Tectonic Metals Raising C$3M; Strategic Investment By Crescat Capital

It is always a good sign of confidence when a large, well-known and widely followed shareholder like Crescat Capital decides to invest more into a tiny junior explorer via a strategic financing, even though they have been buying in the open market at higher cost levels increasing their ownership to 17.5% on a partially diluted basis. Their timing appears to be right, as the company in question, Tectonic Metals (TECT:TSX-V; TETOF:OTCQB; T15B:FSE), has been trading at all-time lows for a while now, as investors have been waiting for new developments:

Share price 3 year timeframe (Source: tmxmoney.com)

I started coverage on April 3th, 2022, when the share price just touched current levels, but almost 4 weeks later it seems there is strong support around C$0.06. This surprised me somewhat, as the markets experienced a hefty sell-off the last week on the back of surprisingly hawkish rate hikes and outlooks by the Fed, and added risks of inflation, shortages and the ongoing Russia-Ukraine conflict, but on the other hand it seems ongoing selling in Tectonic has been completed and the bottom seems to be in. Crescat Capital obviously thought so too, and opted for another injection of fresh capital, enabling Tectonic to finalize and commence their exploration programs soon. As Dr. Quinton Hennigh, Geologic and Technical Director of Crescat Capital, put it in the news release: “Tectonic has assembled an enviable portfolio of high-quality gold projects in Alaska, all ready for drilling. They have a very strong technical team able to execute on multiple exploration campaigns, and importantly, they have a drill available for the 2022 season. We are fully supportive of their plans to drill at the Seventymile and Tibbs projects, both with exceptional potential for large-scale intrusive related and orogenic gold mineralization. Our participation in this financing shows our full commitment to the company.”

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Tectonic’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Tectonic or Tectonic’s management. Tectonic Metals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

On April 25, 2022, Tectonic Metals announced a non-brokered private placement of up to 50M shares @ C$0.06, with a 2-year half warrant (exercise price C$0.10) for gross proceeds of up to C$3M. The warrants are subject to an acceleration clause, when the share trades C$0.20 or higher during 20 consecutive trading days.

Tectonic is looking to close this financing before May 16, 2022, and according to CEO Tony Reda, the company is willing to make room in the financing for new retail shareholders if interested, as Tectonic is heavily held by respected resource funds and could benefit from more liquidity. Entry into the company at below insider cost levels would provide shareholders with potential upside to three exploration programs, including two drill programs targeting high-grade gold. Proceeds will mostly be directed towards exploration of the Tibbs and Seventymile projects, to a lesser degree to the Flat project, and for general working capital. CEO Tony Reda was pleased with the participation of Crescat Capital:

“Crescat’s continued support of Tectonic has once again demonstrated the technical merits of our projects, the strength of the company’s durable partnerships, and the importance of sophisticated strategic shareholders, who understand the challenges and recognize the opportunities in the junior mining industry. As existing cornerstone shareholders in Tectonic, Crescat, and Quinton Hennigh need no introduction to investors, and their continued endorsement speaks to the work we have done to advance our properties and the value-creating programs we are targeting this year.”

This financing will of course account for a decent chunk of dilution, as Tectonic Metals currently has 161.68M shares outstanding, and 223.69M fully diluted; however, 63% (partially diluted) of the shares is in strong hands, held by the Tectonic team, their strategic partners (Crescat and Alaska’s leading Native Regional Corp, Doyon) followed by other resource funds as Gold 2000, RCF and Mackenzie Investments. 50M new shares and 25M additional warrants would take these totals to 211.68M O/S and 298.69 F/D, which is considerable, but what is comforting is that many of the existing shareholders are doubling down in this latest financing. Of these F/D shares about 30M warrants are expiring before the end of June 2022, so this takes away some of the warrant overhang..

The cash position is estimated at C$4M after closing, which is a decent start for new exploration. As the closing is expected in two weeks, exploration plans are scheduled to be announced shortly after, with the first drill rig commencing action around June.

