Dolly Varden Silver Intersects 29m @ 381g/t Ag At Wolf Vein

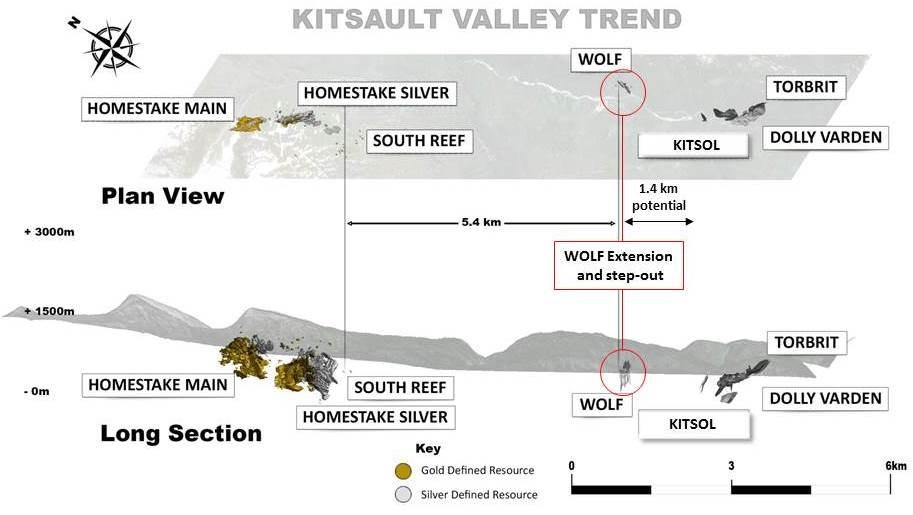

In uncertain times, where the Fed gradually seems to be pushed closer and closer to a rate hike pause, potentially followed by rate cuts somewhere in 2024, the Russian conflict keeps aggrevating, and the Chinese government keeps coming with soft measures to restart their economy, Dolly Varden Silver (DV.V)(DOLLF.US) doesn’t seem to faze one bit, and continues with 5 rigs on their impressive 55,000m drill program at Kitsault Valley Project in BC. Recently the second batch of results came in, focusing on the Wolf Vein, with lots of intercepts being very narrow (<1.5m), but with one pretty impressive assay: 29.3m @ 381g/t Ag from 712m. This hole was a 75m step-out hole to the north-east, adding potentially a few million ounces of silver.

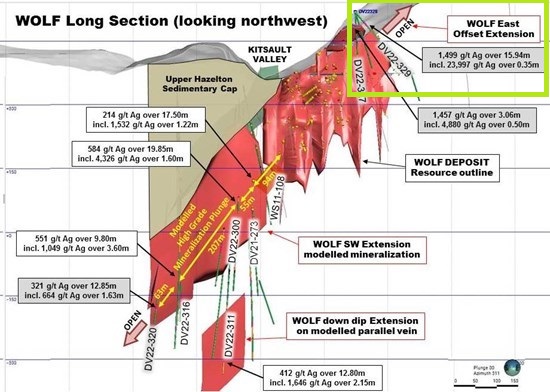

This happened after reporting the successful initial results for this program at August 8, 2023, when Dolly Varden drilled Kitsol and Torbrit. Highlights were 18m @ 342g/t Ag and 8.3m @ 297g/t Ag, and these and other results expanded the Kitsol Vein to over 250m. After hitting more impressive intercepts like 25m @ 46,3g/t Au at Homestake Ridge and 15,94m @ 1,499g/t Ag at the Wolf Vein earlier, Dolly Varden is well on its way to delineate substantial resources at Kitsault Valley.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Dolly Varden Silver's NPV and resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Dolly Varden Silver or Dolly Varden Silver's management. Dolly Varden Silver has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

After completing 43,000m of drilling of their from 45,000m to 55,000m expanded drill program, Dolly Varden Silver published the second batch of results involving 19 holes, targeting the Wolf Vein.

