Tim Oliver: The Black Box of NI 43-101 Reports

This article is republished with permission of Exploration Insights. The original was published on August 14, 2015.

The Black Box of NI 43-101 Reports

POSTED ON August 14, 2015 BY Tim Oliver

CATEGORY Stories,

Via TimOliver.us: Note to Readers: This is the July 26, 2015 Issue of Brent Cook’s Exploration Insights. “EI” is the premier newsletter devoted to early discovery, high-reward opportunities, primarily among junior mining and exploration companies. I occasionally contribute articles to Brent’s weekly newsletter. My articles focus on the engineering aspects of early stage mine development projects. I will post the entire EI newsletter issue when my pieces appear.

The article includes a description of a benchmarking exercise I use as a reality check on mine capital cost estimates. In the future I’ll offer similar tools for readers to use in their evaluation of investments in companies with early stage mine development projects in general and NI 43-101 reports in particular.

Exploration Insights by Brent Cook www.explorationinsights.com

Issue No. 335 July 26, 2015

An ugly, ugly week in which the gold price dropped 3.2% (now -15% for the year), silver ended marginally lower (-1.3%, now -28% for the year), copper -4% (now -25% for the year), and the Bloomberg Commodity Index fell to its lowest level in 13 years. The Gold Miners index (GDX) dropped 9%, the Junior Miners index (GDXJ) was down 7%, and our EI portfolio declined 5%, finally taking it into negative territory for the year (-3%). The major indices were also hit, with the S&P 500 off 2.2%, NASDAQ off 2.3%, and the Russell 2000 down 3.2%. Yep, ugly.

On Friday we did see an afternoon bounce; and although it’s just possible that we maybe, just might possibly, have seen the final capitulation (the bottom) early Friday, I am not convinced, nor am I adding any positions. I intend to hang on to my cash and see where all this leads. If it goes at all like the 1997-2001 mining rout, we should be able to buy real companies run by honest and competent people with solid properties for something close to cash in the bank. We are close, but not there yet.

I want to draw your attention to the independent rant below from our go-to engineer Tim Oliver. In it he discusses technical studies and two projects in Latin America. If there is a project/company whose technical report you particularly need an independent and serious opinion on, contact Tim—that is what he does for a living

The Rant

The Black Box of NI 43-101 Reports By Tim Oliver tim@timoliver.us

“I’m just comparing numbers and have quite a bit of experience, reading Feasibility/Pre-feasibility Studies, etc., since a few years, but sure I have to trust the official numbers and I know how many will fail/are already failing; it’s for sure a black box in a few parts until they really reach production, hopefully on time and on budget.”

The preceding quote from a recent conversation with an experienced industry investor and advisor stuck in my mind. He asked my opinion of a single-project company developing an underground gold mine in South America.

I took a quick look at the project’s feasibility study and found significant problems. I suggested he dig a bit deeper here and there. Do some benchmarking and consider the unrealistic construction schedule. He made the statement quoted above, and went forward, happy with his investment and that of his clients.

Here at EI we tend to be a bit more circumspect and not inclined to “trust the official numbers”. We are usually more inclined to unlock the mysteries of the “black box” these studies often appear to be–hence the following discussion.

Opening the Black Box: A Primer on Reviewing Advanced NI 43-101 Reports

National Instrument 43-101 came to be in 2001 in the wake of the 1997 Bre-X scandal where unscrupulous promoters parlayed an imaginary Indonesian gold deposit into a blockbuster stock with a share price of CAD$286 and a market cap over CAD$6B. The scam collapsed and so did the Canadian mining stock market. In order to prevent a recurrence, the Canadian securities regulators issued NI 43-101, which requires public disclosure of mining data and studies; it also requires that the studies be sanctioned by a “qualified person” (QP), as defined in the instrument.

Overall, NI 43-101 has been a good thing for Canadian mining and investors. NI 43-101 compliant reports contain valuable information and, to the savvy reviewer, reveal important facts and other important, but less tangible, information about the deposit owner. The reports are easily accessible through www.sedar.com.

At the same time, the program has serious shortcomings, described in more detail below. The main takeaway for readers is: Do not take these studies at face value; there are a myriad of motivations behind these studies. Use this guide to peer into the black box, assess the motivation of the owners and engineers, and divine the truth between the lines.

