Tax Loss Selling Season Bottom-Fishing Candidate: Banyan Gold

Lots of things are happening in the world around us recently, as the Israel-Hamas conflict intensifies to a degree that the rest of the world gets increasingly worried to see Israel crossing some lines regarding the use of proportional violence. Besides this, the Russian invasion isn’t done yet after Ukraine failed to break through Russian lines and conquer Crimea, the BRICS nations intending to move away from the US Dollar as a reserve currency, Argentina just elected a president that makes Trump look like a sophisticated bookkeeper, and lots of areas around the world are recovering from numerous wildfires, although now it is Brazil’s turn.

On the macro front, the Chinese economy keeps lagging despite lots of softening policies, and lots of European countries are into an official recession these days. However, the US keeps generating mixed economic data, increasing the likelihood of a soft landing by avoiding a recession, hereby causing the Federal Reserve to stay neutral and delay the anticipated pivot into rate cuts as inflation isn’t back to the 2% target yet although it has come down lately, depending on which numbers of course. Although gold has been trading around US$1950-2000/oz for a while now, sentiment for gold mining stocks has been negative for some reason, maybe amplified by inflated opex and capex, neutralizing most of the gold gains and thus economic viability.

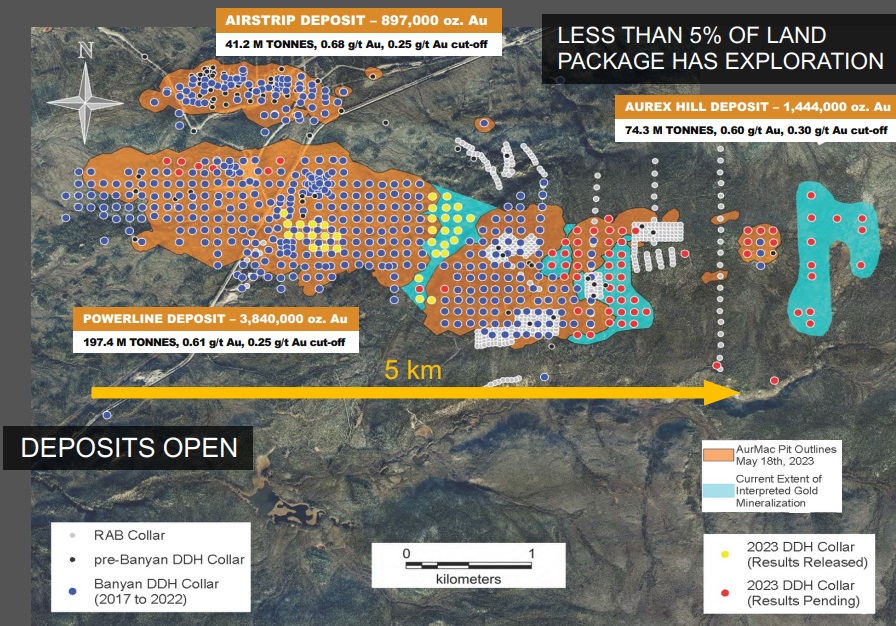

Banyan Gold Corp. (TSXV:BYN) (OTCQB:BYAGF) is no exception to this, growing their Aurmac project located in the Yukon beyond the May 2023 NI43-101 compliant Inferred resource of 6.2Moz Au. Notwithstanding this, after finishing their 2023 drill program in July and releasing the results since, I noticed that the share price has been trending down during the summer, and could be an interesting candidate during upcoming tax loss selling season, and therefore this article will delve deeper into potential economics, peer comparisons and valuation.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

All tables are my own, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Banyan Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Banyan or Banyan’s management. Banyan Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Tax loss selling is an annual phenomenon, causing many Canadian investors to sell losing positions to off-set gains they made during the same year, in order to pay as little capital gains taxes as possible. The selling is usually the most intense in the last 2 weeks before the Christmas holidays for obvious reasons, and usually stocks start to pick up again in between Christmas and New Year, and the first weeks of January. 2023 wasn’t a good year for many investors, so one could think there aren’t many gains to off-set, but nonetheless the selling continues and might provide better entry points. I do believe Banyan Gold is no exception, as it trades at 2 year lows:

Share price 3 year timeframe (Source: tmxmoney.com)

Banyan didn’t loose too much of its value, and this is probably due to the fact it has a lot of things in common with producing neighbour Victoria Gold which operates the Eagle Mine. This mine is one of the peer projects I will reference to in order to analyze Banyan’s flagship Aurmac.

