Gold Terra Restructures Senior Management: Mining Legend Gerald Panneton stepping in as Chairman and CEO

As inflation grows rampant across many sectors, to levels not seen in decades, it only seems a matter of time before gold leaves its side ranging pattern of late. Gold Terra Resource (TSXV:YGT)(OTCQX:YGTFF) (FRA:TXO) aims at making the most of it, as the current President and CEO David Suda is stepping down on December 31, 2021 to pursue other opportunities. Gerald Panneton will be switching from being Executive Chairman to Chairman and Chief Executive Officer (CEO), and David Suda will remain close to Gold Terra as he will be a part time advisor to the company going forward. This restructuring came right at the heels of signing the important option agreement with Newmont to buy the Con Mine late November, and wasn’t a big surprise for those who followed the company closely.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Panneton will assume the role of Chairman and CEO effective January 1, 2022, although he was already been dominant during his tenure as Executive Chairman. When briefly discussing the switch with him, it appeared that he was leading already all the major developments for Gold Terra, from property acquisitions to financings, and was effectively a mentor to David Suda. When you have a mining legend joining the company, not planning on semi-retirement anytime soon, you would be foolish not to exploit all experience, knowledge and network for the greater good. I felt it was the right thing for Suda after a while to give Panneton the keys of the house, taking on a 1 year advisor role himself and pursue other opportunities. It is good to keep in mind Suda effectively restructured Gold Terra two years ago, and Panneton was quickly to acknowledge this:

"I sincerely thank Mr. Suda for his significant contributions to the Company and I look forward to be working with him in his new role. The Gold Terra team remains intact and very committed to increasing value for our shareholders by accelerating our exploration strategy with the aim of delineating additional high-grade ounces along the Campbell Shear extension south of the Con Mine, and adding to our current inferred mineral resource estimate, which stands at 1.21 M oz (March 16, 2021 News Release)."

As a reminder, Panneton isn’t your everyday mining executive according to his bio:

“Mr. Panneton is a geologist with over 35 years of experience and has played a key role in the discovery and advancement of several gold deposits worldwide. Mr. Panneton was the founder, President and CEO of Detour Gold Corporation (2006-13), where under his leadership, the Detour Lake project grew over tenfold from 1.5 million ounces in mineral resources to over 16 million ounces in mineral reserves and brought into production in just over six years. Mr. Panneton raised approximately $2.6 billion in capital while at Detour Gold. Mr. Panneton and his team were the recipients of the PDAC 2011 Bill Dennis Award for Canadian mineral discoveries and prospecting success of the year. Earlier in his career, Mr. Panneton spent 12 years at Barrick Gold Corporation (1994-2006), where he was instrumental in advancing the Tulawaka and Buzwagi gold projects in Tanzania towards production. Prior to Barrick Gold, he worked for Lac Minerals Ltd., Placer Dome Inc. and Vior-Mazarin Group. Mr. Panneton received his Bachelor of Science in Geology from the University of Montreal and his Master of Science in Geology from McGill University.”

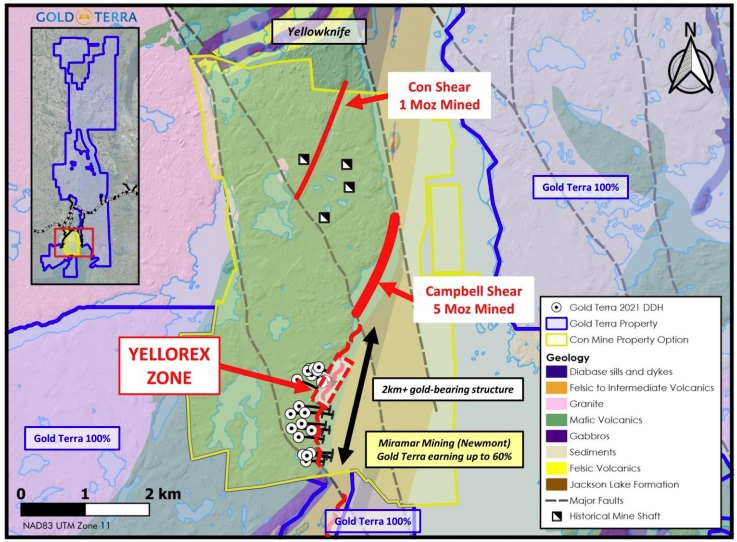

Panneton joined Gold Terra in 2019, after Suda asked him many times, and he finally joined for the exceptional potential of the Campbell Shear south of the Con Mine, and also, north of the Giant Mine. Panneton believes there could be at least 2M+ oz Au at a gold grade exceeding 10 grams per ton (g/t) present in the underexplored areas. After the last acquisition, the company has consolidated all ground at and around the Con Mine, including the anticipated trajectory of the southern part of the Campbell Shear:

Again as a reminder, the part of the Campbell Shear north of the Con Mine and near the Giant Mine is off limits anyway, as this former mine currently is a reclamation nightmare, so Gold Terra isn’t planning on going anywhere near it.

