Platinex Consolidates W2 Copper-Nickel-PGE Project In Ring Of Fire; Gearing Up For Exploration

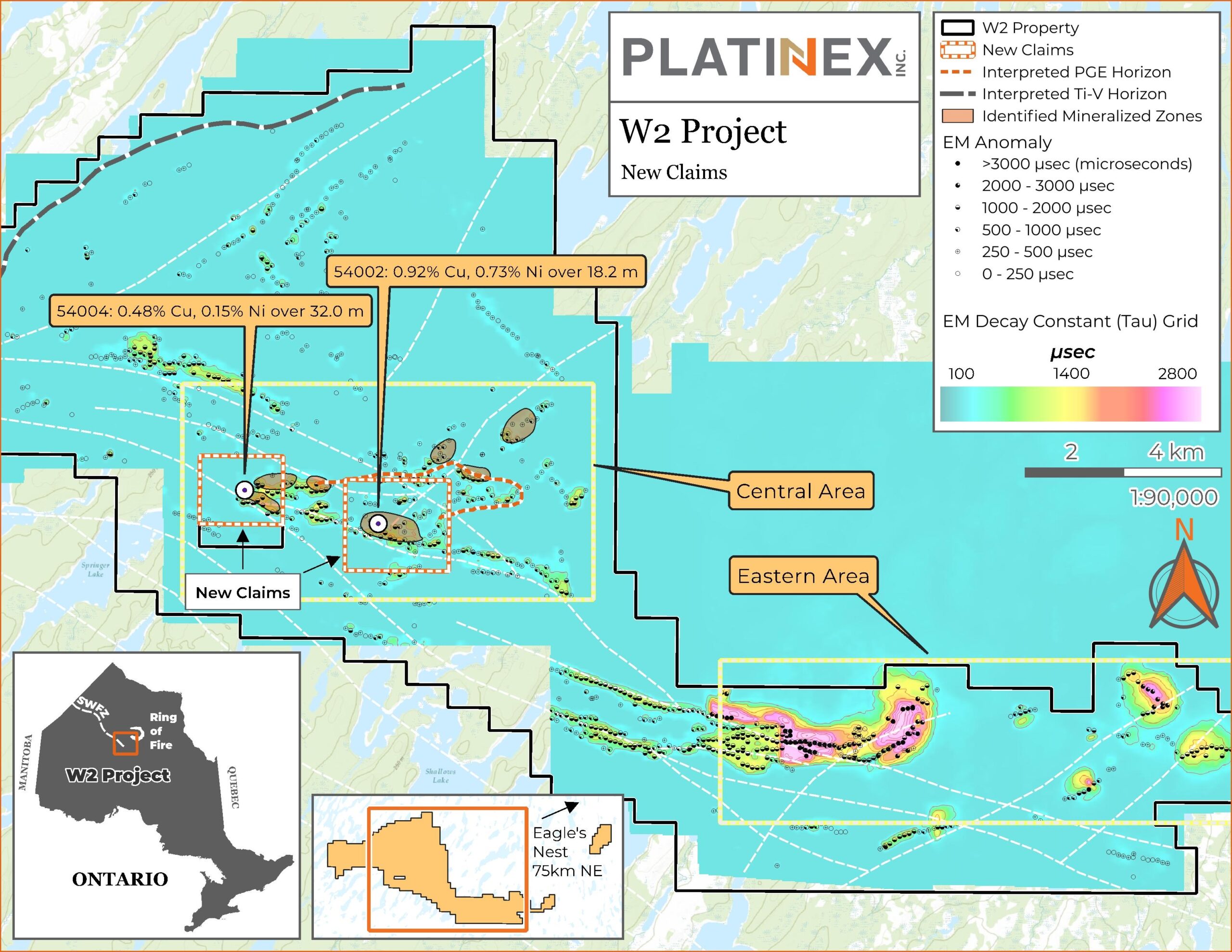

Platinex Inc (PTX:CSE)(9PX:FRA) had to manoeuvre carefully on their fully permitted flagship W2 copper-nickel-PGE project, a district scale land area in Northern Ontario, but finally managed to acquire the two missing pieces of the puzzle in the centre of their claim package.

Management had been trying to buy the two square-shaped claims in the middle of their project for a long time, as they contain lots of drill results including a small historic resource, and are an integral part of the W2 project. The acquisition price was surprisingly modest and mostly paid in Platinex equity, so good negotiating by CEO Greg Ferron there. As Platinex is cashed up with C$3.5M in the treasury, and the mineralized potential is really significant according to the historic drill results and the recent 3D modelling, I’m definitely looking forward to upcoming exploration plans.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Platinex’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Platinex or Platinex’s management. Platinex has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

After acquiring and expanding the W2 project during the last 2 years, CEO Ferron finally managed to get the last two remaining claim packages, located south-west in the Central Area, from the vendor Gungnir Resources (GUG.V), who noticed the progress with exploration permitting, and decided it was time to get some leverage to the upcoming action.

