Vior Goes Lithium: Identified Potential For Lithium-Bearing Pegmatites At Belleterre, Expands Land Package

Although lithium juniors are in somewhat of a correction phase after the last round of conferences ignited a real lithium hype, it is good to see Vior Inc. (TSXV:VIO)(FRA:VL51)(OTCQB:VIORF) joining the lithium narrative, as I firmly believe lithium supply will not be able to match demand in the foreseeable future, and shortages and resulting high prices will be the standard. This creates a very healthy environment for any capable junior with a serious lithium project, and I view Vior as highly capable, as do the likes of Osisko Mining and a roster of institutional funds. If Vior has a serious lithium project on their hands remains to be seen, but extensive reconnaissance exploration of their Belleterre grounds showed many targets for lithium-bearing pegmatites, as greenstones are a fertile host for these rocktypes. The company didn’t hesitate and staked a lot of additional claims after the pegmatite potential in the area became clear.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

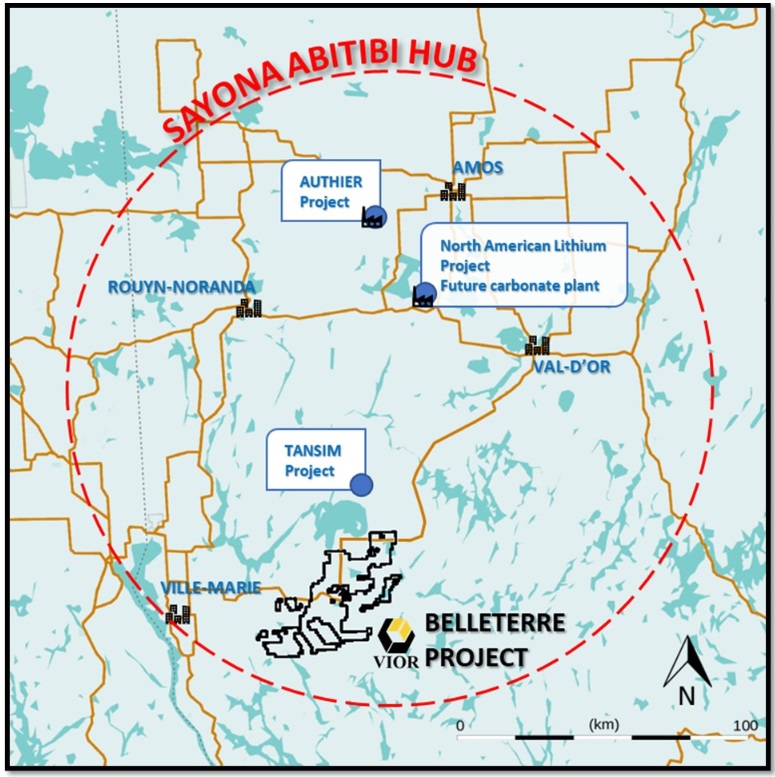

Usually I am not a big fan of flavor-of-the-day metal narrative changes, but the switches from gold to nickel at Skyfall and now the expansion from gold to lithium at their flagship Belleterre project in Quebec make a lot of sense, as at least Skyfall gets to see work done on it with SOQUEM funding it, and earlier drilling at Belleterre wasn’t very successful yet. The lithium angle seems to be legit here, and could reinvigorate enthusiasm for the project for sure. Although known for its historic high-grade gold production, the Belleterre region is also recognized for its lithium endowment with economic grades drilled at the advanced Tansim Lithium Project, located 20km north of Vior’s property, like for example 12.35m @ 1.29% Li2O and 43.7m @ 0.82% Li2O. Owned by Sayona Mining (ASX:SYA, market cap of A$2.3B), aiming at production in March 2023, the Tansim project is part of Sayona’s Abitibi Hub strategy that includes the Authier resource (87.8Mt @ 1.05% Li2O M&I) and other advanced production assets (mine, concentrator, plant):

