Kenorland Minerals’ Bold Step-Outs Successful At Regnault Gold Project

Ice drilling at Regnault target, Frotet project, Quebec

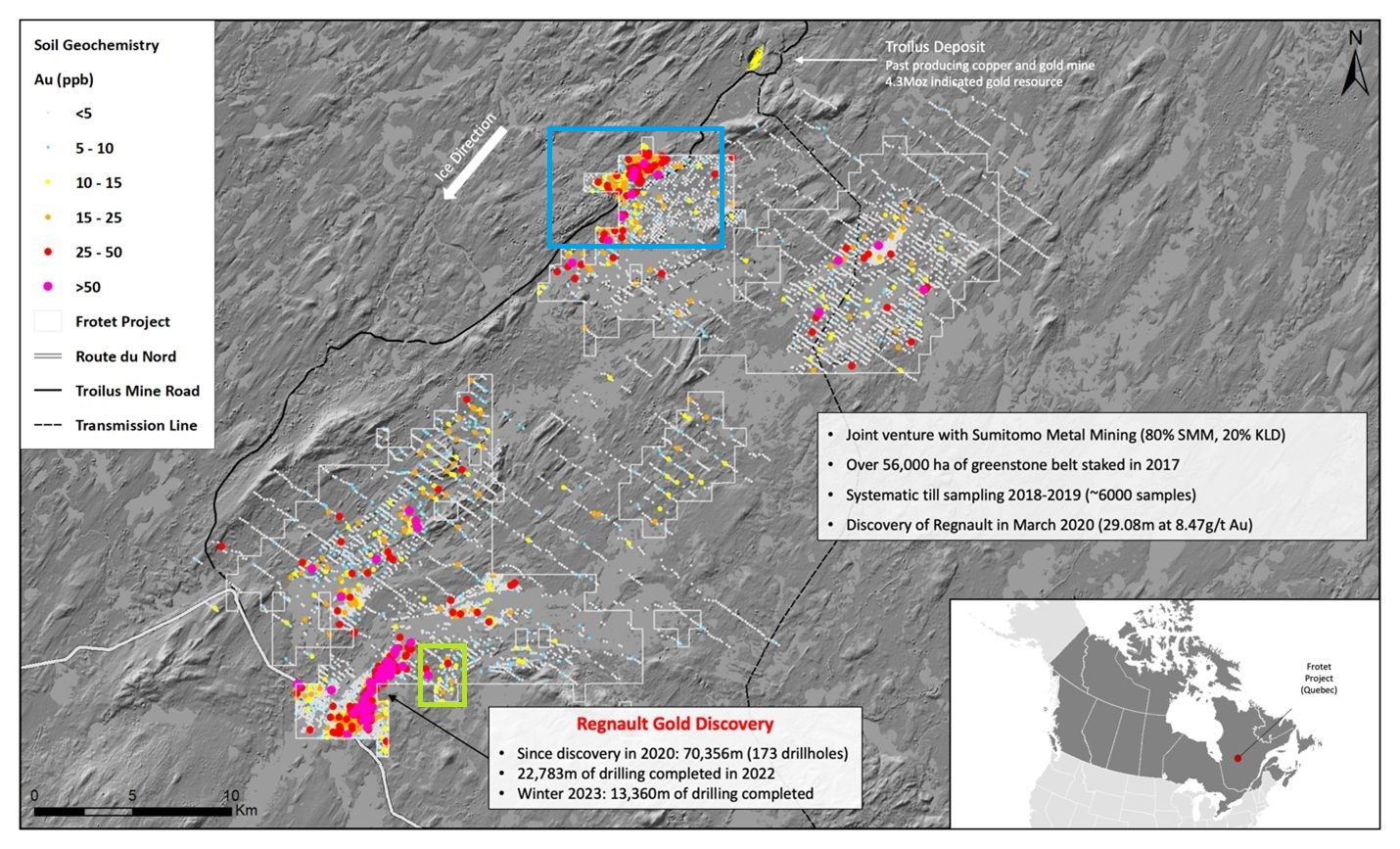

With a recession looming large in the US but continuously delayed, the Fed unsure whether to hike one last time or to pause, the debt ceiling bill passed through the Senate, and inflation going down, there are a lot of mixed signals to take into account for the stock markets. Kenorland Minerals (KLD.V)(3WQO.FSE) isn’t directly impacted by these developments, and keeps its head down, working hard as operator on multiple projects together with major producers, generating newsflow on a continuous basis. Drilling at its flagship Regnault Gold project, JV-ed with Sumitomo, delivered some excellent results on step-out holes, with the absolute highlight being the 3.15m @ 138.74g/t Au intercept at the R5 Vein but also hitting new structures at depth.

Besides being a prospect generator, with C$18M in the treasury, and planned exploration expenditures of C$33M, it’s worth noting that Kenorland has become a profitable entity with significant taxes owing this year based on C$3.5M in revenues (management fees for being operators) and nearly a total of C$100M in expenditures applied to a properties by the end of this year (since inception).

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

The 2023 Winter drill program at the Regnault gold discovery has been completed with a total of 13,360 meters over 15 drill holes. A combination of unseasonably warm weather delaying ice construction and slow drill production resulted in less meters being drilled than originally planned, which was an amount of 22,000m over 25 holes.