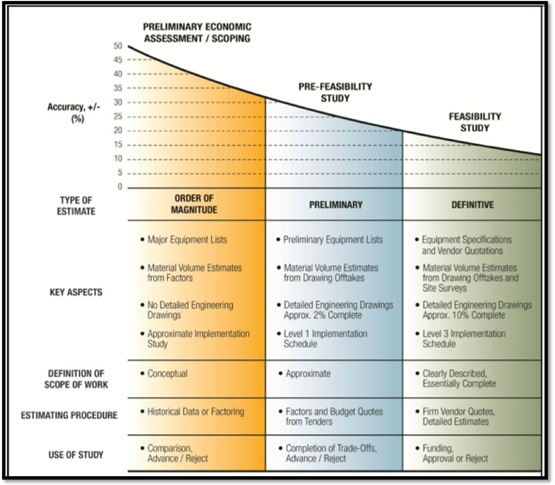

NI 43-101 covers a variety of disclosures. Here we examine the sequence of three engineering studies used to assess, with increasing detail and accuracy, the potential value of a mineral property.

The three studies are:

- The Preliminary Economic Assessment (PEA)

- The Prefeasibility Study (PFS)

- The Feasibility Study (FS).

As illustrated in the chart below, the studies are conducted in the sequence listed. No set scope exists for any of the study levels.

(Fig. 1: From “Minimum Engineering Study Requirements” by RungePincockMinarco [RPM])

These studies are not new. They have a long history as the engineering basis for the orderly development of mining and other capital intensive projects. The study series spans the gap between exploration and construction. Fundamental to the practice of mine development is the principle that rigorous engineering breeds project success. The corollary is true as well: weak or sloppy engineering leads to project failure.

NI 43-101 codified the traditional study contents and added requirements for public disclosure, plus oversight by a “Qualified Person.”

Generally the PEA (often termed “scoping study” outside the coverage of NI 43-101) takes less time and costs less than the PFS or the FS, mostly because less drilling, lab work, and engineering are required. A PEA might require from several weeks to a year to complete and cost from $100,000 to $2.5 million. A more detailed PEA might reduce or even, in very special circumstances, eliminate the need for a PFS. The findings are suitable for either rejecting the project or approving funding for the PFS. They are not adequate for full project approval. Estimate accuracy is no better than ±40%.

The purpose of the PFS is to evaluate all the available options for mining, processing, and infrastructure in order to fix the plan to be evaluated in the Feasibility Study. The Pre-feasibility study is the first stage with enough financial resolution to determine and declare mineral reserves. Like the PEA, the PFS provides sufficient information only for project rejection or approval of the next study phase—the FS. The PFS might take six months to two years to complete and will cost from about $500,000 up to $10 million or more for a major, multi-billion dollar capital project. Estimate accuracy is no better than ±25%.

The FS describes and evaluates the complete project to be built. The design work is sufficient to support cost estimates at ±15% accuracy and is the proper vehicle for approval to construct. The time required to complete the study will range from at least one year to as many as five years; and, it will cost between $1 million and $50 million for large capital projects in remote, inaccessible areas.

Some noteworthy aspects of NI 43-101 studies are:

- All three studies must follow the same cumbersome NI 43-101 Table of Contents.

- Studies must be sanctioned by one or more “qualified persons” (QP).

- The study report, or an extensive executive summary of the report, must be posted on the SEDAR[1] web site for public access.

The March 1 and 23, 2014, issues of EI contain a two-part series titled “Top Ten Signs of a Bogus NI 43-101 Report.” This is worth a read.

Why is the report being undertaken?

The March 1 piece described three types of owners and their motivations for performing the study. Discerning the motivation for the study is the first evaluation step. The three types of owners and their motivations are:

- Management is serious: The owner wishes to objectively assess the development potential of the deposit through a rigorous engineering analysis. Let’s use the term “real” here.

- Management seems lost: That is, the owner seems to desire only to comply with the NI 43-101 disclosure requirements. The study is superficial and meets minimum requirements. This will be referred to as “misdirected.”

- The owner wants to promote a marginal property: Put lipstick on a pig. This will be called “sham.”

This week we have a look at NI 43-101 in general, and then compare two studies. In upcoming issues, we may take a close look at each of the three study levels.

The QP

The fundamental tenet of NI 43-101 is that an official, written sanction from a qualified, independent person will ensure the integrity of the study. Unfortunately the program, as implemented, often misses that mark widely.

First, any schmo can call him/her self a QP. NI 43-101 requires:

- A university degree (or “equivalent accreditation” whatever that means) in engineering or geoscience,

- Five years of “relevant” experience in mining or a related field, and

- Membership in good standing in a professional association.

