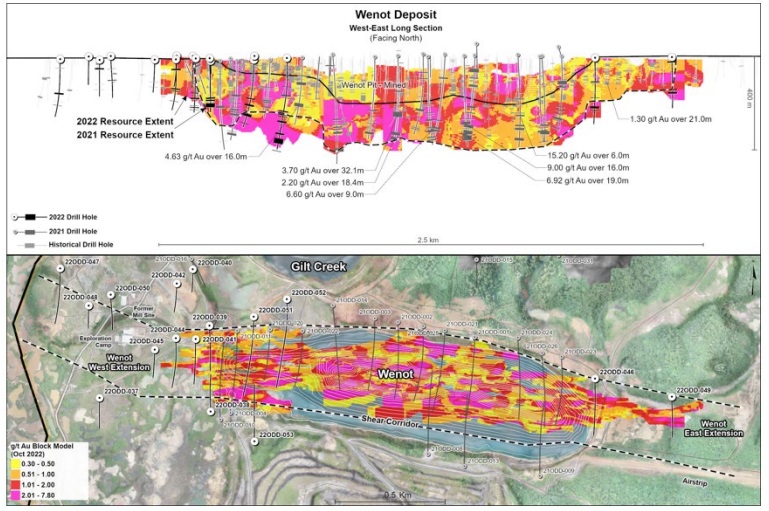

The updated Wenot resource came in as expected, adding 300koz, but the surprising part was that hardly any tonnage was added, but the change in average grade of the Inferred part was almost completely responsible for the increased resource. CEO Ellingham explained how this remarkable increase in Inferred grade was possible at Wenot: “With our additional drilling and also with the increased knowledge of the deposit, we were able to work with the independent QP to better model and refine the individual gold mineralized zones, to essentially trim off the lower grade material. This would closer reflect how the deposit would ultimately be mined and as a result, we removed some tonnage (of the lower grade material) pushing the average grade up. The recent drilling also contributed quite a bit of the higher grade material, as you can see in the attached Wenot long section and plan map showing the mineralized blocks for the resource calculation.”

As can be seen above, the mineralization is pretty continuous, also based on a huge amount of historic drilling, allowing Omai to increase the January resource estimate for Wenot on a relatively low amount of new drilling. For the January resource, a total of 21,541m (549 diamond drill holes) were taken into account, this October resource was based on a total of 21,991m (579 diamond drill holes) according to the news release. The difference in number of holes was explained by CEO Ellingham. She stated: With our new drilling, we were able to extend the resource a bit further along strike both east and west. So, in addition to our 12 new drill holes that contributed to the new resource, there were 18 historic holes that fell within those expanded areas that now could contribute to the calculation of the grade and width estimates. Of course, we were originally planning to complete more drilling at Wenot before updating the Wenot resource, but when the opportunity to add Gilt Creek into our NI 43-101 resource was realized, we wanted to advance that as soon as possible. Under NI43-101 that meant we had to include Wenot (being on the same property). We had not drilled as much as planned, but we wanted to get to this next major milestone with Gilt Creek.

I also noticed that the open pit parameters remained the same, with one exception: the used price of gold (US$1700 vs US$1650), so I wondered if this added additional ounces besides drilling as well. Again CEO Ellingham: Our independent QP determines the assumptions, including the gold price assumption. They use the Consensus commodity pricing which is used by many of the mining companies, including larger producers. It is unlikely that a slight change in the gold price would result in the addition of many ounces of gold.

I also found this used gold price (well above the current spot price of US$1640-1650/oz at the time of writing) not particularly conservative, usually companies use a gold price 10-15% below the spot price for resource estimates. When the gold price was hovering around US$1900-2000/oz, companies used a US$1650/oz gold price for example. CEO Ellingham answered, Companies that are required to use independent QPs, like Omai Gold, don’t set the commodity prices used in the resource estimates. The independent QPs are not experts on commodity pricing, forecasts or trends so they look to the experts and usually rely on a published consensus forecast, similarly even for the larger producers doing their in-house studies they look to published consensus forecasts.

