Kenorland Minerals Finds More Gold At Depth At Regnault Gold Project, Quebec; Commences Exploration At Fully Owned South Uchi Project, Ontario

Ice drilling at Regnault target, Frotet project, Quebec

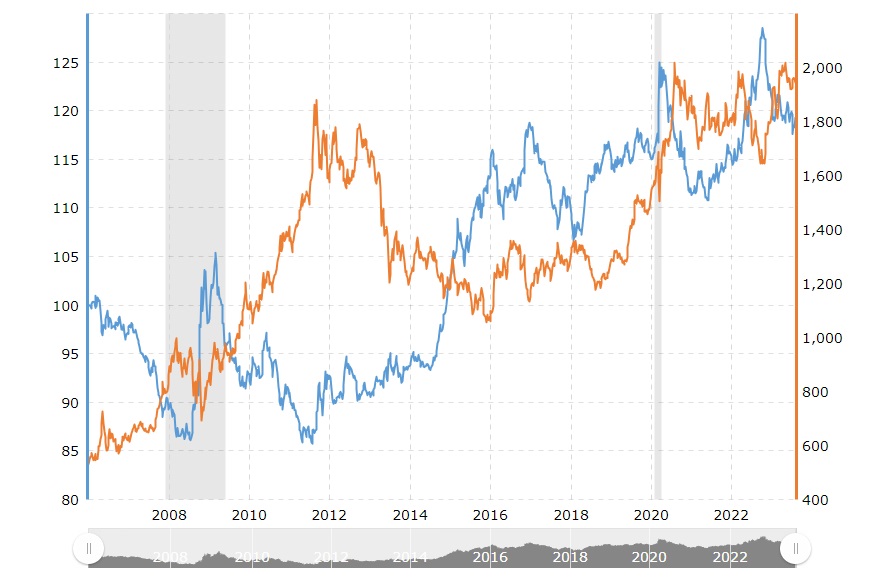

After experiencing the last rate hike by the Federal Reserve in July, it seems more and more likely that the world economy is heading into a soft landing, with inflation continuing to go down. Although there are lots of mixed signals, spearheaded by Chinese developments pointing downwards (recession indicators), the Fed is anticipating (or more aptly the markets are) one last rate hike, a rate pause for the remainder of 2023, and rate cuts in 2024. As this seems to be set in stone already, the markets are already pricing this in, approaching all time highs again. A lower interest rate would mean a cheaper US Dollar, and this usually is a strong sentiment driver for the gold price, especially coupled with negative real interest rates. This is something we don’t experience anymore with the Fed rate at 5.5% now, and US inflation at 3.18% in July. This could mean a less aggressive gold bull market than anticipated by many when the Fed pivots to rate cuts, but I do believe a sequence of rate cuts should depreciate the US Dollar, and might have at least some effect on the gold price.

The correlation isn’t always clear as the gold price remains affected by sentiment drivers and not fundamental causes.