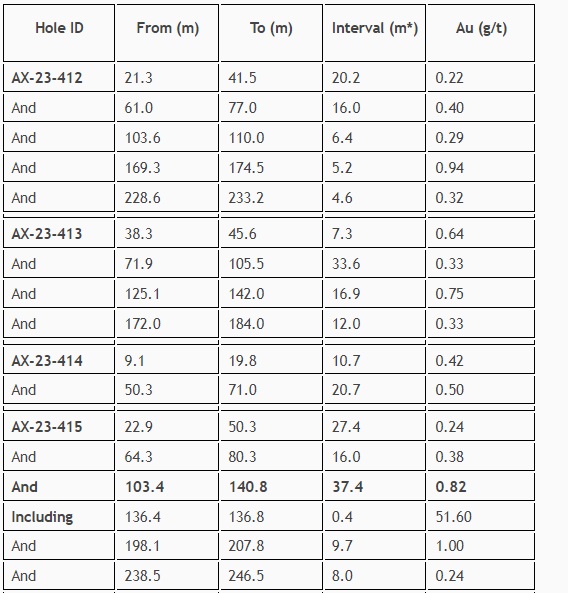

Before I delve into project economics and valuations, let’s have a look the latest drill results, and potential impact for the current resource. In July and September Banyan released two batches containing assays of 38 drill holes, as part of its ongoing Phase I drill program. The holes were intended as infill exploration at Powerline, and to potentially connect Powerline to Aurex Hill:

Highlights included:

- AX-23-415: 37.4 metres ("m") of 0.82 g/t Au from 103.4 m

- AX-23-429: 28.0 m of 0.81 g/t Au from 80.5 m

- AX-23-429: 18.5 m of 2.22 g/t Au from 182.0 m

- AX-23-436: 53.8 m of 0.81 g/t Au from 194.5 m

- AX-23-451: 17.7 m of 1.44 g/t Au from 141.1 m

- AX-23-455: 39.9 m of 0.60 g/t gold from 61.6 m

- AX-23-458: 34.2 m of 0.95 g/t gold from 33.5 m

- AX-23-458: 16.1 m of 1.66 g/t gold from 85.8 m

- AX-23-460: 70.0 m of 0.31 g/t gold from 10.0 m

- AX-23-460: 37.4 m of 0.65 g/t gold from 165.7 m

- AX-23-461: 90.3 m of 0.52 g/t gold from 10.0 m

- AX-23-462: 61.5 m of 0.39 g/t gold from 72.1 m

- AX-23-463: 144.5 m of 0.38 g/t gold from 8.5 m

- AX-23-464: 115.0 m of 0.31 g/t gold from 27.0 m

- AX-23-466: 59.4 m of 0.53 g/t gold from 72.1 m

- AX-23-467: 73.7 m of 0.48 g/t gold from 90.1 m

- AX-23-469: 65.1 m of 0.50 g/t gold from 27.2 m

Keep in mind most holes returned multiple intercepts like you can see in the table below showing just a few holes as an example, so the highlights only show the best parts of the best holes:

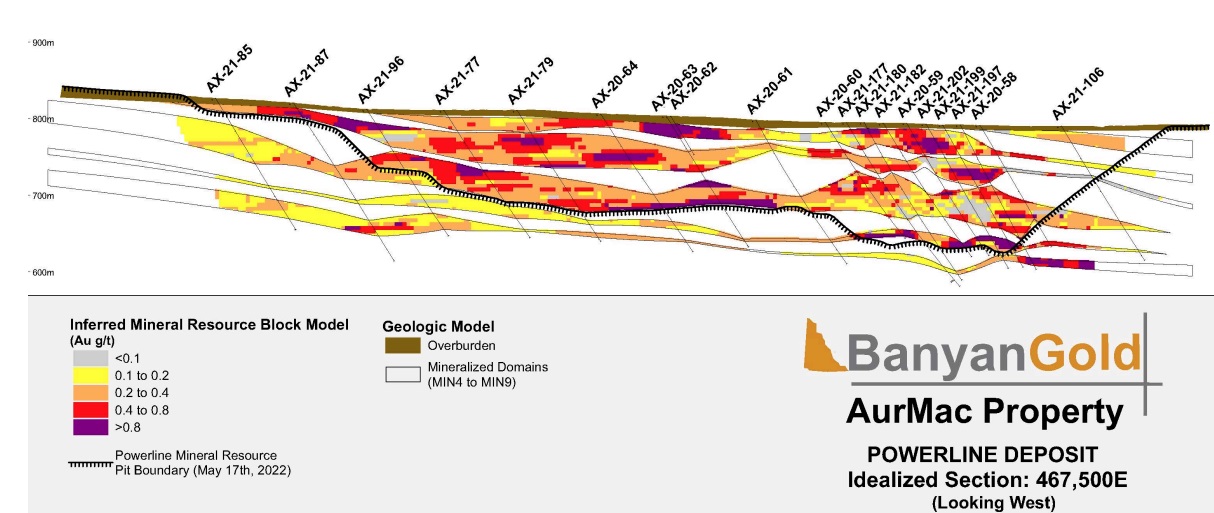

Be aware of the Aurmac mineralization very much consisting of a layered stratigraphy, often stacking 4-5 mineralized layers on top of each other.

The infill drill results of Powerline were pretty solid (see highlights of holes 455 to 469 above), capable in my view to add another estimated 300-400koz Au. The infill exploration results connecting Powerline and Aurex Hill were less convincing and consistent, as mineralized intercepts were also stacked but often short and lower grade. On average, I do believe they could add 200-300koz Au at an estimated average grade of 0.40-0.50 g/t Au. This grade can only be economic when the ore is heap leachable in this time with highly inflated opex and capex. I was wondering what CEO Christie had in mind for exploration plans for 2024. She stated: “We are waiting until late Q1 to announce our program for 2024 as we have a lot of technical work underway on our results and need to strategize what to do. This will help maximize our program and we can also see a bit what the market wants.”

