Vior Signs LOI To Advance Skyfall Nickel Project; Provides Belleterre Gold Project Update

Although markets are turbulent again after the Federal Reserve raised another 50 base points as expected but didn’t appear to be as dovish as hoped for, Vior Inc. (TSXV:VIO)(FRA:VL51)(OTCQB:VIORF) has been looking for ways to generate other exploration success besides their flagship Belleterre project in Quebec, where the first two phases of exploration have been completed and will likely continue with a Phase III drill program in Q2, 2023. To my surprise, their Skyfall gold exploration property in Quebec appeared to have all the hallmarks of potential nickel deposit geology as well, and Vior management succeeded in convincing SOQUEM, a subsidiary of Investissement Quebec (large government fund), to sign a Letter Of Intent (LOI) on this project.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Personally I like this LOI deal a lot, as Skyfall wouldn’t have seen much work anyway as the majority of Vior’s budget, staff and time is focused on its flagship Belleterre gold project. When signed into a definitive agreement, SOQUEM could earn into the Skyfall Nickel project up to 50%, with Vior being the operator, under the following highlighted terms:

- SOQUEM will have the option to acquire a 50% undivided interest in the Skyfall Nickel project, with VIOR owning the other 50% and being the operator

- SOQUEM will finance exploration work commitments totalling C$2.5 million over a two-year period

- SOQUEM will make cash payments to VIOR totalling C$350,000 over a two-year period

It is refreshing to see Vior maintaining a relatively large ownership, as many earn-ins leave the junior partner with a 15-20% minority interest, which often is pretty hard to value for investors. According to the LOI, SOQUEM will have the option to acquire the aforementioned 50% interest in the project for a period of two years beginning April 1, 2023, by fulfilling the following conditions:

- Financing exploration work commitments totalling C$2,500,000 as per the following schedule:

- C$500,000 before March 31, 2023; and

- an additional C$1,000,000 before April 1, 2024; and

- an additional C$1,000,000 before April 1, 2025

- Cash payments to VIOR totalling C$350,000 as per the following schedule:

- C$50,000 on the signing of the definitive Agreement

- C$75,000 on or before April 1, 2023

- C$100,000 on or before April 1, 2024; and

- C$125,000 on or before April 1, 2025

After fulfilling all financial obligations, the parties will then execute a JV for the project with all terms and conditions to be set out in a final agreement.

Should Vior and SOQUEM execute the definitive agreement at the end of January, 2023, Vior would have 2 months to spend C$500k before the end of March. When I asked CEO Fedosiewich if he already had made plans for this, he answered that they are already in the process of looking to book a 3,000 km of line VTEM to fly the property in February or March, which will probably cost C$700k, with the balance being paid shortly after the end of March.

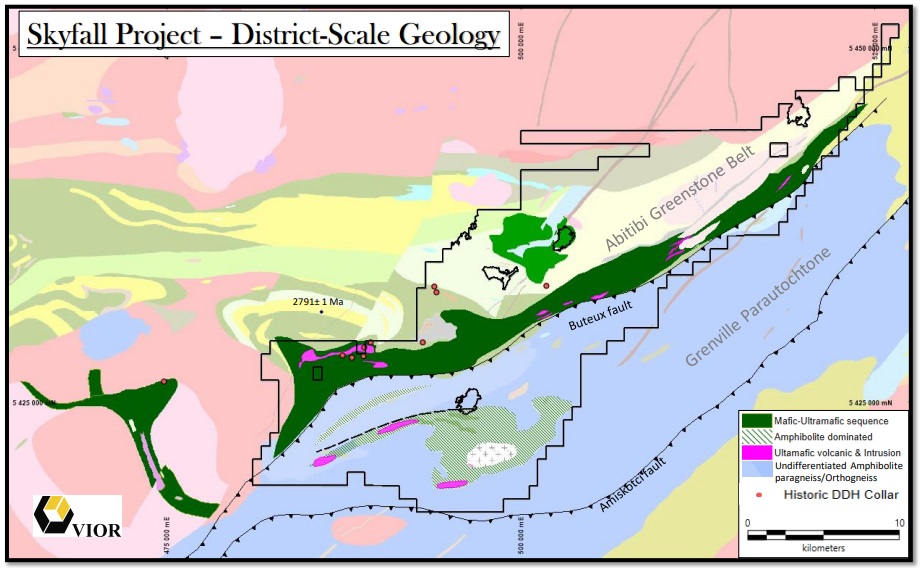

The Skyfall Nickel project encompasses a large, district-size land package of 515km2, after Vior recently added more land, issuing 107k shares to Osisko when acquiring 46.8km2:

Desktop research by Vior geologists showed that a combination of geochemistry, mag surveys, lithogeochemistry and sampling represented nickel/chromite/magnesium potential, as samples generated up to 0.17%Ni, 0.25%Cr and 23% MgO, which are very good numbers for just surface samples as they already come close to economic drill hole results. Of course, just sampling doesn’t forecast much but this information was sufficient for SOQUEM to act on it, so I’m looking forward to their exploration plans in 2023. As an example, fellow junior Inomin Mines (MINE.V) went completely ballistic from 10c to 72c on heavy volume earlier this year when they reported a few drill holes with one containing 252m @ 0.16%Ni, 0.33%Cr and 20.6%MgO, so this could give you an impression of the potential here. Besides this, for reference, economic nickel deposits globally range from 0.20% to 1.4%Ni.