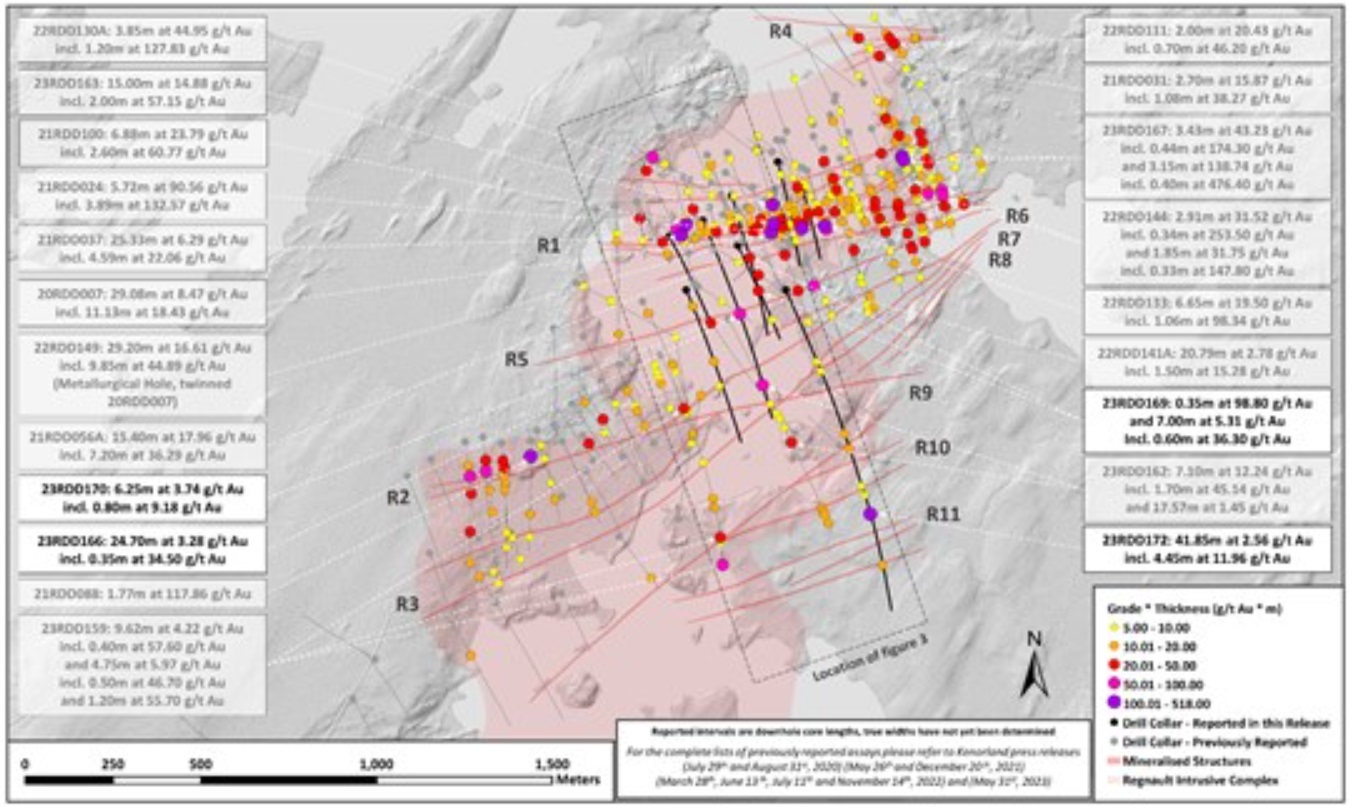

A higher gold price should of course be good for Kenorland Minerals (KLD.V)(3WQO.FSE), with their flagship Regnault project (20/80 JV with Sumitomo) focusing on the yellow metal. The latest batch of announced results showed additional economic intercepts at depth, as it focused on deeper veins besides further infill exploration of known veins. The highlight result was the 4.45m @ 11.96g/t Au intersection on the R11 Vein, the deepest discovered vein so far at Regnault.

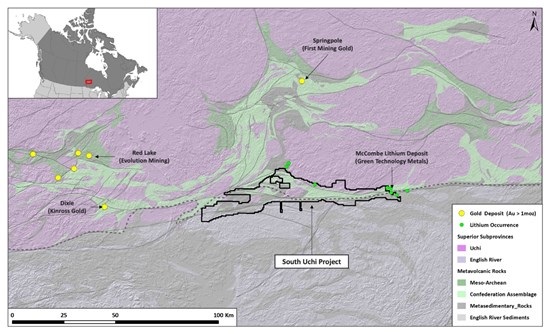

The company also commenced large-scale surface exploration at their South Uchi project in Ontario, including their thoroughly tested glacial till geochemical survey method. Kenorland is aiming at gold, nickel-copper and lithium mineral systems.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