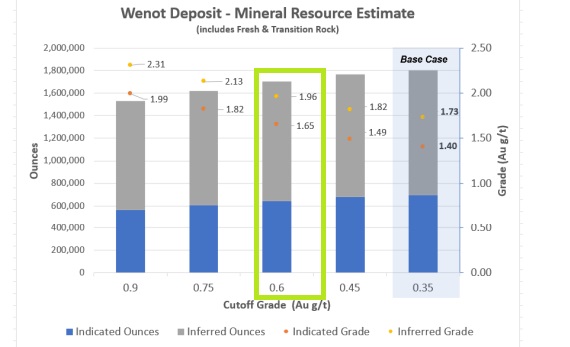

Since Wenot mineralization is present in many, almost vertically oriented, fairly narrow veins, I assume that the strip ratio is substantial. A quick back-of-the-envelope estimate comes in at 6-7 : 1 waste to ore for the ore below the existing pit, and 4-5 : 1 for the ore delineated along strike of the existing historic open pit. The average grade of 1.62g/t Au certainly can handle this at US$1600/oz Au, as it already could at US$1250/oz Au, so I figure the 6% NSR royalty doesn’t have too much of an impact. A fun thing here is that Wenot is very robust when considering higher cut-off grades:

As can be seen, when using a much more robust cut-off grade of 0.6g/t Au the ounces only go down from 1.85Moz Au Ind & Inf to 1.7Moz Au Ind & Inf, but the average grade increases from 1.62g/t Au Ind & Inf to 1.86g/t Au Ind & Inf, which is a lot in open pit mining land. I consider this a very healthy margin for economics, as the LatAm jungle is known for problems with water inflows, potentially causing much less steep pit slope angles in the softer rocks for example, increasing strip ratios.

CEO Ellingham commented the following about my estimates on strip ratio, and general remarks on potential LatAm water inflows: “For resource estimates the constraining pit is not an engineered pit design, that comes later during the Preliminary Economic Assessment (PEA). A lot of the western Wenot mineralization is shallow so will bring down any overall strip. For the main part of the pit, probably a 6-8 strip ratio is a good guess, but as we expand on the zones east and west, the average strip will continue to come down. Regarding the pit slopes, when Wenot was in production the north pit slope (in the volcanics) was above design at over 60 degrees. Guyana has a lot of rainfall, but Omai operated for many years with no major recorded issues on the rainfall or inflows, although they had facilities in place for ongoing control.”

