Aztec Minerals Hits High Grade Silver At Tombstone: 1.52m @ 3,477g/t Ag

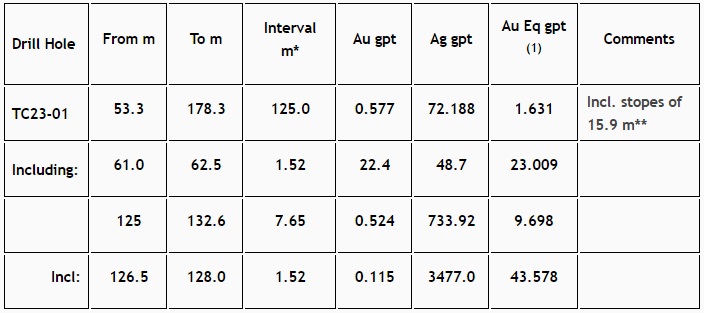

After Aztec Minerals (AZT: TSX-V, OTCQB: AZZTF) commenced drilling at Tombstone in Arizona at the end of February, the first result came in on April 26, 2023, and it was pretty spectacular. As the company was drilling for oxidized gold in order to expand the mineralized envelope, estimated by me at about 600koz Au, high grade gold was also hit in first hole TC23-01, generating 125m @ 0.577g/t Au and 72g/t Ag from 53.3m depth, including an impressive 7.65m @ 733.92g/t Ag, which included an excellent 1.52m @ 3,477g/t Ag from 126.5m depth (residual grade of 54g/t Ag). This hole in fact added so much silver to the gold, that the overall gold equivalent grade almost tripled to 1.631g/t AuEq, which potentially makes this a very economic result, and without a doubt bodes well for the mineralized potential at Tombstone.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

After closing a non-brokered C$1.1M financing on February 23, 2023, Aztec Minerals commenced its 10 hole 2,250m diamond drill program at its Tombstone project in Arizona on February 28, 2023, with the aforementioned results of the first hole being released a few days ago. CEO Simon Dyakowski was obviously pleased with the results:

"Initial results from our first core drilling program at the Tombstone Project have successfully intersected Bonanza silver grades, +100 oz silver, near the water table. This result represents the highest grade of silver encountered in Aztec's drilling at Tombstone to-date, and the broader zone of oxide gold-silver mineralization continues to expand the open-pit heap leach potential of the project. We await the receipt of assays from additional drill holes as our 2023 core drilling program continues at the Contention pit target of the project."

As a reminder, the company is the operator of a 75/25 JV with private Tombstone Partners, and the beauty of the Tombstone project is, besides the already found oxide potential, that it hosts a historical mine, which was closed due to multiple failures of the less advanced, historical pumping facilities (as the mine was being developed below the water table), with lots of potential mineralization at depth still to be explored. All former drilling was halted above the water table (-150 to -200m), and all holes ended in mineralization.

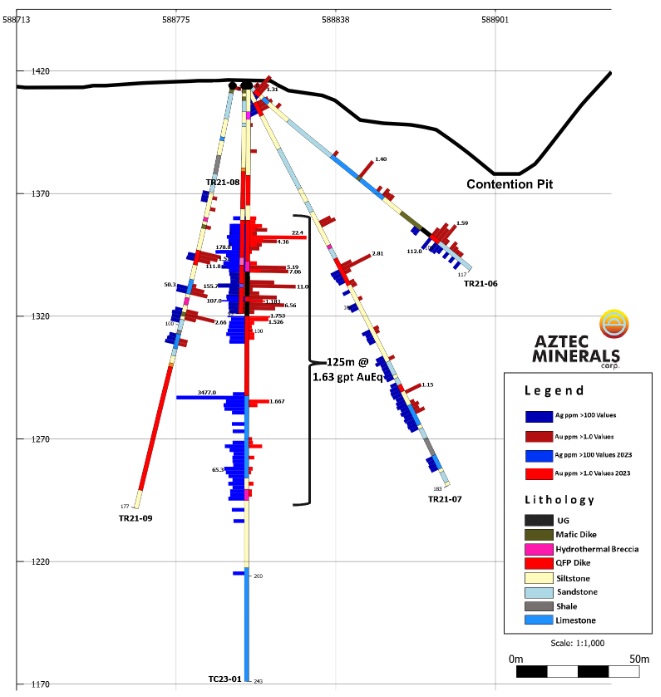

The first drill hole TC23-01 is part of a program that is being drilled in a fan-grid pattern over the length of the shallow Contention pit, drilled from a drill pad just outside the pit at higher elevation:

The highlight was of course the bonanza grade intercept of 1.52m @ 3,477g/t Ag (112 ounces of silver), and the complete table of results for TC23-01 looks like this:

To give you an idea, this high grade silver intercept ranks nicely just behind the best silver intercepts of the first 4 months of 2023:

- Kuya Silver: 3.04m @ 16,838g/t Ag

- Aya Gold&Silver: 7.5m @ 4,980g/t Ag

- Abrasilver: 14m @ 3,025g/t Ag

- Dolly Varden Silver: 16m @ 1,499g/t Ag

- Outcrop Silver: 5.3m @ 2,719g/t Ag

- Aztec Minerals: 1.52m @ 3,477g/t Ag

But keep in mind Tombstone is first and foremost a gold oxide project, and silver is just a bonus here. Also of interest is the high grade gold intercept of 1.52m @22.4g/t Au from 61m depth, this could imply a combination of oxidized host rock and veins, which you often see in comparable deposits.

This hole went below the water table at this target location, and crossed 4 different historic underground workings. According to CEO Simon Dyakowski, they were lucky not to lose the drill over these voids (total length 15.9m), and were able to reduce diameters each time, using larger diameter cases as a tube for the next smaller diameter drill bit and core. They had to reduce diameters 4 times, going from PQ to HQ to NQ, and finally to BQ, but this had no consequence for the quality of core or assay results.

Knowing that these old workings were mined in the early20th century, when they more or less just tracked mineralized ore visually, it is very likely that more multi-kilogram silver mineralization is still present across and around the old workings, being non-economic at the time but very much so nowadays.

Aztec has now completed the first 5 out of 10 holes, and the program has been decreased to a total, at minimum, 1,000m of core drilling at Tombstone. I asked CEO Dyakowski why the program was decreased. He told me that the holes had been re-oriented to reduce the amount of drilling through in-pit fill material, and broken rock near surface, which is difficult and time consuming to drill through. Although the program was reduced in terms of meters, the goals of stepping out East and West, and at depth, as well as testing other targets will still be completed.

As a reminder, the total drilled area measures 900m long x 230m wide, and to maximum depths of 200m. When doing a back-of-the-envelope guesstimate, this could result in a 900m x 150m x 50m x 2.75t/m3 = 18.5Mt mineralized envelope, at an average grade of 1g/t AuEq this could already result in an estimated 600koz AuEq resource. The discussed hole in this update could add 15-20koz Au alone. Besides this open pit potential, management firmly believes there could be large CRD type mineralized potential at depth (150-1000m depth), based on several meaningful deeper drill results which already had results like 7.16m @ 6.5%Pb and 2.6%Zn, indicating high grade CRD mantos, the presence of nearby manganese-silver rich mines, and other polymetallic mines located in the same type of host rock, in this case Paleozoic limestone. Management also believes there is potential for a mineralized porphyry-type deposit as a source of the Tombstone mineralization.

As another reminder, Aztec is also pretty occupied at their Cervantes project in Sonora, Mexico. According to my back-of-the-envelope estimate, the company could have delineated a mineralized envelope of about 1Moz Au, but is looking to expand on this. The dry season has started, and because of this Aztec is carrying out channel sampling and geologic mapping of the new drill roads at California, California Norte and Jasper at the moment, as well as expanding surface sampling and mapping on the property in general, in order to generate new drill targets for a follow-up of the 2021 – 2022 drill program. A new drill program consisting of 26 holes and 4,000m of RC drilling, is planned to commence in June. With a current cash position of C$1.6M, the company has sufficient cash to complete Tombstone drilling, and do the stage 1 sampling and mapping program for Cervantes, but will need to raise more cash soon for Cervantes RC drilling.

Conclusion

The extreme silver grade intercept in the very first hole of Aztec’s Tombstone diamond drill program increased the gold equivalent grade of this hole considerably to a very economic (for oxides) 125m @ 1.63g/t AuEq. With these kind of grades not too much tonnage is needed in order to get to 1Moz AuEq pretty quickly, and according to my back-of-the-envelope estimate Aztec Minerals should already be hovering around 600koz Au. Results of 4 more holes are expected in the coming weeks, and 5 more holes are being drilled at the moment, with results following suit. Things are looking bright for Aztec Minerals, as Tombstone seems well on its way to prove up 1Moz Au/AuEq, just like the company probably does with Cervantes, with both deposits accounting for oxidized heap leach potential, and all this for just a C$30.7M market cap. And both deposits still have a porphyry/CRD wildcard at depth looming. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.