Platinex Closes C$2.0M FT Financing; Looking For District Scale Gold, Copper And Nickel In Ontario; Spinning Out Uranium Focused Green Canada Co

Introduction

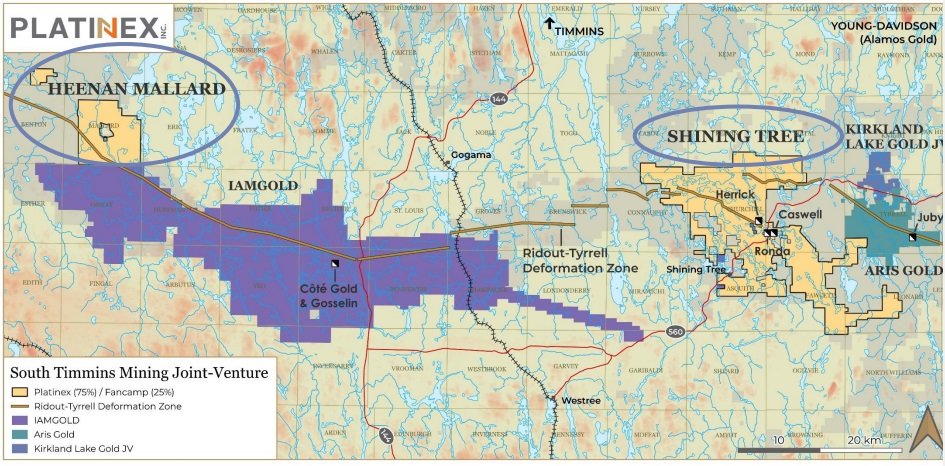

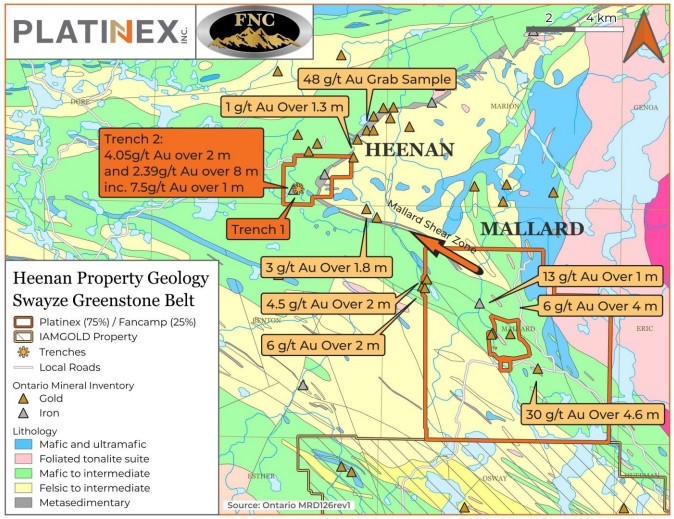

After spending almost 1.5 years assembling and permitting several significant projects in Ontario, junior explorer Platinex Inc (PTX:CSE)(9PX:FRA) commenced reconnaissance exploration work in August at their gold and lithium projects, with assays for the lithium project called Muskrat Dam being expected around in January 2024. Solid gold sampling results have been coming in since October at the large Shining Tree project and the nearby, smaller Heenan and Mallard projects. These 3 gold exploration projects are part of the South Timmins JV with Fancamp Exploration (FNC.V), which funds a 2 year exploration program. No time was wasted, and a first 5 hole drill program has begun at the Heenan Gold project to test a greenfield trenching discovery and an IP target, and step out from these as well. There has not been any historical drilling at Heenan. There was an attractive historical gold discovery at nearby Mallard by Noranda.