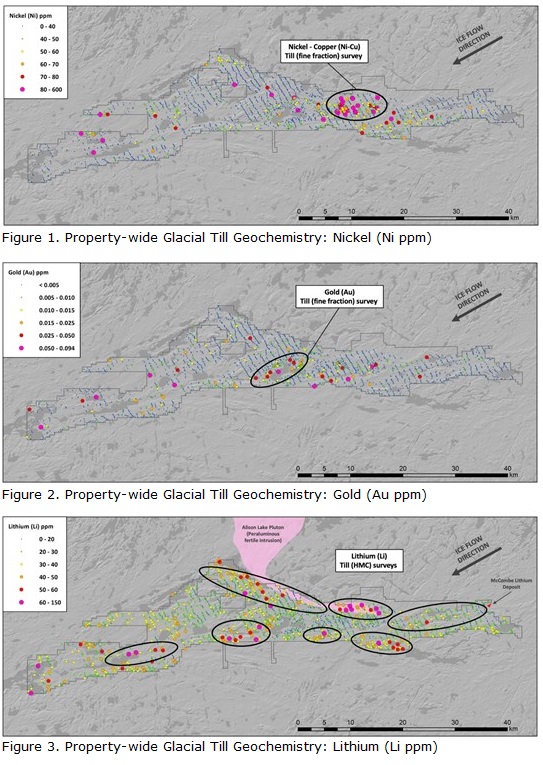

Before I delve into the results of the 2023 winter drill program at Regnault, I would like to discuss the South Uchi program a bit further with CEO Zach Flood. Barrick returned the project to Kenorland earlier this year, as geochemical surveys didn’t return sufficient results to convince Barrick to spend more on the extensive property. The property-wide results looked like this for the target metals:

When looking at the results, they didn’t seem impressive as 8 samples of 0.05 – 0.094 ppm Au for best results is well under the standard average 20ppm which is often used as a minimum threshold. Is this low number due to the nature of looking at glacial till data? CEO Flood had this to comment, and why he thinks the encountered values are still of interest: “Yes we are looking at till data here, which is not residual soil data and not rock data either, its transported (and diluted) material. The tenor and spatial distribution of gold in till in the primary gold target area is in fact comparable to what we saw in the first pass sampling at Regnault, so we are very excited to follow up on this target. Regnault was also not the only gold system we discovered using these methods; earlier this year we announced a grassroots gold discovery at Chebistuan, which is held under option to Newmont.”

The same could probably be said of the nickel-copper samples, and the lithium samples. CEO Flood commented: “The thresholds for base metals are high for till samples and lithium is a difficult one to compare, because basically no one has done geochemical exploration in glacial environments for pegmatites - but can tell from the dataset the samples are statistically anomalous.”

The company believes there could be significant exploration potential due to obtained results and lack of historic exploration, and the discovery of several favorable geological structures, among those strong shearing, alteration, folded metavolcanic-clastic and metasedimentary-iron formation stratigraphy, all representing strong indicators for orogenic gold mineralization.

South Uchi is located in the western Superior Craton, and also contains Archean aged mafic to ultramafic greenstone rocks, besides a gravity trend, all factors in itself hosting magmatic Ni-Cu-PGE deposits, and the project possesses all three of them. As previous sampling showed multiple lithium-cesium anomalies, management believes these could indicate LCT pegmatite systems, despite their low grade. A large baltholith and neighbouring lithium deposits reinforces this belief.

CEO Zach Flood expects the surveys to last until October, and results are expected around November. Further exploration including drilling will be completely dependent on results. If they were to drill it would be sometime next year.