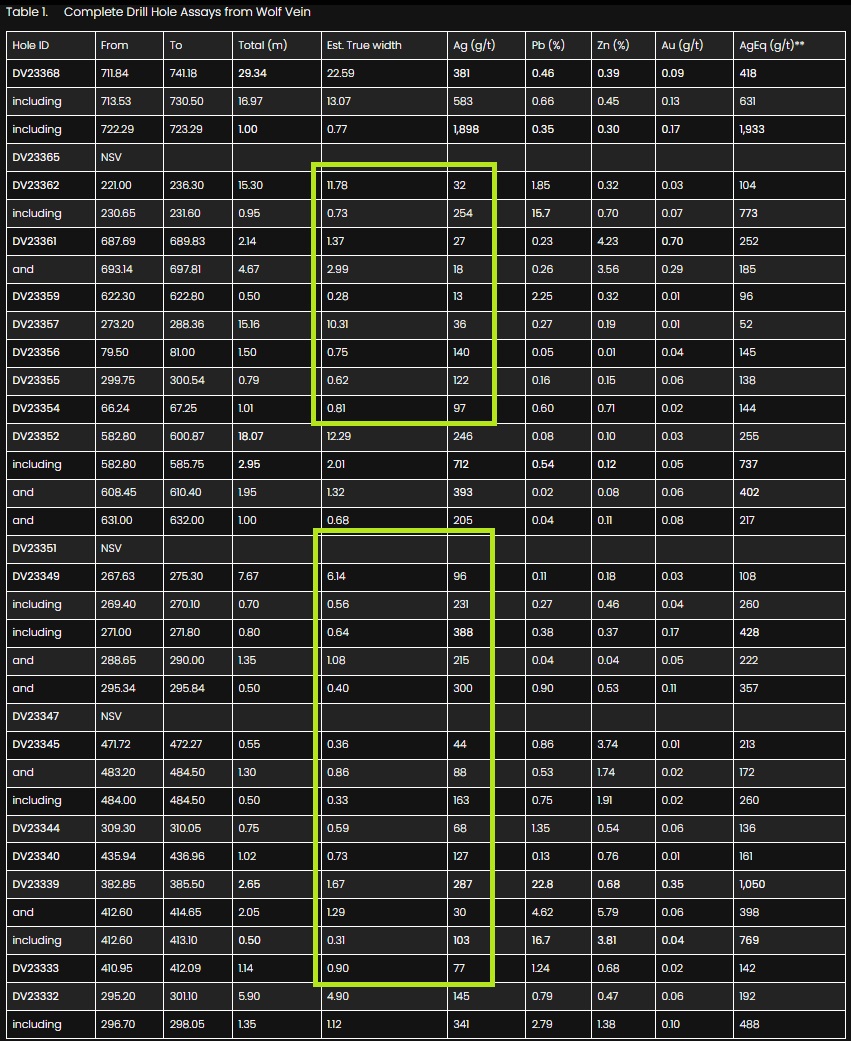

Highlights included:

- DV23-368, Southwest Extension step-out: 34m @ 381 g/t Ag, 0.46% Pb, 0.39% Zn (22.59m estimated true width), including 1.00m @ 1,898 g/t Ag (0.77m estimated true width) from a 75m step-out

- DV23-352, Southwest Extension: 07m @246 g/t Ag (12.29m estimated true width) including 2.95m @ 712 g/t Ag (2.01m estimated true width)

- DV23-339: 2.65m @ 287 g/t Ag. 0.35 g/t Au and 22.83% Pb (1.67m estimated true width)