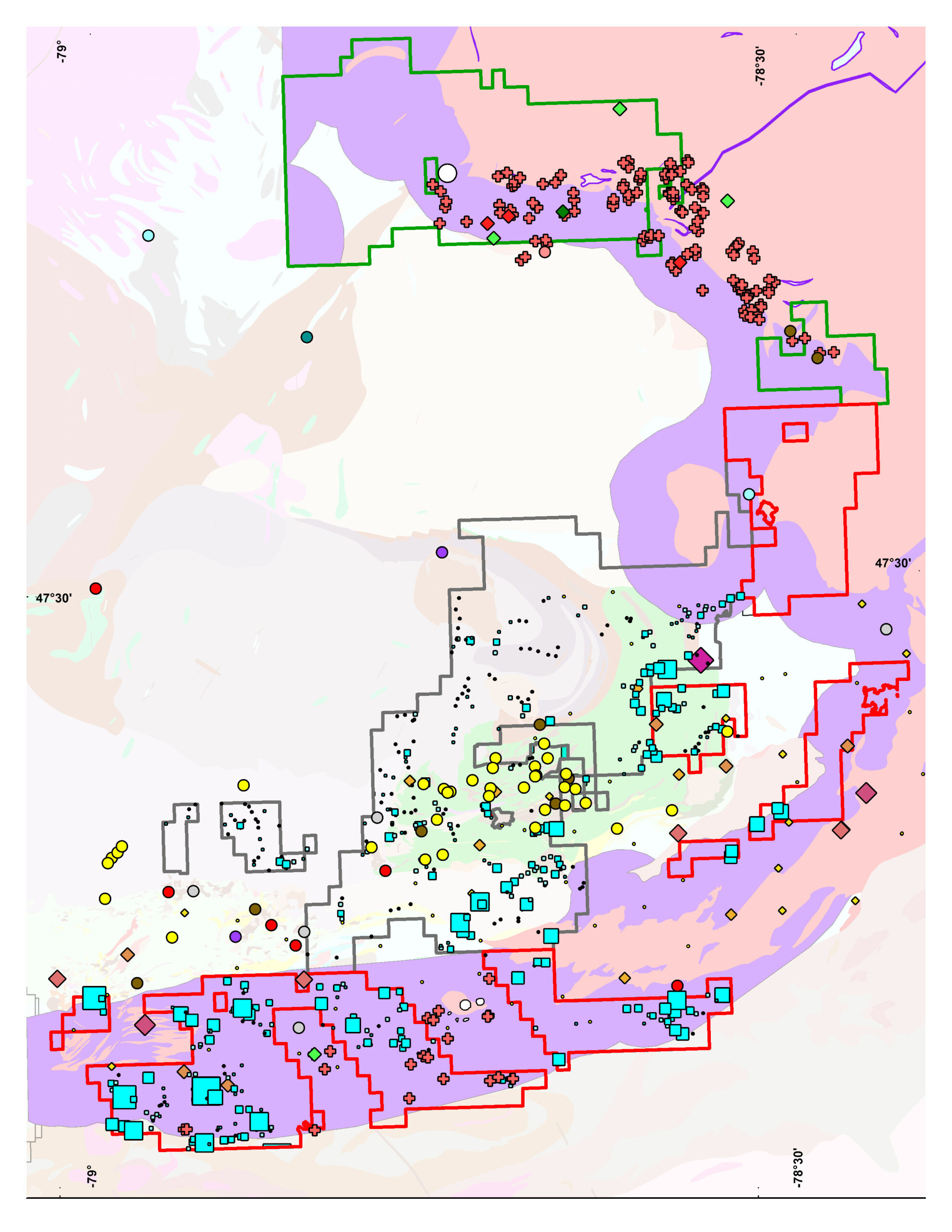

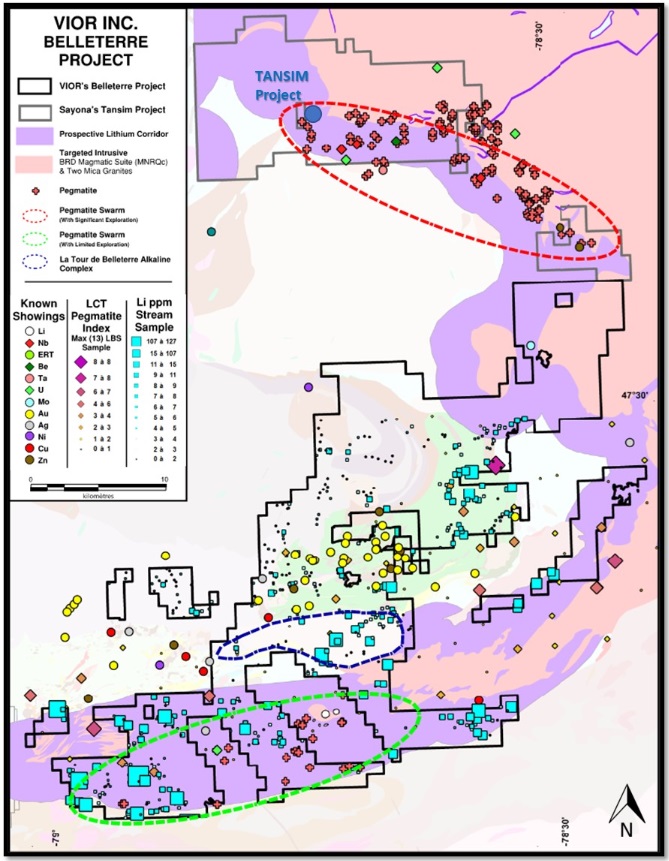

As mentioned, Vior completed an extensive regional reconnaissance exploration program in and around its Belleterre Gold project, and after identifying the lithium-bearing pegmatite potential, management set out immediately and staked 466 additional claims in the area, covering over 268.2km2, to get as much prospective ground as possible. The new claims are shown in red:

Since the little red crosses represent pegmatite showings (and the blue squares indicate lithium sampling results as can be seen at the next map), I wondered if the company aims at going after other, not yet staked claims. CEO Mark Fedosiewich and VP Exploration Laurent Eustache answered: “We did claim the best targets that we identified and some other available claims.

Since Vior is active in the area lots of small prospectors rushed claiming some area of the camp so there is no more space available since our recent claim acquisition. We are the major player of the camp and we agree with you that if we recognize some new potential down the road we will go after it.”

Vior’s geologists identified a 80km prospective lithium corridor in the region, which can be seen below in magenta:

So it seems the company has expanded in the right directions, especially in the south. CEO Mark Fedosiewich was pleased with the latest events:

“This is an exciting time for Vior. While finalizing the regional data compilation at our flagship Belleterre Gold Project, the Vior team identified multiple high-potential targets for lithium-bearing pegmatites. This staking of additional claims further expands and consolidates our land package at Belleterre, and helps to secure multiple gold and lithium targets across what has truly become a district-scale opportunity. It is clear that there is an urgent need for a secure and sustainable access to critical and strategic metals in North America, and this timely opportunity provides additional upside exposure for Vior’s shareholders, while remaining committed to our core focus of making a new gold discovery in the historic Belleterre mining camp.”

As I am a big fan of lithium juniors, as the paradigm shift to renewable energy and EV’s is real now, I’m excited about the lithium potential of Vior’s extensive land package. Maybe they are even able to raise more money to drill the pegmatites separately. I wondered what kind of plans management had in mind for this, if they could elaborate on the amount of drilling, budgets and timelines, if they needed permits for this, and potentially more relevant information. CEO Mark Fedosiewich and VP Exploration Laurent Eustache answered: “We are planning an aggressive late Spring/Summer field exploration program, and if successful, a potential initial drill program this Fall.”