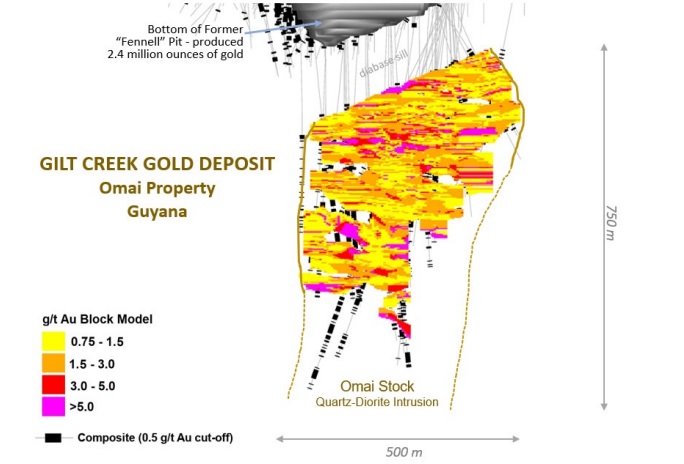

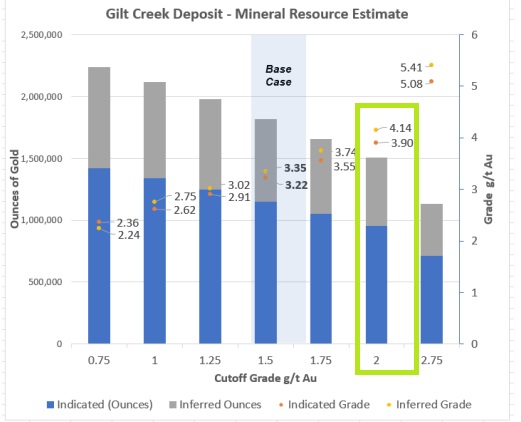

Let’s continue with Gilt Creek now. As mentioned, the historic core data at Gilt Creek was able to generate many more ounces than anticipated, at a very decent grade. The Gilt Creek resource was based on 27,997m (46 diamond drill holes, all historic), with a 1.5g/t Au cut-off and again the US$1700/oz gold price for the base case. A good thing here is that most of the historic resource could be converted into Indicated ounces, as the upper part has seen lots of drilling. The assays were capped to 40g/t Au, which bodes well for the future as there have been several intervals with grades over 1,000g/t Au.

Personally I view the base case 1.5g/t cut-off as somewhat optimistic for a underground mining scenario, and the average resulting grade of 3.22g/t Au Ind and 3.35g/t Au Inf in itself doesn’t seem to imply a very economic scenario with a gold price of US$1500-1600/oz in my view. Fortunately, the sensitivity analysis for gold grade shows lots of margin, and it makes a difference that Wenot would be the first phase as a starter, accounting for much of the capex. It seems viable, after depletion of Wenot, to go to Gilt Creek by a ramp from the bottom of the Wenot pit. CEO Ellingham had a different opinion on the cut-off grade: “We can care to differ here because there are many large stope underground mines with lower grades. For example, Alamos’ very successful Young Davidson mine in Ontario does almost 200k oz/yr production from an intrusive-hosted gold mine avg grade 2.3 g/t Au. The other advantage of Gilt Creek is that there is no development required to satellite deposits. The deposit is very compact, making mining very efficient. The sensitivities show that you can increase the cutoff to 2.75 and have an average grade of over 5 g/t and still over 1 million ounces. However, if you mined this, once you hoist the “waste” you would take it to the mill, likely anything over 0.5 or 0.75 g/t Au, so you would still produce more than that 1 million ounces. We were all quite happy with the grade.”

As she and Chairman Renaud Adams (New Gold) have quite a bit of knowledge of producing mines, she is probably right, but I prefer to see slightly more conservative cut-offs and higher grades for margin of error. Too many times I have seen ramping up mines fail, and often grade variance caused by overoptimistic resource estimates and economic studies was an issue. In this case, I do believe the sensitivity provides sufficient safety margins:

Keep in mind, the historic resource contained just 1.4Moz Au @ 2.5g.t Au. A cut-off grade of 2.0g/t Au decreases total ounces from 1.8Moz Au to 1.5Moz Au, with the average grade increasing to 4.02g/t Au, and this is much more robust for an underground project. I asked CEO Ellingham what caused the increase, as no new drilling was done. She answered: “The previous resource was done in 2007 when the gold price was around $425/oz. That would have the most impact, but we also noticed that they only put blocks around certain areas for their analysis, without any explanation. The resource work was done after the company had decided to relinquish the project to the government, so little priority was put on this resource.”

So with a slight increase in cut-off grades for both deposits, a likely pretty economic resource of 3.2Moz Au is achieved. Based on former production data, general recovery seems to come in at 92% which is standard for such projects.

CEO Elaine Ellingham was pleased with the outcome of this resource estimate, and she sees lots of exploration potential:

“The Gilt Creek Deposit holds potential to expand both laterally, where there has been limited drilling, and to significant depths, providing the potential for expanding the Gilt Creek Deposit through future drilling. Our initial plan was to complete further drilling on the Wenot Deposit prior to this MRE (mineral resource estimate), however the opportunity to accelerate the inclusion of Gilt Creek into our MRE drove our decision to proceed with the updated MRE rather than continuing with Wenot drilling at that time.

