Gold Terra Closes Oversubscribed C$4.6M Financing

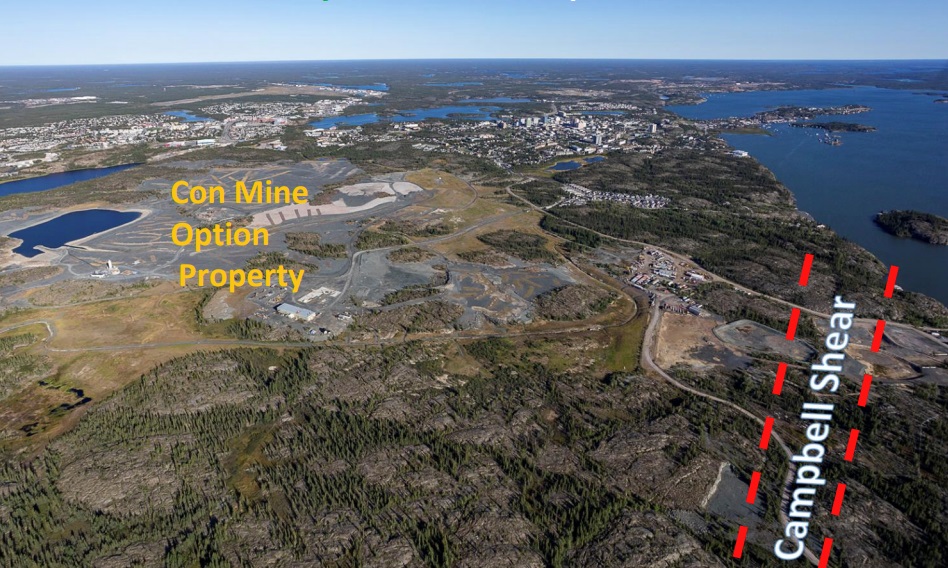

With the threatening debt ceiling default off the table for now, and markets slightly positive because of it, Gold Terra Resource (TSXV:YGT)(OTCQX:YGTFF) (FRA:TXO) managed to raise C$4.6M in the markets through a short form offering. The proceeds of the issued common shares and flow through shares enables the company to follow up on the ongoing drill program at the Con Mine Option Property as part of their Yellowknife project in the Northwest Territories. Gold Terra is currently busy drilling a very deep 2,300m hole at a high grade target at depth, and awaits assays for another 5 holes at the near surface Yellorex target.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Gold Terra’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Gold Terra or Gold Terra’s management. Gold Terra has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Gold Terra closed the oversubscribed C$4.6M short form offering quite quickly on May 26 after announcing it on May 17, with Paradigm Capital as lead agent for a syndicate including Agentis Capital Markets. The offering consisted of 17.1M common shares at a price of C$0.10, and 25.2M flow-through shares at a price of C$0.115, as both issues were oversubscribed This wasn’t the first attempt, as Gold Terra announced an up to C$6M overnight marketed offering at the same terms on May 4 with BMO as lead, which was terminated on May 5 unfortunately, quoting from the news release:

“This results from an assessment by the Company's management that the Company may have better alternatives for an offering on terms that would be in the best interests of the Company's shareholders.”

This begged for a little additional background, and according to CEO Gerald Panneton they cancelled the May 4 offering as the ratio hard dollars to flow-through at a low premium wasn’t attractive. Paradigm did a better job at it. At least there were no warrants attached to the deal, limiting dilution somewhat. It seemed that interested parties were keen on walking the share price down as low as possible when they heard about the offering, although gold reached all-time highs in the first weeks of May:

Share price 1 year time frame (Source: tmxmoney.com)

