Kenorland Minerals Drills 19.25m @ 19.95g/t Au At Regnault, Receives ECOLOGO Certification

As the stockmarkets in the US are printing all-time highs again, not really urging the Federal Reserve to lower rates anytime soon it seems as inflation remains well above target, Kenorland Minerals (KLD.V)(3WQO.FSE) announced the final drill results for Regnault, part of their flagship Frotet Project in Quebec. Again lots of good, economic intercepts, providing useful infill and step-out results, growing the mineralized envelope. Besides this, Kenorland completed the conversion of their 20% JV interest in the project into a 4% NSR royalty with Sumitomo, which is a formality, but still had to be finalized of course. On a more general note, Kenorland also received their ECOLOGO Certification for Mineral Exploration Companies after following a certification process for 2 years. This certification ensures the highest standard of responsible and social practices, involving a rigorous audit to evaluate performance in environmental impact, personnel safety, well-being of impacted communities, fair and ethical business practices, compliance with applicable legal requirements and efficient use of financial resources. This alignes perfectly with everything else Kenorland is doing, as in my view it is the best prospect generator around by a countrymile.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

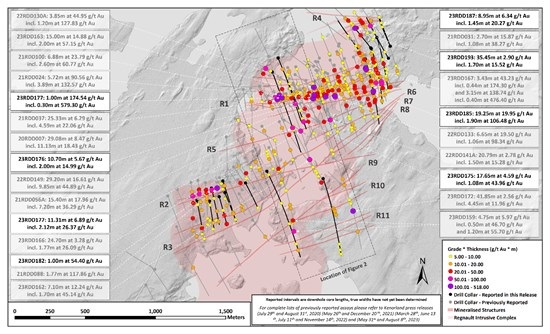

The Fall 2023 drill program results for Regnault were announced on February 23, 2024, and handled the assays for 20 holes, totaling 11.918m. These holes were designed as step-out and infill holes, especially for the R1 and R5-R8 structures, with the absolute highlight being 23RDD185, an infill hole for R6 which returned 19.25m @ 19.95g/t Au including 1.9m @ 106.48g/t Au, leaving a pretty decent residual grade of about 10.5g/t Au. Other highlights are:

- 23RDD185: 19.25m at 19.95 g/t Au incl. 1.90m at 106.48 g/t Au at R6

- 23RDD177: 1.00 m at 174.54 g/t Au incl. 0.30m at 579.30 g/t Au at R1

- 23RDD193: 35.45m at 2.90 g/t Au incl. 1.70m at 15.52 g/t Au at R4

- 23RDD175: 17.65m at 4.59 g/t Au incl. 1.08m at 43.96 g/t Au at R5

- 23RDD177: 11.31m at 6.89 g/t Au incl. 2.12m at 26.37 g/t Au at R5

- 23RDD176: 10.70m at 5.67 g/t Au incl. 2.00m at 14.99 g/t Au at R5

- 23RDD182: 1.00m at 54.40 g/t Au at R2

- 23RDD187: 8.95m at 6.34 g/t Au incl. 1.45m at 20.27 g/t Au at R4

The following map is probably hardly readable, but the black lines represent the recently reported collars.

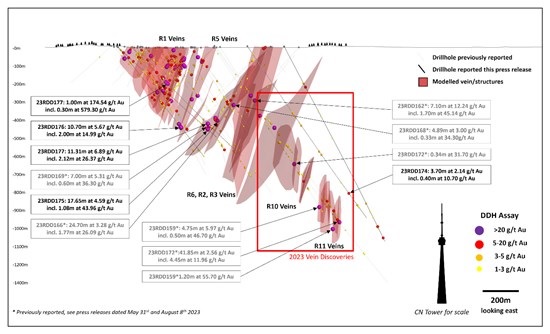

For more clarity, here is the 3D model of Regnault structures:

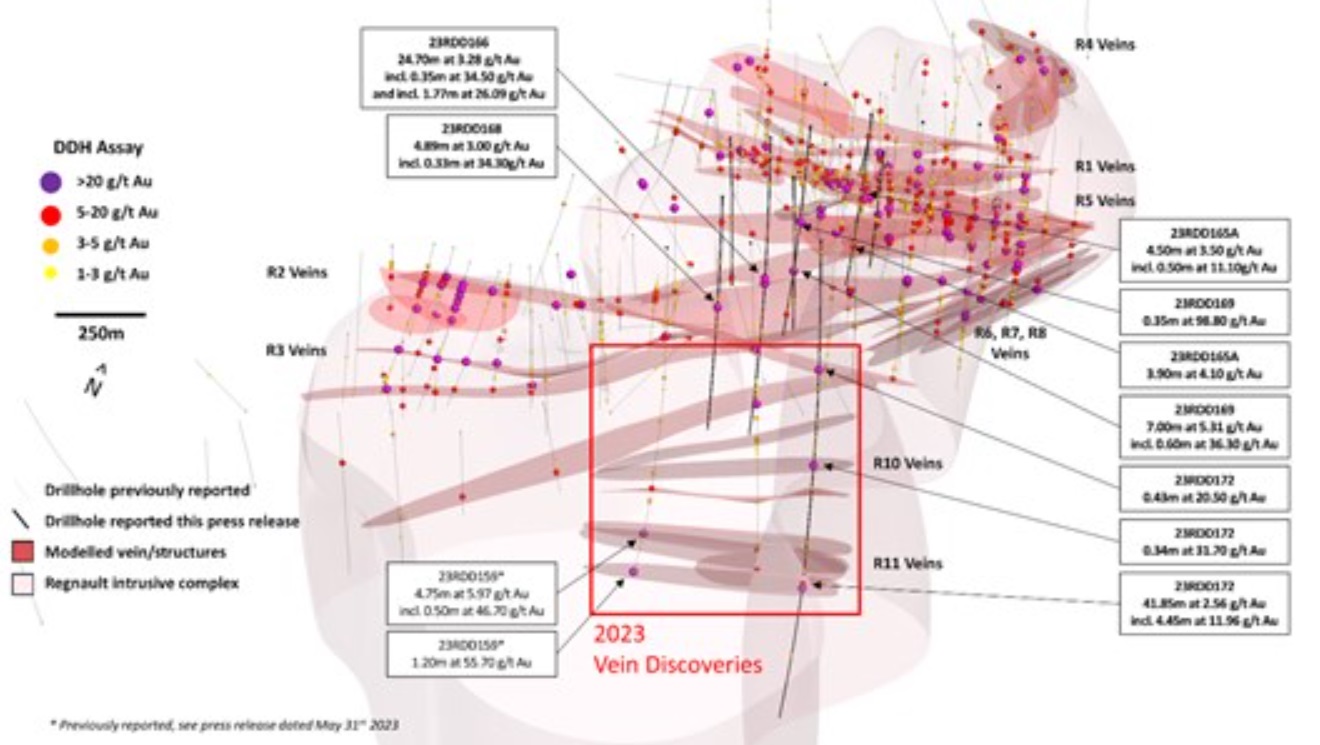

Combined with this older 3D model:

Let’s see what the latest results could have added for ounces at Regnault. The latest reported results didn’t appear to extend R1, so we still arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at a slightly higher average guesstimated grade of 6.2 g/t Au because of the recent high grade intercepts, this would mean a hypothetical 897koz Au.

The R2 vein only saw further infill drilling although narrow and high grade, so R2 is estimated unchanged at 1800 x 200 x 2 x 2.75 = 1980kt, at a slightly higher average guesstimated grade of 8.3g/t Au this results into a hypothetical 528koz Au. For the R3 structure it is the same, so the envelope could still be estimated at 1500 x 100 x 2 x 2.75 = 825kt, at a slightly higher average estimated grade of 7.4g/t Au this results in a hypothetical 196koz Au.