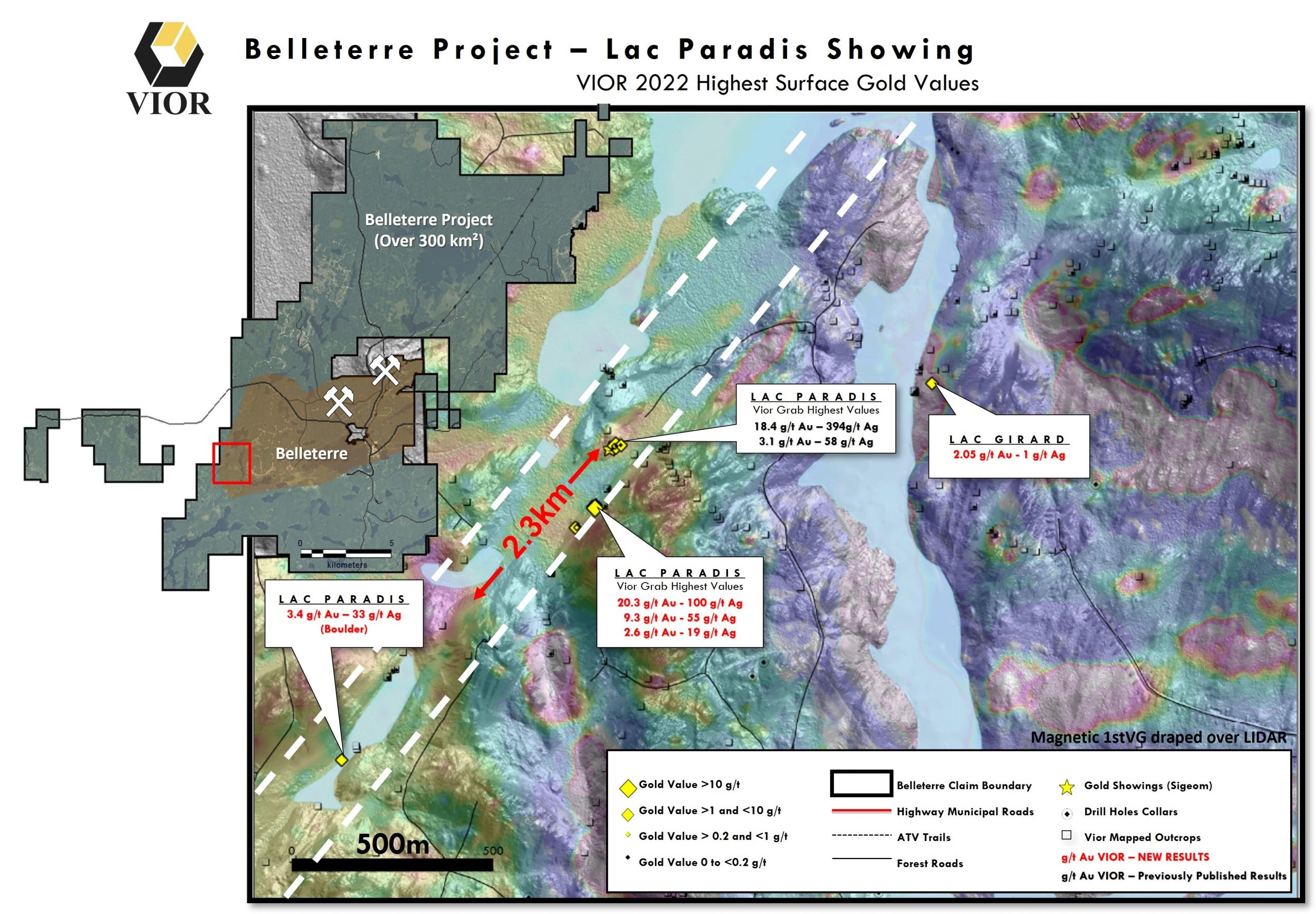

Earlier this year, Vior completed their summer sampling program at their flagship Belleterre Gold project in Quebec. A notable result of this work was the identification of an increased footprint of the Lac Paradis gold showing, located 10km from the Belleterre Mine, indicating stronger high grade gold potential in this area. This will be helpful in identifying new drill targets for their planned Phase III drill program to begin in Q2, 2023.