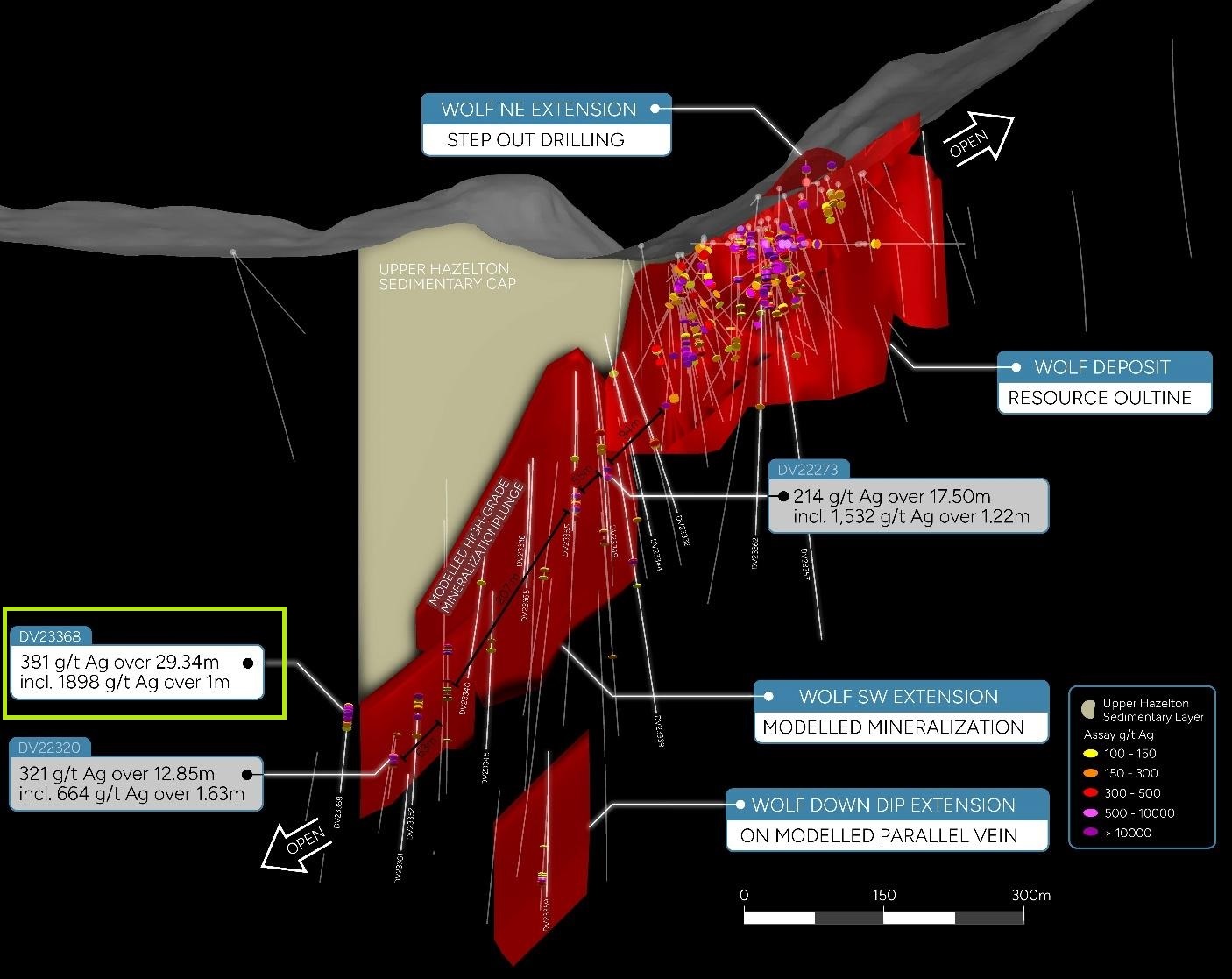

The best intercept (hole 368) is marked green in the following 3D visual:

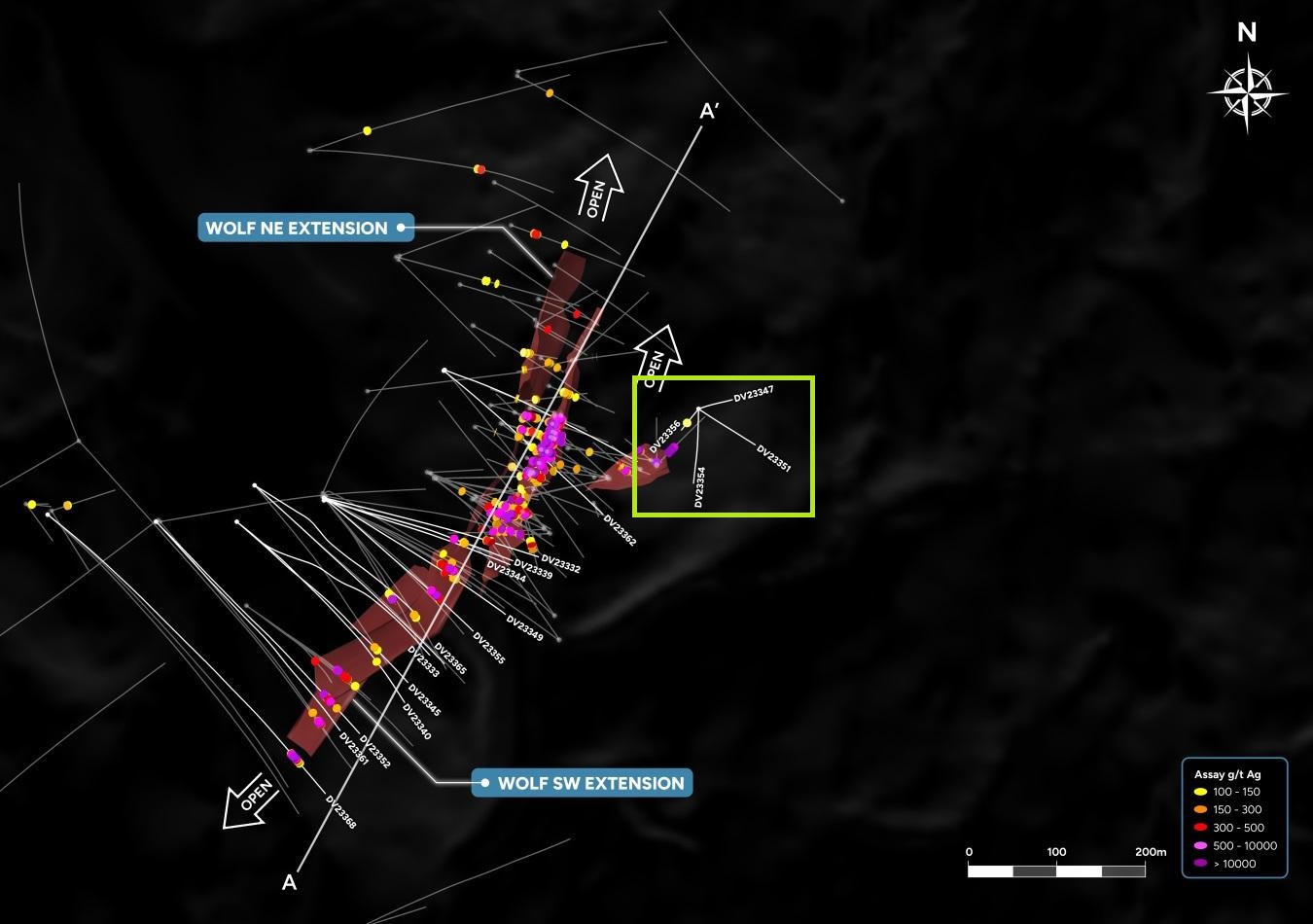

Being a 75m step-out from another robust hole DV22-320 (12.85m @ 321g/t Ag), hole 368 represents a convincing continuation of mineralization down plunge. This mineralization is comprised of multiple phases of brecciation within a northeast-southwest oriented epithermal vein system. Other step-outs like hole DV23-359 and the group DV23-347/351/354/356, designed to test parallel splays and eastern extensions, weren’t as successful yet, but provided more vectoring information for management to follow upon shortly. The group can be observed below, outlined in green, the parallel splay (offset vein) is actually presented in the 3D visual above, being the rectangled red volume in the upper right area, hovering parallel from the main structure.