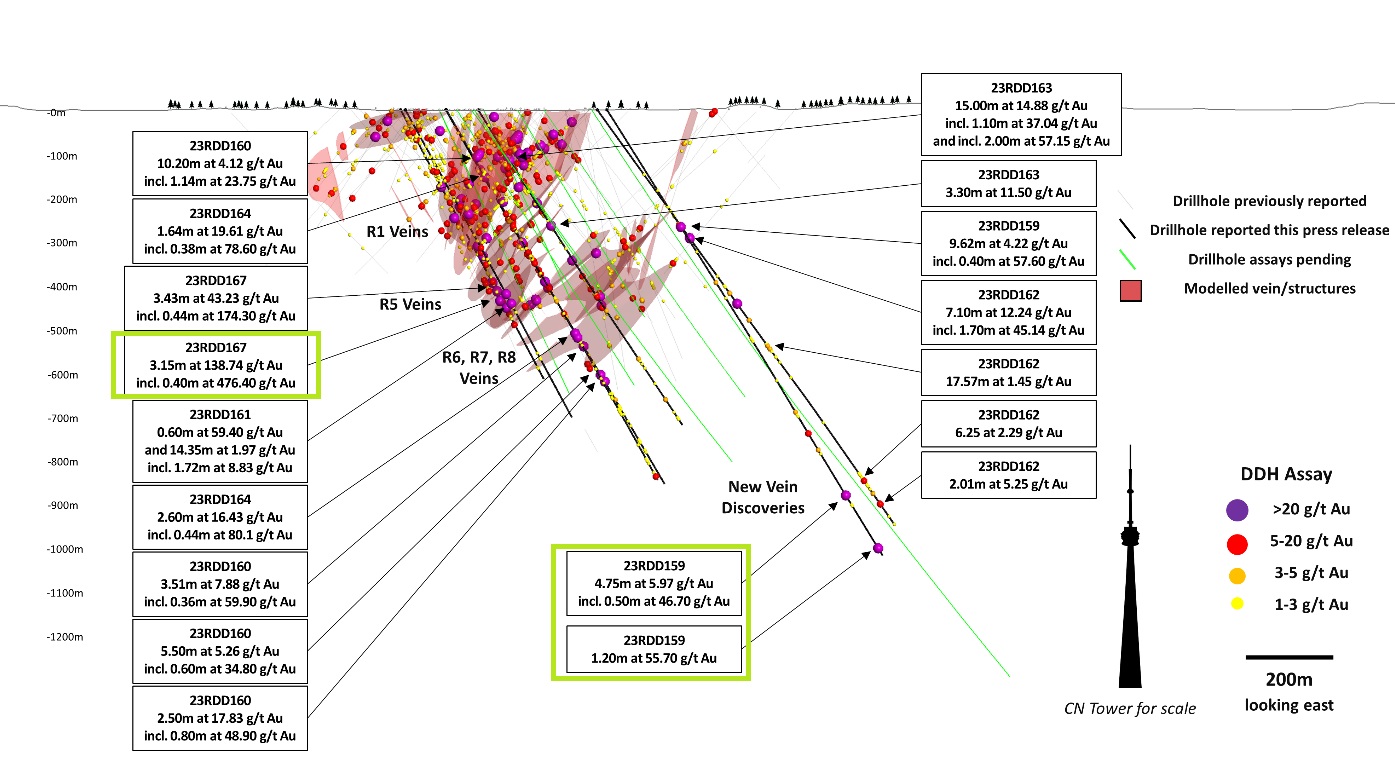

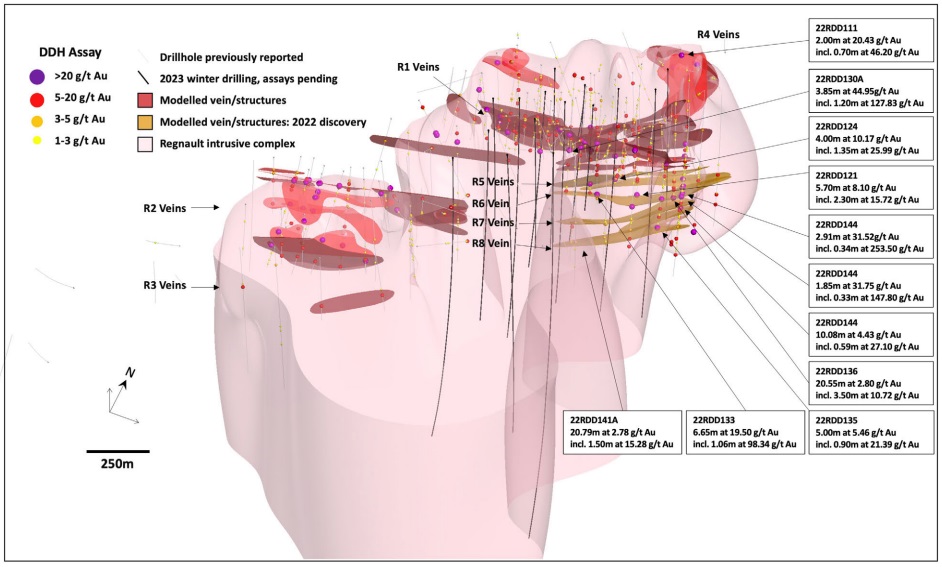

Drill highlights include the following, with 23DD167 being the most significant result:

- 23RDD163: 15.00m @ 14.88 g/t Au incl. 2.00m @ 57.15 g/t Au at R1

- 23RDD167: 3.15m @ 138.74 g/t Au incl. 0.40m @ 476.40 g/t Au at R5

- 23RDD167: 3.43m @ 43.23 g/t Au incl. 0.44m @ 174.30 g/t Au at R5

- 23RDD162: 7.10m @ 12.24 g/t Au incl. 1.70m @ 45.14 g/t Au at R2-R8 Gap

- 23RDD159: 1.20m @ 55.70 g/t Au (new vein discovery)

