Inomin Mines Intercepts 169m @ 23% Magnesium And 0.19% Nickel At Beaver South

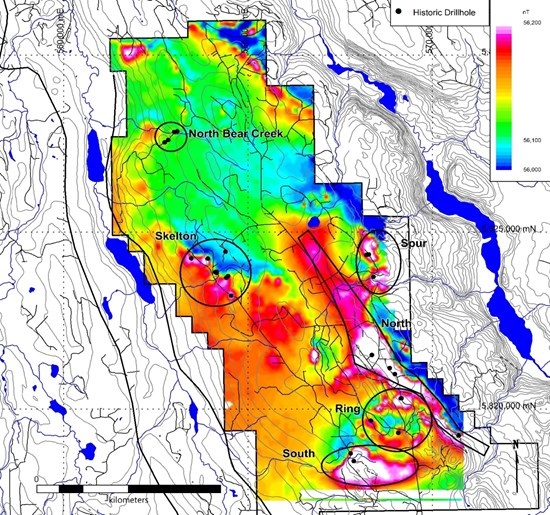

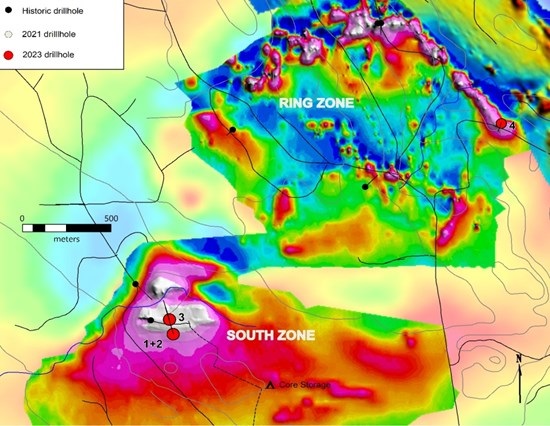

As analysts debate whether the world economy is heading into a mild recession, with the Fed hesitating if they should pivot soon or not, Inomin Mines (MINE.V)(FRA:IMC) delivered further impressive drill results from their 100% owned, 24,000 hectare Beaver-Lynx project in south-central, BC, The drilling program commenced in June, right after the company closed their C$607k non-brokered financing. Inomin drilled three holes in the South Zone and one in the Ring Zone of the Beaver claims, as they identified strong targets in these areas. These zones are located 2 – 5 kms south-west of the discovery drill collars of their last drill program.

The South zone is one of six mineral zones identified at Beaver, prospective for hosting critical mineral deposits. Previous drilling by the company in 2021 intersected mineralization in the Spur and North Lobe zones over a strike length of 5.7 kilometres. All holes encountered significant intervals of mineralization, with drill-hole B21-02 intersecting 252.1m grading 20.6% magnesium, 0.16% nickel, and 0.33% chromium, which generated quite a bit of excitement last year when the results were announced. Preliminary met work indicated excellent recoveries for magnesium (up to 99%) and average recoveries for nickel (58%).

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Inomin Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Inomin or Inomin’s management. Inomin Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

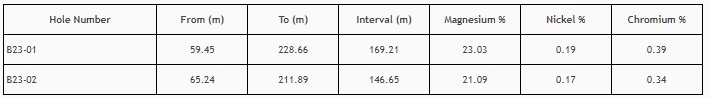

The recently completed drill program consisted of 4 holes (968m), and targeted the South and Ring zones, located approximately 6km and 4.5km respectively of the discovery zone drilled in 2021. The assays of two holes were reported in the September 6, 2023 news release:

The South Zone is a 500 x 500 metre strongly magnetic zone as defined by ground magnetics. Drilling confirmed mineralization occurs in two parallel shallow dipping serpentinized bodies with an estimated true thickness of 160 metres. The mineralization appears to be increasing in thickness toward the north. The location of the drill collars can be seen on the following map:

A more zoomed in map shows the location of the collars in more detail, aimed at the magnetic highs:

If I was to estimate very roughly based on just these two holes, and extrapolating the magnetic highs, we could be looking at a mineralized envelope for South Zone of 800x500x130x2.75(density) = 143Mt, which would add a bit to the earlier estimated 115.5Mt from my first article about Inomin. CEO Gomez was pleased with the results so far:

"Our initial drilling in the South Zone has generated additional outstanding results at Beaver. South Zone drilling was designed to test a prominent mag target located 2 - 4 kilometres south of the Spur and North Zones where our maiden discovery hit long intervals of mineralization. To date, five high magnetic zones hosting significant mineralization have been identified at Beaver. Remarkably, high-grade magnesium, sulphide nickel and other metals, including gold, have also been discovered in moderately magnetic areas, specifically the North Bear Creek Zone. Beaver's exceptional drill results demonstrate the property's excellent potential for multiple, bulk-tonnage, critical mineral deposits. We look forward to reporting analytical results for the balance of the summer drilling program as results become available."

