EGR Exploration Options Out Urban Barry, Plans Further Exploration At Detour West

After a busy summer of prospecting, mapping and VTEM surveys, EGR Exploration (EGR.V) is ready to commence the next phase of exploration at their flagship Detour West Gold property in Ontario. The project is on trend and directly west of the giant Detour Lake gold mine. EGR used a C$200k grant from the Ontario government for its summer work, has about C$300k left in the treasury, and gets a bit of money for optioning out their Urban Barry property, so fresh cash needs to be raised before 2024 drilling will commence. EGR managed to design a pretty extensive drill program, and this article will delve deeper into this.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding EGR Exploration’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of EGR or EGR’s management. EGR Exploration has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

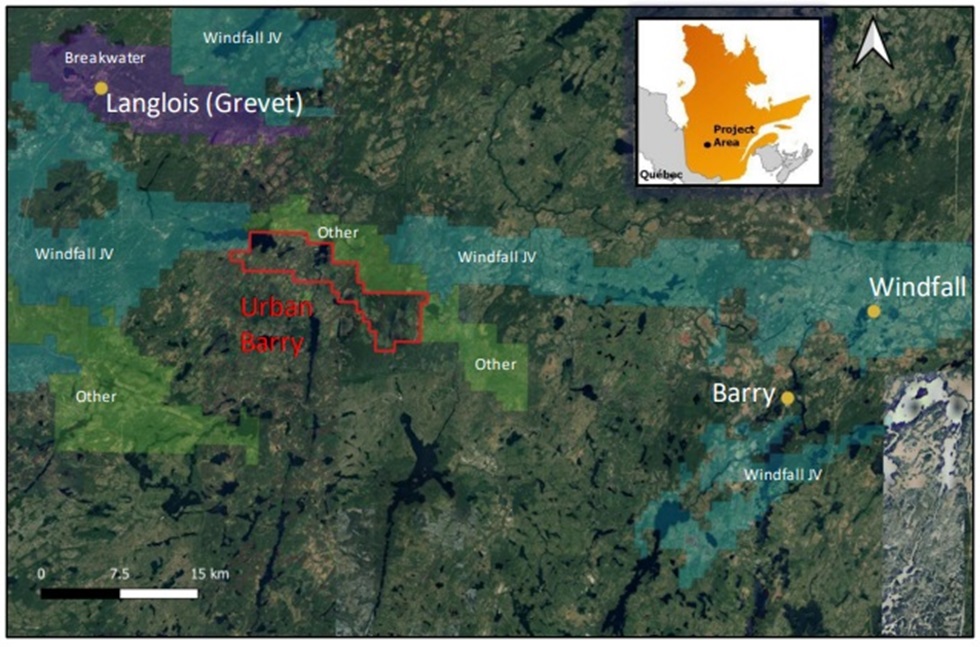

EGR Exploration managed to option out their Urban Barry property to Harvest Gold (HVG.V) a week ago, under the following terms:

- EGR will receive a total of C$90,000 cash (C$15k upon signing, C$30k on/before July 2, 2024, C$45k on/before July 2, 2025), 1,750,000 common shares of Harvest Gold, and a 2.0% NSR Royalty. Harvest Gold is also required to spend a minimum of C$300,000 in exploration expenditures in the first two years. Harvest trades at C$0.035c at the moment, so the 1M shares at signing are worth C$35k.

- EGR will receive an additional 1 million common shares upon Harvest Gold announcing a 43-101 compliant resource estimate of 1 million ounces of gold in the inferred category.

This is a very small transaction, but it brings in some cash and shares, and removes exploration obligations for EGR for a non-core asset, which is always a good thing.

