Blue Sky Uranium Announces First Drill Results At Ivana Main Target

During times of relative stockmarket unrest, caused by more hawkish Fed policies regarding potential interest rate hikes and reduction of bond buying programs, Blue Sky Uranium (TSXV: BSK; US-OTC: BKUCF) is busy drilling several Ivana targets at their flagship Amarillo Grande uranium project in Argentina. Nowadays uranium is a relatively hot market to be in, as the Sprott Uranium Trust is trying to kickstart the utility buying of long term contracts by more or less cornering the spot market for uranium oxide in my view, buying huge amounts with their budget of over US$1.3B since September 2021:

All moves of the uranium oxide spot price are represented nicely on this up to date chart provided by Tradingview, taken from my website.

I don’t have exact figures of Sprott buying at my fingertips now, but it appears they are maintaining the spot price in a US$42-48/lb U3O8 price range, and are probably waiting for signals from markets and utilities, creating an environment where it makes sense to take the spot price to the next level. Keep in mind mothership Sprott Inc, a holding company, besides the uranium trust also manages extensive amounts of capital deployed in uranium stocks through numerous funds and asset managers, and these uranium stocks usually need uranium prices between US$50-60/lb U3O8 for their projects/operations in order to be economic.

In the meantime, Blue Sky Uranium is working hard to be ready for this widely anticipated, upcoming uranium bull market, with one drill program at its Ivana Central target underway now, and the second about a month from commencing. This update will handle the last drill results.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

As Blue Sky Uranium had to wait a long time before the 4,500m RC drill program could resume at Ivana North and Central, permitting for the 3,500m RC program at Ivana Main (at or close to the deposit itself) proceeded much faster fortunately, generating the first batch of results on February 2, 2022. According to CEO Cacos the logistics for transporting samples to a reputable lab in Vancouver is taking more time than usual due to COVID19, but other lab delays were resolved.

The goal for the current 3,500m program is to step-out to the zone west of the current Ivana deposit where 2018 sampling returned strong results. Besides this, infill drilling of this deposit will also be completed, in order to upgrade categories of the mineral resource estimate, necessary for engineering work for the PFS. According to CEO Cacos, he expects the next drill results to be announced soon, in a batch of around 20 holes of the upcoming batch and 94 for the second, both corresponding to drill holes completed by the end of 2021.

Regarding delays, the program at Ivana North and Central is anticipated to resume at the end of February/beginning of March. Management continues to work with the drilling company that is hired at Ivana Main at the moment, and they will deploy a different rig at North and Central.