- Foreigners have a couple of ambiguous additional requirements, easily met.

Second, recent (2011) amendments to NI 43-101 changed the requirements for QP independence so the QP need only be independent (no financial interest in the report findings) in the case of a PEA. PFS and FS may use employees and corporate officials as QPs.

So, NI 43-101 neutered the single provision that should give comfort to the poor investor: the sanction of a qualified and independent expert.

No successful operating company would put a scoping, prefeasibility, or feasibility study solely in the hands of a marginally qualified and compromised individual. A somewhat less genuine company may.

The point is, sham QPs are just as widespread as sham NI 43-101 reports. Don’t trust either without independent verification. The inverse is true as well. If the QP is credible, qualified, and independent, chances are the study findings are sound. This is the hallmark of a “real” study.

The most important quality in a QP is integrity. An honest, ethical QP will produce a credible NI 43-101 study.

Here are two examples.

The first is the December, 2014 PFS for Condor Gold’s La India Project. SRK authored the study with contributions from several specialty subcontractors. Each subject matter chapter was authored and vouched for by one of four QPs, with education, certification, and experience in each area for which the authors certify.

The second is the October, 2014 PEA for Troy Resources’ Karouni Project in Guyana authored by two full-time Troy employees, clearly at odds with NI 43-101 Part 5.3(1), which requires a maiden PEA be done by a completely independent QP. We review the project PFS later.

Cast of Characters

The Owner

Owners have strong incentives for positive study economics. The most obvious is the hoped-for bump in the stock price. Look what happened when Excelsior Mining released a very positive Pre-feasibility Study in January 2014 (Figure 2).

(Fig. 2: Excelsior chart)

Investors are often told to demand “skin in the game” on the theory that it lends incentive to grow the project, not just draw a paycheck. Insider ownership can, however, also drive an intense desire for positive study results, often regardless of the project’s true value. One should consider the insider’s priorities—short-term gratification or long-term value.

The Engineer/consultant

Owners typically contract advanced NI 43-101 studies to a consulting or engineering firm with expertise in the key study areas such as mine design, metallurgy and mineral processing, environmental and social issues, hydrology and water resource management, geotechnical engineering, etc.

The consultant will serve as overall QP, manage the study, and provide specialty QPs as appropriate. Subcontractors fill subject matter specialty gaps (water resources, social impacts, etc.). Subcontractors supply specialty QPs and report either to the owner or the Consultant.

Engineering and Consulting firms also have potent incentive for positive study results.

Large Engineering and Construction (E&C) firms build mines. A study can earn the firm a few $MM in fees. Building the mine can earn several tens of $MM in fees.

Non-E&C consulting firms want the project to graduate to the next study level to keep the project alive. “Study mills” are firms with a reputation for producing positive studies, even for marginal projects. It’s a successful business model, if not a particularly ethical one.

Each type of firm is perfectly capable of delivering fully “NI 43-101 compliant” studies, signed by legitimate QPs, showing economically “robust” economics for perfectly worthless projects. It happens all the time.

No immediate incentive whatever exists to produce a study finding the project has little or no value. However, over the long run, a firm’s reputation is its calling card.

Provincial Securities Commissions

Provincial Securities Commissions implement and enforce regulations such as NI 43-101. The commissions are sparsely staffed and do not routinely review NI 43-101 reports. They will process complaints and will take action when violations are brought to their attention, but there is little active oversight. The regulators have little or no effect on the preparation or outcome of the studies—that is not their role.

Investors

Both institutional and retail investors rely on the NI 43-101 study financial results for investment decisions. Typically, a summary of the financial results appears in a news release published up to 45 days prior to posting the study itself on SEDAR. Investors naturally want to buy in as early as possible. Consequently, the news release summary triggers many investment decisions well before the investor can critically review the study to determine if it supports the announced results.

The important lesson for investors is: do not believe that the phrase “NI 43-101 Compliant,” or the signature of a QP in any way guarantees the soundness of a study. You must dig deeper.

A Tale of Two Projects

This is a comparison/contrast of two different NI 43-101 studies for mining projects in Latin America.

Condor Gold is a London listed Junior (CNR.LON) with a single asset in development stage. The La India Project is a small-scale gold project at PFS level in Nicaragua. Condor management has strong incentive to produce a positive study. Competition for capital is so fierce that only the very few most outstanding projects will find funding.

SRK was selected to manage the study and is a well-established consulting firm with a long history of NI 43-101 study production. A positive PFS could lead to a full FS and more fees.