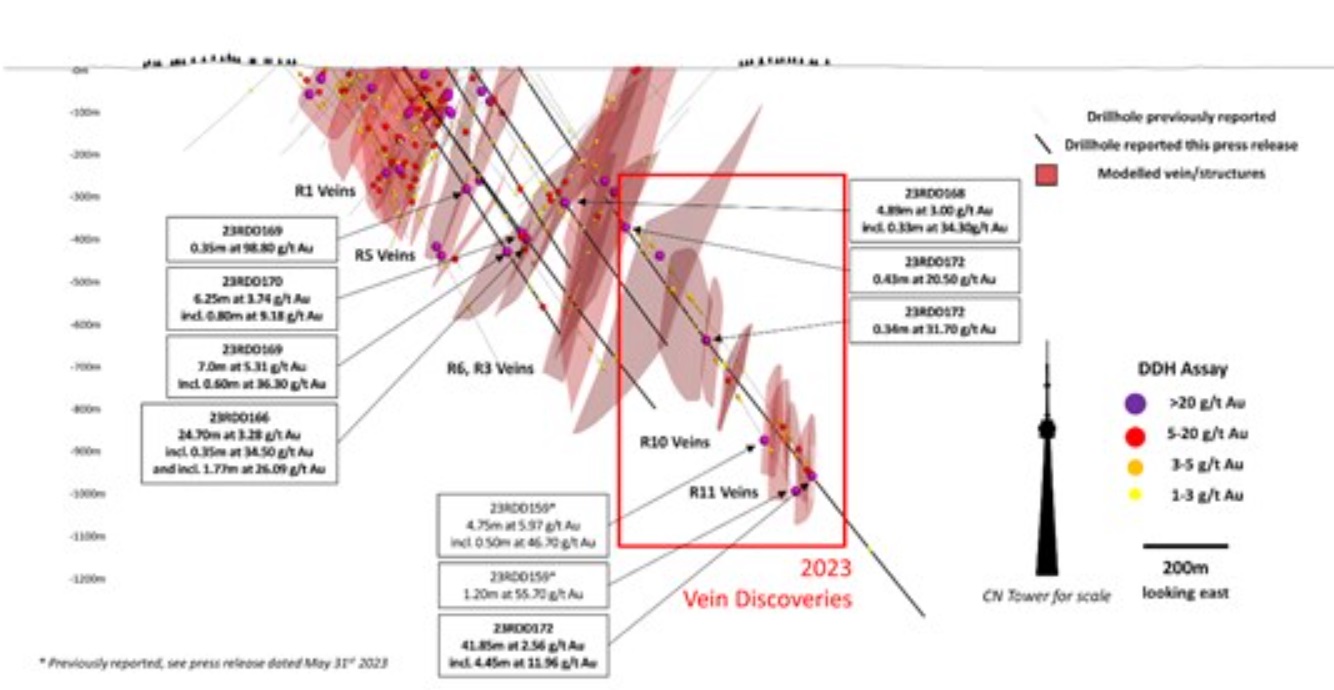

After discussing South Uchi, it’s time to have a look at the latest drill results. The 2023 winter drill program at the Regnault gold discovery, part of the Frotet project in Quebec (20/80 JV with Sumitomo), has been completed, and Kenorland reported the balance of the results in their August 8, 2023 news release, coming from 8 holes representing 6,679m of core, part of a total of 13,360 meters over 15 drill holes.

Drill highlights include the following, with 23DD172 being the most significant result:

- 23RDD172: 2.56 g/t Au over 41.85m incl. 11.96 g/t Au over 4.45m at R11 (new vein discovery)

- 23RDD166: 3.28 g/t Au over 24.70m incl. 26.09 g/t Au over 1.77m and incl. 34.50 g/t Au over 0.35m at R5

- 23RDD169: 98.80 g/t Au over 0.35m at R5 and 5.31 g/t Au over 7.00m incl. 36.30 g/t Au over 0.60m at R6

- 23RDD170: 6.25m at 3.74 g/t Au incl. 9.18 g/t Au over 0.80m at R6

These highlights are indicated on the map below (although hardly readable, the corresponding drill collars are the black lines in the centre):

