Westward Gold Hits Carlin-Type Gold Mineralization At Toiyabe

With the assays for deep step-out hole T2301 coming in, management of Westward Gold Inc. (WG.CSE) believes even more they are right on track to find economic mineralization at depth, in close analogy with the nearby 10 Moz Au Cortez Hills mine, or the underground portion of the Carlin complex (Portal Mines, Leeville) at depth, which generated over 15Moz Au for Nevada Gold Mines. The gold intercepts might not look economic at first sight (12.7m @ 1.01g/t Au including 0.8m @ 4.80g/t Au from 556.4m, 0.9m @ 1.27g/t Au from 606.1m), but keep in mind that for example fellow junior Ridgeline Minerals (RDG.V) reeled in a US$30M earn-in agreement for 70% ownership with Nevada Gold Mines over a confirmation hole that intercepted just 0.2m @ 0.22g/t Au and 0.9m @ 0.55g/t Au in the same type of highly sought-after host rocks.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Westward Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Westward or Westward’s management. Westward Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

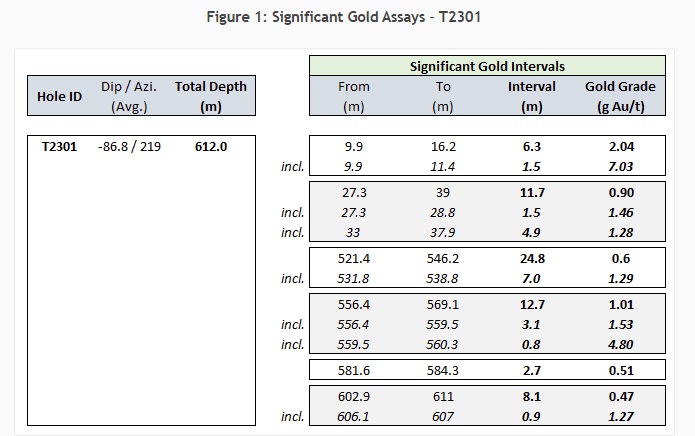

It was good to see Westward disclosing the complete balance of assays for step-out hole T2301, as it first planned to divide it into two batches. The hole was drilled to a total depth of 612m, and the table of results looks like this:

Of course it is nice to find some more gold near surface, which could mean an expansion to the existing small historic deposit of 173koz of gold at 1.2 g/t (2009), but in this case the big prize is to be found at depth, and the deeper results point exactly to this, as the gold mineralization below 500m depth is found in favorable lower plate carbonate host rocks, the type of rock that is host to several 10+Moz Au underground deposits in the region, some of them extending to 1,200m depth.

