Avrupa Minerals Finally Hits It Big With 26.95m @ 2.18% Cu, 2.58% Pb, 5,6%Zn and 88.2g/t Ag At Sesmarias, Portugal

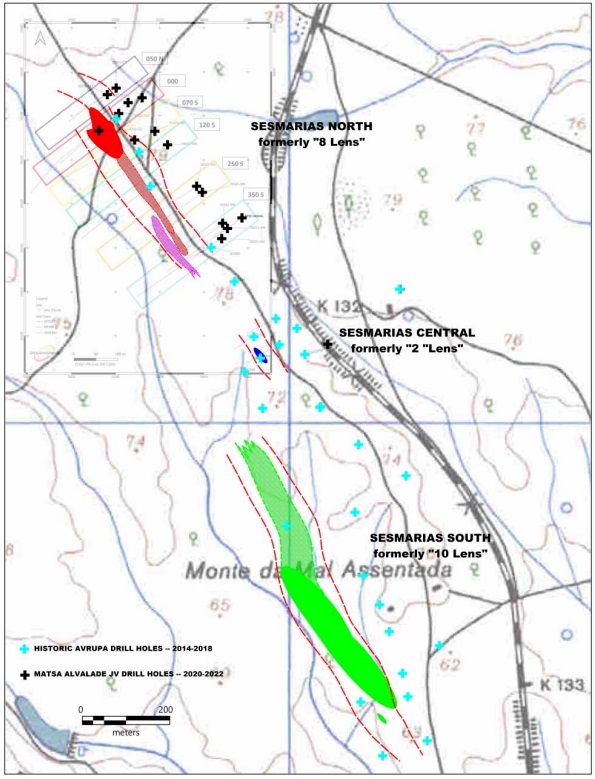

It took a while, but Avrupa Minerals (TSXV:AVU)(OTC:AVPMF) and JV partner Sandfire MATSA finally intercepted a substantial mineralized interval at Sesmarias, after the discovery hole from 2014 intersected 7.95m @ 2.21% Cu, 4.82% Zn, 3.05% Pb and 89.8g/t Ag from 150m. This time the company found mineralization a lot deeper, but the interval was more than tripling the length, and grades more or less coming in the same: 26.95m @ 2.18% Cu, 2.58% Pb, 5,6%Zn and 88.2g/t Ag. As discussed later on in this article, the drill bit seems to have hit a completely different part of the mineralized structure, which was already established as being quite complex, with a lot of folding and faulting. As Sandfire MATSA is looking for 1% Cu deposits in the Iberian Pyrite Belt, this result should be something of interest for them for sure.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

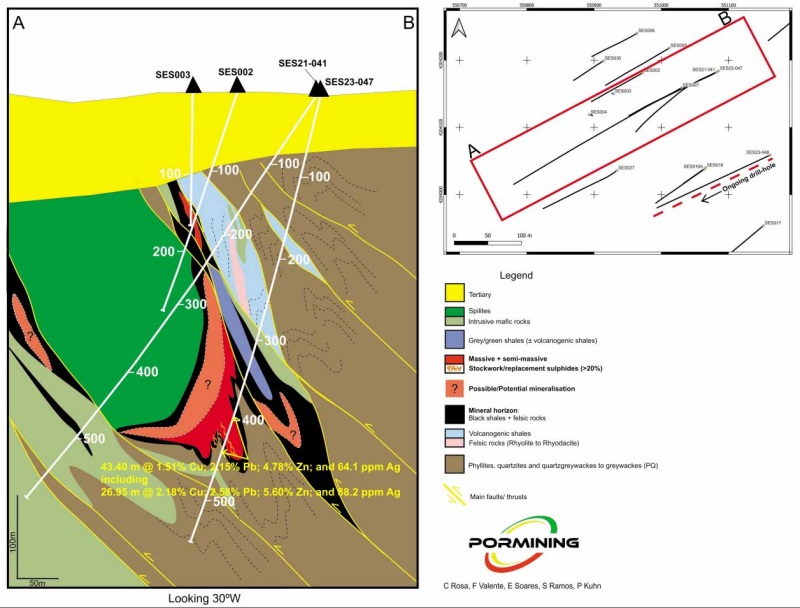

It was good to finally see a really strong result coming from Sesmarias, as I always had high hopes of Alvalade as a whole. The polymetallic intercept from hole SES23-047 hit very nice grades of not only copper but also zinc, lead and silver, resulting in a copper equivalent grade of 5.16% CuEq over the aforementioned 26.95m. This intercept was actually part of an even longer one, measuring 43.4m @ 1.51%Cu, 4.78% Zn, 2.15% Pb and 64.1g/t Ag from 392.8m. The JV targeted the Central Zone of Sesmarias this time, after compiling 20,000m of drilling (46 holes) at Sesmarias in all phases since the discovery in 2014.