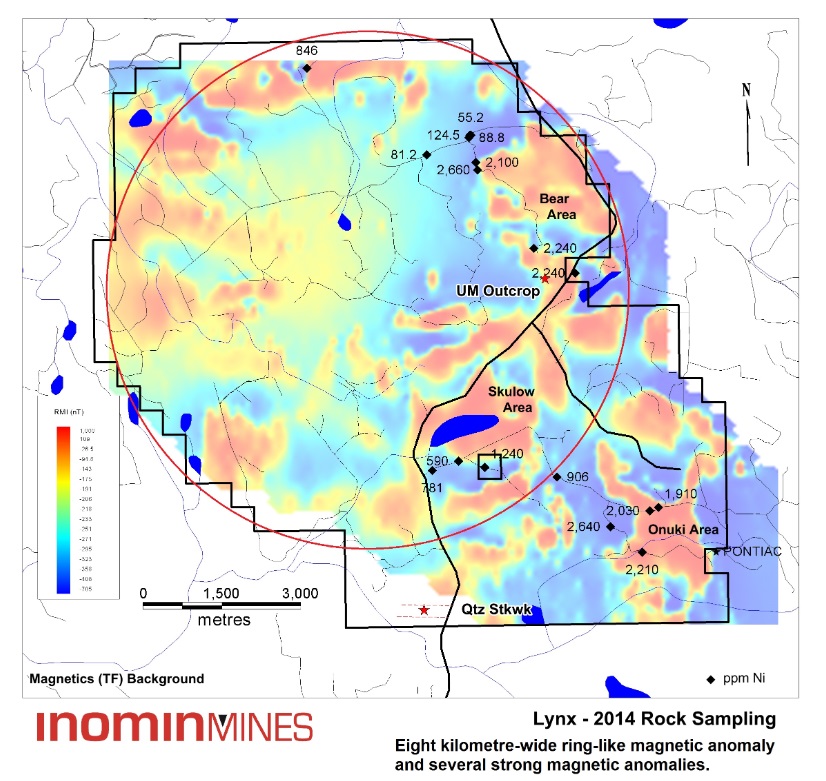

I have no doubt the remaining two drill holes will provide equally good results. In the meantime, the project also contains the Lynx property, and I have high hopes for this claim package. Sampling and an airborne magnetics survey showed excellent results, perhaps even better compared to Beaver. The following map shows magnetics:

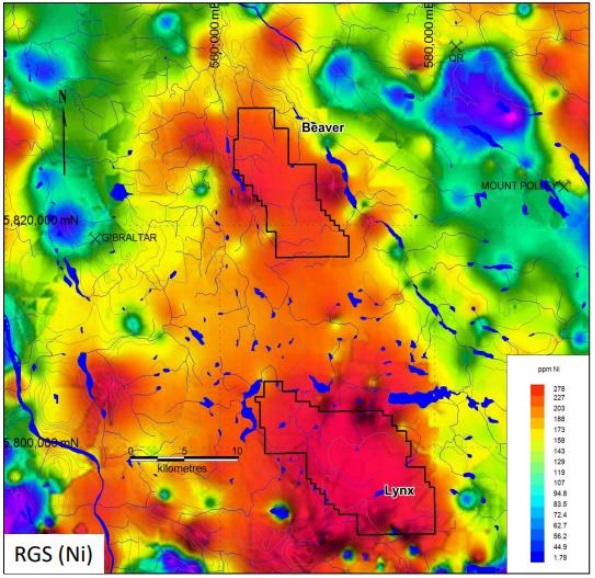

The next map represents stream sediment sampling for nickel:

As a reminder, the regional stream sediment (RGS) nickel data at Beaver-Lynx is among the highest in British Columbia. Furthermore, the project is located between two of the largest polymetallic mines in the province – Taseko’s Gibraltar mine and Imperial Metal’s Mount Polley operation, in other words “elephant country. Also keep in mind: the current magnesium price would generate a gross metal value of US$656/t at drill grades of about 20% Mg, which is equivalent to a 7.7% copper grade, so really robust. The Gibraltar mine by comparison grades only 0.27% copper equivalent –

copper and other metals mined, an average grade which isn’t uncommon for BC operations.

As all-in drill costs per meter at Beaver-Lynx are about C$300/m, this program cost about C$300k so there must be cash left for more drilling as the treasury contained about C$700k in June. It seemed impatient investors, waiting for Lynx drilling, used the good news as a liquidity event. CEO John Gomez responded with the following: “We’re delighted with the latest drill results which confirms the discovery of a sixth substantial mineral zone. As we continue to advance the project, by finding more mineralized areas and/or delineating resources, we will increase the project’s value and ultimately our company’s valuation.”

I’m also curious what follow-up strategy CEO Gomez has in mind after all results will be in from Beaver, as the big target seems to be at Lynx. He stated, “Going forward we want to continue drilling at Beaver as well as complete inaugural drilling at the larger Lynx area. If we find similar mineralization at Lynx, we’ll confirm a district-scale critical mineral system.”

The company is also working hard on the 100% owned 494 hectare La Gitana project in Oaxaca State in southwestern Mexico with 8,230m of drilling over 38 holes completed in 2005-2006 on the property by former co-owners Chesapeake Gold and Goldcorp. About half of the holes hit significant gold and silver mineralization, most starting close to surface, including the first hole that intersected an impressive 133.5m of 1.78 g/t gold and 100.7 g/t silver.

Given available drilling data, just 20% verification drilling (about 6 holes) would be needed for a NI43-101 compliant resource. I estimated the mineralized potential at 500-600koz Au for now, and management thinks there is even potential for 1Moz Au as the deposit is open to expansion in all directions. As Inomin management is busy renewing the discussions with the local communities, I wondered what the status update is for the moment. CEO Gomez had this to disclose: “We’re pleased to continue to interact with community officials about the project, and we hopefully see soon how working together can be beneficial to all stakeholders.”

Conclusion

The initial drilling results at Beaver South were fully in line with the 2021 results, confirming the southern part of an already impressive estimated 434Mt overall mineralized envelope. Two more results are pending in the coming weeks, and Inomin is busy designing the right strategy to advance Beaver-Lynx further. Lynx especially has my attention, as the magnetics and sampling indicate more compelling targets compared to Beaver. At the current very low share price Inomin remains an interesting opportunity. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a position in this stock. Inomin Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.inominmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.