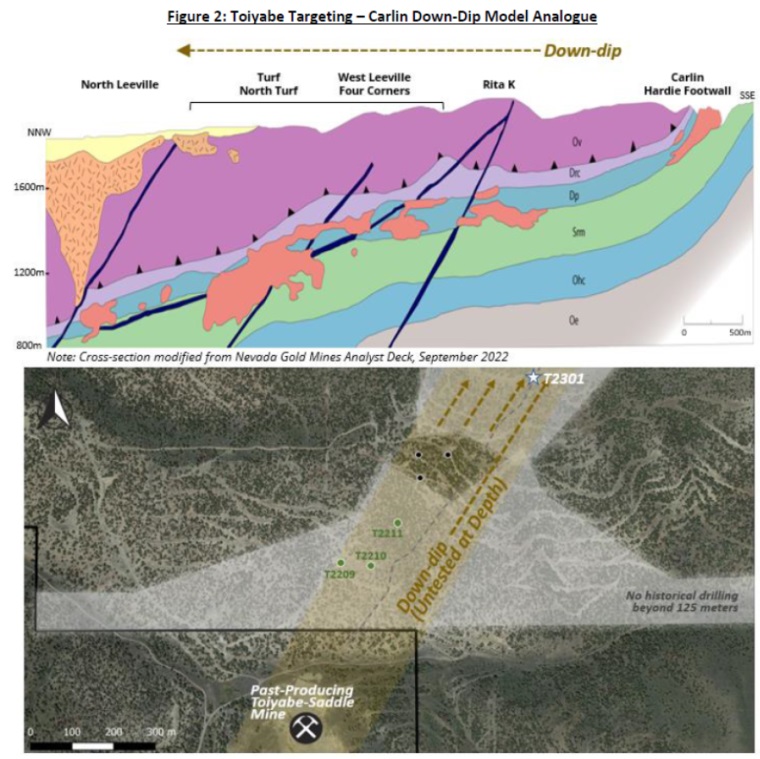

According to Technical Advisor and Carlin-type expert Steven Koehler, he noticed several similarities with the early stage discovery of the multi-million ounce Cortez Hills and Leeville deposits. According to him, there are compressional tectonics, favorable lower plate carbonate host rocks, pervasive vertical alteration of these rocks combined with extensive oxidation at depth, and of course there is already some gold mineralization. He thinks the hydrothermally altered SSD Zone extends and strengthens to the northeast, and this is where further drilling will focus, preferably widely-spaced step-out drilling, for which permits are already in hand. Koehler also commented:

“The recognition of gold in upper plate rocks above or outboard from gold mineralization in lower plate carbonate rocks in T2301 is reminiscent of geologic patterns in the Carlin Trend north area – especially those gold deposits down-dip from the Carlin and Pete open-pit deposits. The down-dip continuation of the SSD Zone – and its association with favourable carbonate stratigraphy and compressional tectonic features – is similar to the setting of deeper deposits discovered on the Carlin and Cortez Trends.”

Mr. Koehler continued: “In T2301 we’ve tapped into a previously-undiscovered area of lower plate gold mineralization, never before drill tested in this section of the property. Utilizing well-documented geologic models from the Carlin and Cortez areas is key to unlocking exploration value at Toiyabe.”

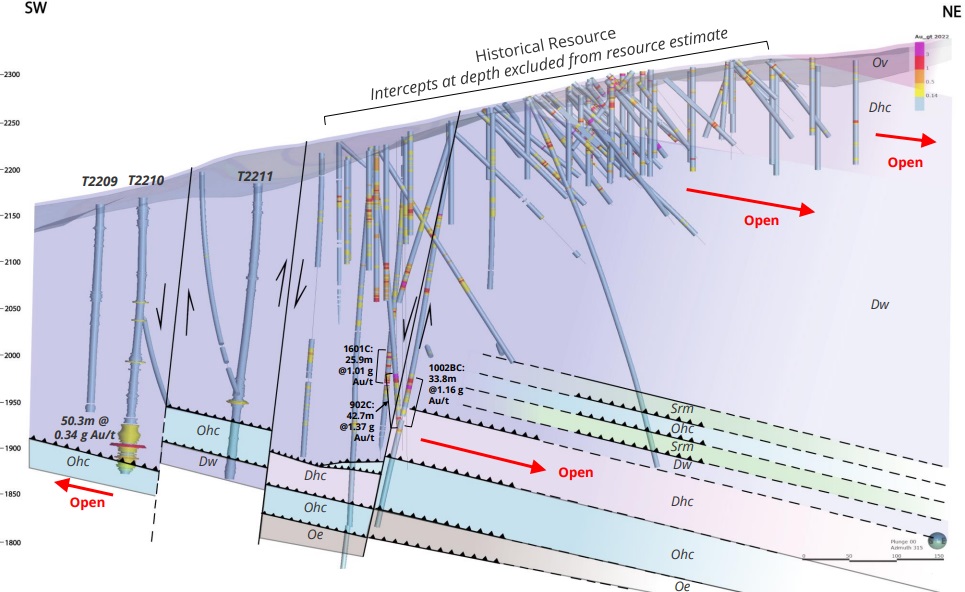

When looking at the schematic sections of Toiyabe, it appears that the targeted host rock (Dw = Devonian Wenban) plunges under a steeper angle than previously thought, and is confined by faults. Below is the old section before the results of T2301 were released:

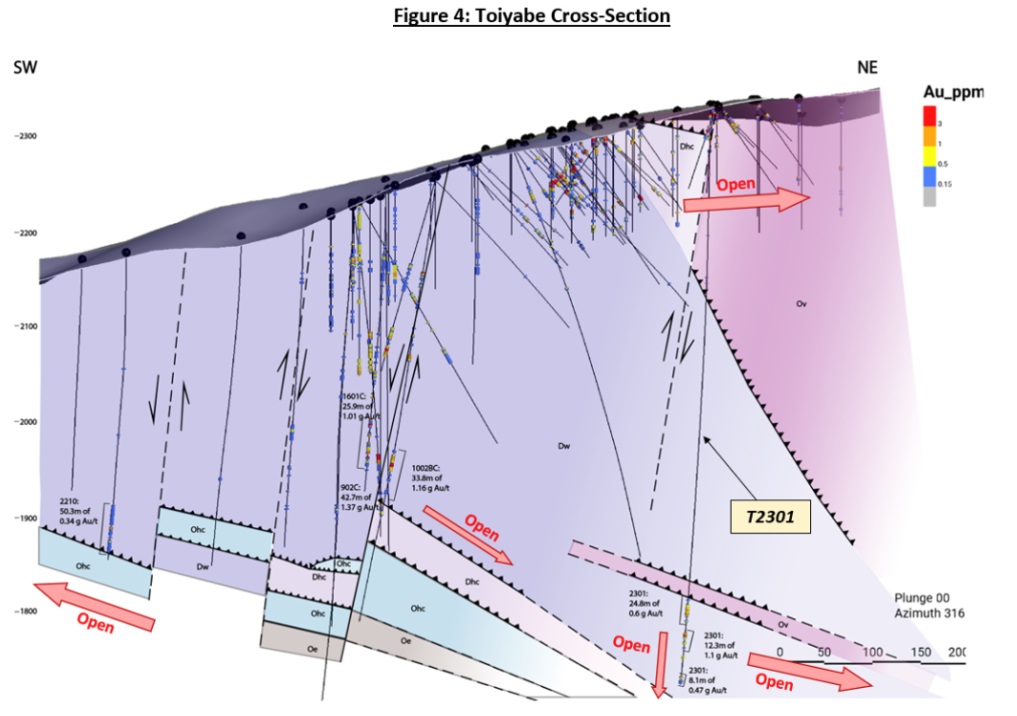

And this is the newly interpreted section for comparison:

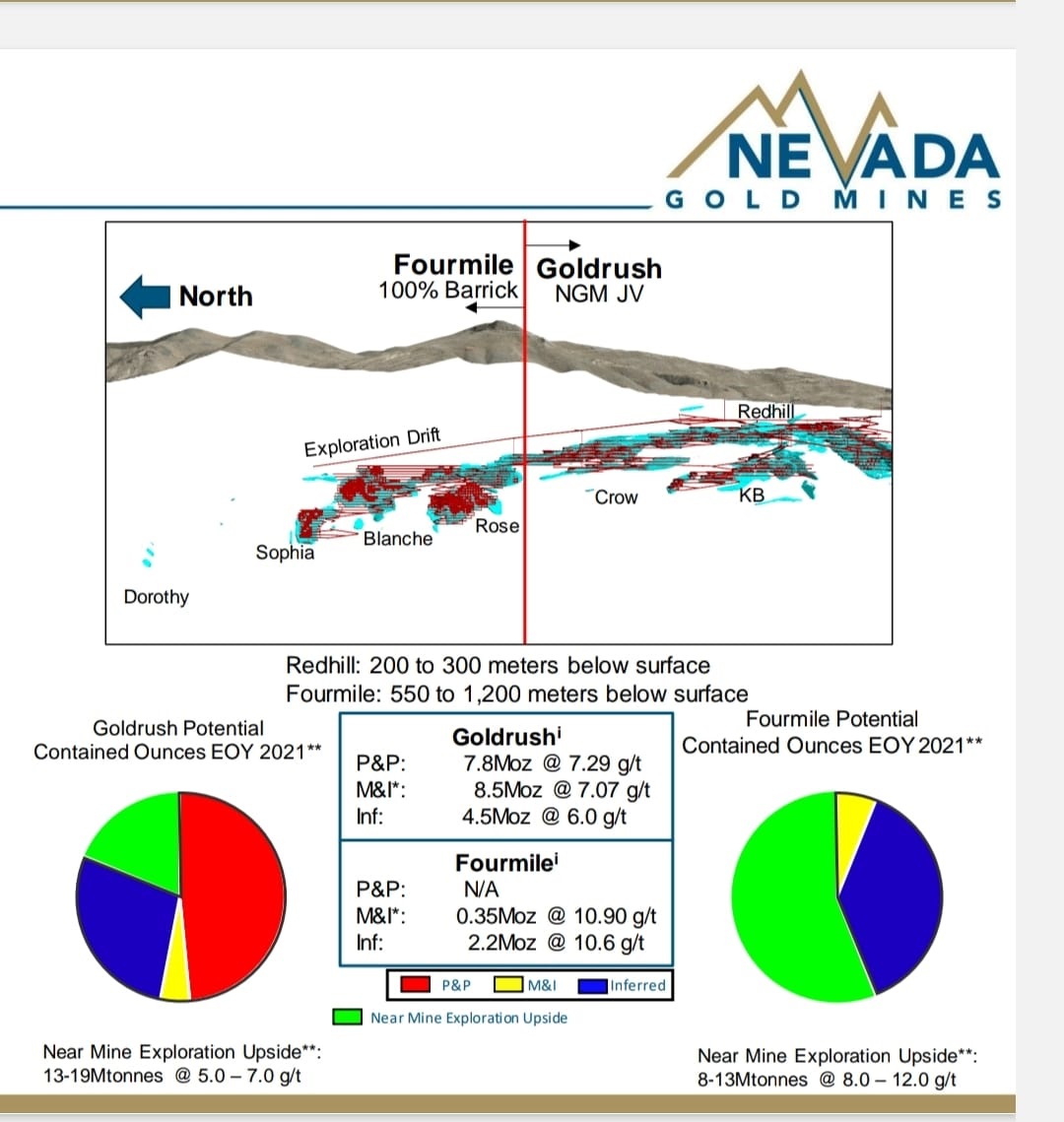

So the Wenban host rocks seem to plunge steeper to the northeast, but lots of step-out drilling needs to be completed to establish the stratigraphy here. It also needs to be noted that existing large deposits (owned by the likes of Barrick and NGM) start around 200-550m below surface, and extend to 1,200m of depth as mentioned.

And I find it fascinating that Nevada Gold Mines has been all over the Swift project of Ridgeline Minerals via this US$30m earn-in, after just a few verification holes were completed of historic drilling which intersected Lower Plate Wenban and Roberts Mountain formations as well, but starting much deeper at 727m. Their news release of September 22, 2021 refers to the same geological concept as Westward:

“Swift is located on the Cortez District of the historic Battle Mountain – Eureka Trend approximately 30 km south of the town of Battle Mountain, in Lander County, Nevada. The 75 km² property is on trend to the Pipeline, Cortez Hills, and Goldrush deposits, which comprise the multi-million ounce Cortez Complex owned by Nevada Gold Mines (a joint venture between Barrick Gold Corp. and Newmont Corp.). Ridgeline’s 2020 Phase I drill program intersected typical Lower Plate carbonate host rocks of the Cortez District including the Wenban Formation (primary host to all >5.0 million ounce gold deposits in the Cortez District), which had been historically misidentified in the project area. Recognizing the preserved Wenban formation was an important technical milestone for the project and further validates the district-scale discovery potential at Swift.”

It is obvious NGM recognized smoke signals at Swift, with the vast experience they have in the region. As Toiyabe seems to have the same features, Westward management is determined to continue exploring the SSD Zone further to the northeast. For now, it seems quite a bit of retail investors don’t really seem to grasp the importance of drillhole T2301, as the share price went from C$0.17 to C$0.15, and 1.48M shares changed hands on the day of the news, in no less than 216 trades on all exchanges. To use this news as some kind of liquidity event seems pretty premature in my view, as this is still early stage.

Conclusion

The first step-out hole T2301 didn’t disappoint, and provided the geologists and advisors of Westward with many indicators they are on the right track for a potential discovery at depth with Toiyabe. The Wenban formation was intercepted, gold was encountered, lots of alteration and oxidation was seen, and Nevada experts working with Westward indicated that they recognize all this from their early discovery work on nearby large scale gold deposits. Let’s see how this story will unfold regarding potential funding and follow up drill programs. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Westward Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.westwardgold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.