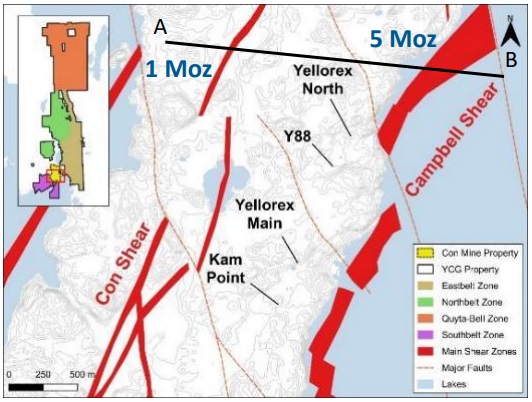

Not much you can do in that case as a gold explorer despite CEO Panneton feels that their Con Mine Project is one of the best one in Canada , especially when gold corrected on the latest rate hike and no certain outlook on rate cuts for H2, 2023. But the financing is closed now, I consider this rock bottom levels so there should be support, with in total 1.76 Moz Au NI43-101 compliant resources (Con Mine Option Property and Yellowknife Project) and a gold price still hovering in the US$1950-2000 range.

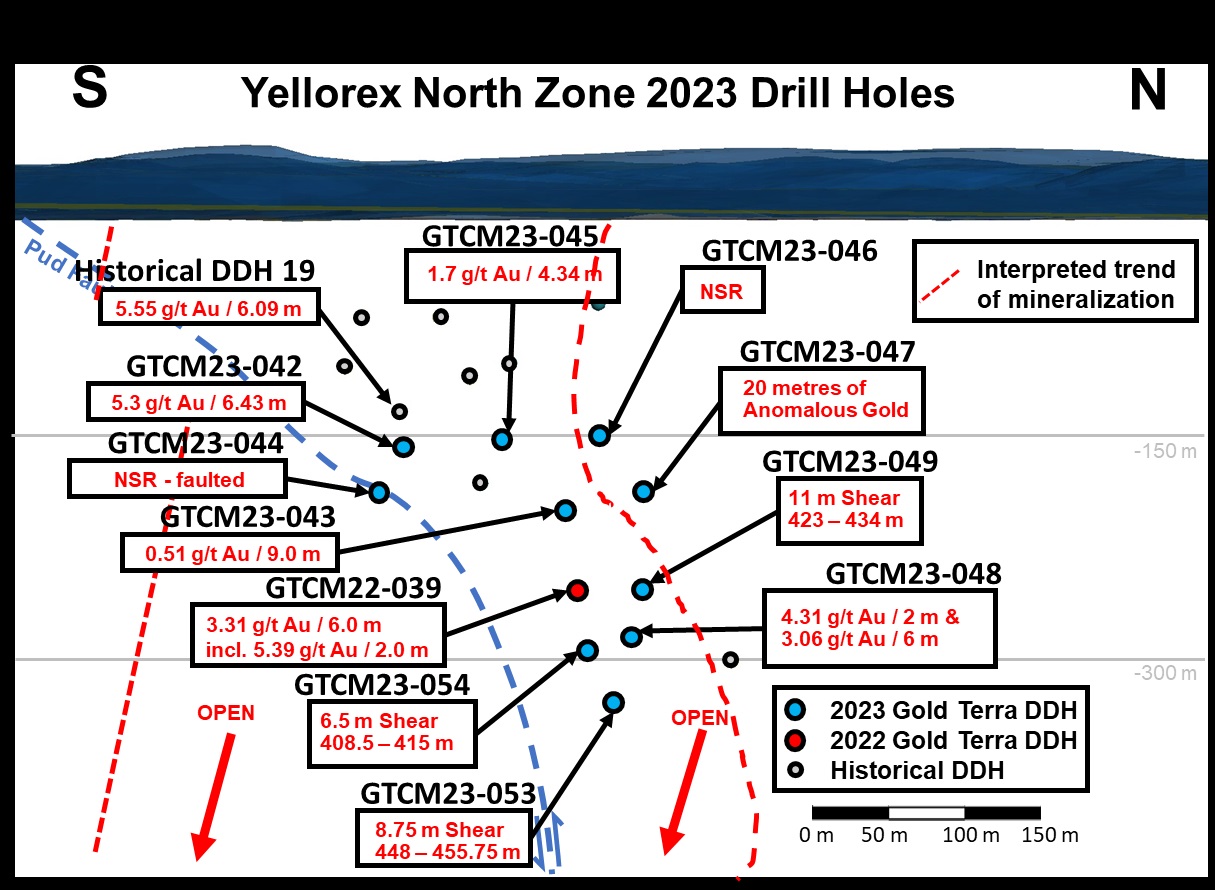

In the meantime, on April 21, Gold Terra announced more results of the completed 13 diamond drill holes (5,769m) on the Con Mine Option Property (CMO), as part of the C$2.4M - 8,000m drill program, which commenced on January 18, 2023. Drilling was done to a depth of 600m, at Yellorex North, Yellorex at depth and Kam Point, with the last assays still pending:

The first assays were disclosed on March 3, 2023: hole GTCM23-042 returned a solid 6.43m @ 5.3g/t Au at Yellorex North. Other results were announced in the aforementioned April 21, 2023 news release for this target:

- Hole GTCM23-045 returned 4.34m @ 1.7g/t Au from 172m, after intersecting 107 metres of the Campbell Shear with 8 metres of good smoky veining, pyrite mineralization, and sericite alteration.

- Hole GTCM23-048 returned 2m @ 4.31g/t Au from 383m and 6m @ 3.06g/t Au from 392m, after intersecting 120 metres of the Campbell Shear; 15.1 metres of strong veining and strong sulphide mineralization.

Holes GTCM23-043, 046 and 047 intersected just anomalous amounts of gold, and hole GTCM23-044 was designed to target the boundary of Yellorex North nearby the Pud Fault:

Management awaits the assays for the remaining holes 050 and 051 at Kam Point, 052 at Yellorex and 053 and 054 at Yellorex North.