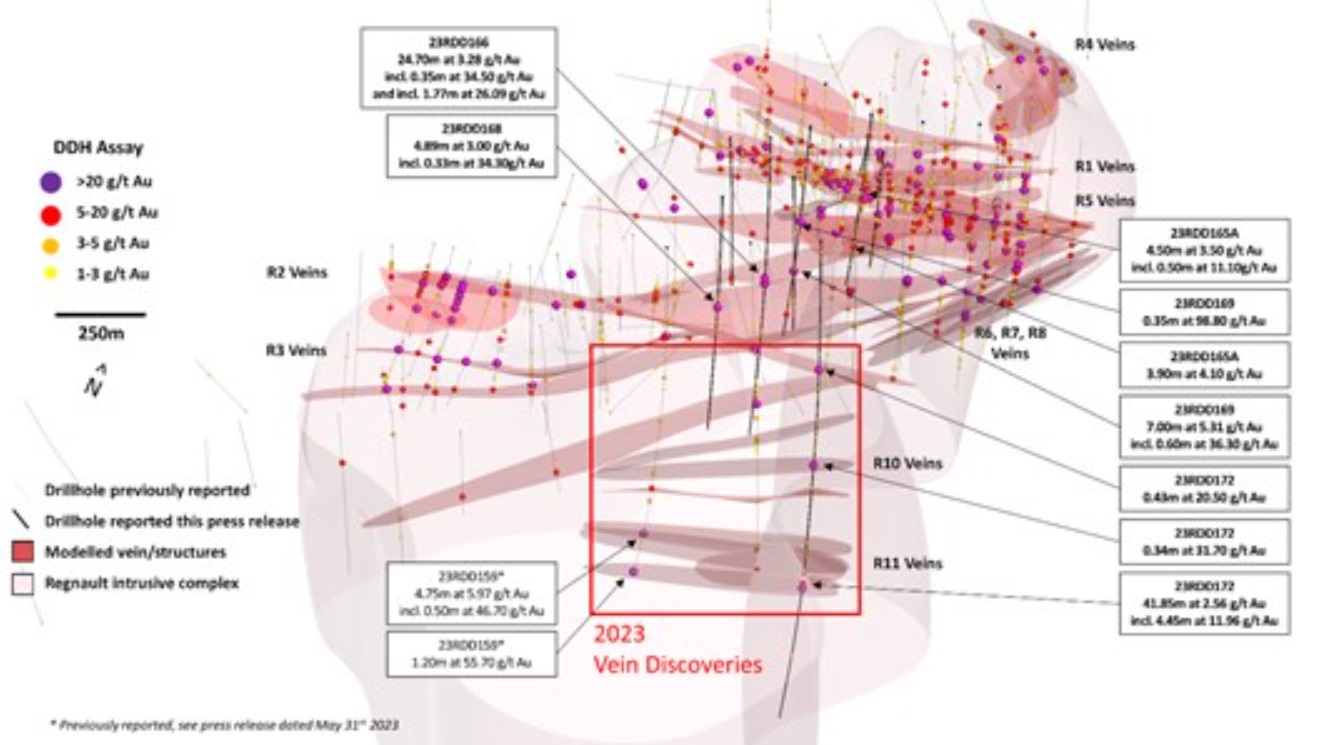

There was a combined strategy of infill, stepouts, and deeper drilling to find new structures. A big focus was the center of the system between R5, 6, 7, 8 and the R2/R3.The deeper drilling was also targeting new parallel vein structures, similar to how they found the R5, R6, 7, 8 etc, the deepest hole drilled was just over 1600m, and two more holes of 1200m were completed as well in that target area. As Kenorland was successful in hitting new parallel vein structures (R9, R10, R11), CEO Flood was obviously happy with the results:

"The 2023 winter drill program was a great success highlighted by the discovery of multiple high-grade gold bearing structures intersected in the deepest drilling to date. The scale of this project is reaching critical mass and I believe the value of this will become recognized over time."

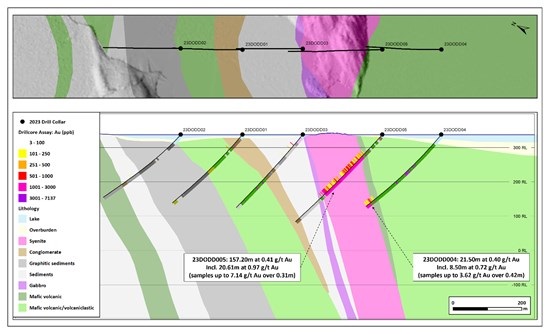

The R10 and R11 veins are visualized here:

So far, Regnault seems to be following the concept of a large intrusive Lamaque like plug with series of stacked, (semi) parallel veins extending to great depths. The latest results also indicate further extensions of many known veins, and especially R2 and R3 appear to be quite long, almost 2km:

The new veins R10 and R11 seem to be multiple stacked vein sets, consisting of 3 separate veins each. The R11 length is estimated at about 800m, the width 100m, and the R10 length about 800m and the width 50m. Lots of intercepts were extremely narrow, below 50cm but high grade (25-36g/t Au).