So far, 2021 metallurgical studies (bottle rolls on pulps) indicated an average recovery of 90% for Powerline and Airstrip. Bottle rolls are a first step to determine amenability to heap leaching and management was pleased to see both the sulphide and oxide leach at similar rates.

Banyan is completing its metallurgical work with VAT tests, gold deportment studies and Column testing which will help them understand what the optimal crush size and actual heap leach recoveries might be, and results are expected by first quarter of 2024 according to management.

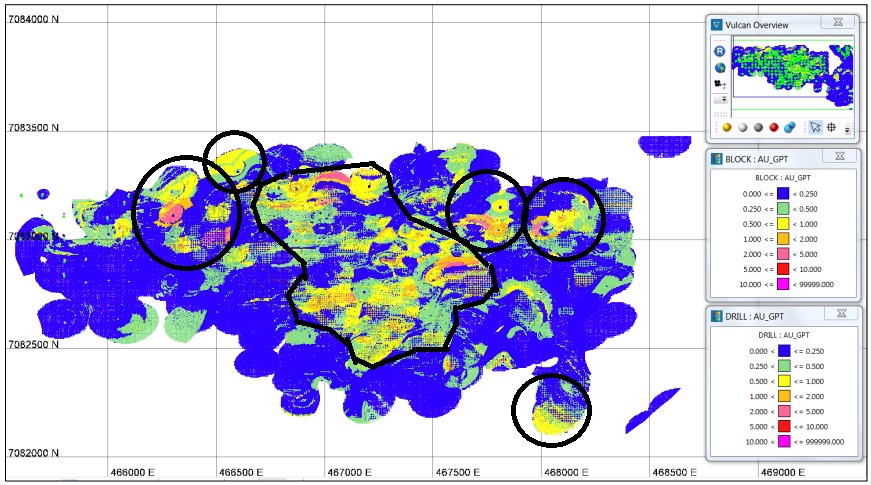

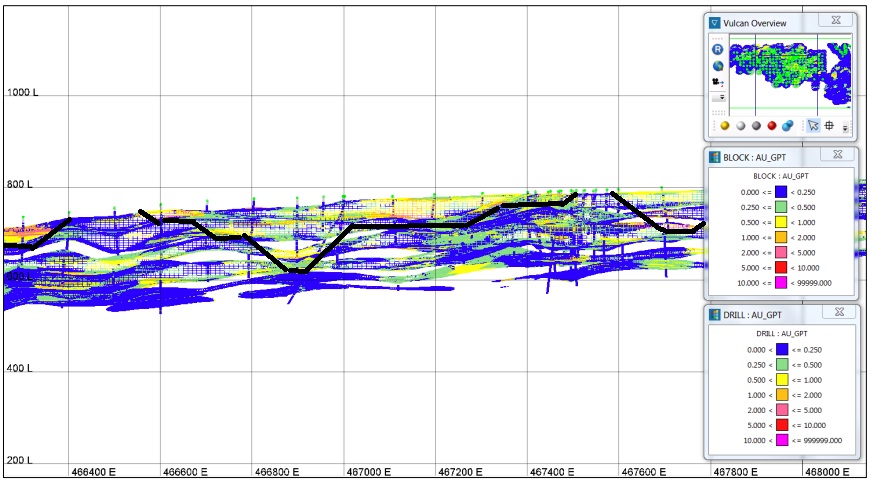

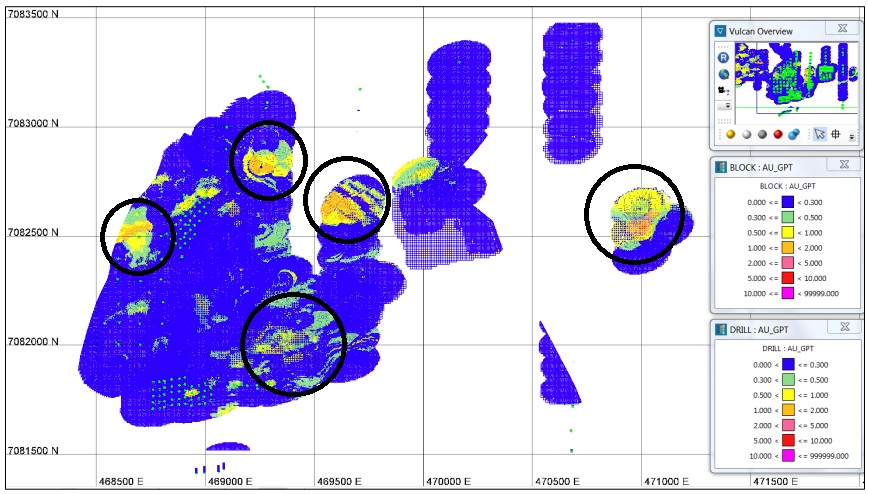

Management isn’t quite sure yet about heap leachability, and although they are testing all sorts of recovery methods, they are also taking into account conventional mining (flotation, CIP and CIL). With other nearby discoveries, including Victoria Gold’s high grade Raven just across the valley, there is a case that a district mill will be built somewhere. CEO Christie has made the case for increasing the cut-off grade significantly which highlights there are areas of higher grade, which a mine plan could mine early to get payback and also which might support more conventional methods, creating an average grade that closes in on 1g/t Au, within a 2Moz Au operation. Connected with this was the idea to create multiple small “honeycomb” pits, in order to high-grade the resource effectively. I tried to visualize this for Powerline in the following map by simplified circles:

The focus would be on mining blocks with a cut-off grade above 0.50g/t Au (yellow to red), with stockpiling the blue/green material until later times. A simplified section would look like this (scale of sections is different from the map):

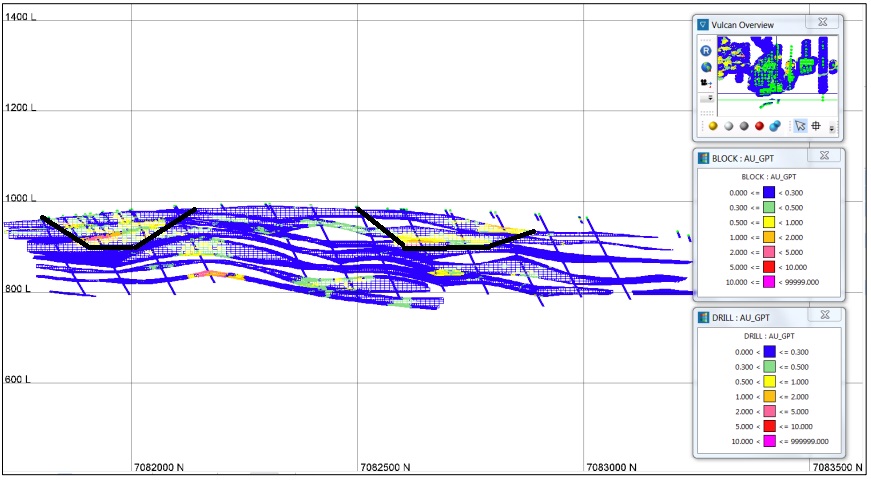

Another example would be Aurex Hill:

With a conceptual section:

Pits would be pretty superficial with a low strip ratio, to a maximum depth of 80-100m (other sections have different profiles for >0.50g/t Au mineralization). As low grade material from the blue/green zones has to be stockpiled, it is probably safe to say it will be treated as waste in a mine plan, and therefore increasing the strip ratio somewhat. Keep in mind the previous NI43-101 report uses an extremely low strip ratio of 1 : 0.34 for the Powerline deposit. (The current 43-101 did not provide a strip ratio as most inferred resource 43-101 reports don’t provide that detail).

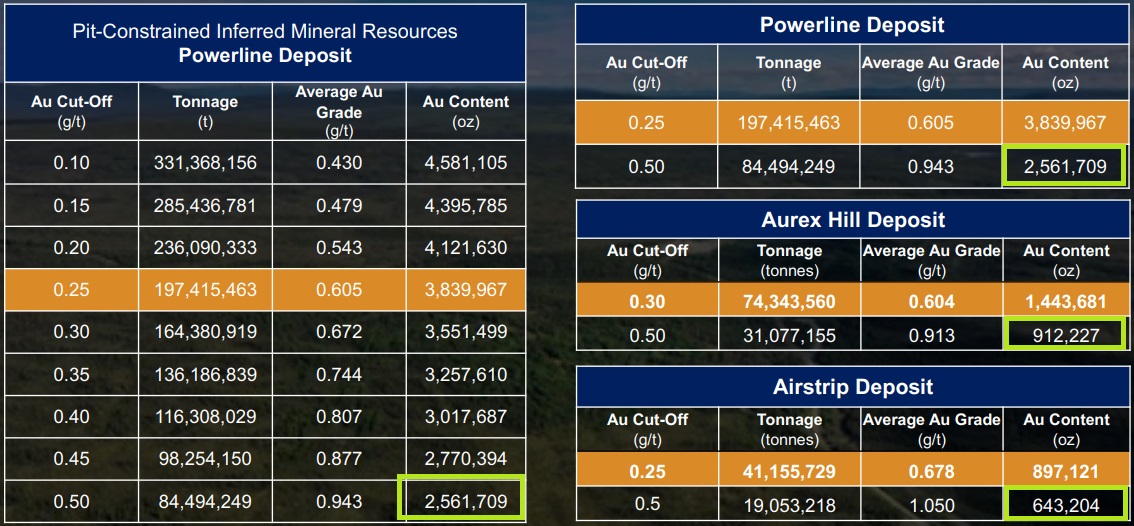

By increasing the cut-off grade to 0.50g/t Au, the resource would look like this for the 3 separate deposits:

The total Inferred resource would come in at 4.1Moz Au, at an average grade of 0.943g/t Au, being just 43% of tonnage at the 0.25-0.30g/t base case cut-off. A mineplan based on a combination of “starter” pits would lose the ounces below those pits, and therefore the base case for such a scenario would involve the upper high grade part, estimated at 1.9-2Moz Au.