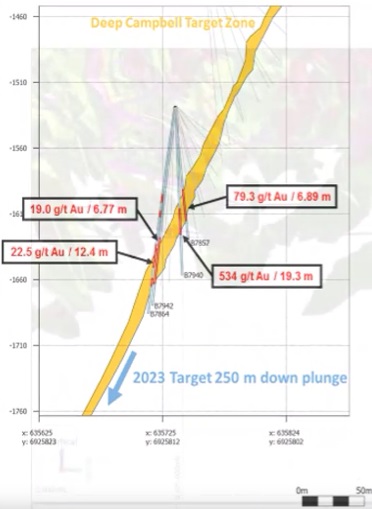

As the majority of results should surpass a threshold of 4-5g/t Au over 3m in order to be economic, Gold Terra still has some drilling to do here. As this type of veins typically pinch and swell, there could be economic mineralization present, although it doesn’t seem to lead to a significant satellite deposit for now. My focus of attention is and has always been geared towards drilling at depth, where the bulk of the mineralization of the Con Mine is/was located. To this purpose, a 2,300m hole is drilled at the moment, targeting a potential extension of a historic gold zone at depth:

“The deep drill hole program is designed to target high-grade gold zones below the northern end of the lowest mining levels of the historical Con Mine. Historical underground drill holes that were drilled below the lowest workings have intersected various high-grade gold zones in this area and very high-grade assays exist in many historical holes immediately above the target area. The objective is to expand these zones at depth. The initial hole is aiming to intersect the Campbell Shear 300 metres below the lowest working, or approximately 2,080 metres below surface. The opportunity will exist to wedge off the initial hole and target other high-grade zones in the area.”

Needless to say that an intercept like the historic hole B7940 provided (19.3m @ 534g/t Au) would be a real gamechanger for Gold Terra. With the existing Robertson Shaft going 1,900m deep, costing about US$120M at current prices to build from scratch but would only cost about US$20-25M to dewater and refurbish, the company has distinct capex- and time advantages as at that depth it will take 2 years to sink a shaft. For now the assays for the remaining 6 holes at Yellorex are expected soon and the assays for the ongoing 2,300m deep hole probably come back from the labs in July.