When drilling resumes later this year, additional drilling at Wenot will be included as part of the program and is expected to contribute to future Mineral Resource updates. The Wenot shear corridor can be traced 8 km across the Omai Property. Wenot’s past production of 1.37 million ounces of gold plus our current Wenot Mineral Resource Estimate are both hosted within about 2.5 km of strike along this shear corridor. Much of the corridor has seen little exploration and it is one of our priority areas for both our current and 2023 exploration programs.”

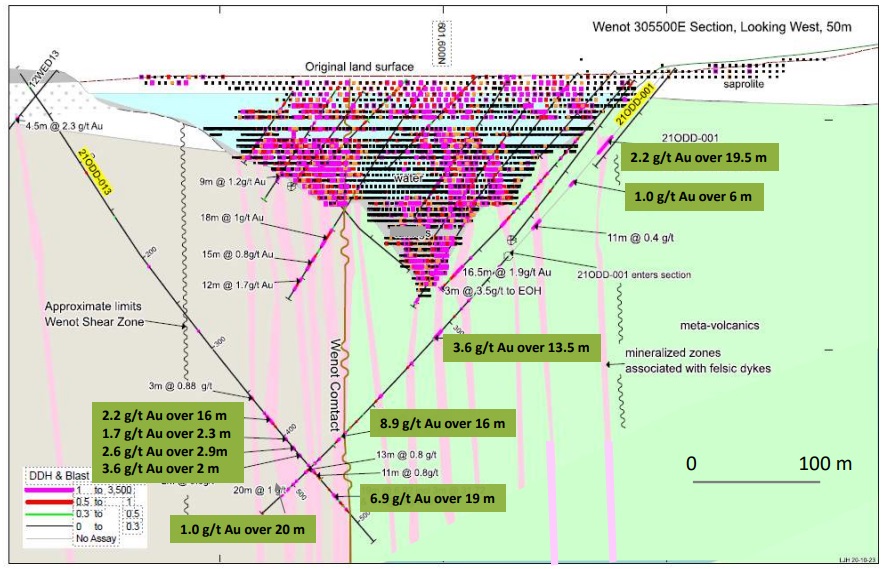

Expanding the Wenot resource into these un-mined areas is significant for an ultimate mine plan as these could contribute to lower-strip-ratio starter pits for the larger Wenot deposit. Omai Gold Mines has the advantage of having a pretty good idea about more near surface mineralization at Wenot, as historic drilling tested this shallow mineralization in the saprolite layer. Another aspect that seems to be typical for this deposit is the predictability of the width and grade of the vein structures from near surface to depth. This gives management more confidence, not only in the mineral resource estimate but also to the exploration potential.

As of now, the company has established an exploration target at Wenot with a size of at least 2.7 km long, by 450 m deep, by 200-300 m wide, with only 50% of this larger area having been drill tested. The Wenot shear corridor is a regional structure and it is highly likely that the gold-bearing zones extend beyond the drill-tested area. They have identified an eastern extension of the Wenot shear corridor that continues four to five kilometres along strike, onto the adjoining Eastern Flats property.