As can be seen, sampling resulted in several samples grading 2.6-20.3g/t Au which is excellent for sampling. Since the Belleterre project has shown many more excellent sampling results but not equally strong drill results yet, the Phase III drill program will prove whether economic gold mineralization is present at Lac Paradis or not.

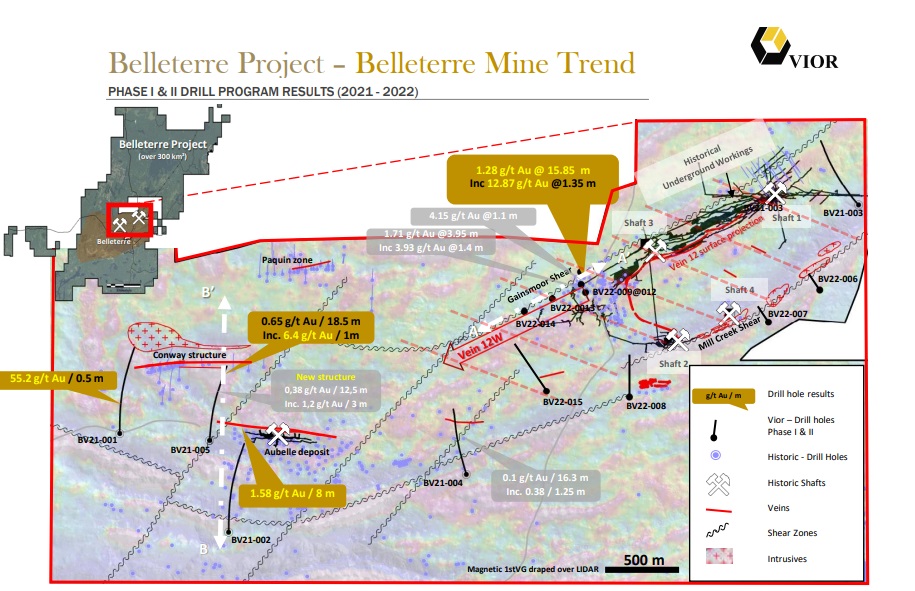

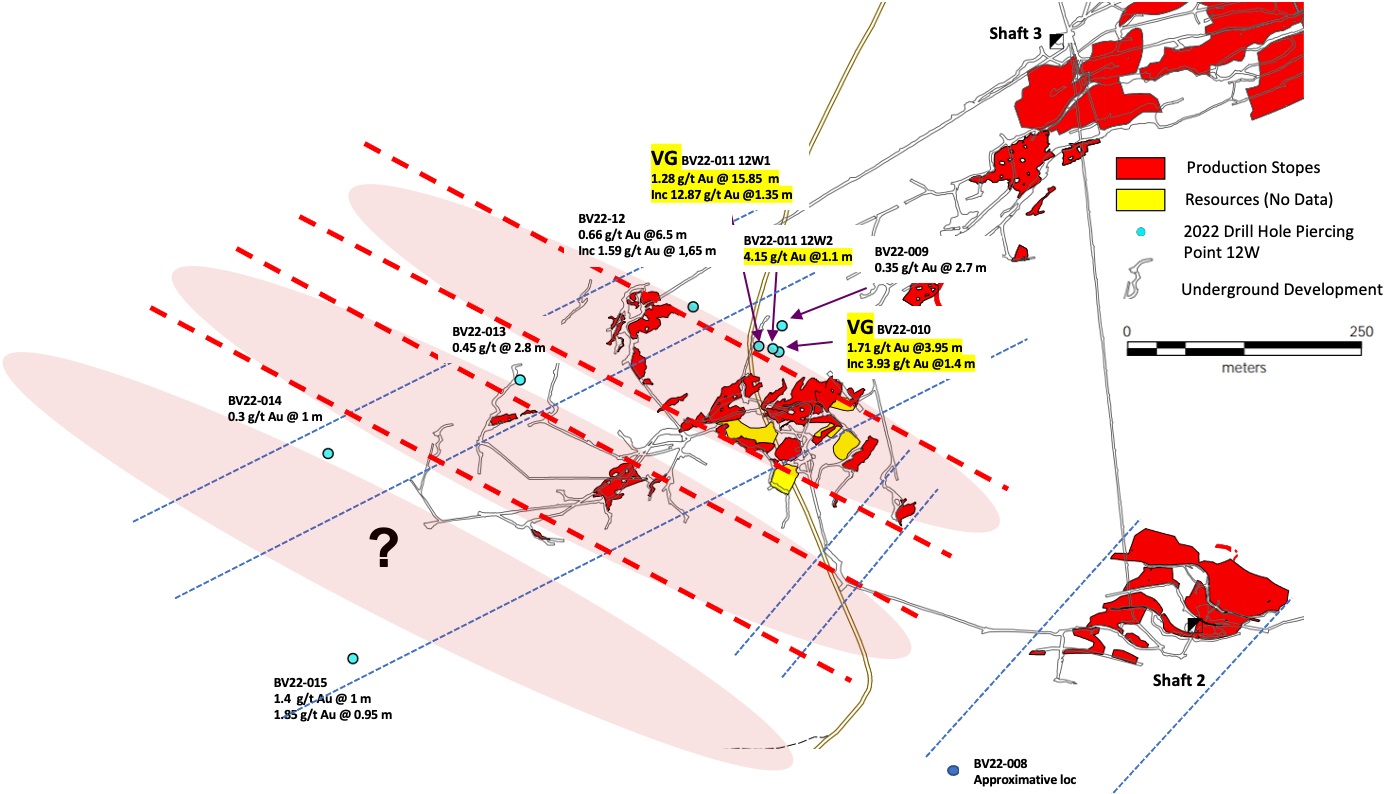

As a reminder, Phase II results reported modest results for the targeted 12W vein structure, with best intercepts quoting 1.35m @ 12.87g/t Au and 1.1m @ 4.15g/t Au, being part of a completed 4,000m Phase II drill campaign. In turn this was following up on a 3,587m Phase I drill program, which was highlighted by a 0.5m @ 55g/t Au intercept. Although both programs didn’t exactly return stellar results, which was also somewhat reflected in the share price (which wasn’t immune to negative stockmarket sentiment either), keep in mind they were both completed at a very early stage in Vior’s systematic exploration process of an extensive project with lots of targets still to be tested.

The 12W structure (main producing vein historically) remains open at depth and laterally, and most importantly gold mineralization appears to correlate with the intersection of a secondary NW-SE structural orientation also observed at the mine. This orientation could be a key structural control to the gold-bearing mineralization.

Of 15 holes drilled by Vior in Phases I & II, 10 holes returned prospective gold intercepts in strongly altered and mineralized quartz veins, indicating the discovery potential at the Belleterre camp according to company management. Exploration isn’t a walk in the park, and with vein structures it often takes a while before you hit them, and Vior is no exception. As a reminder, CEO Fedosiewich and EVP Laurent Eustache had this to remark earlier this year when I confronted them with this:

"This is the nature of exploration, where most often you need to test various areas to better understand the geological gold potential and its distribution. Even in an advanced and proven mining camp like Belleterre, where high-grade gold has already been produced, sometimes gold is not easily discovered in the initial drill campaigns. It is very easy to miss a good intercept or deposit with just a few drill holes, as evidenced by many great discoveries made in the Abitibi that took many drill holes before the right structures were discovered.

