Aztec Minerals Ready To Commence Cervantes Drilling After Closing Oversubscribed C$1.55M Non-Brokered PP

Aztec Minerals (AZT: TSX-V, OTCQB: AZZTF) did a good job raising C$1.55M , after announcing the non-brokered placement on August 8, 2023 for an amount up to C$1M, and upsizing it to C$1.2M on August 29, 2023 due to additional interest from investors. Although overall sentiment isn’t very positive, a recession seems to be approaching with the Fed doubting what to do with interest rates, and tax loss selling is coming up (November-December), I viewed this financing as impressive for a small junior like Aztec, providing them with sufficient cash for upcoming drill programs.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Aztec’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Aztec or Aztec’s management. Aztec has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

With the share price hovering around C$0.19 which is a long time low on negative precious metal junior sentiment, Aztec Minerals did well to raise C$1.55M at a price of C$0.225 with a half 3 year warrant @ C$0.30, issuing 6.9M shares and 3.45M warrants. CEO Simon Dyakowski, who participated meaningfully with 400k shares, was happy with the oversubscribed result:

"We are pleased to complete this financing and are grateful for the ongoing support of our existing shareholders and several new shareholders. Notably, Aztec's largest shareholder, Alamos Gold Inc. (TSX: AGI, NYSE: AGI) subscribed for 625,000 Units of the financing, thereby maintaining their equity ownership of approximately 8.8% on an undiluted basis."

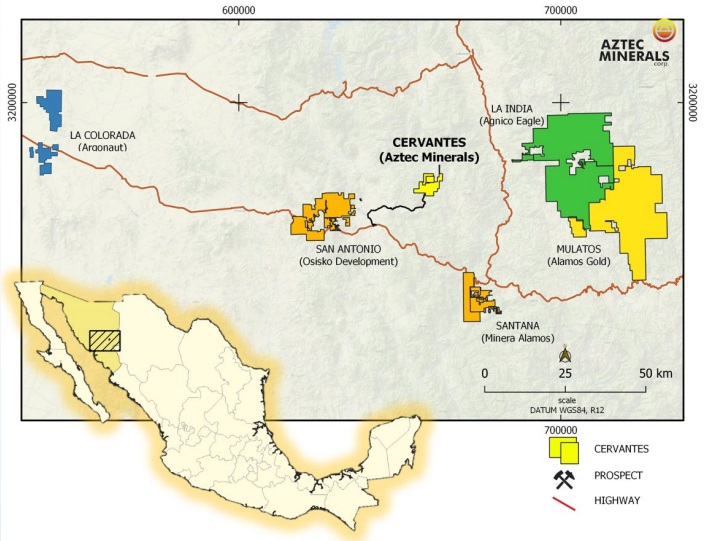

Alamos Gold is a natural suitor for the flagship Cervantes project in my view, as its Mulatos operation is within trucking distance:

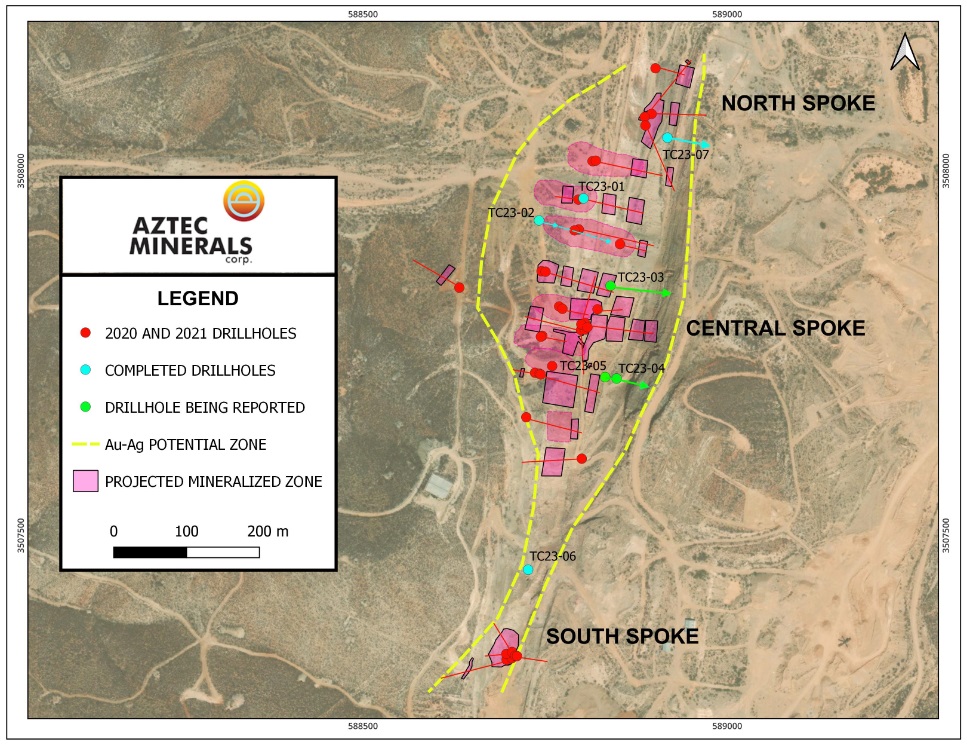

The financing took 2 weeks longer to close than intended, but the result justified the delay, as the second tranche doubled in size. According to CEO Dyakowski, a global budget exercise would indicate C$500k for Cervantes and C$100k for Tombstone drill prep. After asking for some more detail, he told me that he wants to start drilling at Cervantes first, and they are contemplating a 2,100m RC drill program at the moment, with results expected in November. Drilling is planned to commence in a few weeks from now. As CEO Dyakowski discussed a 4,200m 28 hole RC program in my last article, I asked him what changed the amount of drilling. He answered: “Since the financing took a little longer than expected, we broke the program into two stages, one for this autumn, and the subsequent stage next year once we have the results from stage 1 in hand.”

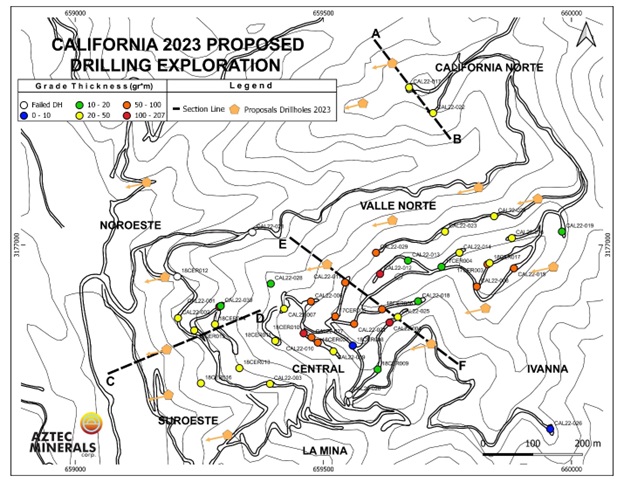

The primary objectives of the September 2023 drill program are to continue to define the open pit, heap leach gold potential of the porphyry oxide cap at California, test the down dip extensions of the silicic-phyllic alteration in the Qfp intrusive for deeper copper-gold porphyry sulfide mineralization underlying the oxide cap, and test for extensions of the California North target. My current estimate for the Cervantes mineralized envelope stands at little over 1Moz of heap leachable gold.

CEO Dyakowski has no plans to do two projects at the same time, and prefers one project at the time, because it provides ample time to interpret results from one drill program at each respective project before following up, and keeps the news flow steady over the year over the 2 separate projects. Therefore Aztec is currently working on interpretation and targeting for Tombstone at the moment, although he expects this to shape up during Q1, 2024.

Keep in mind my global estimate for the mineralized envelope for Tombstone stands at a hypothetical 700koz Au. Future drilling is expected to focus on targeting step-outs to the west, filling in gaps, and deeper CRD targets, more specifically on strike and dip extensions of the shallow oxide mineralization, and move deeper to test for larger, deeper "Taylor-type" CRD targets along and adjacent to the Contention structure.

Conclusion

Raising an oversubscribed C$1.55M enables Aztec Minerals to drill Cervantes in a few weeks, and potentially complete a NI43-101 resource estimate in 2024, which is an important milestone, as it will likely put Aztec firmly on the radar of mid-tier producers, especially large strategic shareholder and neighbour Alamos Gold. It will be interesting to see if Aztec can grow and delineate the resource above my estimates. After Cervantes, Tombstone will be next, tentatively commencing somewhere in Q1, 2024. At almost 2 year lows, with the US seemingly fending of a recession, and cashed up, it seems Aztec Minerals is at interesting crossroads now, and should be, in my view, at the very least on any precious metals investor’s watchlist. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Aztec Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.aztecminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.