Potential economics

Since cost inflation has been considerable in 2023, it is important to look at recent opex and capex figures from peers. Ideally these should be Canadian heap leach projects, but for credible data I’m also looking into open pit projects with conventional milling and processing, and conventional open pit producers.

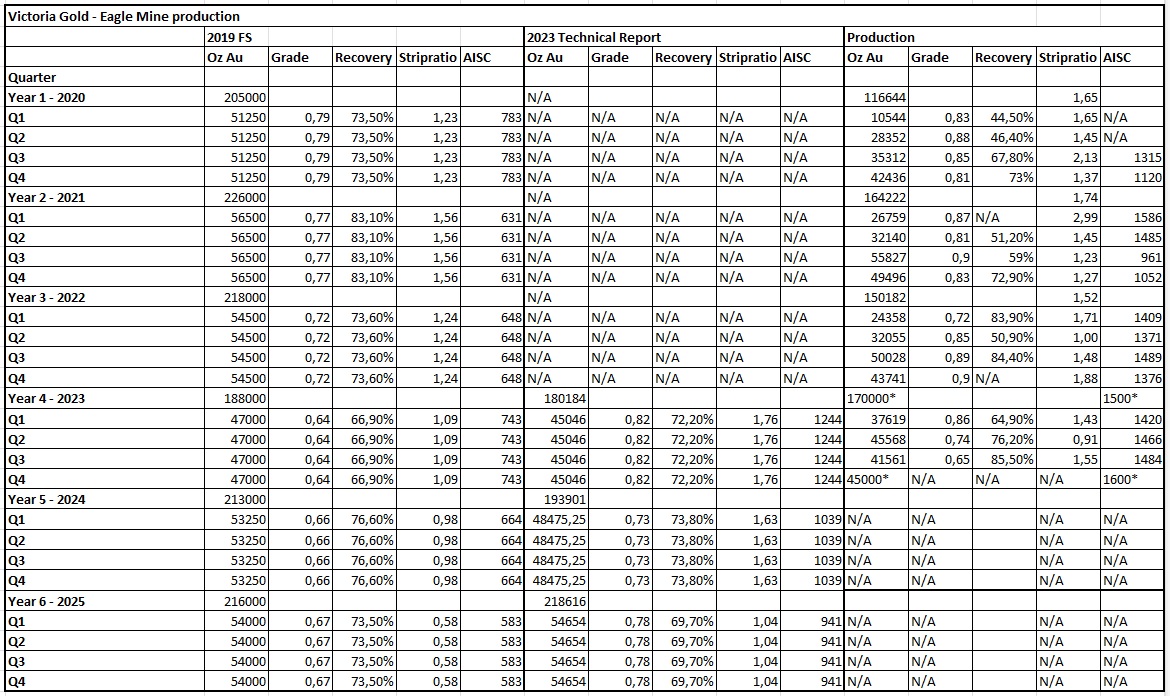

It is interesting in this regard to keep the nearby Eagle Mine performance in mind, who had its fair share of delays, lower recoveries, higher strip ratio, lower gold production, technical issues and wildfires since commencing production. Besides this, the Yukon climate is pretty harsh, Eagle couldn’t stack ore on its leach pad during the winter for the first few years, and as a consequence, gold production in Q1 and Q2 usually was substantially lower compared to the other quarters, at higher costs.

High inflation almost doubled the AISC compared to the 2019 FS, but is also substantially higher compared to the 2023 report, with grade, recovery and production being lower than calculated in this report. So Eagle isn’t out of the woods yet. And keep in mind this is a heap leach operation, with supposedly lower AISC in general. The guidance for 2023 FY comes in at US$1500/oz, and there is no guidance for 2024 yet.

This is just one example, showing the ramp-up of a new mine isn’t a walk in the park. Many new mines failed completely over the last 5 years, destroying incredible amounts of mine financiers capital and shareholder equity, but at least Eagle Gold seems on its way to make it as it doesn’t have excessive debt, enjoys elevated gold prices and is looking to expand the operation to 250koz Au per annum, to incorporate newly found ounces, increase cash flow and thus enhance value for investors.

