Goldshore Resources Closes C$6.9M Brokered PP; Resource Update And PEA Next Catalysts

The markets keep generating mixed to negative signals: on one side you have high inflation causing lowering demand, higher interest rates, the Federal Reserve shrinking its balance sheet, a record credit crunch, banking crisis, deflating bubbles like real estate, decreasing manufacturing, port activities, lowering wages (although in Europe there is a wage-price spiral going on), in short everything points towards a recession. On the other hand inflation seems to be decreasing somewhat with CPI numbers coming in below expectations just like PPI numbers, industrial production and capacity utilization numbers beat expectations, unemployment is still at multi decade lows, and job numbers are coming in only slightly below expectations but still better than at pre-COVID levels, so the Federal Reserve is contemplating one last 25 basis points rate hike in May with the odds near 80% now. The markets are anticipating a pause and potential rate cuts for the rest of this year in order to create a soft landing for a mild recession.

It is my belief that inflation is still way too high for a healthy functioning economy, and if the Fed decides to pivot after May, there is no chance we will see anything resembling 2% inflation again in the near future. Needless to say that even higher consumer prices will see demand dropping off even more, potentially creating stagflation, which is a feared combination of inflation and high unemployment rates. Stagflation is very costly and very hard to get rid of, so governments and central banks are desperately trying to avoid it. Notwithstanding this, upcoming rate cuts would lower the US Dollar Index, which in combination with negative real interest rates is good for precious metals. And the focus metal of Goldshore Resources (TSXV:GSHR)(OTCQB:GSHRF)(FWB:8X00) is of course gold.

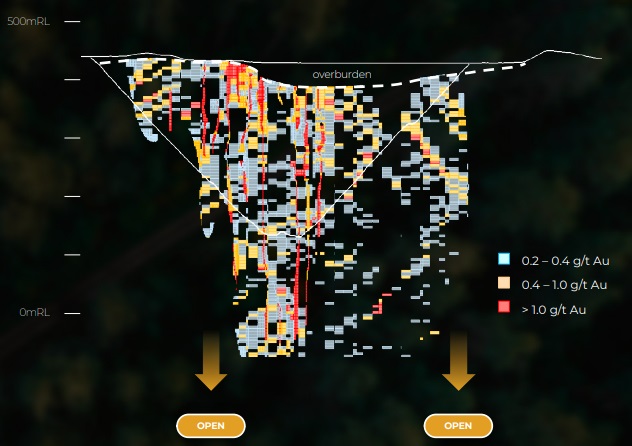

The company just completed drilling at 3 different target zones, Southwest Zone, Main Zone and the QES Zone, in order to expand the open pit mineralization, and according to the earlier announced results Goldshore did a fine job, hitting targeted parallel shear zones, widening the current mineralization. The current NI43-101 compliant Inferred resource stands at 4.17Moz @ 1.1g/t, and management expects to increase this figure to 6Moz Au in the upcoming resource update which is scheduled to be announced at the end of April, followed by a Preliminary Economic Assessment (PEA) in Q3. Goldshore was running low on cash, so they opted to raise C$5M initially to limit dilution, and this figure eventually increased to C$6.9M, providing the company with sufficient cash to do the resource update, complete the PEA, commence district exploration and start drilling again in Q3 after the PEA is completed.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Goldshore Resources’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Goldshore or Goldshore’s management. Goldshore Resources has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

It was good to see Goldshore Resources raising another C$6.9M, after raising C$6.75M in December of last year. The markets expected a bigger raise back then, but CEO Brett Richards indicated to me it wasn’t easy at all unfortunately. The sweeteners back then (no hold period, half warrant, low FT premium) caused selling afterwards, although gold juniors sentiment was picking up during the same period:

Share price vs GDXJ 1 year timeframe (Source: tmxmoney.com)

The last raise was announced as a C$5M brokered private placement on March 23, 2023, led by Eventus Capital and Research Capital, two loyal supporters of Goldshore. This time it wasn’t a short form offering but with a 4 month hold period, but the half warrants and low flow-through (FT) premium were put in place again, as the common shares were priced at C$0.17, and the FT shares at C$0.195, a low 15% premium, whereas normal FT premiums start at 35-45%. The half warrants were priced at C$0.25, with a 2 year exercising period. On April 5, 2023, the company announced that the amount was increased to C$6M, and a 15% overallotment option was granted to the agents. They didn’t hesitate very long, and the financing closed on April 13, 2023, including a fully exercised over-allotment option for gross proceeds of C$6.9M. 16.4M common shares at C$0.17 including a half warrant were issued for C$2.79M, together with 21M FT shares at C$0.195, also with a half warrant for C$4.11M.