With the recent acquisition came a historic resource of 651koz @ 10.2g/t Au located below 1000m depth, and according to Panneton there could be about 1 Moz Au down there. It will probably take at least 10-20% verification drilling to convert this into a NI43-101 compliant resource, and this probably has to be done from surface as it is too early to start dewatering the Con Mine.

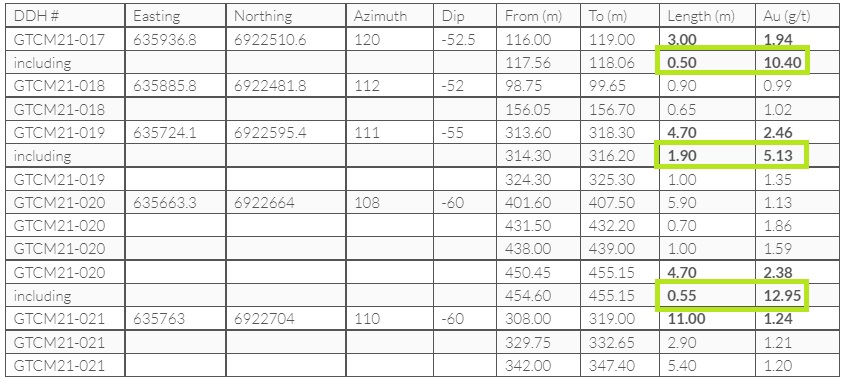

Speaking of drilling, Gold Terra announced the delayed assays of 5 more holes of the current 2021 program, on the Yellorex Zone on December 8, 2021. Although the intercepts weren’t spectacular, every hole managed to hit the Campbell Shear, and have extended gold mineralization on both the northern and southern limits of the Yellorex Zone for over two kilometers. Here is a table with the results, with the economic results highlighted in green:

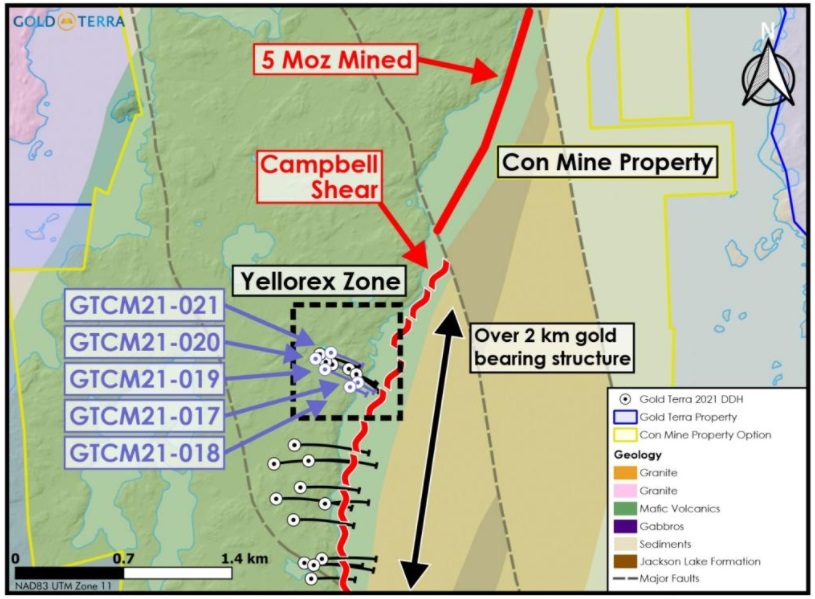

The following map shows the locations of the latest drill collars:

A description of the mineralization and geology encountered in the five holes looks like this:

Holes GTCM21-017 and GTCM21-018 both intersected a strong sericite alteration and some pyrite and arsenopyrite. Hole GTCM21-017 intersected a 22cm-thick smoky quartz vein which is typical of the Yellorex zone. Hole GTCM21-018 intersected the outer limit of the alteration halo around the main Yellorex deposit, which also includes low-grade gold values.

Hole GTCM21-019 was also collared on the south limit of the Yellorex deposit but tested the zone deeper than hole GTCM21-018. Although the hole was collared on the south limit of the Yellorex deposit, it still intersected a significant alteration halo which included a series of small, mineralized smoky quartz veins.