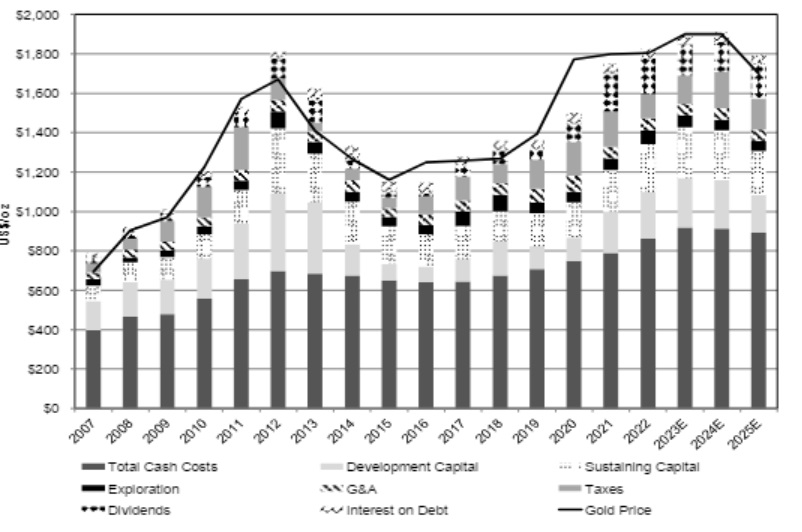

Be aware increasing costs for precious metals producers is something that isn’t just connected to inflation, but also to the curious habit of all-in costs neatly following the gold price itself, although often significantly surpassing inflation itself as this chart for fully loaded (including capex, taxes, dividends etc) costs from Scotiabank research shows:

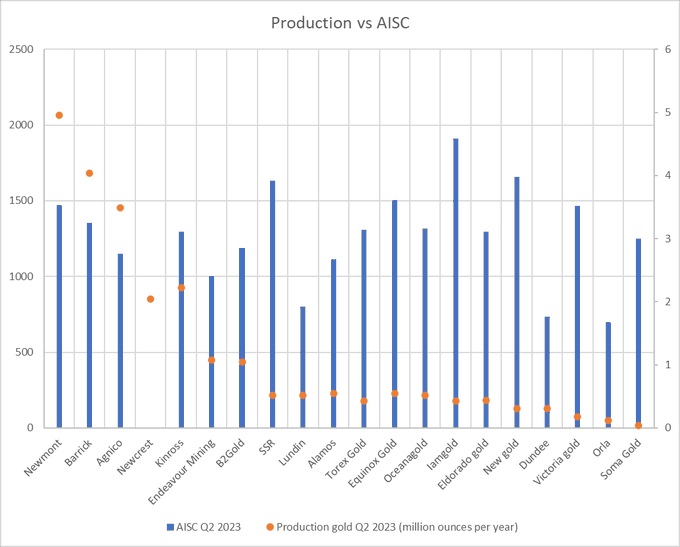

This remarkable phenomenon causes PM producers to hardly receive any net income, no matter how high the gold price is at any given moment. The average global AISC for gold miners stands at US$1304/oz for Q3, 2023, down very slightly from US$1315/oz for Q2, 2023. Here is an indication of the AISC of the largest producers for Q2, 2023:

It shows Victoria Gold at the higher end of AISC, but it will be clear that besides a few outliers like Lundin, Dundee and Orla the average AISC has risen to significantly higher levels these last two years.

All in all, after raising the cut-off to 0.50g/t as contemplated earlier, I feel safe to use 2Moz Au @ 0.94g/t Au in a series of small open pits.