Negotiations were difficult in the beginning, but since Platinex would naturally be the only logical buyer as it owned all claims surrounding the two squared blocks, CEO Ferron managed to settle on pretty favorable terms for Platinex:

“Platinex has paid C$30,000 and issued 3,000,000 Platinex shares to Gungnir. The Platinex shares were issued at a deemed price of C$0.05 and are subject to the standard 4-month and a day hold period. Platinex has also granted Gungnir a 2% net smelter returns royalty on the 19 claims (the “Royalty Interest”), which the Company may repurchase 1% for C$500,000.”

Since Platinex has been trading in the C$0.04 range lately, the total acquisition price accounted for C$150k, 80% being equity, so I consider this pretty cheap considering the strategic location and the 14.6Mt historic resource on the claims.

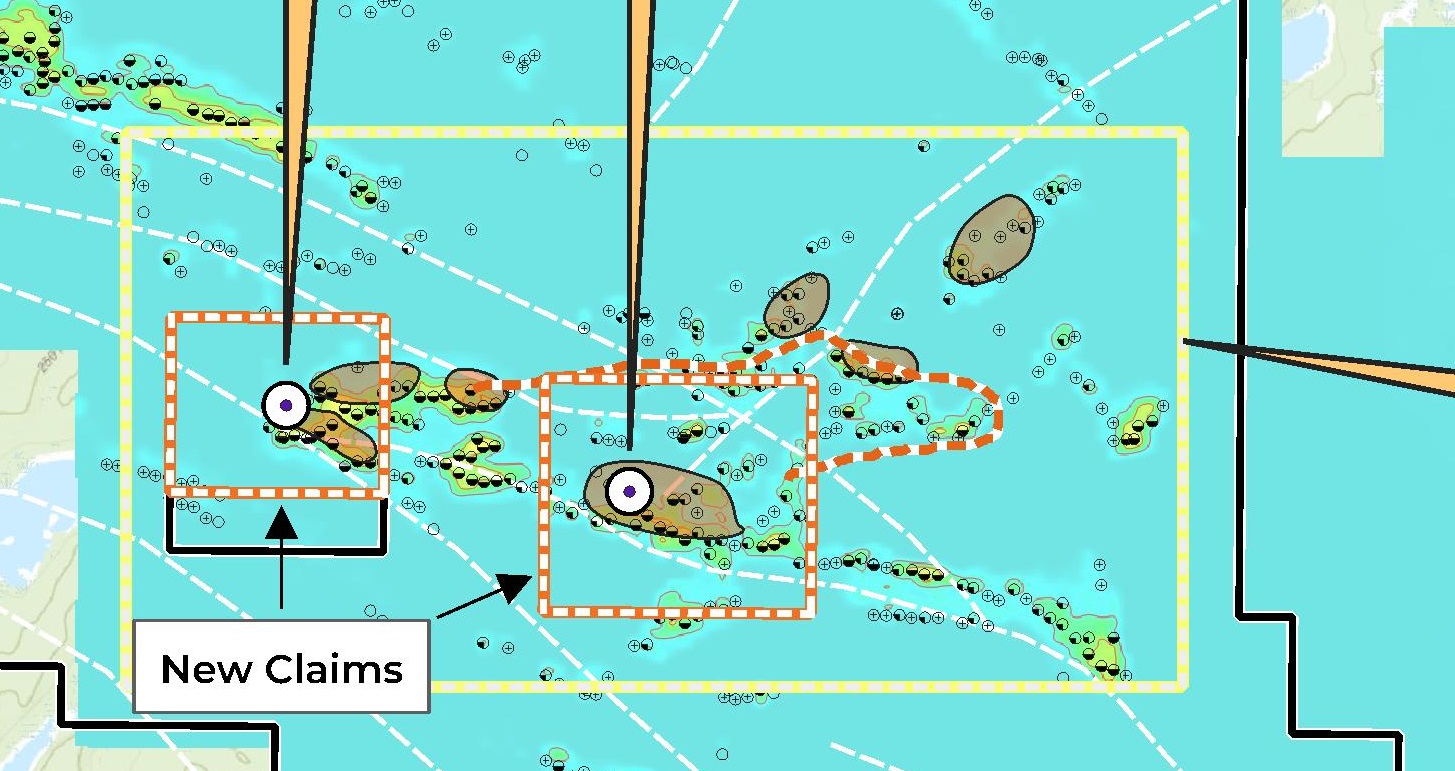

Holding a consolidated claim package is of course very useful for designing drill programs, as the two squares contain several important targets (in brown):