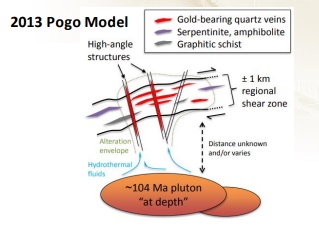

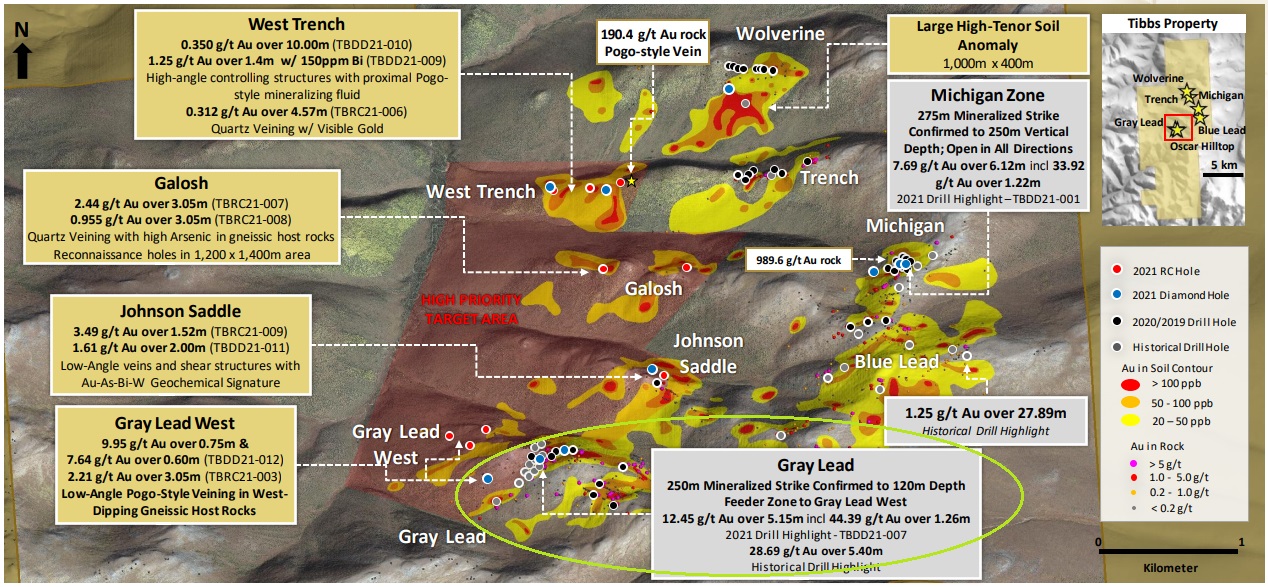

Where will they spend this money? As a reminder, Tectonic is targeting district-scale projects in safe jurisdictions, which have the potential to generate multi-million ounce deposits. Tectonic’s fully owned flagship is the Tibbs project, covering 29,280 acres, 35km east of the 200koz Au per annum Pogo Mine. High-grade gold mineralization at Tibbs occurs in steeply dipping veins, crossing multiple lower grade low-angle veins similar to the Pogo Mine, which serves as an analogy.

The Tibbs property is close to existing infrastructure and an active mill, and has seen lots of exploration, ranging from sampling, airborne geophysical surveys, trenching to drilling. Drill highlights are 28.95m @ 6g/t Au, 5.3m @ 15.7g/t Au, 5.7m @ 19.1g/t Au, 1m @ 104.5g/t Au and 5.1m @ 12.45g/t Au. These are very substantial results, and the most impressive drill results were obtained at the Gray Lead area:

Phase II drilling already established a 1000m x 350m mineralized zone, where the majority of drill results returned grades over 5g/t Au, and within this high grade, steeply dipping veins with grades up to 127g/t Au. It is still early days, but if we would guesstimate a mineralized envelope of 1000x350x5m x2.75t/m3 density, this would result in 4.8Mt, and at an average grade of say 5g/t this could already result in a hypothetical 770koz Au. And keep in mind that this is only a small part of the entire project. Below the Gray Lead target, another target area is located: the Jeans Ridge prospect, where successful sampling up to 50.3g/t established a 450m long gold-in-soil anomaly.

According to management, a major development of the 2021 Phase II drilling program that appears to have been largely ignored by the market was the discovery of four stacked low-angle veins at Gray Lead West. This is significant because the missing piece of the puzzle necessary to confirm Tibbs as a true Pogo analog was a low-angled vein that had previously proven elusive at Tibbs. This matters because the Pogo mine discovery was itself hosted in a low-angle vein. Tibbs now exhibits all of the elements of the “Pogo Exploration Model”. The next step for Tectonic will be to determine whether these low-angle veins exhibit the same swelling or widening tendency as seen at Pogo’s East Deep target.