When looking at the full table of results, it appeared that a quite a bit of assays contained narrow mineralized intercepts and/or low grades within the wider vein zone (marked light green):

I already noticed this variance at earlier results for the Wolf Vein, when Dolly Varden combined likewise results with their most remarkable intercept to date, with 15,94m @ 1,499g/t Ag Wolf Vein including 0.35m @ 23,997g/t Ag, with a residual grade of 993g/t Ag at the northeast extension:

I wondered if the number of narrow/low grade intercepts could have a significant influence on Wolf Vein tonnage and thus silver ounces. Are these intercepts defining the outside edges of the mineralized envelope? VP Exploration Rob van Egmond elaborated; The narrower intervals come from within a wider vein intercept, but outside of the higher silver grade plunge where the higher grade and wider intercepts come from. There is a defined shoot outlined by the yellow arrows in the diagram above. The drilling outside of this will still get vein material but the structural preparation was not there for Ag bearing fluids to move along. These holes define the outer edges of the shoot. To date the shoot has been defined over 900m in length 8 to 29 metres wide and has a vertical thickness of approximately 50m within the Wolf Vein.

As Dolly Varden Silver is infill drilling the 200m step-outs to 70-75m, I was wondering if the focus is at a particular side of the Wolf Vein, especially as the East extension delivered the most extreme grades, versus the larger stepouts and the parallel vein at the Southwest extension. VP Ex Van Egmond explained: Our main focus this year has been to infill on the wider step outs and extend further the Wolf Vein to the SW, down plunge. Follow up on the higher grade to the east missed the vein and indicates to us that the strike of that parallel vein is not what it had been as. It does remain open to the NE which we will test next year.