The 32 newly acquired claims total 630 hectares (6.3 km2) and include 42 out of 73 historical drillholes drilled within the Central Area of W2 (see Figure 1). A significant portion of the historically identified mineralization zones lay on these newly acquired claims. This includes the following drill hole intersections completed by previous owners:

- Hole 54002 intersected 0.92% Cu, 0.73% Ni over 18.2 m

- Hole 54004 intersected 0.48% Cu, 0.15% Ni over 32.0 m

The claims already owned by Platinex had even better results from surface, so the company could have progressed with drilling anyway, but to have this all consolidated certainly helps with designing exploration strategies:

- 220.6 m of 0.62% CuEq or 0.956 g/t PdEq (LH-01-06)

- 151.6 m of 0.64% CuEq or 0.971 g/t PdEq including 17 m of 1.08% CuEq or 1.86 g/t PdEq (LH-01-05)

- 42 m of 1.02% CuEq or 1.8 g/t PdEq including a high grade 4.5 m section of 4.52 g/t PdEq (LH-01-02)

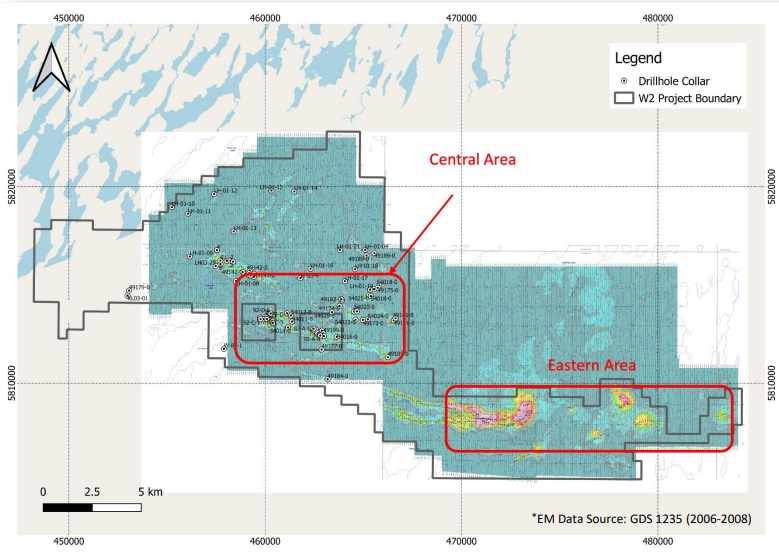

Most of the historical drillholes are shallow (less than 150 m) and with potential open at depth. Keep in mind that regarding geophysics, the most interesting claims are located in the east, as can be seen on this map:

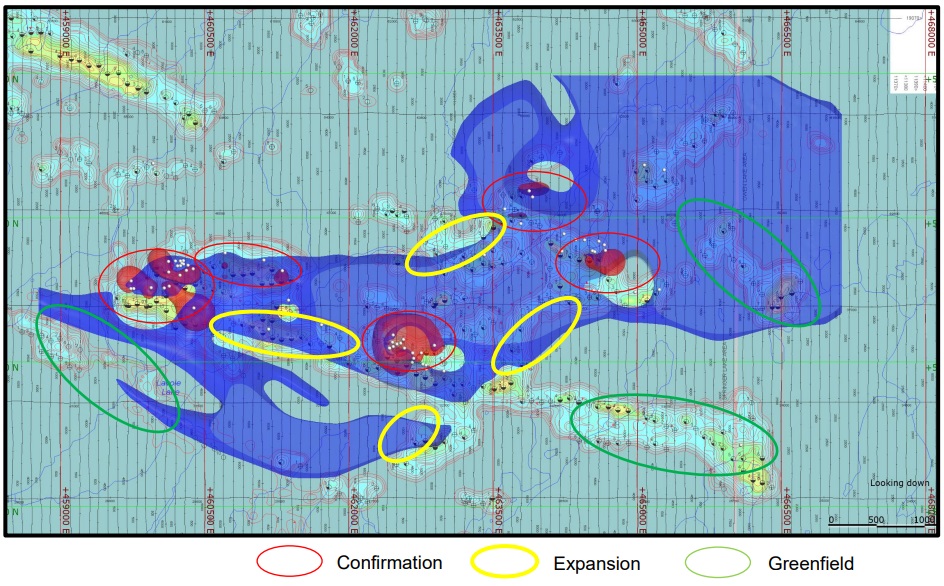

However, these claims haven’t seen any drilling so far, so I’m definitely looking forward to this. The 3D modelling of the Central Area already revealed significant potential. The technical community that follows the project also sees the Eastern Area likely with the best strike length and the potential to host multiple higher grade deposits. The area has not been drilled and it’s the first time the entire W2 (formerly Lansdowne) project is under one roof including the central resource area, the northwest (vanadium area) and the east targets.