CEO Paul Kuhn was obviously happy with the results:

“We are truly excited about the SES23-047 results. The entire team effort putting together a coherent targeting model led to this initial success in the Sesmarias Central Zone, which we hope will continue with follow-up drilling. Previous JV drilling demonstrated the potential for significant thicknesses of massive sulfide mineralization, and we recognized the potential for higher grade mineralization as we moved south towards the Central Zone, perhaps the center of the mineral system. We now recognize that the SES002 lens should be part of the new discovery lens, separated by faulting. Perseverance, continued creative thinking, and strong financial support led to a real success that shows possibilities for further follow-up success.”

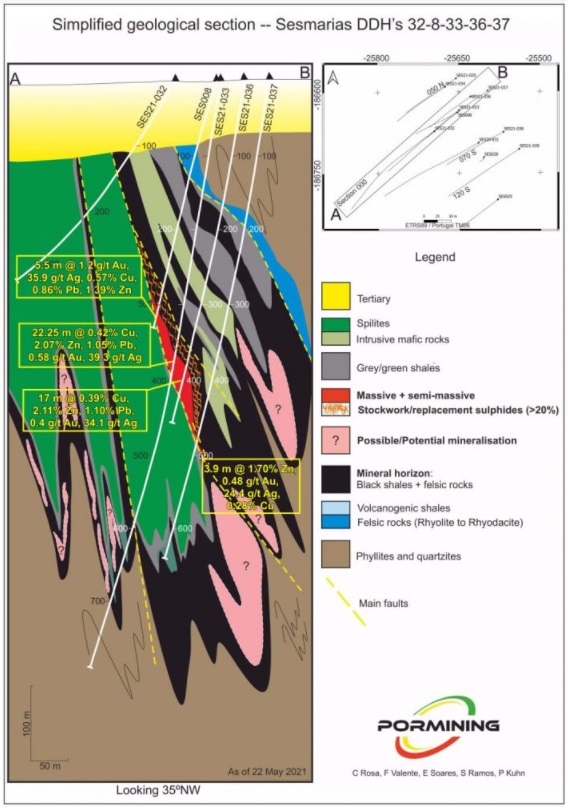

On the section below it can be seen why it is so difficult to hit substantial mineralization at Sesmarias, as the folding structure with all sorts of synclines and anticlines, further complicated by faulting, is very complex and hard to predict:

I do hope they hit something like the conceptualized major mineralized zone (represented red) in the centre soon, which could imply a high grade hit with a length of over 100m if the geologist who has drawn this is right. As mineralization seems to be located deep, I wondered if using directional drilling or wedges isn’t an option, as it would save a lot of time and money, using hole 041 or 047 as the master hole. CEO Kuhn answered: “We have discussed this at various times over the course of the present joint venture, and decided to stick with the status quo for the time being. However, if we continue to hit good mineralization in the next five holes after SES23-047, then we will re-consider our strategy for the next phase of exploration at Sesmarias Central.”

Avrupa management believes the represented structure above is a continuation from the structure found at Sesmarias North, of which one section can be seen here:

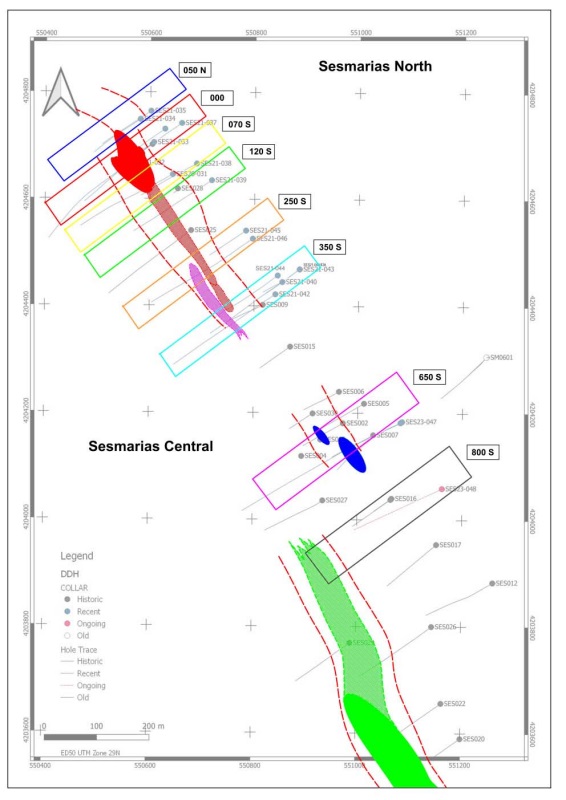

The following map shows a bit more detail about earlier drilling of fences at Sesmarias North and the current program at Sesmarias Main:

The success holes 002 and 047 are indicated by the blue ellipse-shaped forms in the middle. The idea is to connect Central with North, and possibly with South (green) as well, as there could have been a lateral displacement between Central and South. The mineralized trends are represented by the brown dashed lines. The JV is currently drilling hole 048, which is indicated by the red dot in the 800S section, and has planned to drill 5 more holes, including SES23-048. Three of these holes will be 150-meter stepouts along strike, one to the northwest of SES23-047 and two the southeast of SES23-048. The collar of the last hole in this phase will be determined later, depending on results.

I wondered how Avrupa visualized the South zone, if this could also be part of the heavily folded structure running southeast-northwest, or different? CEO Kuhn explained patiently as always, “Yes, we indeed think that it is all part of the same system. There is no need to suspect otherwise, though the system has certainly been heavily modified since deposition by folding and faulting.”

Shareholders of Avrupa Minerals were happy to see lots of trading activity on the day the news came out, as the share price peaked at 8c, on a daily volume of around 1M shares, almost a 50-fold increase from the average daily volume at the time:

Share price, 1 year time frame (Source: tmxmoney.com)

Let’s see if the next results could impact the share price again this way. These are expected to be announced after the company completes several more holes. The stock already traded up from the lows because of the signed Slivova agreement, although I must say I didn’t expect this to be such actionable news. As a reminder:

the upcoming Slivova PEA NPV probably doesn’t go way beyond US$40-50M as it is a small project, and a 15% interest (=US$6-7.5M) is normally discounted quite a bit for de-risked stage (around 70-85% for PEA). The company stands to receive just about C$100k in payments before year end while being free carried by WTR developing the project towards PEA, FS, permitting and ultimately production, where the Avrupa interest could be sold to WTR or diluted to a 1% NSR as I don’t see Avrupa as a prospect generator participating in future capex funding as capex will likely be US$25-30M (15% pro rata for Avrupa will be US$3.75-4.5M, which is over 2 times current market cap).

Regarding Avrupa’s Finnish projects, the status of exploration work at the copper-zinc Kangasjärvi project is as follows, as drilling was planned for the end of June here, but it will be re-scheduled for later in the summer when drills will be available, and more targets become available. As far as the Kolima copper-zinc project goes, the Finnish mining bureau approved the exploration permit, but now the courts must work through three appeals submitted in a 37-day comment and appeal period after the approval. For now, ongoing exploration work has been temporarily suspended until the courts have made their decisions.

As another reminder, Kangasjärvi was an historic zinc mine, and potentially part of a VMS project. Lots of data have been obtained for the project, including historic drilling, and a small historic, open pittable resource (300kt @ 5.4%Zn, of which 85kt already has been mined out) is present. Regarding Kolima, historic exploration efforts defined a 2000 x 200-400m zone with zinc mineralization, but also numerous boulders containing zinc and copper are present, in typical VMS fashion and geology. A resource wasn’t defined despite 70 drill holes completed. A SkyTEM survey indicated two important electromagnetic (EM) targets, which will be drilled as soon as the permits are fully granted.

Conclusion

I was hoping for actionable news by Avrupa at their Alvalade project, and they certainly didn’t disappoint, with the 26.95m @ 5.16% CuEq, which is pretty economic regardless of 400m depth, as the gross metal value would be US$439.4/t at hypothetical 100% recoveries. Or about 7g/t AuEq, but at least it gives you an idea of economic potential. Avrupa is looking to explore the complex and folded structure at Sesmarias further, and I’m looking forward to upcoming results. When they hit even bigger, this could prove to be a real gamechanger. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Avrupa Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.avrupaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.