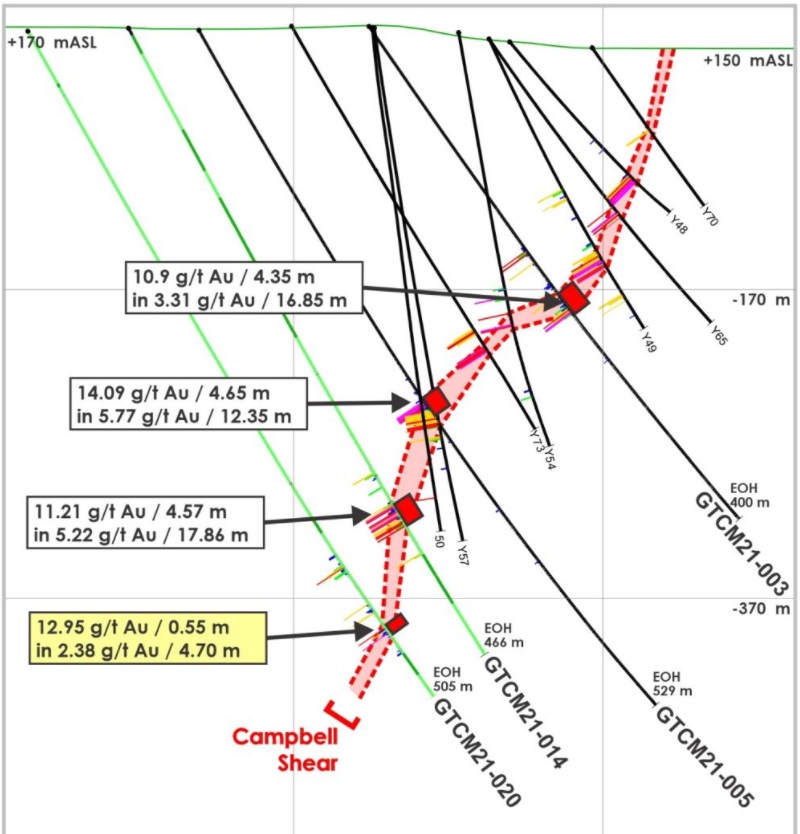

Hole GTCM21-020 was drilled about 60m underneath one of the best holes so far, GTCM21-014, which returned 5.22g/t Au over 17.86m including 11.22g/t Au over 4.57m. Two main gold zones were intersected with two minor zones in between from 401.60 to 455.15m. The mineralized zones consist of intense sericite alteration with arsenopyrite and pyrite stringers with local smoky quartz veinlets. The mineralization intersected in hole GTCM21-020 is typical, but just off the main shoot of hole 014.

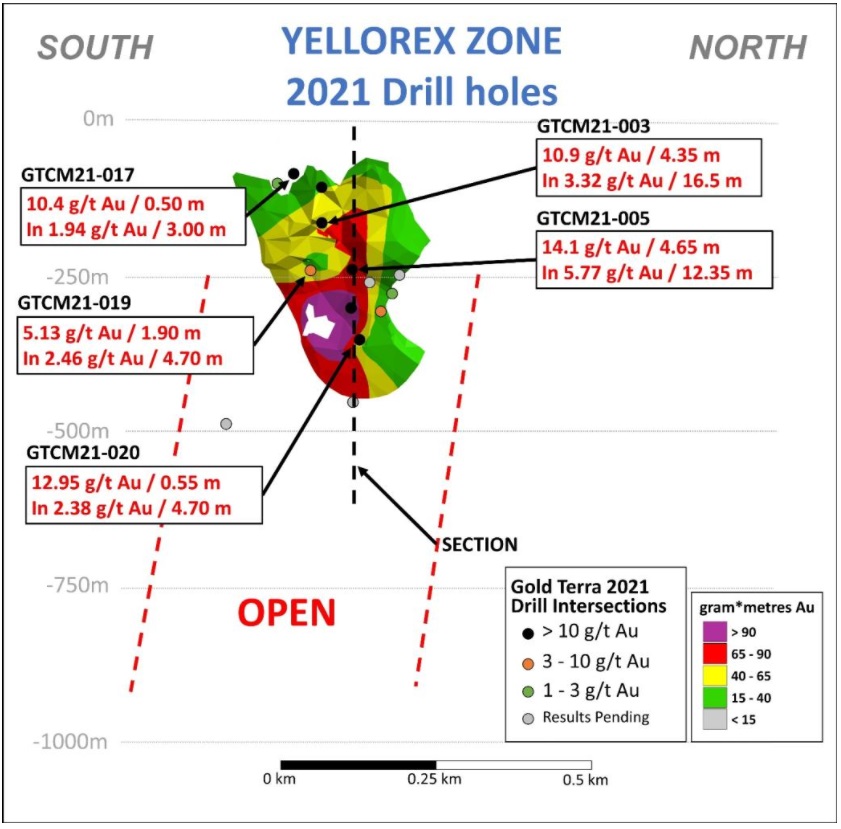

The location of holes 17, 19 and 20 at the Yellowrex mineralized envelope can be observed here:

It can be observed that the colored zones aren’t as continuous as marked in their mineralization as per gram*meter, as for example infill holes 19 and 20 would show grey spots in the green and yellow zones. I don’t bother that much about this, as the main prize is anticipated to be located much deeper.

GTCM21-021 was drilled about 50 metres to the north-east of hole GTCM21-015 and 100 metres from hole GTCM21-020. To date, this hole is the furthest to the north-east limit of the known Yellorex deposit extending the gold-bearing lens by about 50 metres along strike. The sericite alteration in this hole is still strong and pervasive and limited to the mineralized intersections. Arsenopyrite and pyrite stringers are associated with the gold mineralization, with minor smoky quartz veinlets. This type of mineralization is exactly similar to the one found at the historic Con Mine. The section indicated at the last east-west view is shown below:

A quick estimate on tonnage results in an estimated 1.7Mt, if an average grade of 5g/t Au is assumed, almost 300koz Au could be present. According to the latest results, historic results like Y84 and Y90, and the old sections which were discussed in my last article, it seems at -500m to -750m there could be little mineralization, and it could get really interesting below these depths, as the main mineralization of the Campbell Shear at the adjacent Con Mine was located at depth as well.

Management estimates the timeline for drilling the deepest holes to happen around January-February 2022, with the results hopefully coming back from the lab at March-April. As the Phase 2 drill program will see 10,000m of drilling and just 4,430m is completed, there is still 5,570m to go.

Joe Campbell, COO and Qualified Person stated: "The current drill program in the Yellorex zone is focusing on testing the extension of the upper limits and southern limits of the zone while confirming some additional areas of intense mineralization. The Campbell Shear envelope is typical of Archean greenstone belt style with higher grade mineralization in structurally controlled shoots within large, altered envelopes, and more drilling is often required to define them. We have had 100% success rate intersecting altered envelopes in the Campbell shear similar to the Con Mine. Our drilling approach is defining the outlines of higher-grade shoots, to be followed down plunge in a very similar pattern to the 5.0 Moz mined at the neighbouring Con Mine.”

So the plan is to follow the mineralization down plunge, and over the next 24 months the strategy is to increase the current extent of drilling mainly south of the original Con Mine to a depth of 1,000 metres. Management is looking to use a step out drill spacing of 100 metres and with 50 metres of infill, with the objective of delineating at least a 1.0Moz high grade gold resource at the end of 2022, and eventually a minimum of 1.5Moz high-grade gold the year after, south of the Con Mine. Investors are waiting for the drill bit to deliver, and although a European trip of Panneton and Suda in November initiated a significant amount of buying, the share price has come down again, potentially still through some tax loss selling pressure as well:

Share price 1 year timeframe (Source: tmxmoney.com)

The stock seems to be bottoming again, and if gold does pick up on inflation fears, and good results start piling in next year, this could prove to be an excellent entry point. The absolute low seems to be 17c, so there is support not to far from current levels. The treasury contains C$3.9M after the closing of the C$1.5M investment by Newmont, so Gold Terra is cashed up for at least completing the ongoing drill program, costing approximately C$1.5M, which will take them most likely into Q2, 2022 before they need to go back to the markets.

Conclusion

I must say I am really looking forward to what incoming CEO Gerald Panneton can do at Gold Terra, as he will undoubtedly make some changes, although he already strongly guided the direction of the company as the Executive Chairman. My guess is Panneton will aim at more aggressive drilling, and might be able to do just this as he will be in full control of proceedings after January 1st, 2022. In my view the markets probably like the somewhat changed narrative, as it really is becoming the next play of legend Gerald Panneton now, who is not in the business of running small juniors for years but thinks big. Gold Terra will announce the last assays of currently completed drill holes soon, and after that investors should be looking out for assays of deeper holes a bit further down the road in Q1, 2022. And remember, this exploration of the Campbell Shear is being backstopped by a solid 1.2Moz NI43-101 resource and a 0.65Moz historic resource at depth, with pretty good data available on it.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Gold Terra Resource is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldterracorp.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.