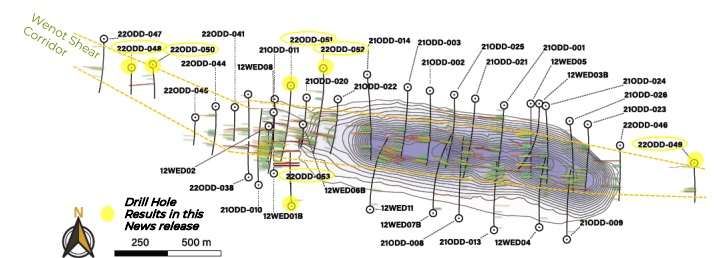

Another aspect of the summer exploration program I found pretty interesting was the discovery of gold mineralization in sediments, besides the known gold within the volcanic rocks. Both 2021 and 2022 drilling has shown that the dikes and other shears also penetrated the sedimentary layers where they host similar gold mineralization. At the western extension of Wenot, the mineralized zones in the sediments are even wider with similar grades. Hole 22ODD-051 was recently completed in this area and tested well into the sediments. Results came out on September 12, 2022, and showed an intercept of 12.7m @ 1.45g/t Au. Other holes were successful too, with intercepts of 33.9m @ 2.27g/t Au, 3.5m @ 13g/t Au and 7.3m @ 6.28g/t Au. CEO Ellingham was very pleased with the outcome, and rightly so:

“These impressive new drill results continue to confirm the strike and depth continuity of the Wenot mineralized zones. We have not seen any limitations at this point to the depth and strike potential of the Wenot zones, and as such are optimistic that additional drilling can further expand the gold zones. Holes 22ODD-051 and 052 were designed to in-fill and confirm the continuity of the gold mineralized shears at depth below the western end of Wenot and proved extremely successful with wide intersections, including 33.9m averaging 2.27 g/t Au and 20.3 m at 1.92 g/t Au, in addition to multiple additional subparallel gold zones. These gold-bearing shear structures at the west end of Wenot are particularly important since they come to surface and are now identified to a vertical depth of at least 320m, which is expected to allow the expansion of the constraining pit for the updated resource. Only the surficial saprolite cover was historically mined in this area.”

Summer drilling at Wenot saw the completion of 1,200m, and the next drill program will likely consist of 5,000m. As the current cash position is around C$800k, I assume that management has to go to the markets sooner than later. CEO Ellingham had this to comment about their exploration plans: “We have commenced a geochemical survey program along the eastern trend of the Wenot shear corridor and also have initiated trenching on the lower part of Broccoli hill. We may initiate the drilling this year, and with the two drills stored on site, we can start up fairly quickly.”

This wraps up the discussion about resources and exploration for now. When a company comes out with a meaningful resource- or study update, I always prefer to include an updated peer comparison as well.

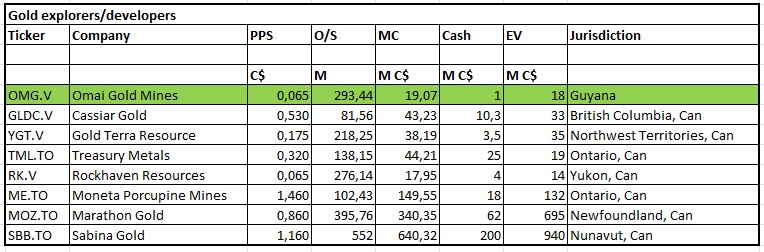

In general as a continuous reminder for investors, a peer comparison as a valuation method isn't perfect as every single company has a unique set of parameters and should actually be analyzed in full and normalized as far as this is possible of course, and for example EV/oz doesn't say much about profitability of the project yet, potential high capex, potential permitting issues, capability of management etc, but with some comments to go with such a peer comparison it provides at least an indication, which is my intention. The main intent for peer comparisons is a basic valuation tool by trying to find the most equal companies regarding quality and size of projects, jurisdictions, financial situation, backing, management, permitting, in short everything that makes every project and company so unique in this space. The better the resemblance, the more useful the company for a comparison.