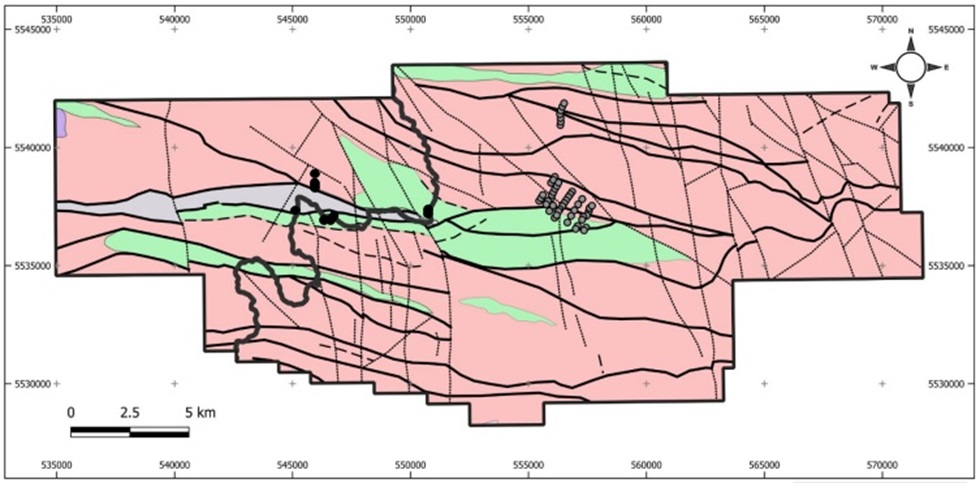

EGR completed its summer outcrop and prospecting program at Detour West in September, after completing interpretation of the high resolution airborne magnetic survey, both focused on drill targeting. As Detour West doesn’t have the easiest topography (most of it is swamp land), outcrops are limited, and had to be identified by LIDAR satellite imagery. This also means, that most of the outcrops needed to be accessed by helicopter. All gathered data will serve as a base for glacial till RC drilling. EGR has one of the foremost experts on glacial till sampling/RC drilling on its team, David Stevenson from Kenorland Minerals, where he co-developed a successful glacial till exploration strategy with the likes of Kenorland CEO Zach Flood.

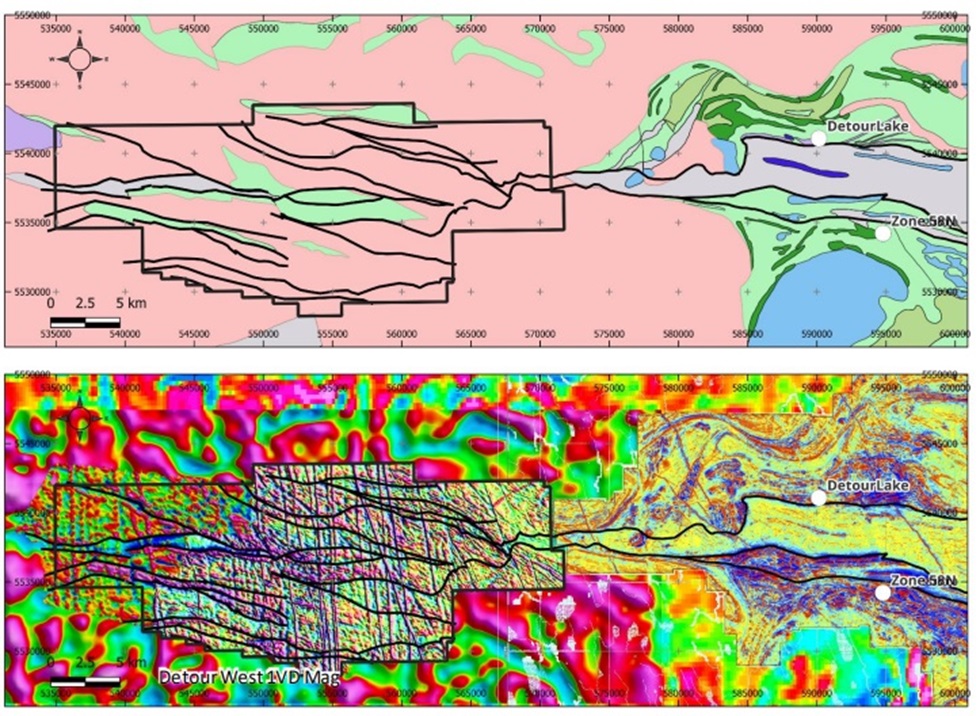

The airborne magnetics survey generated a very detailed map, clearly representing 2 important fault lines, the Sunday Lake Deformation Zone (SLDZ) and Lower Detour Deformation Zone (LDDZ), which originate onto the Detour Lake Mine property, with SLDZ containing most of the mineralization at Detour Lake.

The company is targeting gold deposits associated with the potential extensions of the Detour-Fenelon trend structures onto the Detour West property:

As a reminder, EGR Exploration has decided to follow the exploration approach which has been successful for the Detour Lake Mine. This approach had a number of subjects which EGR wants to apply, with a few tweaks here and there. A review of Detour Lake Mine’s 2018 NI43-101 report 1 indicated that a successful pre-drilling exploration approach especially south of the Lower Detour Deformation Zones (LDDZ) has been Induced Polarization (IP) surveys on 200 m line spacing and Mobile Metal Ions (MMI) geochemical survey to assist in ranking of the geophysical IP anomalies.

