Inomin Mines Closes C$607k Oversubscribed Financing, Drilling At Beaver-Lynx Planned This Month

In these times of increased uncertainties, with a recession looming, a US government that last minute avoided a potentially catastrophic default by approving the debt ceiling bill, and a Fed doubting if they should raise interest rates further or not as inflation is on the way down but still high, Inomin Mines (MINE.V)(FRA:IMC) managed to close their non-brokered financing for C$607k. The proceeds are sufficient for a follow-up drill program on their magnesium-nickel Beaver-Lynx project in British Columbia, a significant discovery announced last spring.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Inomin Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Inomin or Inomin’s management. Inomin Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Inomin Mines closed the non-brokered private placement on May 31, 2023, and raised a just slightly oversubscribed C$607k (the intention was up to C$600k), consisting of a combination of hard dollar shares (repriced from C$0.075 to C$0.07) and flow-through (FT) shares (C$0.10). Both have a full warrant, the common shares with an exercise period of 3 years and a price of C$0.13 per share, the FT shares with an exercise period of 2 years and a price of C$0.15. A total amount of 3.99M hard dollar shares were issued for C$279k, and 3.275M FT shares for C$327.5k, totaling C$606.95k.

The FT proceeds will be spent on exploration expenditures at Beaver-Lynx in order to qualify for tax incentives, and the drilling budget might be increased, as the company has about C$700k in the treasury now. The upcoming drill program will commence this month according to CEO John Gomez, and as last year’s drill holes had an average length of 150m, and the all-in drill costs were about C$300/m in 2022, my expectation is that Inomin will be able to drill at least 5-6 holes. If drilling is as successful as the last program, and metal prices and market sentiment cooperates, the idea is raise more at better prices right after drill results, in order to keep drilling at Beaver-Lynx, and start exploration at La Gitana and/or other property to provide more or less continuous news flow.

Management is aiming at revitalizing the same investors sentiment from last year, as the results of the first five drill holes at the Beaver area sent the share price from C$0.105 to C$0.72 in just three trading days late March, 2022, on colossal volume (20.8M shares changed hands - almost the company’s entire free float). The sampling and geophysics look even better at the Lynx target, so I am really looking forward to results coming from that area:

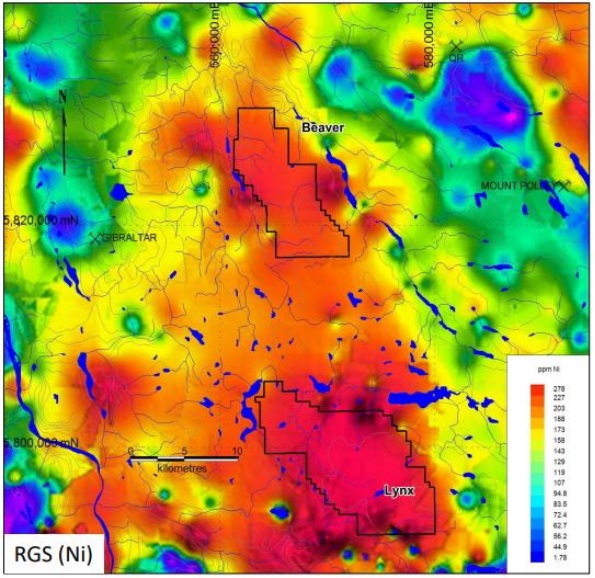

Regional stream sediment (RGS) nickel data at Beaver-Lynx is among the highest in the province. Furthermore, the project is located between two of the largest polymetallic mines in the province – Taseko’s Gibraltar mine and Imperial Metal’s Mount Polley operation, in other words “elephant country.

Magnesium was a big part of the excitement last year, and prices for this metal have dropped back again to 23300Y/t levels, which is US$3,282/t:

The current magnesium prices would still generate a gross metal value of US$656/t at the drilled grades of about 20% Mg, which is equivalent to 7.7% copper for example, so pretty impressive, especially when 4 out of the 5 drill intercepts at Beaver were ranging from 64 to 252m in length. Historic drill holes collared 1-4km to the west confirmed more near surface magnesium and nickel at similar grades, with intercepts varying from 9 to 100.6m in length, indicating large scale mineralized potential. The nearby Lynx area is geologically similar to the Beaver discoveries, with even larger targets.

As a reminder, imagine if Lynx could return say a hypothetical 400Mt @ 0.25%Ni just like I estimated for Beaver, then Beaver and Lynx combined might even provide 1.7-2.0Mt contained nickel, which would put it not too far from Decar (2.4Mt contained nickel @ 013% awaruite DTR nickel (0.21% total Ni), FPX Nickel has a C$114.6M market cap). Or Crawford (3.5Mt contained nickel @ 0.24% sulfides, Canada Nickel has a C$202M market cap). With high-grade magnesium, large volumes of nickel, plus chromium and cobalt credits, Beaver-Lynx already seems to be shaping up as a potentially pretty economic deposit, although it is still very early days of course.

The company is also working hard on the 100% owned 494 hectare La Gitana project in Oaxaca State in southwestern Mexico with 8,230m of drilling over 38 holes completed in 2005-2006 on the property by former co-owners Chesapeake Gold and Goldcorp. About half of the holes hit significant gold and silver mineralization, most starting close to surface, including the first hole that intersected an impressive 133.5m of 1.78 g/t gold and 100.7 g/t silver. Given available drilling data, just 20% verification drilling (about 6 holes) would be needed for a NI43-101 compliant resource. I estimated the mineralized potential at 500-600koz Au for now, and management thinks there is even potential for 1Moz Au as the deposit is open to expansion in all directions. As Inomin management is busy renewing the discussions with the local communities, it is hoping to reach an agreement soon in order to resume exploration.

Conclusion

It took a while, but a filled treasury after closing the C$607k raise finally enables Inomin Mines to commence drilling this month at Beaver-Lynx. As the Lynx target seems to look even more promising than Beaver, which already caused a 7-bagger when the results were announced, I am quite curious what the company could find there. Besides this, I’m also curious about the community work that is being done at the moment at their La Gitana gold-silver project in Mexico, as an agreement with the community could be a gamechanger. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Inomin Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.inominmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.