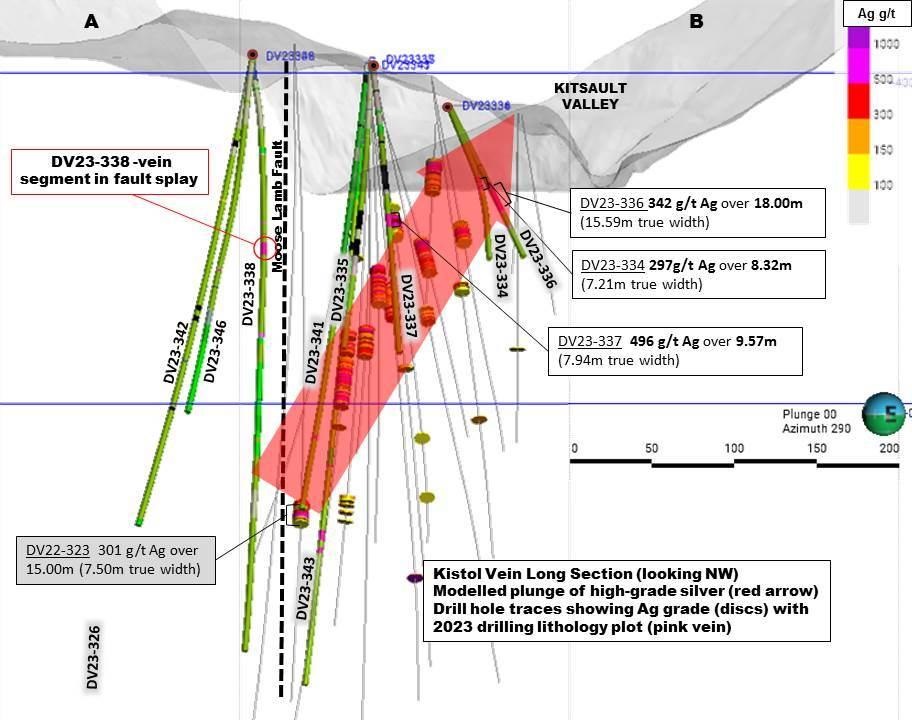

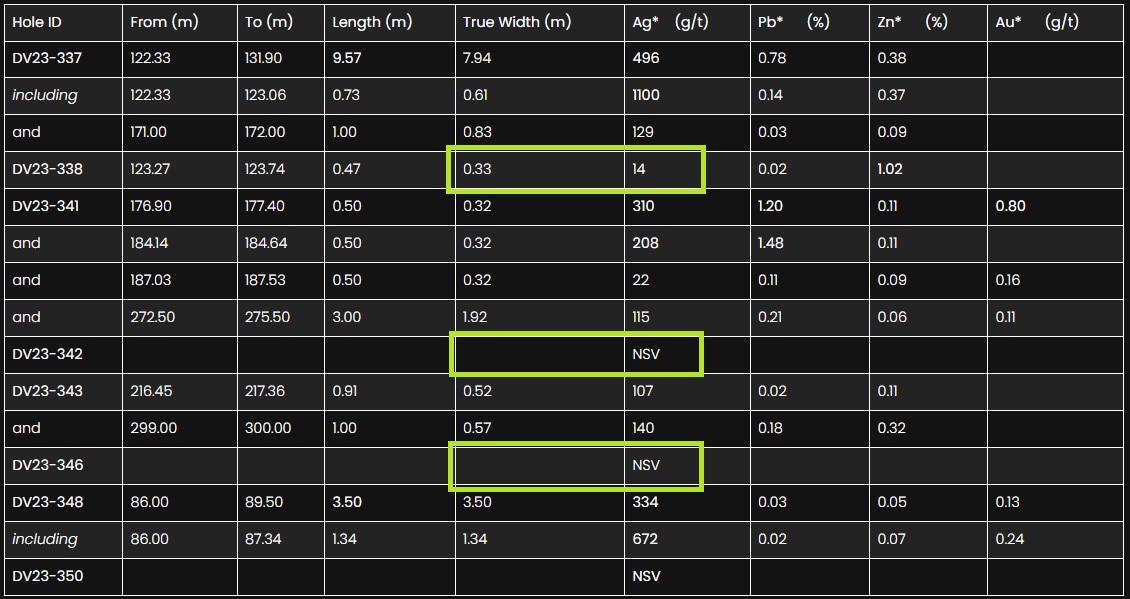

Besides the Wolf Vein, the company is also drilling the Kitsol Vein in the Torbrit Deposit area. Results were announced at August 8, 2023, revealing substantial highlight assays:

- DV23-334: 32m @ 297 g/t Ag including 0.90m @1,090 g/t Ag at Kitsol

- DV23-336: 00m @ 342 g/t Ag including 0.50m @ 2,270 g/t Ag and 0.60m @ 995 g/t Ag with 3.6% Pb at Kitsol

- DV23-337: 57m @ 496 g/t Ag including 0.73m @ 1,100 g/t Ag at Kitsol

- DV23-348: 50m @ 334 g/t Ag including 1.34m @ 672 g/t Ag at Torbrit Main, south extension