The R4 structure was drilled with broad step-outs, which also intersected much wider (but lower average grade) intercepts (35.45m @ 2.9g/t Au and 8.95m @ 6.34g/t Au) so this mineralized envelope increased considerably, and is guesstimated at 300 x 300 x 6 x 2.75 = 1.485Mt, at a lower average guesstimated grade of 5g/t Au (coming from 10g/t Au) this could imply a hypothetical 238.75koz Au (coming from 36koz Au so this is significant). This results in a total hypothetical estimate for R1-R4 of 1.86Moz Au.

Step-out results were also reported for the R5-R8 veins. For the R5 vein, the envelope is estimated this time at 900 x 75 x 5 x 2.75 = 928kt, at a slightly lower average estimated grade of 8.5g/t this results in a hypothetical 254koz Au.

For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated a 100m longer now and slightly thicker due to the headline 19.25m @ 19.95g/t Au intercept, and sits at 1200 x 75 x 6.5 x 2.75 = 1608.75kt, at a slightly higher average estimated grade of 8.5g/t this results in a hypothetical 440koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 1050 x 50 x 7 x 2.75 = 1Mt, at an average estimated grade of 8g/t this results in a hypothetical 260koz Au. For the R8 vein, the envelope is estimated at 1050 x 80 x 3 x 2.75 = 693kt, at an average estimated grade of 7.5g/t this results in a hypothetical 167koz Au.

For the deepest structures R9, R10 and R11, up dip drilling was completed to test extensions towards the surface, but unfortunately intersected mineralization wasn’t economic so far:

“Two drill holes were designed to test the shallower portions of the Regnault diorite up dip from the 2023 winter discovery holes that intersected mineralization down to 1,000m vertical depth including 23RDD172 which returned 2.56 g/t over 41.85m including 11.96 g/t Au over 4.45m (see press release dated August 8, 2023).

These large step-outs (200-300m) returned narrow, moderate grade mineralization within the R9, R10, and R11 shear zones including 23RDD174 which returned 3.70m at 2.14 g/t Au including 0.40m at 10.70 g/t Au, a 215m up dip step-out from 23RDD159 that returned 1.20m at 55.70 g/t Au (see press release dated May 31, 2023).”

Therefore I go with my earlier estimates for these 3 veins. For the R9 vein I arrived at 1250 x 50 x 3 x 2.75 = 516.5kt, at an average grade of 8g/t this remains at a hypothetical 133koz Au. My existing estimates for the other veins resulted in 3 x 450 x 50 x 1 x 2.75 = 185kt @ 10g/t = 60koz Au for R10, and 3 x 450 x 50 x 2 x 2.75 = 371kt @ 15g/t = 179koz Au for R11. These R5-R11 veins result in a total, hypothetical number of 1.49Moz Au.

Adding those two sub totals together, my overall estimate for Regnault would increase quite a bit, and would go from a hypothetical 2.98Moz Au to a hypothetical 3.35Moz Au for now. For average grade I prefer to go slightly lower because of R4, from 7-8g/t Au to 6.5-7.5g/t Au.

Kenorland is drilling at full speed ahead at Regnault with 4 rigs, and at O’Sullivan with 2 rigs, and is still well funded with over C$20M in the treasury. The company will come up with an exploration update on all other projects later this quarter.

Conclusion

After closing the conversion transaction of their 20% interest in the Frotet project into a more valuable and much more tradeable 4% NSR, Kenorland keeps delivering with the drill bit at Regnault. According to my estimates, the final set of drill results has added another guesstimated 0.4Moz Au, arriving at a hypothetical 3.35Moz Au for now. This will certainly provide Sumitomo with a nice base case to build a mine plan upon, so I’m definitely looking forward to way Sumitomo plans to advance Regnault towards production, as solid plans for realization would put the 4% NSR firmly on the radar of the big royalty names. Besides this, let’s not forget Kenorland is well funded on its own, and doesn’t have just JV Tier I opportunities, but also some fully owned exploration jewels to work for on this year. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.