Argentina Lithium Raises C$4,99M In First Two Tranches Of Non-Brokered Private Placement, Expects To Raise C$6.75M In Total

Salar de Rincon; Salta province, Argentina

Argentina Lithium & Energy Corp. (TSX-V: LIT, FSE: OAY1, OTC: PNXLF) seems to be capitalizing nicely on the unstoppable all time high lithium prices, as it is raising significant amounts of cash at the moment, currently standing at C$4.99M and not done yet. The proceeds will be used for new exploration programs on their various LatAm lithium projects. The company already owns several early stage lithium projects in Argentina, and recently signed an option agreement to acquire two more projects in the same country, the Rincon West and Pocitos properties in the Salta Province.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Argentina Lithium announced the non-brokered private placement for up to C$4.95M @ C$0.45 with a full C$0.70 3 year warrant on November 1, 2021. A first tranche of C$2.75M was closed on November 10, 2021, a second tranche was closed on November 26, 2021 for another C$2.25M, so gross proceeds so far stand at C$4,997M. On top of this, the company was pleased to announce that they had to increase the PP to C$6.75M due to high demand, so the third tranche is expected to bring even more cash into the treasury. Total finder’s fees for the first and second tranche of C$185.9k and 413k warrants will be paid to arm’s length parties of the company after closing. It was good to see CEO Cacos buy into this round, acquiring 225k shares, bringing his total to 1.325M. According to him, the money raised came primarily from high net worth individuals, industry trade professionals and investors from Argentina.

The C$0.45 price is a decent one, as the current share price stands at C$0.48 and has been sideranging around this price since the last month, after enjoying a huge spike up on October 18 & 19 on massive volumes, going as high as C$0.96:

Share price 1 year timeframe (Source: tmxmoney.com)

As the share price went up almost 4 times in a few days on no news, I wondered what could have caused this. According to CEO Cacos, the spike was a reaction to the takeover activity of companies operating in the Lithium Triangle in Argentina, as seen by the takeover of Neo Lithium Corp. and Millennial Lithium Corp.

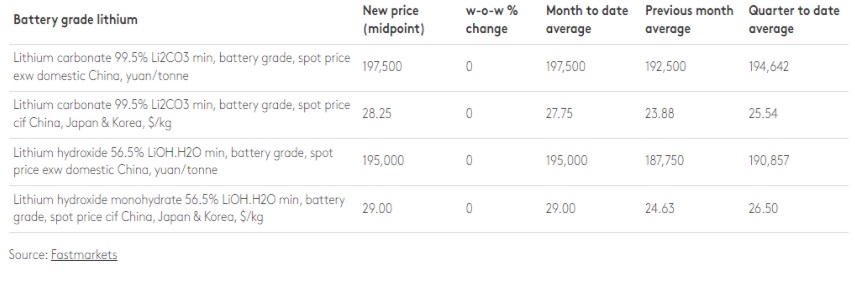

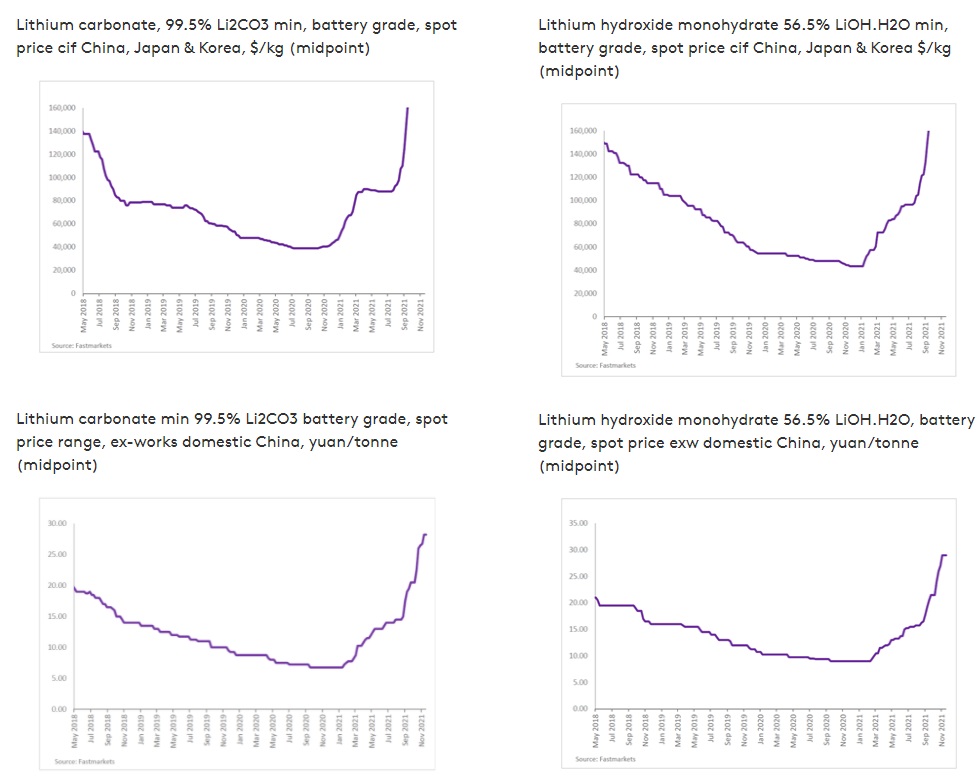

Talking about lithium product pricing, new all time highs keep getting printed almost every week now, as at this moment Fastmarkets shows lithium carbonate prices at US$28,250/t:

Fastmarkets also produces insightful charts, representing the difference between international markets in USD, and Chinese domestic markets in yuan:

The domestic prices in China are still rising faster than international prices. According to Argentina Lithium CEO Niko Cacos, this is most likely caused by higher interest for everything EV related in China. If the current shortages and especially extremely high prices of lithium products are short-lived and caused by COVID is hard to say, but the recent new COVID-19 variation coming from Southern Africa seems to be another roadblock for increasing lithium production for now.