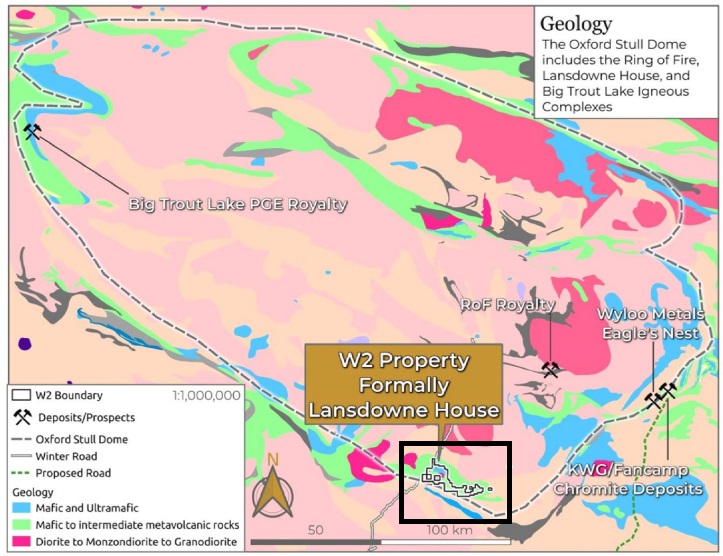

The actual flagship project of Platinex is the fully permitted W2 copper-nickel-PGE project, which is a district scale land package close to the Ring of Fire. This project has seen the most exploration in the past, including 55 historic drill holes, indicating significant mineralization. Recent 3D modeling and interpretation of existing data has revealed large envelopes of potential near surface copper-nickel mineralization, which are waiting to be confirmed and further explored. The large scale of the project will likely see Platinex aiming at a JV, spinout or selling to a major. The recent closing of a C$2.0M financing enables Platinex to do significant exploration, potentially indicating value for third parties.

Another interesting aspect of Platinex is the creation of a subsidiary called Green Canada Co. (GCC), which was launched with a portfolio of 4 uranium projects spread across Saskatchewan, Ontario and Quebec, combined with the Muskrat Dam lithium project, also located in Ontario. The plan is to add another uranium project which will likely be the most prominent one, and after this spin out GCC around March/April 2024, with Platinex dividending out GCC shares to Platinex shareholders.

All pictures are company material, unless stated otherwise.

Company

Platinex is a junior mining company exploring mineral properties in Canada. Management under CEO Greg Ferron has been opportunistic in acquiring new projects where value is likely to be added quickly. For now Platinex is focusing on the W2 Copper-Nickel-PGE project in the Ring of Fire Region, the 75/25 South Timmins JV with Fancamp exploring for gold, which recently reached all-time highs, and the spinning out of Green Canada Co, involving uranium/lithium projects. Demand for battery metals such as copper, lithium, nickel and PGEs (platinum group elements including platinum and palladium), is at historical highs, and expected to remain high due to the unstoppable electrification and durable energy paradigm shift. A shortage in uranium caused by funds and utilities buying up all available uranium already took the price of U3O8 to US$90/lb, after trading at around US$50/lb a year ago, and this shortage is expected to deepen in 2024. It seems Platinex is focusing on the right metals here.

Share structure

Platinex is listed on the CSE, and there are 274.15 M shares outstanding (fully diluted 313.75 M), 44.45 M warrants (average strike price of C$0.06) and incentive stock options issued to the tune of 15.5M options. Management is contemplating a roll-back. Platinex has a current market capitalization of C$13.35 M based on the December 22, 2023 share price of C$0.045. The average daily volume stands at 243k in Canada, and there is increasing volume in the US.

Platinex Inc, 10 year timeframe (Source: tmxmoney.com)

CEO Greg Ferron has been working quietly under the radar since he was appointed to his current position in November 2021, and the various projects in Platinex’s portfolio are finally advancing now, which could hopefully lead to a breakout of the current trading range. Platinex is cashed up nowadays with approx. C$3.5M in the treasury, after closing an oversubscribed (from C$1M) C$2M flow-through financing @4c and no warrant on December 21, 2024. Proceeds of this round will be used for exploration expenditures completed at the W2 project. Shares are tightly held, as management holds no less than 10.5% of the current shares outstanding (CEO Greg Ferron holds 2.5%, Chairman Trusler & Family 8%), Treasury Metals (TML.TO) holds 7.5%, Fancamp 9.5%, Alamos Gold 3%, European HNW’s with strong ties to management hold 25%, and the company also enjoys approx. 5% institutional ownership.

