Platinex Commences Exploration At Shining Tree And Mallard Gold Projects

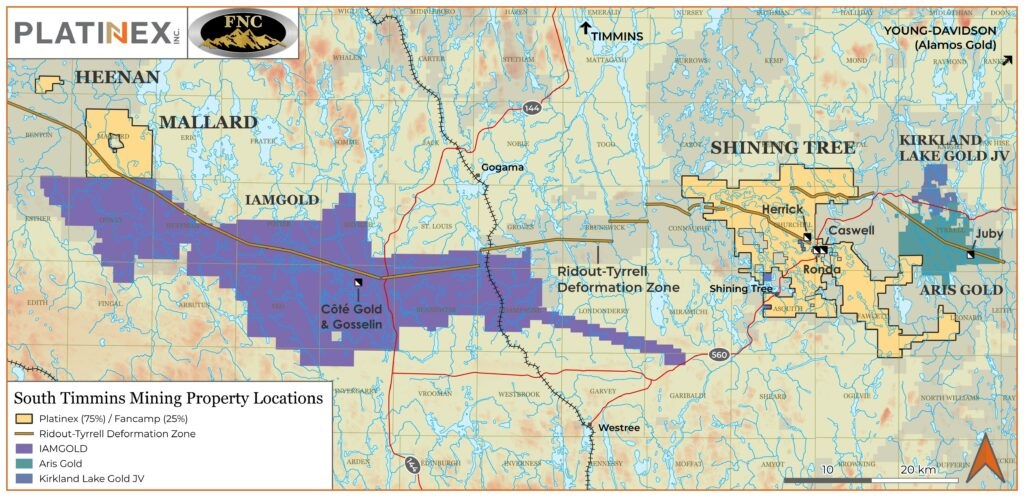

After raising C$2.7M in March and closing the South Timmins JV with Fancamp, Platinex (PTX:CSE)(9PX:FRA) has been busy doing reconnaissance exploration and further developing of exploration plans for their Shining Tree, Heenan and Mallard gold projects located in the Abitibi region, and near well-known assets like Coté (IAMGold/Sumitomo) and Juby (Aris Gold). Since gold is trading near US$2,000 levels and the markets might be facing a soft landing and potentially one more rate hike, followed by a neutral period before a clear pivot sets in, the timing seems to be right for Platinex. Although sentiment isn’t exactly positive at the Venture these days, Platinex has been working hard behind the scenes, accomplishing a lot throughout 2023 although not always with visible results, but since exploration is now the focus for the company I expect this to change soon.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

As expected, the newly acquired Heenan Mallard Gold project which borders IAMGOLD’s Côté Gold Project, and the Shining Tree Gold Property are the first projects to be explored, including a small drill program for Heenan Mallard. Platinex also plans to drill the W2 Ni-Cu project in the upcoming winter.

Following the acquisition of the new gold project near Shining Tree and the joint venture transaction, CEO Ferron decided to focus on Heenan Mallard and Shining Tree. He also focused on completing the permitting and community work at the W2 Cu-Ni-PGE project. In addition, for Muskrat Dam, the company continues to focus on increasing the project profile and building relationships with First Nations. This is understandable as you have to tread carefully regarding permitting and First Nations, although the timing isn’t ideal as lithium is in a red hot stage again, almost singlehandedly saving sentiment on the Venture these days after Patriot Battery Metals came out with a maiden resource of 109Mt, and a strategic investment of C$109M by giant Albemarle one day later.

Therefore, I’m certainly looking forward to exploration news from Muskrat Dam. Asked about a timeline, CEO Ferron stated sampling and prospecting at Muskrat Dam will be completed in August following a grant received from Ontario Government for C$200k which was received in late July 2023. When looking at the latest company presentation on their website I noticed that Muskrat Dam was scheduled for a sale in 2024 for equity, after sampling lithium outcrops this year. One would think that if sampling results would be good, drilling it yourself would be the easiest way to get traction for your exploration dollars.

When asked about this, CEO Ferron answered: “We will of course contemplate all options but the idea is not necessarily an outright sale but actually a spin-off and merger with another player to ensure capital can be accessed for MD. This also allows Platinex to be focused on W2 and Gold joint venture.”

Since Platinex is the operator in the South Timmins JV with Fancamp, it designed and very recently commenced an initial exploration program of C$1.1M which was funded from the recent financing, and after this earn in funds paid for by Fancamp start in 2024. The initial program consists of three separate programs, for Mallard, Heenan and Shining Tree. The current cash position is C$2M.