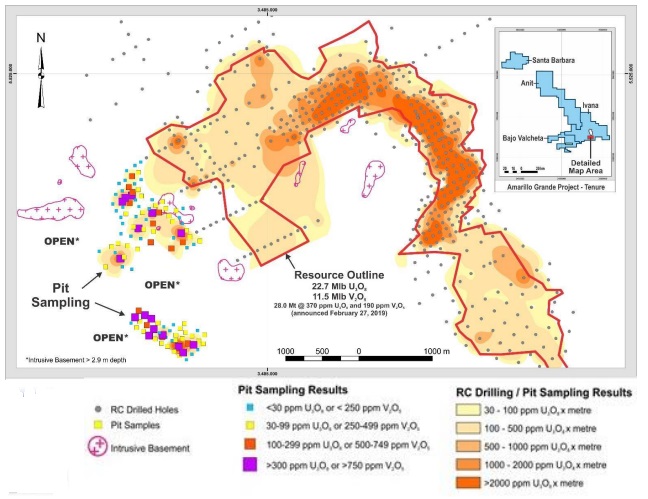

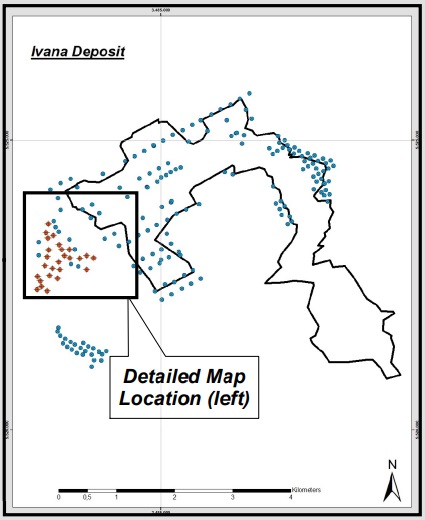

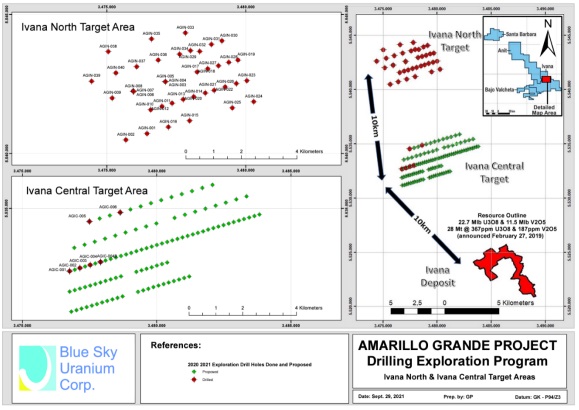

The reported results handled the first 26 holes of a 260 hole, 3,500m RC drill program at Ivana Main. 200 holes are already completed, and the last 34 holes are scheduled to be drilled in the coming 3 weeks. These were all drilled in the direct vicinity of the Ivana deposit, with a very shallow hole depth of 5m on average, with a maximum of 11m, as anticipated mineralization is also located near surface. A map with all existing and about the first 50 (blue dots to the left) of the 260 holes can be seen below:

As can be seen, the most and highest grade mineralization is actually confined in a relatively small area, and this explains why it isn’t easy to meaningfully expand the existing resource, or find new, similar ones. A more detailed map with the locations of all new 260 holes can be seen below (red dots are reported drill holes, blue ones not reported yet):

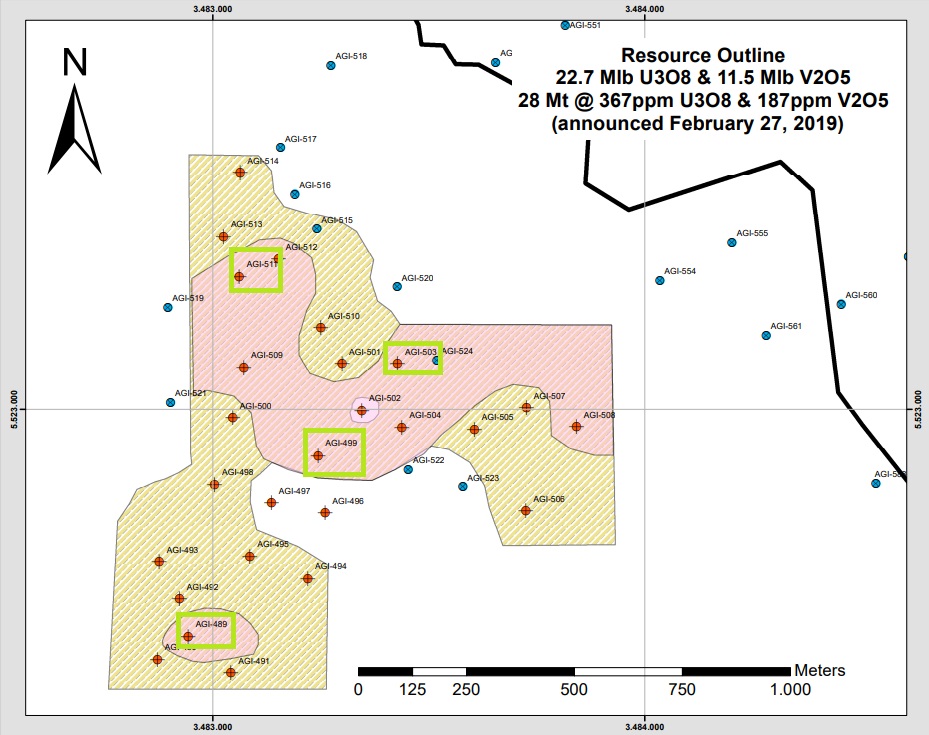

These target step-out zones to the west are based on extensive sampling program results. The other part of the 260 hole program is largely infill drilling. When zooming in on this map, all individual holes can be distinguished on the following map (the red zone has more uranium, the yellow zone more vanadium):