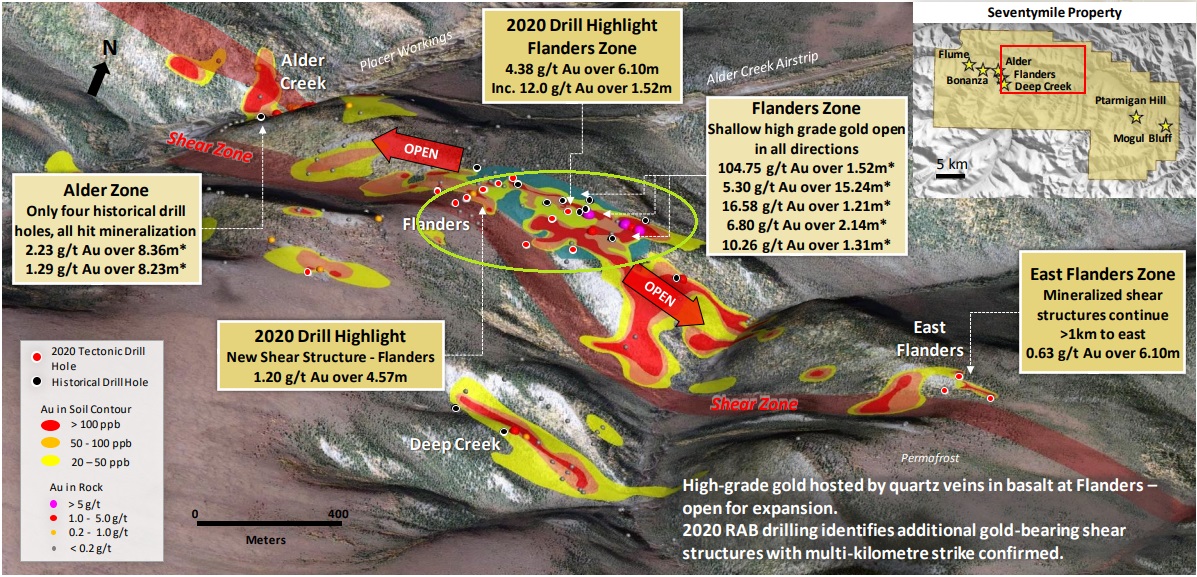

Tectonic’s second project is the Seventymile project, part of an underexplored, fully owned 40km long Greenstone belt, located 270km east of Fairbanks, Alaska. The property is only accessible by air (small aircraft, helicopter), and in the winter by a winter trail.

Seventymile is an orogenic gold system, with lode-style high grade quartz mineralization occurring in shear zones and faults. Drilling highlights are 5.5 g/t Au over 15.0m, 1.1m @ 205.9g/t Au, 6.1m @ 2g/t Au, 19.8m @ 1.37g/t Au and 6.1m @ 4.38g/t Au.

The 100% owned Flat gold project is Tectonic’s latest project acquisition and is located 40km north of the 45Moz Au Donlin Gold project, jointly owned and operated by Barrick and Novagold. Flat gold consists of 92,160 acres of Native-owned land (Doyon) accessible by air with its 4100 ft. airstrip, which can accommodate a Hercules aircraft. Once on-site, there is a network of roads and trails, and materials can be barged to and from via a commercially navigable nearby river. Chicken Mountain and Black Creek/Golden Horn are the two main target areas. Mineralization is hosted in veins and disseminated sedimentary and volcanic rocks, similar to Fort Knox (Kinross) and Eagle (Victoria Gold). Historic drilling from 1997 returned interesting highlights, like 24.7m @ 12.5g/t Au, 36.6m @ 1.36g/t Au and 31.7m @ 1.28g/t Au. The priority target, Chicken Mountain, hosts a robust 4km long gold-in-soil anomaly where drilling indicated gold mineralization over a kilometer and is the likely source of the majority of the historic 1.4Moz of placer gold mined in the area.

Despite the enthusiasm of CEO Reda when discussing Flat, the currently raised budget will mostly be spent at Tibbs and Seventymile for now. Reda’s focus is to apply the methodical, process-driven approach to Flat that Tectonic applies to all its properties. This means that, before spending money on drilling, Tectonic is conducting metallurgical analysis to build on existing, but limited, work that may indicate the gold at Flat is non-refractory and therefore able to be liberated at a lower cost than refractory deposits (for example the 45Moz Au Donlin gold deposit, just 40 km from Flat is refractory). Historical metallurgical data suggests that the gold at Flat could be free milling and have untested oxide potential. Tectonic is taking steps to confirm both characteristics and ultimately the potential for heap leaching at the site.

Conclusion

In the midst of raising C$3M with the help of Crescat Capital, Tectonic is ramping up for another busy exploration season again. As the former Kaminak team has big ambitions, and their 3 projects all have large potential, with 2 of them already verified by lots of good drill results, today’s market cap seems to be at rock bottom levels. If they manage to hit once more this summer in my view, this could generate sufficient market interest to leave the single digits behind very quickly.

If you could have an interest in participating in the current private placement, please contact Bill Stormont (bill@tectonicmetals.com) for more information before May 16, 2022.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Tectonic Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.tectonicmetals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.