The exploration program for Mallard will commence in August, and includes prospecting, geochemical surveying, and geological mapping. The primary objective is to identify potential extensions of the Camp and River zones which were previously explored by Noranda and had revealed gold mineralization hosted within two northwest-oriented shear zones. Following the completion of this program, Platinex plans to conduct a diamond drilling program focused on Camp, River, and new targets generated in the area from the upcoming fieldwork. There are advantages and cost savings for a winter drill program, and timing will be determined once management sees the results in August. The project could be drilled in the fall as well, but the costs are higher due to access.

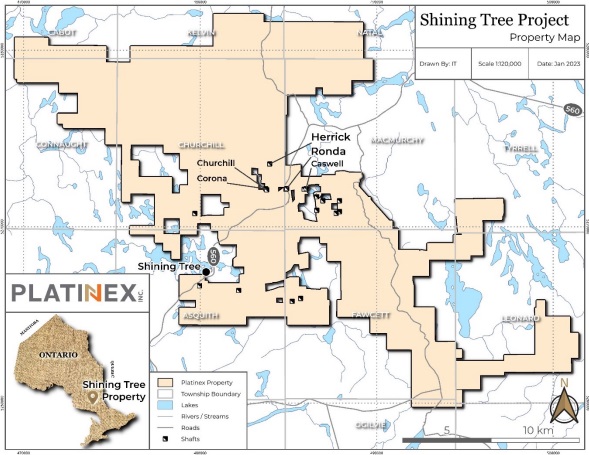

The second exploration program focuses on Shining Tree, and Platinex recommenced activity on July 24, 2023, and is currently advancing a comprehensive program at the Ronda/Central Area including Area 3 of the Shining Tree Gold Project. The central area hosts numerous gold occurrences and small historic producers, and past workers have largely focused on individual vein occurrences. This is a simple claim map, please keep the global shape of the claim package in mind:

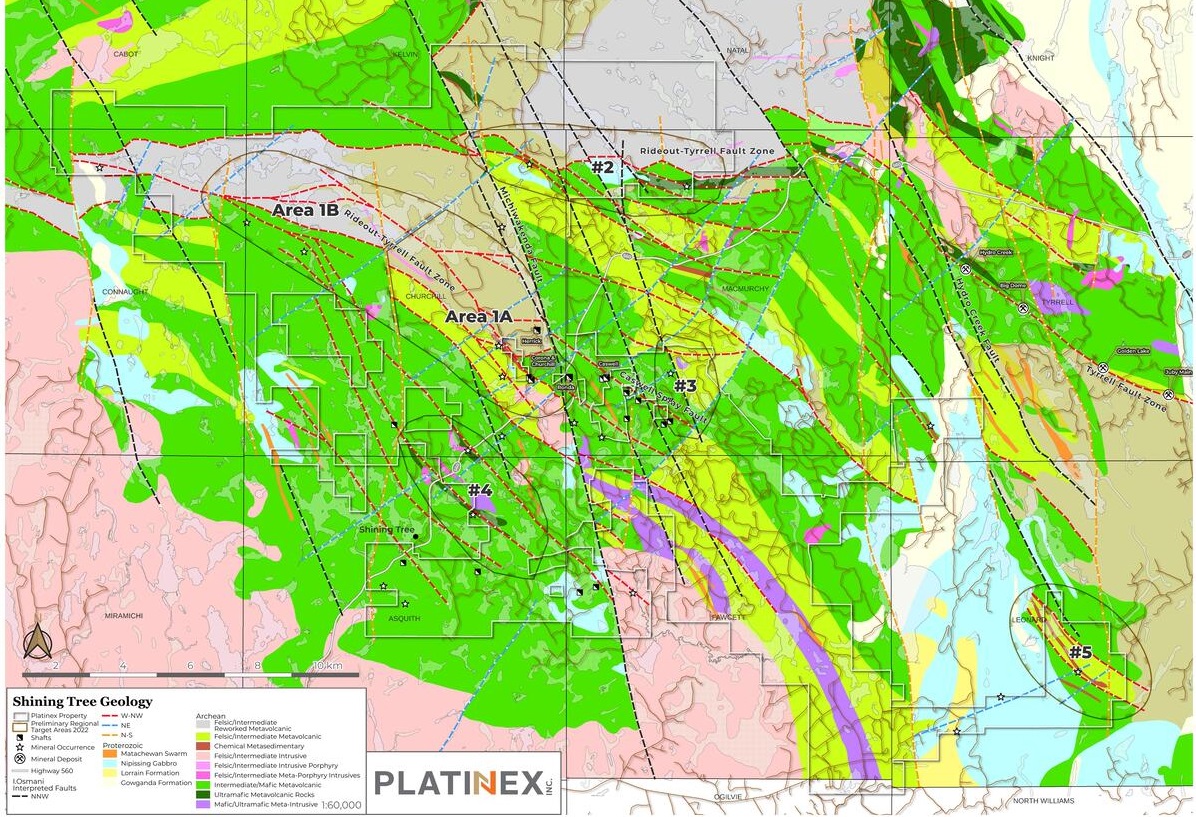

And this is a more detailed map, also indicating mineralized trends and structures, if you look closely you can recognize the claim package boundaries as shown at the map above:

The Joint Venture intends to assess the possible long-strike relationship between these occurrences, and the cross-strike potential, which has been largely ignored. The program includes prospecting, geochemical surveying, and geological mapping. Additionally, stripping and trenching in the Ronda area is planned to better understand the mineralization controls on the surface. Exploration work is also planned in Area 1 which will include reconnaissance prospecting and geological mapping to target the RTDZ northwest of the Herrick area.

Work at Shining Tree’s Area 2 (projected 6 km strike length of the RTDZ) and confirmed with subsequent soil gas hydrocarbon and B-horizon soil sampling has been completed in July, and results will be announced following the receipt of assays within two weeks. . After the assays have been received and interpreted, drill targeting will start asap. The drill program will consist of two phases: 1. new targets in the new areas based on results from the work done the last two years, and 2. expanding the Herrick resource and possibly drilling the former Ronda mine located in the central area of the project. According to CEO Ferron, he likes to assign a C$1.3M budget to this drill program, and has scheduled 2,000m for drilling in October, and Mallard in the winter. Shining Tree could also become a priority for drilling following the results at Ronda trenching.

Last but not least is the Heenan project. A stripping program is planned to commence in September with drilling anticipated to follow upon the completion of the program. The idea is drilling 1,000m at Heenan, also planned for October.

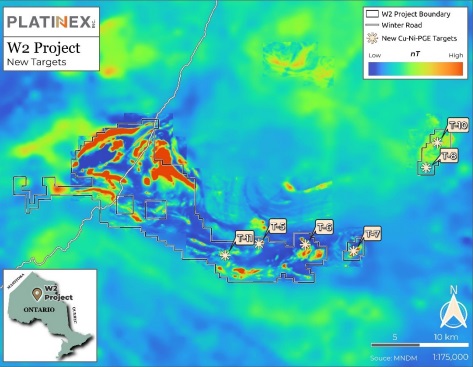

The last project in Platinex’s portfolio is the W2 Copper-Nickel-PGE project, also in Ontario. It is adjacent to Northern Superior’s TPK project and Barrick has taken a large land position that ties onto Platinex’s claims. Platinex recently received additional mineral exploration permits for the project and is in the process of digitizing and compiling historical drillhole data into a 3D model. Maxwell plate modelling of airborne geophysical data is also being carried out, and will be used in conjunction with the 3D drillhole model in order to refine targeting for a drill program that is expected to start in early winter 2024. Community work with the First Nations is progressing well. The company was recently invited to a Mining Day event held by one of the nearby aboriginal communities and attended with representatives from other companies including Barrick and Ring of Fire Metals. Platinex’s technical team has significant ties to the project, with Ike Osmani having managed drill programs there for Aurora Platinum, and Blaine Webster having completed geophysical surveys as part of the original Inco exploration team. Needless to say they know the project very well, and are excited to get drilling underway.

Planned exploration consists of infill drilling to establish the continuity of the historically-defined 7.5 km long widely-spaced CuNi-PGE mineralization corridor, and drill testing several high conductance-high magnetic susceptibility geophysical anomalies identified in a 2008 VTEM survey over the eastern portion of W2. Platinex also plans to carry out a ground gravity survey over the ultramafic intrusion to detect potential chromite mineralization in the northeast part of the western W2 claims, and conducting petrographic and/or preliminary bench-scale metallurgical studies to justify additional drilling along strike of the Fe-Ti-V mineralization in the northwestern part of the W2 claims.

According to Ferron, the phase 1 drill program is 2,500m to infill around the historic resources area and infill drill holes along the 5-7km mineralized trend, and as aforementioned will take place in January 2024.

Conclusion

At Heenan, Mallard and Shining Tree, Platinex has commenced its exploration program for this year on JV ground. After lots of sampling, mapping and trenching, drilling is expected to commence in October at Shining Tree, and later on at Mallard and Heenan. At Muskrat Dam exploration work at this project will start with sampling this month. The W2 project is scheduled for January 2024 or earlier, depending on financings. So after a long wait, Platinex is shifting gears, and will hopefully come with actionable news soon, as shareholders deserve it by now. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock, including stock options. Platinex is a sponsoring company. All facts are to be checked by the reader. For more information go to www.platinex.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.