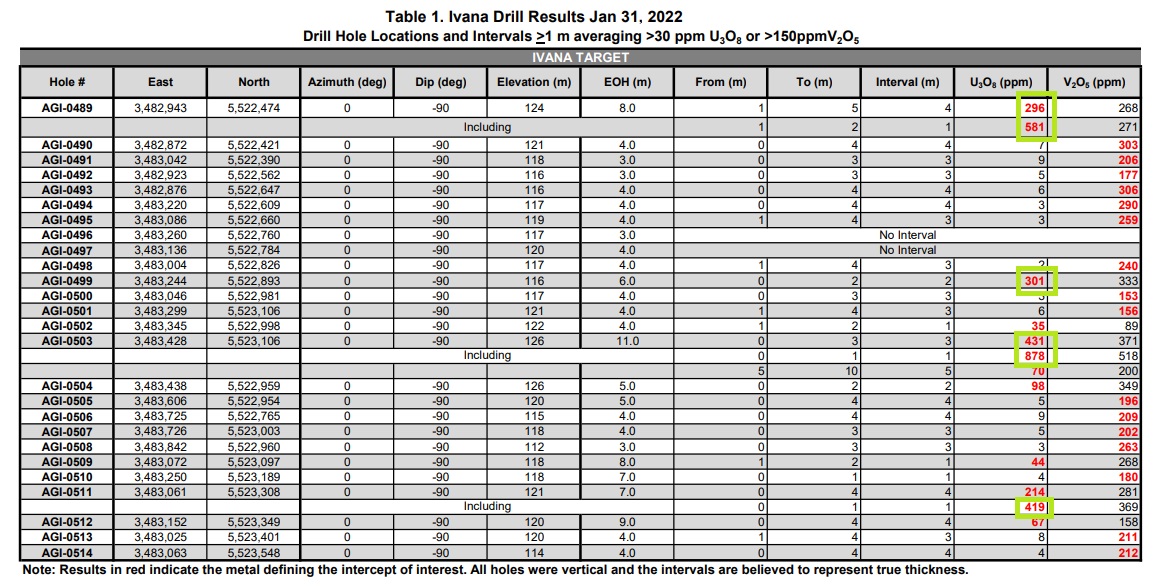

The best holes are marked green, and the results are highlighted as follows:

- 3m @ 431ppm U3O8 and 371ppm V2O5

- including 1m @ 878ppm U3O8 and 518ppm V2O5 in AGI-0503

- 4m @ 296ppm U3O8 and 268 ppm V2O5

- including 1m @ 581ppm U3O8 and 271ppm V2O5 in AGI-0489

- 4m @ 214ppm U3O8 and 281ppm V2O5

- including 1m @ 419ppm U3O8 and 369ppm V2O5 in AGI-0511

- 2m @ 301ppm U3O8 in AGI-0499 and 333ppm V2O5 in AGI-0499

As the average grade of the existing Ivana resource is 367ppm U3O8 (0.0367%), and the cut-off grade is 100ppm U3O8, these holes have no issue making it into an updated resource. Blue Sky Uranium also provided a complete table with all 26 results, to provide context:

These results show the irregular mineralization regarding uranium oxide west of the Ivana deposit, whereas vanadium is almost everywhere in economic quantities, and above the resource grade of 190ppm V2O5. Unfortunately, vanadium oxide only makes up for a small percentage of the PEA economics, and as such isn’t able to make much of a difference. When doing a back-of-the-envelope guesstimate of these results, assuming the edges of the red U3O8 zone in the map above as the 100ppm U3O8 cut-off grade, I arrive at 1000x250x3x2.6t/m3 = 1.95Mt @ 0.02% U3O8 = 860,000 lbs U3O8, which of course isn’t moving the needle yet. As a reminder, the current resource stands at 22.7M lbs U3O8 Inferred. The 2019 PEA, based on this resource, shows a decent post-tax NPV8 of US$135.2M, with a robust IRR of 29.3%, at US$50/lb U3O8. Keep in mind management aims at expanding the resource from 22.7M lbs to 75-100Mlbs, so lots of exploration drilling need to be done first.

Besides the current 3,500 drill program to expand and predominantly infill the flagship Ivana deposit, the 4,500m program at the Ivana North and Ivana Central targets plus two other nearby targets is the main focus for now to find substantial new mineralization: (red indicates assays reported, blue represents the assays pending):

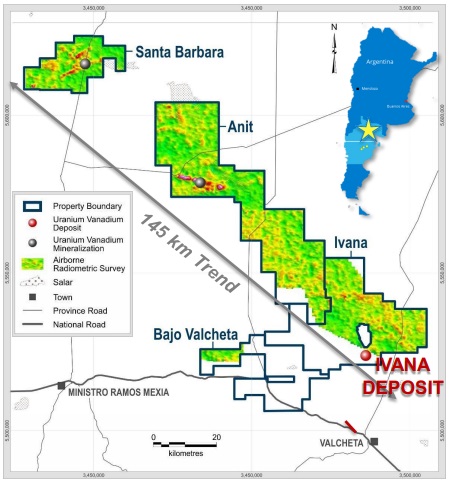

Unfortunately, no reported intercepts came close to the necessary U3O8 grade range to be included in a potential Inferred resource so far, but keep in mind that the initial drill program regarding the Ivana deposit only hit its first potentially economic uranium grade intercept at hole 100. And there is plenty of prospective land to be explored, as there is no less than 300,000ha along a 145km trend waiting to be drilled:

As Blue Sky Uranium management noticed remobilization of uranium oxides during the first drilling of Ivana North and Central, and developed a drilling program with the capacity to prospect down to 50 metres in depth, I wondered if this deeper drilling is planned for the remainder of the 4,500m program, but also the 3,500m program at Ivana Main. CEO Cacos answered that the Ivana Main zone is located in the first 25 to 30m in depth, so it is not necessary to go deeper. In the case of the new targets the team is trying to define targets in the upper 50m; however, the program could go deeper if the results indicated that it is required, having a positive yield potentiality to actual program.

The treasury currently stands at an estimated C$0.8M, which should be sufficient to complete the two drill programs, part of permitting, met work and engineering, and commence working on the PFS. The company expects to go back to the markets to raise approximately C$3M fairly soon, likely in February/March. These funds will allow to complete the exploration work (and any follow up drilling), as well as pay for the baseline environmental studies that will be required for the upcoming Pre-Feasibility Study. This PFS is anticipated to commence in the second half of this year, and is expected to take 10 months to completion, as such generating a potential construction decision in Q2 2023.

Conclusion

Although the Fed does everything to rattle the stock markets at the moment, metal prices maintain high levels, and uranium is no exception, fueled by lots of Sprott Uranium Trust buying. The wait is on for utilities to commence buying long term contracts, and when this happens a much higher uranium price can be expected. Therefore, Blue Sky Uranium seems to be in a good spot after many years of depressed uranium prices, and is busy drilling targets at their Ivana deposit, hopefully soon followed by other targets in the vicinity, potentially meaningfully expanding their resource. A new round of capital raising is coming up soon, and this will enable the company to explore many more targets on their very extensive claim package. Let’s see how big Ivana could get eventually, and if the overarching Amarillo Grande project could harbour other potential deposits, which could cause a substantial re-rating.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Blue Sky Uranium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.blueskyuranium.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.