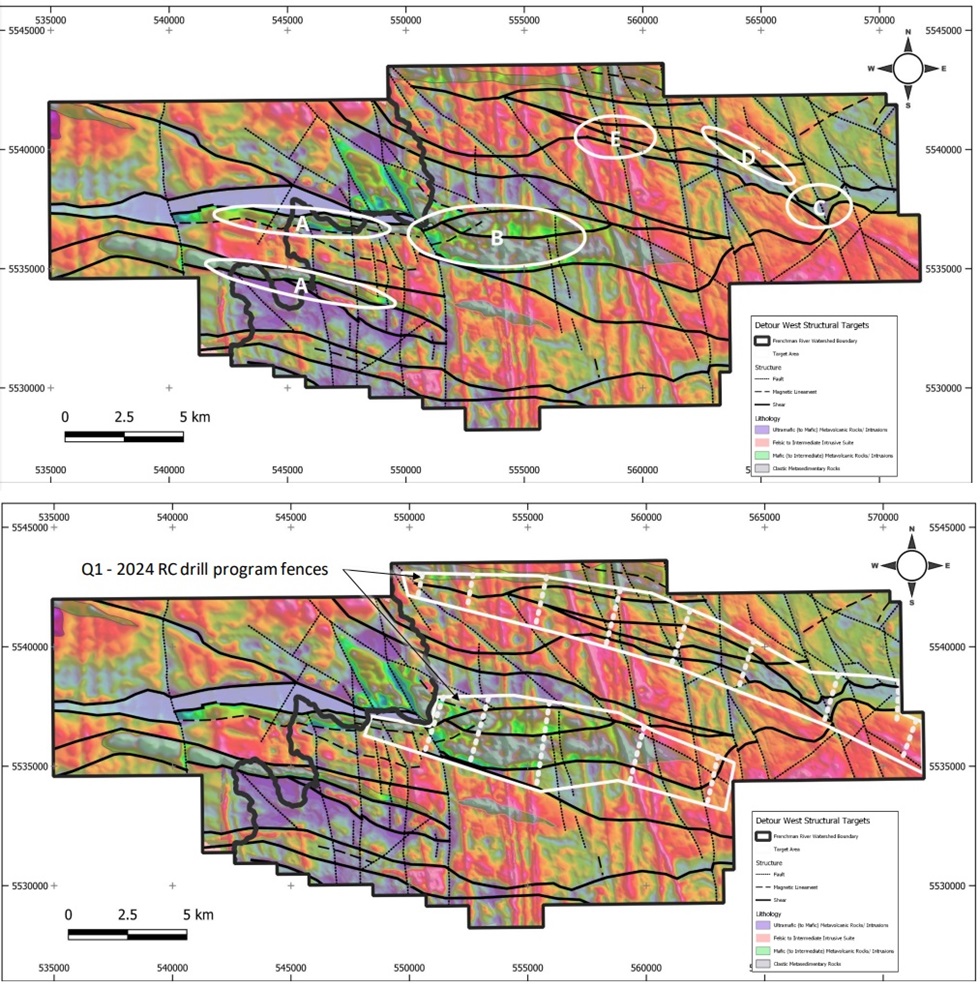

With a bit more detail, the company is looking to do a program along an 8 km stretch of the western interpreted extension of the Sunday Lake Deformation Zone (SLDZ) starting approximately 1 km to the southeast of the A series RS drill holes. There are 10 airborne anomalies and 3 elevated conductivity zones present along this stretch of the interpreted SLDZ. Gold mineralization along the SLDZ is typically associated with the structural contact between mafic rocks of different ages. One thing to keep in mind is that the western part of the property can’t be explored as the thick meandering black line below indicates the watershed boundary.

The combination of all geophysical data, zoning limitations, prospecting, historic results, mapping, structural targets (see ellipses below) etc has resulted into the following drill targets, with drill holes planned 300m apart at fences 1,000m apart (lower map below):

The idea is to drill up to 125 RC/diamond holes in total that are aimed at testing the top of bedrock through the up to 60m thick glacial till, with the base of the till samples being expected on average to be at 40m deep. At that stage they will be ready to follow up with deeper diamond drilling if they receive promising results. So far the goal is to test top of bedrock and get a gold dispersal train, and hitting the right type of rocks along the East/West structures, proving up mafic, ultra mafic rocks and host rocks similar to the Abitibi, Detour Fenelon and Sunday Lake Deformation.

The drilling will be done by a combination of RC and diamond core drill targeting both till and rock core sampling. At the moment, EGR is busy with the drill permitting. After this site preparation will be done in Q1, 2024 parallel with a raise, and the highly anticipated drilling is planned to commence shortly after funds are raised, management believes they are good to go around the end of Q1, 2024. EGR is also looking at a strategic investor, JV and M&A opportunities to fund the drill program, all this without turning into a prospect generator as CEO Rodriguez isn’t ready to hand over a majority interest before knowing what the potential is yet.

Regarding costs for drilling: management anticipates all-in costs of C$10k per hole, including trail building, ice building and drilling. As the glacial till thickness from the previous Sonic program was on average 47.5m, the average expected depth this time will be 49m, with 1.5m going into bedrock. This would mean all-in costs of about C$200/m, and for example a potential first phase 60 RC holes would cost about C$600k. If these holes return sufficient gold values, a follow up program would drill deeper.

Conclusion

EGR Exploration has completed their reconnaissance exploration work including airborne magnetic survey, prospecting, mapping and prospecting, and managed to design two zones that will be drilled somewhere in Q1 2024 after the company raises more money. With strong backers like Crescat Capital and Fruchtexpress, such a financing has a healthy backstop, but better sentiment might help for small explorers like EGR for sure as most money these days flows into more advanced/derisked projects. As Detour West appears to have the hallmarks to potentially contain (very) substantial mineralization, but also has pretty complex geology, EGR acts very thoroughly and professionally in order to be able to strike any gold that could be located on the property. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in EGR Exploration and Kenorland Minerals. EGR Exploration and Kenorland Minerals are sponsoring companies. All facts are to be checked by the reader. For more information go to www.egrexploration.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.