We had higher expectations on some of the targeted drill holes, however, exploration and drill targeting is not an exact science. We have learned a lot from the geology of the results and hope to better vectorize with our drill targeting for the next drill program on the 12W structure. In addition, the results from Phase II on the 12W structure have demonstrated some locally robust grade including VG, width, gold continuity and a little more geological complexity than we expected, which are all ingredients that you want to see when working towards a new discovery.”

It is good to see them using a very methodological approach, which is needed when you explore such a large property like Belleterre, and with complex vein structures. After raising C$1.134M in July of this year, taken up by FSTQ, SIDEX, Osisko Mining, Desjardins Capital and SDBJ, Vior still has a treasury of approximately C$2.1M and almost C$1M in marketable securities, so the company is sufficiently well capitalized to begin a third drill program at Belleterre, beginning sometime in Q2, 2023 as mentioned, once the data compilation, new 3D modelling and a significant drill targeting program are completed in Q1, 2023. Management is aiming at drill targeting for approximately 30,000m of drilling in 2023 and H1 2024 in total, which is ambitious and will need more funding of course, but will also undoubtedly provide a solid picture of the potential mineralization at Belleterre.

Conclusion

By now it will be clear that Belleterre, although very prospective, isn’t the most clearcut exploration project around, and Vior management has to source all geological knowledge, insights and experience available to vector in on potential mineralization, when designing the Phase III drill program. There are clues (and gold) everywhere, the treasury is adequately filled to start this program, so it is up to EVP Eustache now to spend the precious exploration dollars wisely and hopefully successfully this time, maybe Vior could be third time lucky. A pretty interesting development is Skyfall turning into a nickel project all of a sudden, giving the company a potentially explosive opportunity to be part of a nickel discovery, together with SOQUEM. As battery metals are booming these days, this could be an instant gamechanger if Vior would be able to drill substantial nickel intercepts. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Vior Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.vior.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.