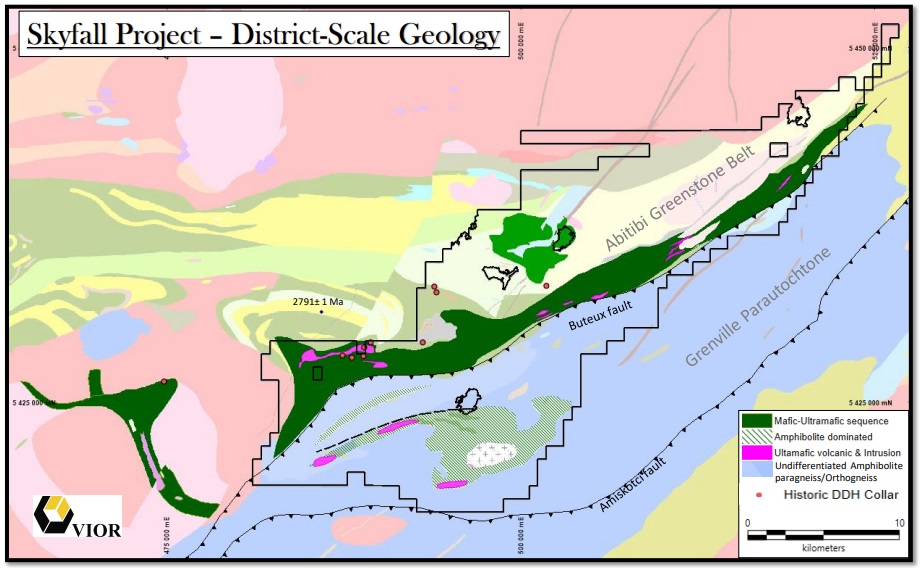

Vior’s second project is the Skyfall nickel project, which encompasses a large, district-size land package of 515km2. They will fly a 3,000 km of line VTEM over the property in late February or early March, which will probably cost C$700k, with the balance being paid shortly after the end of March.

As a reminder, a combination of geochemistry, mag surveys, lithogeochemistry and sampling represented nickel/chromite/magnesium potential, as samples generated up to 0.17%Ni, 0.25%Cr and 23% MgO, which are very good numbers for just surface samples as they already come close to economic drill hole results.

Besides lithium exploration being planned, Vior hasn’t forgotten about the gold potential yet at Belleterre, and is in the middle of identifying new drill targets for their planned Phase III drill program to begin in H2, 2023. As a reminder, Phase II results reported modest results for the targeted 12W vein structure, with best intercepts quoting 1.35m @ 12.87g/t Au and 1.1m @ 4.15g/t Au, being part of a completed 4,000m Phase II drill campaign. In turn this was following up on a 3,587m Phase I drill program, which was highlighted by a 0.5m @ 55g/t Au intercept.

Vior has approximately C$1.85M and almost C$1M in marketable securities, so the company could start a third drill program at Belleterre, beginning sometime in Q2, 2023 as mentioned, once data compilation, new 3D modelling and a significant drill targeting program are completed in Q1, 2023. Management is aiming at drill targeting for approximately 30,000m of drilling in H2 2023 and H1 2024 in total.

Conclusion

In the middle of a lithium boom this re-orientation of Vior regarding the Belleterre project towards potential lithium exploration seems to be not only well-timed by management, but also somewhat necessary, as Belleterre drilling for gold so far didn’t bring in very economic results. It is still early days of course, the project is complex and extensive and Vior is still supported by Osisko and lots of funds to continue gold exploration at Belleterre, so no issue there. However, investors have different horizons, and often aren’t as patient, and exploration success proving up lithium-bearing pegmatites could mean a genuine gamechanger for Vior and its shareholders. I am also curious about the nickel potential at Skyfall, considering recent nickel excitement. Let’s see what’s in store for both projects. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Vior Inc. is a sponsoring company. All facts are to be checked by the reader. For more information go to www.vior.ca and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.