Management

CEO Greg Ferron: Mr. Ferron has 20 years of mining industry and capital markets experience. He has held various senior level roles in mining, corporate finance, corporate development, and investor relations – including at uranium developer Laramide Resources (LAM.TO), gold developer Treasury Metals (TML.TO), TMX Group and Scotiabank. Mr. Ferron has significant diverse merger and acquisitions experience, including Laramide’s Westwater ISR project acquisition, and more recently the Goldlund project acquisition as CEO of Treasury Metals, creating one of Canada’s largest gold developers. Mr. Ferron is also a director of Fancamp Exploration Inc (FNC.V).

Chairman James Trusler: Chairman from 1998 to present; CEO and President of the company 1998-2018, 2019 to 2021; President, J. R. Trusler & Associates (mineral consultant), 1995 to present. Geological Engineer with over 45 years of exploration experience with a history of discovery (multiple Ni-Cu-PGM deposits at the Raglan Nickel mine, owned by Glencore) and strategic acquisitions of world class scale gold, uranium and Ni-Cu-PGE deposits.

Director Felix Lee: Mr. Lee is an economic geologist and Senior Executive with over 30 years of business and project management experience in the minerals industry both in Canada and internationally. Mr. Lee completed his tenure as Director and Principal Consultant to CSA Global Canada in 2019 and was previously owner and President of the predecessor Toronto-based geological consultancy ACA Howe International Limited. Felix Lee is a former director and President of Prospectors and Developers Association of Canada (PDAC), the largest such mining industry organization in the world.

Technical Advisors:

The most prominent name in the advisory team is the recently appointed Mac Watson, a Canadian Hall of Fame entrepreneur and geologist based in Montreal, who was involved in many discoveries, including the Holloway Gold Project and several deposits in the Ring of Fire. Another big name is Dr. Fred Breaks (P.Geo), who is very experienced in greenstone belts, but also a well-known lithium expert. He discovered the two largest lithium-rich rare-element deposits (Li-Ta-Rb-Cs) in Ontario: Separation Rapids (Avalon Advanced Materials) and Pakeagama Lake (Frontier Lithium). Other very experienced geologists are Ike Osmani (MSc, P.Geo), who has extensive experience with various deposit types in Ontario, and actually described the predecessor of the current W2 project, and Blaine Webster (P.Geo). Mr. Webster is a very experienced geophysicist, who discovered among others the Juby deposit and Sandy Lake Gold Project, and completed 1,500 geophysical surveys in 35 countries as President of JVX Ltd. He is also the former President of Goldeye Exploration Ltd. and President of Golden Mallard Corp.

Projects

South Timmins JV

The South Timmins 75/25 JV with Fancamp located in Ontario is viewed as a strategic asset for the company. Its projects are located in the Abitibi Greenstone Belt in Ontario, home to some of the richest gold mineralization worldwide, with total production surpassing a staggering 180 Moz. The JV is fully funded with C$2M remaining to complete a 2 year exploration program. With a large land package in an active camp including Alamos Gold (AGI.TO), IAMGold (IMG.TO), Aris Gold (ARIS.TO) and many quality juniors, there is an real opportunity for the Shining Tree camp to contain a substantial gold deposit.

Both Heenan, Mallard and Shining Tree contain a significant 20km long part of the Rideout Tyrell Deformation Zone (RTDZ), which in turn has delivered several (very) large gold deposits like Coté.