At the conclusion of the 2023 winter drill program, a total of 70,356m over 173 holes have been drilled to date at Regnault, beginning with the discovery drill program in 2020. The upcoming fall drill program, anticipated to begin in mid-September, will include up to 11,300m of diamond drilling, which will likely be a combination of infill and step-out according to CEO Flood. A large-scale surface geochemical program, including the collection of ~1200 soil samples (glacial till substrate), will also be completed immediately to the east of the Regnault discovery to define additional targets for drill testing next winter.

JV partner Sumitomo is pleased by the results, and tends to be more interested towards an emphasis on infill drilling, as they contemplated interest in a resource estimate in the not too distant future. CEO Flood, being the explorer he is, would love to find out first how big the system could be, but also understands that Sumitomo would be satisfied with a 2.5-3Moz gold deposit, and exploration potential at depth would then be drilled during underground mining, which would be much more cost-effective, as deep drilling from surface would be expensive.

With the current results in hand, it should be possible to update my back-of-the-envelope estimate for the mineralized potential at Regnault.

The R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be simplified as one zone. The latest reported results didn’t appear to extend R1, so we still arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at an average guesstimated grade of 6g/t Au, this would mean a hypothetical 870koz Au.

The R2 vein has been connected to the R5-R8 structures, so R2 is estimated at 1800 x 200 x 2 x 2.75 = 1980kt, at an average guesstimated grade of 8g/t Au this remains a hypothetical 509koz Au. For the R3 structure we have more visual information now, so the envelope could be estimated at 1500 x 100 x 2 x 2.75 = 825kt, at an average estimated grade of 7g/t this results in a hypothetical 186koz Au. The R4 structure appears to be unchanged, so this mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 10g/t Au this could imply a hypothetical 36koz Au. This results in a total hypothetical estimate for R1-R4 of 1.60Moz Au.

For the R5-R8 veins a link between R2-R3 and R5-R8 has been established through the summer program, so I’m inclined to extend the R5-R8 veins by 100m each. For the R5 vein, the envelope is estimated at 800 x 75 x 5 x 2.75 = 825kt, at an average estimated grade of 10g/t this results in a hypothetical 265koz Au.

For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated now at 1100 x 75 x 6 x 2.75 = 1361kt, at an average estimated grade of 8g/t this results in a hypothetical 350koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 950 x 50 x 7 x 2.75 = 914kt, at an average estimated grade of 8g/t this results in a hypothetical 235koz Au. For the R8 vein, the envelope is estimated at 950 x 80 x 3 x 2.75 = 627kt, at an average estimated grade of 8g/t this results in a hypothetical 161koz Au.

The envelope for R9 appears to be pretty long as shown on the first map, at least 1250m long, and is therefore estimated conservatively at 1250 x 50 x 3 x 2.75 = 516.5kt, at an average grade of 8g/t this results in a hypothetical 133koz Au. New triple vein sets were also discovered at depth as discussed, which were called R10 and R11, and each has a minimum length of 450m per the news release. This would result in 3 x 450 x 50 x 1 x 2.75 = 185kt @ 10g/t = 60koz Au for R10, and 3 x 450 x 50 x 2 x 2.75 = 371kt @ 15g/t = 179koz Au for R11.

These R5-R11 veins result in a total, hypothetical number of 1,383koz Au.