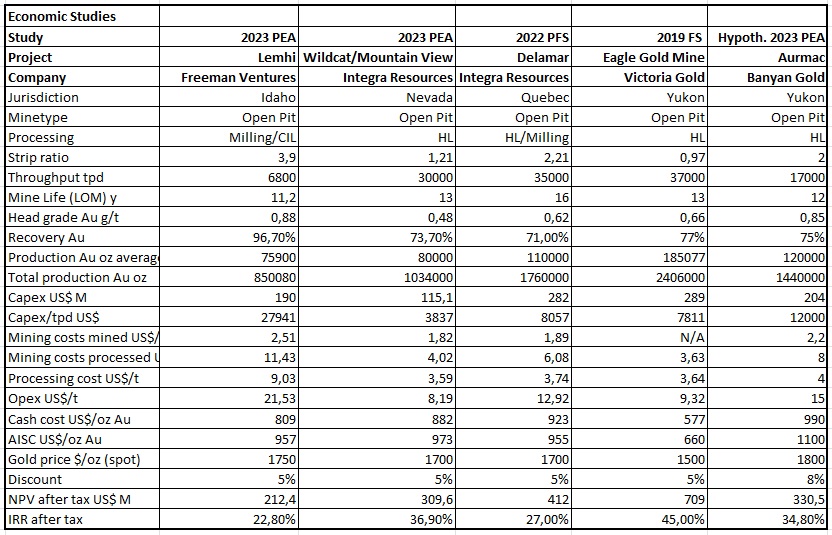

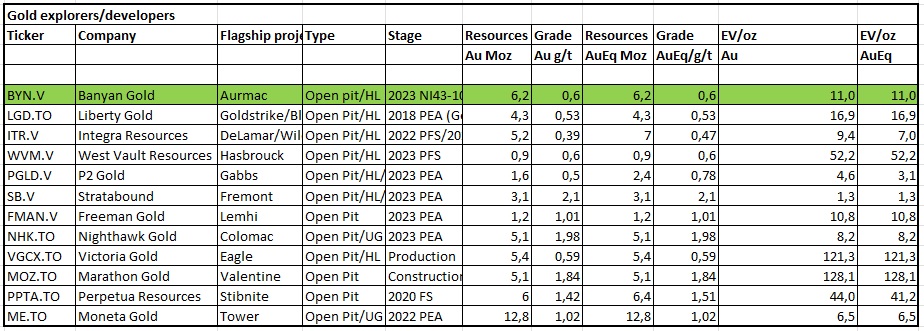

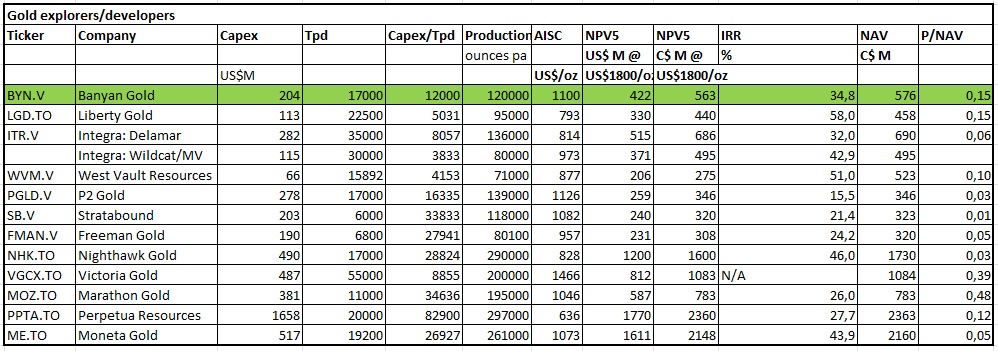

Before I proceed further with my assumptions, it is a good thing to get an impression of peer projects, so I selected a few heap leach projects (and one conventional mining project, Lemhi although oxidized), of which of course the inevitable Eagle Gold is the only one in production (using 2019 FS figures here to get an idea of project metrics, but costs are completely outdated of course). The Lemhi project was added in order to provide context regarding a conventional open pit project, which is usually less economic compared to heap leach. I already added my assumptions for Aurmac, and I will elaborate further on these figures below the following table:

Notwithstanding the fact that Aurmac is located very closely to the Eagle Mine, with costs for infrastructure, power etc limited to a minimum, I assumed a higher capex/tpd metric compared to Delamar due to rising inflation risk. .Wildcat has staged development so their extremely low capex metric isn’t fully representative.

I discussed some production data from Eagle Gold earlier on, but it will be clear one ramping up heap leach operations can be difficult, with the Yukon adding additional challenges because of climate, interfering in the first two years with stacking of ore on the leach pads.

As always, a peer comparison based on discounted cash flow analysis (DCF) is of course the most useful if the projects selected are as close as possible on parameters, but as no project is exactly the same, a sub-optimal comparison is the inevitable result directing my assumptions. Although inherently flawed, DCF provides at least some meaningful guidance, way beyond simple metrics like EV/oz or critically flawed metrics like "gross metal values compared to market cap”. Of course keep in mind that Banyan Gold just established an Inferred resource at Aurmac, and although the deposit seems fairly continuous and it is perfectly possible to engineer a PEA based on just Inferred resources, all numbers based on Inferred resources are highly speculative as these resources aren’t economic per NI43-101 definitions.

According to Aurmac met test results, oxidized holes generated extremely good 90% recoveries. As this is bottle roll leach testing and not exactly heap leaching, but still believed to be above average, I assume an overall recovery of 75% since the Eagle Gold Mine had issues reporting recoveries above 70% for the first two years, but is frequently reporting values above 83% this year, indicating the planned LOM average recovery of 76% seems achievable. I’m also assuming a higher head grade for Aurmac, which usually supports higher recoveries as well.

With some dilution/ore loss/pit outlines etc etc taking into account, I expect 2Moz Au to be mined before recoveries. A minimal life of mine of 12 years generates 167koz Au per annum, at an average grade of 0.85g/t Au this would result in a 17,000 tpd throughput. At 75% recovery, Aurmac could produce 120koz Au per annum, meaning a LOM production of 1.44Moz Au.

The capex and opex assumptions will be based on averages while taking into account scale and location, but the current rampant inflation makes any assumption pretty difficult, so I allow for a substantial margin for error. For capex, I looked at the Delamar PFS of Integra Resources and the Eagle Gold Mine FS of Victoria Gold, and added substantially to both (roughly the same) capex/tpd ratios, about 50% more. This includes the fact that AurMac has a lot better infrastructure than Victoria Gold started out with, saving roughly US$60-90M. This results in a capex of US$204M.

For mining cost, it is tempting to simply use the (for heap leach very) high US$1500/oz AISC of Victoria Gold, but at the same time they are still not at nameplate capacity, and process a lower average grade (in my view Banyan could frontload production with grades well over 1.1g/t Au during the first 4-5 years), so the AISC per ounce comes in higher. I do believe adding a substantial percentage to recent Integra figures for mining and processing costs should do the trick, resulting in an Aurmac AISC of US$1100/oz.