Historic drill results at Shining Tree include 35.1m @ 1.1g/t Au, 5.2m @ 4.3g/t Au, 10.5m @ 1.65g/t Au, 7.15m @2.76g/t Au, 46.3m @0.65g/t Au, 7.2m @2.38g/t Au, 14.1m @1.2g/t Au and 12.2m @1.47g/t Au, all within open pit depths. A trenching program is being completed at the moment, with results likely due in January 2024. Drilling will follow shortly after this.

The combined Heenan Mallard property has also seen historic drilling, with highlights including 3.7m @ 5g/t Au, 3.8m @ 5.3g/t Au, 2.8m @ 3.5g/t and 1.8m @ 6.6g/t Au. Recent channel sampling returned gold values of over 0.5g/t Au for 13 samples out of 41, up to 7.5g/t Au. This is an extraordinary result for sampling, as usually a 20ppb threshold is used (= 0.02g/t Au) for drill targeting.

The JV has just completed 3 drill holes in trenches, and 2 stepout holes, drilling for a total of about 1000m, with assays expected back from the labs at the end of January 2024.

W2 project

Platinex could pick up the W2 project on the cheap, as the Ring of Fire area is known for its lack of infrastructure. However, sentiment around this area changed quickly after Wyloo acquired nearby Noront (NOT.V) for C$616.9M after a bidding war with a formidable competitor: BHP. As BHP is known for doing extremely thorough due diligence on their transactions, it seems certain they saw compelling reasons to bypass the usual Ring of Fire objections (despite being one of the most promising mining opportunities in Ontario for more than a century).

After lots of exploration in the Ring of Fire, the wait is on for building the road that will connect this area to the rest of Canada, most likely with the help of Ontario, the province with the most revenues coming from mining across Canada.

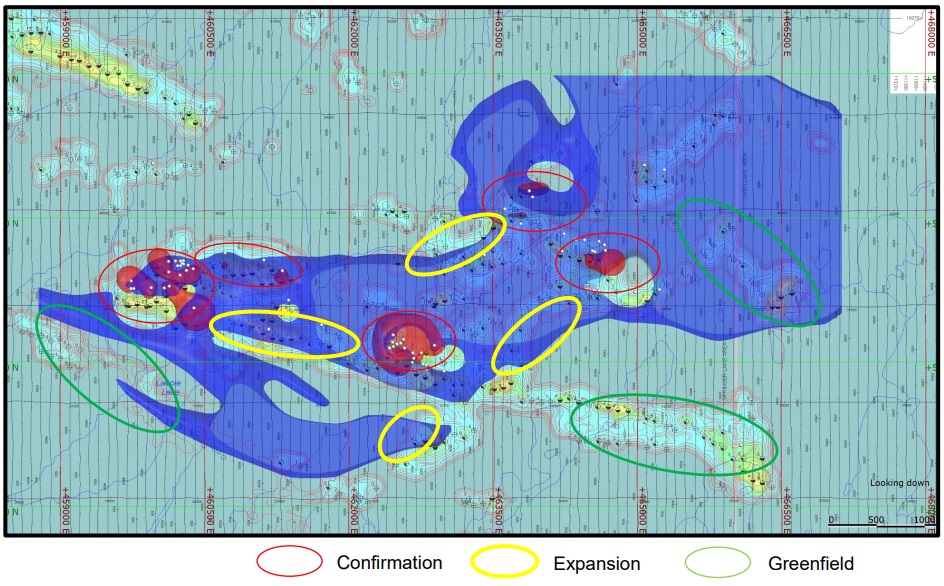

The W2 project has seen significant exploration so far, ranging from sampling to airborne surveys to 8,772m of drilling. Two distinct zones are specified by the company geologists, the Central Area (drilled historically) and the Eastern Area (no drilling yet but very promising EM survey anomalies, correlating well with copper-nickel mineralization):

Drill results for the property were impressive:

- 220.6 m of 0.62% CuEq or 0.956 g/t PdEq (LH-01-06)