Adding those two sub totals together, my overall estimate for Regnault would come in at an hypothetical 2.98Moz Au for now, up over no less than 21% from my last estimate of 2.47Moz Au, so I consider the latest batch a pretty meaningful one. For average grade I maintain an estimated 7-8g/t Au. When listening to CEO Flood who becomes more and more vocal about it, I do believe Sumitomo might be inclined to do a NI43-101 compliant resource on Regnault fairly soon, as the 3Moz threshold seems to be within reach now.

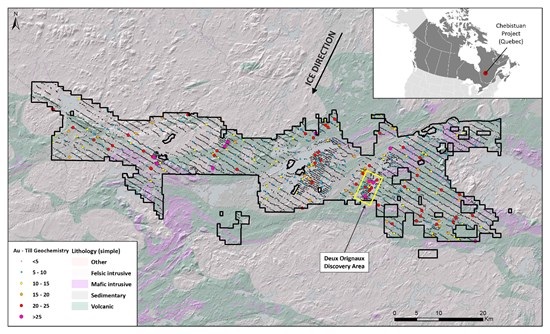

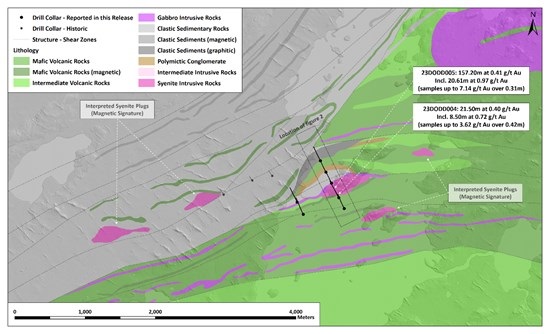

That’s it for flagship Regnault for now, let’s have a look at 2 of the most important other projects. The Chebistuan Project, Quebec saw a maiden 2,170m, 7 hole diamond drill program recently completed at the Deux Orignaux target area.

Seven shallow holes, up to 358m in length were drilled along two fences to test across a structural and magnetic corridor within the Deux Orignaux target area.

Along the eastern drill fence, hole 23DODD005 intersected a mineralized porphyritic syenite intrusion over 157.20m averaging 0.41 g/t Au from 84.41m to 241.61m downhole, including 20.61m at 0.97 g/t Au with individual samples returning up to 7.14 g/t Au over 0.31m along the northern contact zone.

Although low grade, CEO Flood was pleased with the results:

"The grassroots discovery of another significant gold system is a major milestone for our company and is a testament to our exploration strategy, as well as the expertise of our exploration team. Following over two years of systematic geochemical exploration, initially covering over 178,000 hectares of ground, we managed to make this discovery with a very limited initial drill program, and we believe we've only scratched the surface of this intrusion-related gold system. We're very excited to see how this evolves moving forward."

Tanacross Project, Alaska: The recently approved 2023 exploration budget and program includes 4,500m of diamond drilling scheduled to commence in June. Drilling will focus on three target areas; East Taurus, West Taurus, and South Taurus. Results are expected late fall/early winter if drilling wraps up in September. CEO Flood stated: “We are wrapping up the program shortly, will update market in due time.”

Finally, Kenorland holds C$21M in equity interests and private holdings, after recently selling 1M shares of Li-FT Power for C$7M in July. Besides being a prospect generator, and planned exploration expenditures of C$30M, it’s worth noting that Kenorland has become a profitable entity with significant taxes owing this year based on C$3.5M in revenues (management fees for being operators) and nearly a total of C$100M in expenditures applied to a properties by the end of this year (since inception).

Conclusion

According to my estimates, Regnault should have already reached the 3Moz Au threshold, which might be the number that could trigger JV partner Sumitomo to begin with a NI43-101 compliant resource on the project. As always, majority owners usually aren’t too inclined to shine too much light on their intentions, but CEO Flood has regular meetings with Sumitomo, and believes the Japanese giant might be shifting gears soon in this regard, as they love to develop mines. The fall program at Regnault will begin in mid-September, and JV partner Sumitomo will indicate which direction will be chosen, further exploration for size, or infill for delineating a resource. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals and LiFT Power. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.