Let’s have a look at the projects of Argentina Lithium, all firmly located in the Lithium Triangle:

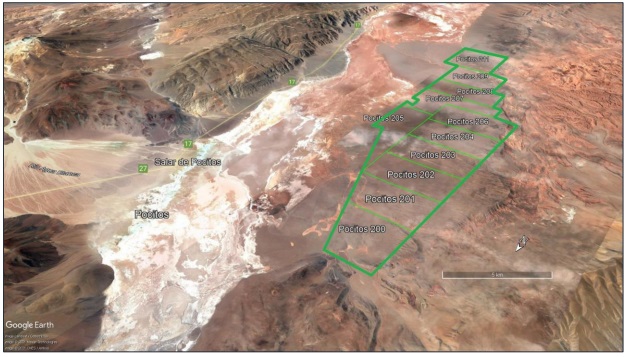

Rincon West and Pocitos were recently acquired. The terms for the two properties, with a combined footprint of 18,227 hectares, weren’t cheap, as the company already issued 750,000 shares to the local vendor on signing plus C$500,000 worth of shares over a 12-month period; and cash payments totaling US$4,200,000 over 36 months, but limited to only US$1,050,000 in the first 18 months, US$800,000 of which are firm commitments over the first year. Therefore the ongoing financing is pretty important, not only to initiate exploration, but also considering the cash payments of the two latest additions are substantial. Argentina Lithium has high hopes for these projects, but especially for Rincon West, as it is planning on completing 40 line kilometers of deep seeing Transient Electromagnetics (TEM) soundings on the Rincon West property, followed by 5 diamond drill holes after targeting:

The neighbouring project of Argosy has an average grade of 321mg/L, which is economic at lithium carbonate prices over US$10,000/t, so I expect the potentially encountered grades at Rincon West globally to be the same. The project is already permitted for exploration.

The Pocitos prospect is located on the western side of the Pocitos salar, and has seen modest lithium exploration in the past, including geophysics and surface sampling, with very limited drilling.

Salar de Pocitos

I asked CEO Cacos who owned the majority of the Salar the Pocitos, and if the company has an eye on acquiring more of it, located closer to the salar itself. He answered: “We are always looking to acquire more prospective ground to add to our portfolio, and this includes the Pocitos Salar. This is a large salar with many owners.”

Exploration plans for Pocitos involve 50 line kilometers of TEM soundings in H2, 2022, and as such is a second priority target for Argentina Lithium.

Another first priority target is the Antofalla project. As a reminder, the company optioned additional properties at the Salar the Antofalla in August, where they already owned a significant 9,000 hectare land package.

Argentina Lithium is earning into a 100% interest in a 5,380.5 hectare property set adjacent to the existing claims. Albemarle owns the largest part of this salar, which has a historic estimate of 11.8Mt LCE @ 350mg/l Li, which is the average grade I hope to see as a result of Antofalla exploration by the company. Terms of the option agreement includes a cash payment C$600,000 in the first 18 months, and annual exploration expenditure commitments of C$500,000 in year one, These amounts mean that the company has to spend sufficient money, and the current plans involve 35 line kilometers of TEM soundings, followed by an estimated 3 diamond drill holes. The exploration permitting process is almost finalized, as the company expects to receive them around first quarter of 2022.

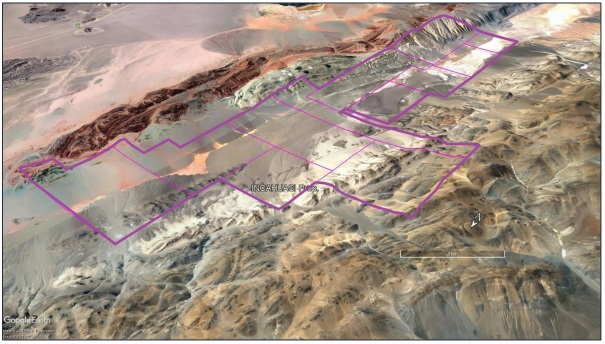

Finally, the company is planning on doing 50 line kilometers of TEM soundings on their Incahuasi Project in the second half of next year, making this a second priority target like Pocitos.

Exploration programs from a few years ago returned interesting sampling values (up to 409mg/L Lithium) and low grade brine drill results (on average 109mg/L Lithium), indicated by CEO Cacos with the black ellipse, so Argentina Lithium will be looking at exploring new zones on the Incahuasi Project claim set.

Conclusion

Argentina Lithium is making the most of the record-breaking lithium price environment these days, as it hopes to raise no less then C$6.75M, and already closed 2 tranches for C$4.99M. This money enables the company to finally start geophysics and diamond drilling, with the focus on Rincon West and Antofalla. The company is looking to disclose the new exploration plans right after the closing of the third and last tranche of the ongoing financing, and hopes to start drilling in the first quarter of next year. The extreme lithium prices already lit a fire under this tiny explorer, but if they actually achieve solid drill results and lithium sentiment is still as strong, a further re-rating seems likely.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on www.criticalinvestor.eu in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Argentina Lithium and Energy is a sponsoring company. All facts are to be checked by the reader. For more information go to www.argentinalithium.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.