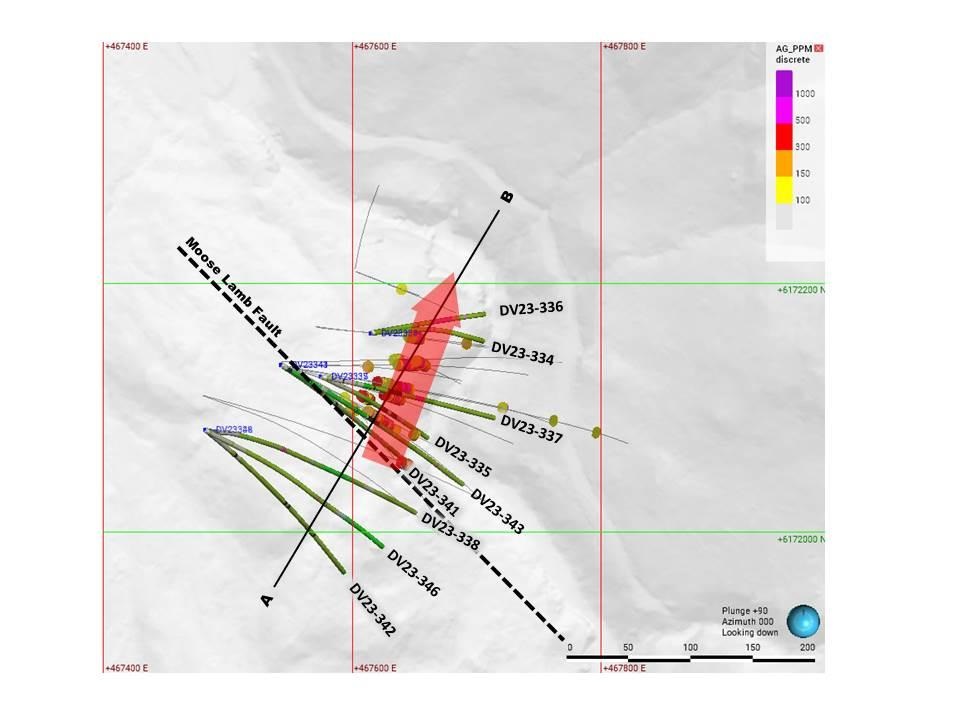

Infill drilling was successful in both directions, to surface and to depth, extending the strike length to 250m. Unfortunately holes 338/342/346 didn’t hit much at the depth extension, in an attempt to find the potentially displaced vein (by the Moose Lamb fault) but VP Ex Van Egmond thinks there might be other options to track it down: “There was a unmineralized fragment of the Kitsol Vein within the fault splays of the Moose Lamb Fault in hole 338 which tells us that there is the possibility that the offset is more to the north of what the original projection was.”

The map representing the Kitsol Vein is shown here:

When there is a big fault, things can complicate quickly when drilling vein structures like this, as displacements can be quite substantial. The fault line itself could even be the conduit for precipitated mineralization, only causing it to flow to the northeast. VP Ex Van Egmond had this to say about this line of thought: “The Moose Lamb fault is a possible conduit for the mineralization as it is an older structure that was there prior to mineralization and re-activated after mineralization. We do see vein in the Moose Lamb structure near the Torbrit deposit where some of the Torbrit mineralization has moved along it. At Kitsol the only possibility is that the mineralization has moved to the NW as we have tested the fault to the SE and did not find any vein extending along it.”

The part of the table with the relevant results marked green can be seen here:

As can be seen, holes 338/342/346 didn’t hit economic quantities, but Dolly Varden will continue to develop targets to the northwest of the fault in order to be sure. Drill holes DV23-335, 337, 341 and 343 tested the high-grade shoot along strike; hole DV23-337 was a 41 meter step-out, up plunge from DV18-131, confirming the consistent vertical dimension of the shoot to be of 50-75 meters, along the length of the plunge, which I will use for estimating the mineralized envelope. The remaining holes intersected the Kitsol vein, either above or below the higher grade mineralized shoot. The average grade is fairly consistent (around 350g/t Ag on average) in a steeply plunging high grade vein in the center of the extension down dip, surrounded by a low grade halo.

As a reminder, the 2019 NI43-101 compliant resource estimate for Dolly Varden stands at 32.9Moz @ 299.8g/t Ag Indicated and 11.4Moz at 277g/t Ag Inferred. Homestake Ridge’s 2022 NI43-101 compliant resources includes 0.16Moz gold with 1.8Moz silver Indicated and 0.81Moz gold with 17.8Moz silver Inferred.

For Torbrit the estimated 300x150x8x2.75 = 990kt envelope remains the same, containing 9.6Moz Ag at an average estimated grade of 300g/t Ag. The Wolf Vein added quite a bit of ounces, as the strike length doubled since my last article. After looking into the results, it appears there is a high grade shoot in a larger mineralized envelope. Tonnage of this high grade shoot could be an estimated 900x50x15m x2.75t/m3=1,86Mt now, at a slightly more conservative average estimated grade of 330g/t Ag (coming from 350g/t Ag) this results in an estimated 19.7Moz Ag (up from 7.8Moz Ag). The lower grade halo surrounding this (at least when looking at the 3D visualization) could be 950x140x20m x 2.75t/m3 = 7.3Mt – 1.86Mt = 5.44Mt. Determining the average grade is difficult, but when assuming 50g/t Ag this would result in an additional estimated 8.8Moz Ag. As this grade isn’t economic, I leave these halo ounces out of the estimation.