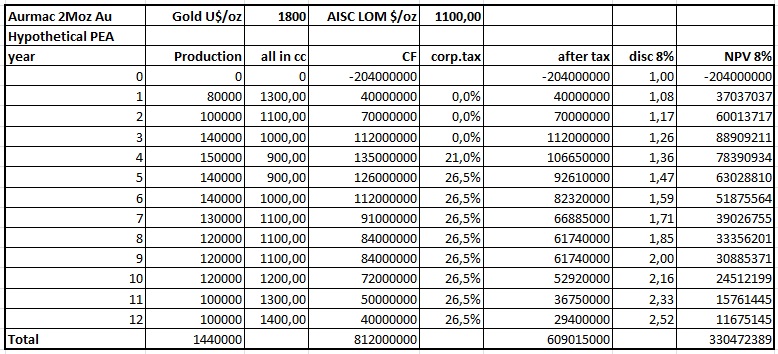

For a while we have seen healthy NPV discounts of 8%, but now with these high costs lots of developers are struggling to present decent NPV figures this way, and grasp back to the old 5% discount. My base case discount will be 8% to be safe:

At a gold price of US$1800/oz, the after-tax NPV8 is a solid US$330.5M and the IRR is healthy at 34.8%. With a discount of 5% the after-tax NPV5 generates US$422.2M. If we would use an AISC of US1300/oz, the after-tax NPV8 goes down to US$186.7M and an IRR of 24.5%. Still above the general IRR threshold of 20%, but when capex surpasses NPV this is usually not considered a positive for a project. At US$1900/oz gold, the NPV8 increases to US$404.7M, and the NPV5 to US$509.5M.

So the upside isn’t as impressive as it was in the summer of 2022, as opex and capex increased further. The large size of the Aurmac resource became less relevant as a result as well at the moment, but since the high inflation can’t go on forever and is projected to come down next year, I do expect more ounces to be incorporated into the mine plan. For now, I believe management is going the right direction by contemplating a possible scenario for a smaller but lean and mean project, high grading it for efficiency, with the potential Tier I upside waiting when costs improve.

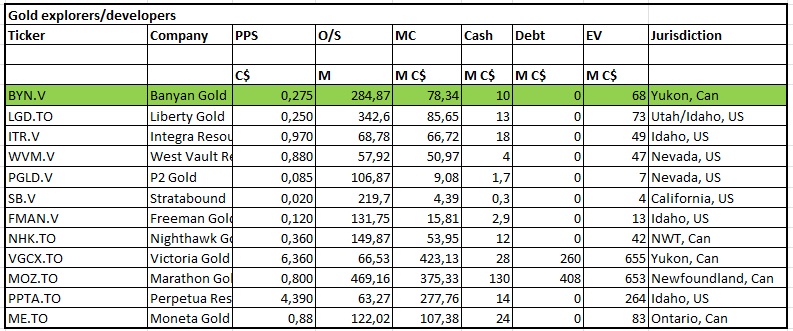

Let’s see where Banyan Gold ends up this time against several of its peers, if aforementioned guesstimates were to be realized. Several heap leach and conventional open pit gold operations in the Americas were selected, one better suitable than the other, as always with peer comparisons:

Most importantly I tried to find peers with fairly recent economic studies:

The EV/oz metric for Banyan has come down from $21/oz last year to $11/oz, by a lower share price and an increased resource, and is trading at the same level as peers with significant resources and a PEA like Integra and Nighthawk. This is probably caused by Banyan having the advantage of the adjacent Eagle Mine, which could provide lots of synergies, and advantages considering for example permitting. So their EV of $11/oz is cheap, but in line with peers.

When looking at the economic studies below, it is very likely that most studies need significant updates in the cost department, resulting in lower NPVs and IRRs.

Again, Banyan appears to be valued higher than many peers based on the P/NAV metric, predominantly caused by my high-grading and downsizing, but I am convinced when these peers would update their economics to today’s standards, the differences wouldn’t be as significant anymore. Keep in mind Aurmac has many options depending on costs and metal prices, something other projects maybe don’t even have. Besides this, there is substantial exploration upside (management believes there is 8Moz+ Au potential for next year, I do believe they are already closing in on 7Moz Au, even more likely after announcing all 2023 drill results), low risk jurisdiction and nearby Victoria Gold who just paved the way for them regarding permitting and infrastructure. According to management, a PEA is planned by H2, 2025, and this also seems to be a strategic move, probably aiming at lower opex and capex by then, and growing the resource in the meantime. CEO Christie had this to comment on this: “Yes, a H2, 2025 PEA timeline provides us with more options, as circumstances are in flux. With the 5th largest undeveloped resource in North America, in a jurisdiction where you permit and operate mines, with our exceptional infrastructure, Banyan is well positioned as we move into 2024.”

Conclusion

As gold is trading at US$2,000/oz at the moment, lots of gold developers including Banyan Gold have been trending down, due to increased opex and capex, rendering many projects less economic. As inflation seems to be suffering from high interest rates which are paused at the moment, costs might be coming down soon again, although there is a remarkable relation between the gold price and opex/capex. As I view the current situation with even smaller average margins for producers than usual unsustainable, and interest rates likely being cut somewhere in 2024, the upcoming tax loss season could be a very interesting time to look at gold developers like Banyan Gold. Their Aurmac project is flexible, and could provide anything from a lean and high grade 2Moz Au project to a large, low grade 7-8Moz Au Tier I mastodont. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Banyan Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.banyangold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.