- 151.6 m of 0.64% CuEq or 0.971 g/t PdEq including 17 m of 1.08% CuEq or 1.86 g/t PdEq (LH-01-05)

- 42 m of 1.02% CuEq or 1.8 g/t PdEq including a high grade 4.5 m section of 4.52 g/t PdEq (LH-01-02)

Most results were intercepted close to surface, indicating substantial open pit potential. Extensive 3D modeling generated many significant target zones, look at the scale at the bottom right to get an impression of the shear sizes:

When doing a back of the envelope estimate, one could easily arrive at a 70-100Mt target for the orange-red shapes (indicating > 0.8% CuEq), and keep in mind these shapes are all positioned near surface, so this kind of grade would be pretty economic. After the current C$2.0M @ 4c FT financing is closed, a gravity survey will be conducted, together with met work. Drilling is likely to commence in Q1 2024.

Green Canada

Green Canada is an investment vehicle created to give investors and Platinex shareholders direct exposure to predominantly uranium, with a tight capital structure. What I like a lot is the involvement of Laramide Resources, a long term uranium developer and one of the best success stories during the last uranium boom. Laramide CEO Marc Henderson is one of the most experienced, respected and knowledgeable uranium executives out there, and he will likely be a strategic advisor to Green Canada as well, which could be pretty beneficial of course.

Green Canada holds 4 uranium properties at the moment, one with a small historic resource, and will acquire another one soon which will likely be the flagship asset. Besides these projects, the company also received the Muskrat Dam lithium project, which is waiting for summer samples to return from the labs any day now. Some basic data: Green Canada as a private entity has 30M shares and is valued at C$2.7M, with a cash position of C$500k. Greg Ferron will be the CEO (he plans to find a uranium expert on the board and as Uranium VP Exploration and corporate development. The plan is to list in 1H 2024 and raise more at the IPO on the TSX Venture Exchange. Since Platinex currently holds about 60% of Green Canada at the IPO, the idea is to dividend a significant part of this out to existing Platinex shareholders on a pro rata basis.

Key points

- In 2023, Platinex permitted, 3D modeled and defined drill targets for the fully owned district scale 22,094ha W2 Copper-Nickel-PGE property in Ontario, close to the prospective Ring of Fire area, which is home to large chromite, base-, and precious metal deposits

- Platinex jointly owns (75/25 JV with Fancamp) the equally district scale 28,736 ha Timmins South gold project, which is located strategically between other gold projects nearby, and consists of Shining Tree, Heenan and Mallard

- The Shining Tree gold project contains 21 km of the prolific Ridout-Tyrell Deformation Zone, which in turn contains the 6.5 Moz Coté Gold deposit (IAMGold), the 2.3 Moz Juby gold deposit (Aris Gold), the October Gold property (Evolution Mining) and the Dore Gold property (GFG Resources)

- The company has commenced drilling at Heenan, and is planning drill programs for W2, Shining Tree and Mallard in 2024

- Platinex has experienced management, and enjoys strong financial backing by companies like Alamos, Fancamp and Treasury Metals, a few institutions and a group of powerful European investors

- After 1.5 years of preparation, Platinex seems to be ready to finally break out its trading pattern, with a tiny market cap of just C$11.8 M, with lots of drilling and the spinout of uranium hopeful Green Canada coming up in H1, 2024

Platinex seems to be shifting gears now, with drilling at the South Timmins JV recently commencing, more drilling coming up and having raised additional cash for drilling at flagship W2. Especially the latter has a high chance at success in my view, as this project has already seen strong results in the past, and the 3D modeling shows lots of mineralized potential. Add the spinout of Green Canada to the mix with its promising uranium properties and with a flagship asset in the works, uranium being the hottest commodity around these days and likely in 2024 as well together with gold, and it will be clear Platinex could be creating serious value for shareholders next year. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Platinex Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.platinex.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.