The Kitsol Vein increased in strike length as well although much less due to the encountered Moose Lamb fault, resulting in an estimated 250x50x10m x2.75t/m3 x330g/t = 3.7Moz Ag (up from 2.8Moz Ag).

All in all, including the infill drilling which found much higher grades in some instances, I do believe Dolly Varden might have added another 32-34Moz Ag after 2022 drilling, which could mean an estimated increase of 72-77% of their silver resources. As management told me in our interview earlier this year, they are aiming at a 100% increase of silver resources before the cut-off will be determined for a resource update, so it sure looks they are closing in on this target. I wondered if they are focusing on Wolf for the necessary additional ounces, as the fault at Kitsol could limit resource expansion, or do they have other targets in mind to reach this goal? Do they believe the ongoing program will achieve these numbers? VP Ex Van Egmond answered this: ”We may very well hold off on a resource update because we think the best value for the exploration money spent is to see how large the system is, and we will more than likely do another year of drilling to define the new discoveries we found that can then be included in an update. The drilling to date has added mineralization and we will be doing internal estimates this winter to see where the best value can be added in next year’s drilling.”

As drilling was scheduled to start at Homestake in the beginning of July, I wondered what the status is here. Again VP Ex Van Egmond stated: “We started drilling at Homestake Ridge in the beginning of July with 3 drills to work on step outs at Homestake Main, Homestake Silver and exploration targets elsewhere in the property, with one drill remaining at Wolf to continue follow up and infill. A fifth drill was brought in for September to help in reaching our estimated 55,000m goal”

With a burn rate of about C$3.5M per month while drilling from May to October, with C$20.7M in flow through money to spend before the end of December, the cash position at the moment has gone from C$28M in March to C$8M, on schedule to finish the 55,000m drill program before the end of September, so right about now. According to VP Ex Van Egmond, an updated mineral resource estimate for the combined project may still be possible for Q2 of 2024, and then can be used in a consolidated PEA for the Kitsault Valley project, which in that case may be completed for H2, 2024. However, the discoveries and continued step out success seen in 2023 may likely dictate that one more year of drilling would benefit the estimate by the addition of new zones that stll need better definition drilling. Such a program would cost another C$15-20M, and according to VP Ex Van Egmond they will likely raise this somewhere between October and January. They will probably start in May with the next phase of drilling due to the upcoming winter break.

I estimated a Kitsault Valley after-tax NPV8 at an estimated C$550M-600M at US$1850 gold and US$22 silver, and even further past C$700-800M when drilling continues to be successful and we could see the projected silver resource target becoming a reality. I wouldn’t even rule out a NPV8 target of C$1B if drilling at Homestake is successful and the production plan could be frontloaded, but only time will tell. It will take a full year from now before the consolidated PEA comes out, and it usually is discounted because of the high PEA margin for error, but the future potential for Dolly Varden, with a current market cap of C$186M is significant for sure. There aren’t too many substantial primary silver deposits in Canada, and in my view Dolly Varden Silver has the grade and size to make it into production.

Conclusion

After Dolly Varden Silver completed almost 80% of their 55,000m drill program for this year, they already managed to add more strike length to both Wolf and Kitsol, which in the end contributed nicely to tonnage and silver ounces. According to my estimates, the company is well on its way to achieving their original goal of doubling silver resources before announcing a resource update. However, as management now aims at determining size first and because of this wants to follow up on new discoveries, it will likely take another year of drilling before a resource update comes out. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Dolly Varden Silver is a sponsoring company. All facts are to be checked by the reader. For more information go to www.dollyvardensilver.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Dolly Varden district

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.