The first table is mentioning basics like structure, enterprise value and jurisdiction:

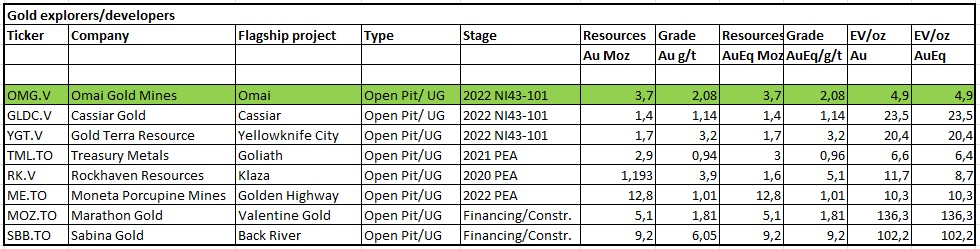

The second table shows resource figures, and the important metric EV/oz for developers:

We can all see the extremely low EV/oz valuation of Omai Gold Mines in this table, which in my view doesn’t do any justice to the likely pretty economic ounces of Wenot and Gilt Creek. It wouldn’t surprise me if a PEA would generate economics along the lines of an NPV8 of US$400-500M with a solid IRR at US$1600/oz gold.

An interesting peer project would have been Toroparu, also located in Guyana, also an open pit/underground project and owned by Gold X Mining, a company which got acquired by GCM Mining for C$315M. This project was at PEA stage when acquired in 2021, and contained over 10Moz AuEq. This would have meant an EV/oz of about C$30/oz, despite its low grade and probably less robust economics, in a far more remote location in Guyana. The gold price traded around US$1900/oz at that time, so for this project it probably was the catalyst for the buyout, as with the current gold price it wouldn’t have had much profit margins. At the same time the people controlling both companies were very familiar with each other, so one can’t rule out the possibility that negotiations weren’t exactly harsh. Besides all this, when such a ratio would be applied to Omai it will be clear that there could be 5-bagger potential.

Treasury Metals and Rockhaven are enigma’s of their own, as both have very low EV/oz ratios but at the same time pretty solid PEA economics at US$1600/oz gold. Treasury has been the story of the disappearing ounces basically, as not only the not too long ago acquired Goldlund deposit has been downgraded 3 times in its existence, but also its flagship Goliath deposit has become much smaller these days, and is only a relatively small open pit resource now with an even smaller underground component. Notwithstanding this, the consolidated PEA NPV5 stands at C$328M with an IRR of 30.2%, which is fairly economic. The current CEO Jeremy Wyeth is an experienced mine builder who unleashed a very conservative approach to Goliath and Goldlund, and Goliath has received an environmental permit years ago, so it seems Treasury can develop at least Goliath into production, with Goldlund to follow later on. So with their solid cash position and support of Sprott Resource it seems it should deserve more love from the markets, but unfortunately the current sentiment doesn’t help.

Contrary to Treasury Metals, I’m not very familiar with Rockhaven, but since it is in the Yukon, has a large open pit component, has been involved since 2011 with doing baseline environmental studies and has to start permitting, my suspicion is that permitting could be the cause for its extremely low valuation here, as Yukon permitting could be a very lengthy affair, as Victoria Gold showed, although Victoria was the first, so things could potentially proceed faster now.

Although we are talking about Guyana and not about Canada as a jurisdiction here, Guyana is stable, and a very reliable working environment for those who have experience and the right networks, and Omai Gold Mines has both in spades. According to CEO Ellingham, for example permitting is expected to be much faster as Omai isn’t working anywhere near local communities, and the government is very pro mining. They haven’t forgotten the time when the Omai gold mine was the largest contributor to Guyana GDP for many years, employing over a thousand people, and would like to see this happening again.

Conclusion

After the latest resource update for Wenot and Gilt Creek, total ounces stand at an impressive 3.7Moz Au for Omai Gold Mines at the moment, which is coming closer to Tier I territory (> 5Moz Au). Although the used gold price and cut-off grades weren’t very conservative, in my view a healthy higher grade 3.2Moz Au could be very economic as a base to work from. Management is convinced that there is much more gold to be found as there are plenty of targets in the direct vicinity, and hopefully strong drill results could turn around the current low valuation, especially combined with improving market sentiment which I expect somewhere next year, possibly in Q2/Q3 2023.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Omai Gold Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.omaigoldmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.