When doing a back of the envelope estimate, one could easily arrive at a 70-100Mt target for the orange-red shapes (indicating > 0.8% CuEq), and keep in mind these shapes are all positioned near surface, so this kind of grade would be pretty economic. An IP survey and prospecting is planned for Q2, targeting some new areas like the eastern section, together with met work. Drilling in the central area is scheduled to commence in Q1, 2024. According to CEO Ferron, the drill program will consist of 2,000m of diamond drilling, spread out over 8 holes.

The exact program will be determined following the completion of the Maxwell plates modelling which will be concluded in January 2024. The drilling will focus on a combination of deep holes and new targets in the Central area, and some in-fill exploration/verification/twinning along the mineralized trend. The timing of the Eastern Area will be determined during the Central Area program, but for now it seems realistic to have this commencing in Q2.

Existing mineralization seems to correlate well with geophysical anomalies and other data, so no more prospecting and mapping should be necessary according to CEO Ferron, but he wouldn’t rule this out either, depending on what his technical advisors have to say. He prefers to be aggressive though and drill as soon as possible at the Eastern Area as well. It was also good to hear from him that he isn’t contemplating optioning W2 out anymore or even selling it, as the potential for a real company maker is impressive, and much bigger compared to Platinex’s other project Shining Tree-Heenan Mallard in my view.

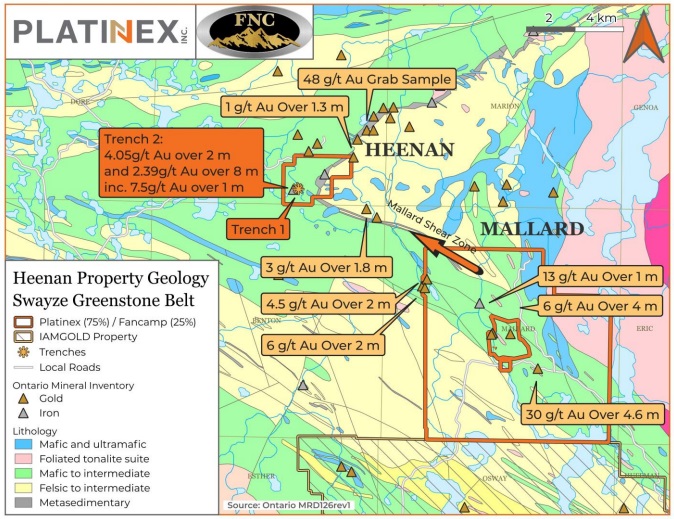

Shining Tree-Heenan Mallard

Since Platinex is also working at the Shining Tree – Heenan Mallard project, a quick update on this is always a nice to have. A trenching program is being completed at the moment, with results likely due at the end of this month. Drilling will follow shortly after this in Q2, 2024, and Platinex is in counsel with its JV partner Fancamp Exploration (FNC.V) about this.

The JV has just completed 3 drill holes in trenches, and 2 step out holes, drilling for a total of about 1,000m, with assays expected back from the labs at the end of this month and throughout February. Currently, 4 of 5 holes have been completed.

Green Canada

Platinex is planning to spin-out Green Canada, a fully owned subsidiary owning 4 uranium projects (with more coming) in Q2, 2024. The company aims to hold about 60% of Green Canada leading up to the IPO, the idea is to dividend a significant part of this out to existing Platinex shareholders on a pro rata basis. At the moment, Platinex is very busy closing one final uranium asset acquisition, involving a project which according to CEO Ferron will be by far the new flagship asset for Green Canada. Currently, they are also doing due diligence on 3 other uranium projects, and starting to work out the listing strategy, timing and structure, aiming for a listing in H1, 2024.

Conclusion

It was good to finally see CEO Ferron closing the acquisition of the central claims at the flagship W2 project, as I knew it had been a bit of a burden for Platinex over the last 2 years. Claim acquisitions are always very sensitive matters, hence I didn’t discuss this topic earlier. With the company cashed up, and having prepared drill targeting based on various datasets, and drill permits in hand, I’m looking forward to the upcoming drill program and especially the results. Considering the realistic potential for a 70-100Mt near surface target, W2 has the potential to grow into a real company maker. The spinout of Green Canada is likely a value accretive event too depending on the incoming flagship asset, and as a wild card Platinex’s gold exploration at Shining Tree-Heenan Mallard might provide interesting results as well. I’m certainly looking forward to 2024 developments as a longtime suffering, patient shareholder as this could definitely be the breakout year. Stay tuned!

This article is also published on www.criticalinvestor.eu. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Platinex Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.platinex.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.