The stage is set.

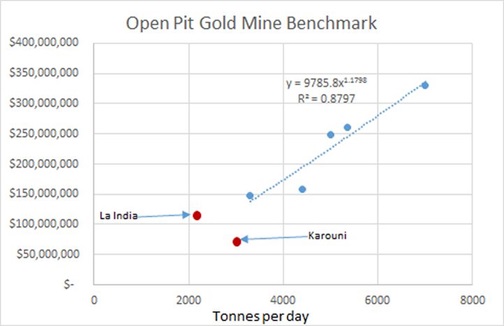

Considering the highly charged circumstance, the Condor PFS shows restraint. The estimated initial capital cost of $110 million for a 2,200 tonne per day underground mine and mill is spot on the cost curve, compared to other small to mid-size open pit gold projects with mill recovery (not heap leach). See Figure 3. Had Condor Gold and/or SRK so desired, they could have trimmed the initial capital estimate and improved economic model results considerably, by using low equipment bids, adjusting productivity, squeezing installation cost factors, etc. It is quite possible to massage figures to attain the desired initial capex.

I worked on a project once where the owner declared, at the FS kickoff meeting, his expectation that the project would not work with an initial capex over $100 MM. It was clear he expected the team to achieve that number. Ultimately the project was built, but it exceeded the construction budget and struggles to make money.

EI looked at initial capital cost estimates from NI 43-101 studies for six small to medium size (<7000 tpd) open pit gold operations. Figure 3 shows a plot of the initial capex against the feed capacity for the six properties. The two properties being examined are shown in red.

(Fig. 3: Benchmark capex for open pit mines)

The benchmark model predicted initial capex for La India at $86 million– about 22% lower than the PFS estimate. Clearly, the study did not thumb the scale on the capex estimate. Likewise, the estimated operating cost of $58.50 per tonne milled is on the high side for open pit gold mines. We did not run a benchmark on opex.

The estimated financial performance is healthy, but not over the top. The study base case NPV5 at $1250 gold is $92 M over a mine life of eight years. Project IRR is 22%– moderately strong.

Condor Gold and SRK clearly fall into the motivation category “real.” They objectively assessed the economic potential of the deposit through a rigorous engineering analysis.

Troy Resources Ltd. (TRY.ASX) is an Australian Company, which up until last year maintained registration on the Toronto Stock Exchange. We reviewed the PFS for the Karouni Project in Guyana. Karouni is a 2750 tonne per day open pit gold mine project with milling recovery.

The PFS was nearly indistinguishable from the PEA. The same two employees wrote it; and it contained the same lack of engineering support and scarcity of information. A PFS should contain a great deal more engineering and information detail than a PEA. By all appearances, this PFS was no more than an update, covering the change to open-pit only operation and a slightly higher production rate.

Troy, like Condor, has ample incentive for a strongly positive FS.

Troy’s PFS shows lack of restraint. The study report states the capex is $73.3 million (Figure 3), not including $11.3 million for pre-production mining. The $11.3 million does not appear in the cash flow model either. We assume this cost is considered sunk and therefore not part of the project economics.

Our benchmark model (see Figure 3) calculates initial capital for a 2750 tonne per day open pit mine and mill would be $112 MM, over 50% higher than the PFS estimate.

In a mid-2014 report (dated June 30, 2014) Troy announced construction had commenced on the Karouni Project, predating the publication of the PFS.

One other item bears mentioning. Condor reasonably estimated a two-year construction period. Troy, on the other hand, unrealistically estimated only one year for construction. Troy issued a project update on July 10, 2015, noting that startup had been delayed from June 2015 until September 2015 due to a variety of fairly serious problems with mill installation and alignment. This type of problem and resulting delay are typical of poorly engineered and executed projects.

Troy’s economic model predicts an after-tax NPV6 of $72 MM with gold at $1250 over a mine life of just over three years. The predicted IRR is an eye-popping 50%. Troy presents a sensitivity analysis showing a 20% increase in capex drops the NPV6 from $72 million to $54 million. If we plug the modeled $112 million into a cash flow model, the NPV6 drops to about $30 million and the IRR goes to a quite modest 20%.

By our reckoning, the Troy effort falls into the motivation category “misdirected” with some elements of “sham.” The study is superficial and fails to meet minimum requirements. At the same time, it equips the company to promote the project based on unrealistic, though attractive, financial results.