The FT proceeds will be used for exploration purposes only, in line with eligible tax deductables. It was also good to see CEO Brett Richards participating for another 882k shares, taking his total to 4.3M shares, VP Peter Flindell for 150k shares (total of 300k shares), and director Shawn Khunkun buying another 103k shares (total of 903k shares). The cash position is estimated at C$6.8M at the moment, which will be sufficient for the resource update, recon exploration, the PEA and some capital to be preserved for a way forward after the PEA according to CEO Richards.

As a reminder, I listed and summarized a few highlights from the March interview with CEO Brett Richards, to get a recap and additional understanding of his strategy for Goldshore Resources:

- The importance of a strategic investor: “You allow a strategic to come in, in stages. $1M-$3M now - $3M-$6M in six-eight months (after PEA is out) and the $5M to $10M at the end of the year or early 2024 to allow for us to do a winter drilling program to assist the PFS modelling. Doing this in stages – and (hopefully) incrementally higher share prices, is the best way to prevent warrant flippers to crash the share price. We need to create market tension – we need to create retail pressure whereby they can only buy through the market to gain exposure to GSHR.

- PEA: “A two staged PEA (150-200koz Au pa focusing on high grade and lower capex in the first 3-4 years, 500-600koz pa thereafter, expansion capex financed by internal cashflow) would give us more than one exit option: we can build a mine or look at M&A opportunities, or both. If we just scope to 65K tpd and 600K-700K oz pa, then we could never finance that given our equity price, and we are stuck with only M&A as an exit option.”

- Royalty: “Anyone wondering about the 1-2% royalty, or the 8.75 % NPI: the Net Profit Interest will most likely be “zero” for at least the first 7 to 10 years of the mine operation, due to the application of depreciation: Phase One CapEx depreciation; future exploration appetite (and there will be a lot of it); Phase Two of production capacity increases (CapEx); Spin Outs; Earn Ins, there will be little or no consideration to showing profit for the first 10 years, as all of the proceeds will be reinvested to increase the equity value of the company.

- Amount of drilling: “All of the 122 holes for 68,732m drilled at Moss, plus the 16 holes (7,958m) Goldshore drilled at East Coldstream (soon to be released), will find its way into the April 2023 mineral resources estimate (MRE). There will not be any new drilling starting before the PEA comes out, probably later this year as mentioned. At the moment, management is aiming at resource expansion via the Southwest Zone and QES Zone at Moss Lake.

- Economics: “The PEA will be based on the outcome of this updated resource, and there is no doubt in my mind and with management that economics will be much better compared to the outdated 2013 PEA (After tax NPV5 of US532$M @ 1,700 gold, IRR of 24%, capex of US$542M). The company probably has a robust resource coming soon with hopefully a high grade component of 3Moz @2g/t Au”.

- Met work: “Goldshore is also working hard at metallurgical test work. Management anticipates 90% recoveries for the low-grade intrusion ore, and 90-92% recoveries for the higher-grade shear zone ore, which is much better than the 2013 PEA figures for overall recovery (79% and 84% - south and north). Management is also doing the first tests for eligibility of heap leaching, which would indicate a real gamechanger for economics if successful. The results of the ongoing met work are expected back during Q2 2023, and will be released in the market.

- Future drilling: “As just about 30% of the historic cores can be used for a compliant resource overall, the PFS will need 30,000-40,000m of redrilling/infill drilling.”

All in all, Goldshore Resources is quite a complex story for investors, no doubt about it. However, the potential for a very large, economic open pit project is real, as management sees the 6Moz Au target as a first step, 10Moz Au as the second phase and even much more after this. The new shear zone/intrusion concept allows for a staged mine plan based on processing the high-grade shear zone mineralization first, while stockpiling the low grade intrusion ore and processing it later, and this combined with likely improved recoveries will probably result in much improved economics, despite capex- and opex inflation. I consider the heap leach option in recovery methods as a game changing wild card, and this will take 3-4 months to work out anyway, and the market will be updated on this aspect before the PEA. The upcoming PEA will show investors the economic viability and scale of Moss Lake, and in my view it will establish the project as a Tier I asset in the making. There are very few of those around, especially in top jurisdictions like Ontario, so with robust economics established and a gold price around or above US$2,000/oz it will probably not be around much longer.

Conclusion

After raising another C$6.9M in a brokered PP, Goldshore Resources is set to complete several important milestones: an updated resource estimate within a few weeks, and a PEA around September. The resource estimate will most likely see a 6Moz Au figure, with 3Moz Au of those being relatively high grade for open pit at an estimated 2g/t Au average grade. When the resource estimate comes out, it will be time to look into economics as well, but after talking to management it became clear that expectations show ball-park numbers well above 2013 PEA numbers, which indicated after-tax NPV numbers of half a billion US Dollars based on a US$1,700/oz gold price. With a current market cap of C$34.4M in mind it will hopefully be clear that the upside of Goldshore could be substantial. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Goldshore Resources. Goldshore Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldshoreresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.