The remaining historic 650koz Au reserves and M+I resource left at the Con Mine when the mine closed in 2003 is located above the 1,900m depth and represents a bonus, if the company could delineate a deposit at depth. With the recently raised C$4.6M added to the treasury, the current budget will allow the company to complete its deep program below the Con Mine existing underground workings. According to CEO Panneton, the idea is to drill another 5,000-6,000m through wedges and upper cuts from the 2,300m master hole. The current cash position stands at more than C$5.6 M.

As a reminder, Gold Terra’s exploration ventures are backstopped by solid resources, as there are 1.2Moz Au Inferred OP/UG resource for Sam Otto, Crestaurum, Barney and Mispickel, a 542koz @ 7.6 g/t to 6.6 g/t Au Ind & Inf resource for Yellorex/Kam Point, and the aforementioned historic 650koz Au @ 11-12 g/t Au reserves and resources at the former Con Mine. This provides Gold Terra with back-of-the-envelope 2.4Moz Au resources in total, which should be able to provide support for a C$22.7M market cap in my view, hypothetically speaking trading at less than C$10 per ounce of gold.

Gold Terra also signed the definitive option agreement with Midas Minerals on May 31, 2023, in order to explore for lithium and rare earth minerals on its Yellowknife property. As a reminder:

The Midas Minerals deal has the following highlighted terms:

- Gold Terra is to receive up to C$ 1.2 million over 3 years, 2.20 million shares of Midas, and retain a 1% Gross Revenue Royalty (GRR) after the 51% earn in.

- Midas Minerals has exclusivity to earn 51% interest in the first 3 years, and up to another 29% interest over the next following 2 years for up to 80% interest in the Critical Minerals rights over a 544.7 square kilometre portion of the Company's Yellowknife property (YP) (of the total 800km2)

- The Yellowknife Lithium Project (YLP) is located East and North in close proximity to Yellowknife, Northwest Territories, Canada.

- More than 100 LCT pegmatites are known in the region, including historic references to lithium and tantalum occurrences within the YLP tenure.

- Midas Minerals plans to commence exploration at YLP in June 2023 and expects to have initial drill targets identified by August 2023.

If Midas Minerals exercises the option to earn a 51% participating interest, then Midas Minerals can elect to earn an additional 29% participating interest by incurring by no later than September 30, 2028, an additional $5.0 million in exploration expenditures. If Midas Minerals does not elect to earn the additional 29% participating interest (after having earned the 51% participating interest), then Midas Minerals must transfer a 2% participating interest to Gold Terra (so that the participating interests between Gold Terra and Midas Minerals will be 51%/49%). If Midas Minerals earns the 80% participating interest, the interest of Gold Terra in the Critical Minerals joint venture will be fully carried until the Critical Minerals joint venture has approved a bankable feasibility study for the development of a Critical Minerals project on any part of the Quyta-Bell and Eastbelt Block of Gold Terra's holdings in Yellowknife, NWT.

This is an interesting deal for Gold Terra as the 2.2M shares are already worth over C$400k without any discovery, and the company also receives C$100k before June, and Midas has to spend C$250k on or before September 30th 2023. According to CEO Panneton, there will be a lot more spending on exploration before year end. With James Bay exploration heating up and most participants in upward trajectories after lithium carbonate prices recovered quite a bit, this could be an interesting wild card for Gold Terra.

Conclusion

It was a good thing to see Gold Terra closing the oversubscribed C$4.6M offering shortly after the failed attempt a few weeks before, with a different lead agent. This way the company can proceed asap with new follow-up drilling, providing continuous news flow, and of course hopefully with more chances at success. As the first deep 2,300m hole is being drilled now, with assays expected back in July, I view this as the first real chance at game changing results, so I’m really looking out for this. In the meantime, 6 more results are expected for Yellorex which will probably not move the needle that much, but might very well add some useful ounces here and there. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.