Troy successfully raised the projected capital with this study. In April 2014 they received a revolving credit facility of $100 million from Investec Bank. Stand by to learn if the project can survive the mill problems and limited funds when faced with the current gold price crash.

Conclusion

We have two projects under study. Condor Gold’s PFS demonstrates a realistic, sound engineering evaluation resulting in a healthy economic forecast. The project has the hallmarks of success.

Troy Resources’ Karouni PFS demonstrates a lack of engineering rigor, resulting in an apparent underestimation of costs and an unrealistically rosy economic forecast. We can already see some results of the lack of engineering rigor with the mill installation problems. It’s reasonable to anticipate that these delays, coupled with unrealistic initial capex forecasts, will force Troy to find additional funding, weakening project economics and lessening or even wiping out investment returns.

Brent here again…

Tim put this rant together with very little input from me. I think it is a useful, albeit cursory, look at the technical and economic studies upon which most of the folks in the mining sector base their investment decisions. His points are very legitimate– one must really consider the objectives and competence of the people behind any technical study.

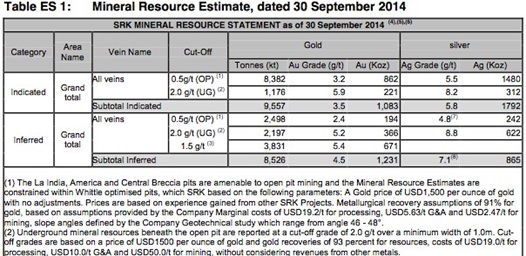

The foundation of these studies is of course the resource estimate, and you will note that Tim’s commentary focused on the mine and costs that are meant to exploit said resource. It has been assumed by SRK that their estimate of Condor’s resource is a fact. The PFS only exploits the probable 675,000 ounces grading 3 grams per tonne gold out of a total resource of 2.3 million ounces grading 4.0 grams per tonne gold indicated and inferred (Fig. 4).

(Fig. 4: Mineral resource estimate by SRK, Sept 2014)

Although Condor’s market capitalization is £24 million (US$37 mil), the PFS NPV5% is US$92 million (@ $1250 gold), and there are another 1.7 million ounces in the resource, you will note we do not own it in our EI portfolio.

Why not?

It’s simple. Without belaboring the point, I have issues with the resource estimate, particularly the indicated and inferred. The deposit is comprised of epithermal veins of variable width and grade. Much of the resource is attributed to single and isolated high-grade drill intersections that are often pretty far below the surface. The life of mine strip ratio (tonnes of waste moved per tonne of ore) for both the FS and PFS is ~13:1—pretty high. If that 1 tonne of expected ore is not as expected, the operation suddenly becomes uneconomic. Given what I saw when parsing through the deposit, cross section by cross section, I will hesitantly concede that the probable reserve (675,000 oz) may work, but am unwilling to bet that the remaining ~1.7 million ounces will be economically recoverable.

This discussion brings home a much broader point, one we have made numerous times here at EI (see Nov. 16, 2014): the interpretations and economic projections in 43-101 studies are only as good as the initial data upon which the resource is based. If the sampling is bad, the geology wrong, the interpretation flawed or disingenuous, then everything that comes after is illusory. The follow-on economic studies are essentially worthless and it is usually the resource estimate that got it wrong.

That’s the way I see it.

Brent Cook

Disclaimer

This letter/article is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. Nothing contained herein constitutes, is intended, or deemed to be — either implied or otherwise — investment advice. This letter/article reflects the personal views and opinions of Brent Cook and that is all it purports to be. While the information herein is believed to be accurate and reliable it is not guaranteed or implied to be so. The information herein may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. Research that was commissioned and paid for by private, institutional clients are deemed to be outside the scope of the newsletter and certain companies that may be discussed in the newsletter could have been the subject of such private research projects done on behalf of private institutional clients. Neither Brent Cook, nor anyone else, accepts any responsibility, or assumes any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information in this letter/article. The information contained herein is subject to change without notice, may become outdated and my not be updated. The opinions are both time and market sensitive. Brent Cook, entities that he controls, family, friends, employees, associates, and others may have positions in securities mentioned, or discussed, in this letter/article. While every attempt is made to avoid conflicts of interest, such conflicts do arise from time to time. Whenever a conflict of interest arises, every attempt is made to resolve such conflict in the best possible interest of all parties, but you should not assume that your interest would be placed ahead of anyone else’s interest in the event of a conflict of interest. No part of this letter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Brent Cook. Everything contained herein is subject to international copyright protection.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.