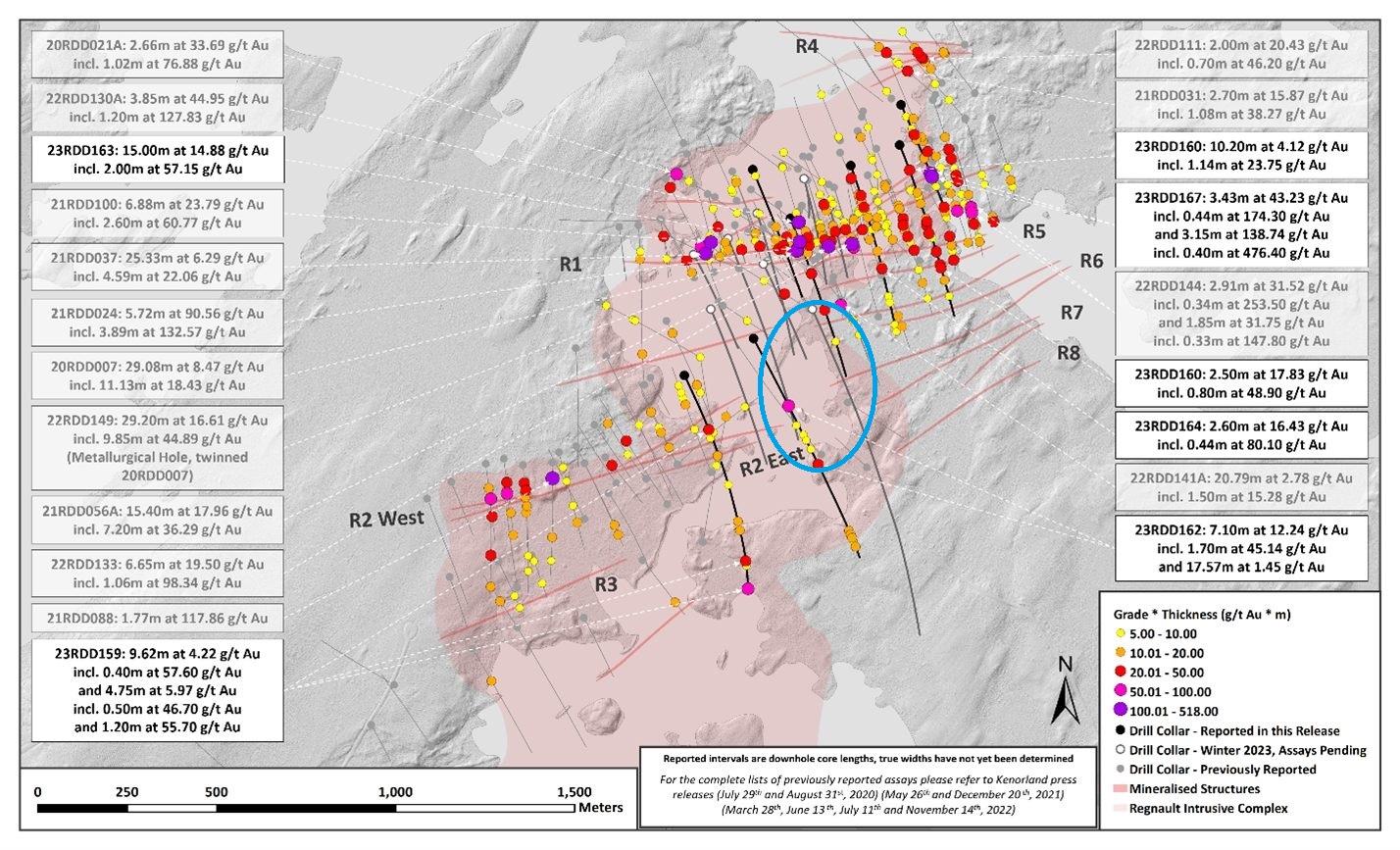

These highlights are indicated on the map below:

An important part of the drill program was no less than 8500m designed to “infill” a 450m gap (blue ellipse above) between R5-R6-R7-R8 and R2-R3, and 2500m was planned to target an untested zone to the south of Regnault, and just 13,360m was completed. There was a combined strategy of infill, stepouts, and deeper drilling to find new structures. A big focus was the center of the system between R5, 6, 7, 8 and the R2/R3.The deeper drilling was also targeting new parallel vein structures, similar to how they found the R5, R6, 7, 8 etc, the deepest hole drilled was just over 1600m, and two more holes of 1200m were completed as well in that target area.

CEO Zach Flood was obviously happy with the results:

“Incredible work by the team on this program and throughout the discovery of this major gold system. As our geologists have been developing a robust geologic model, Regnault is becoming remarkably predictable in the sense of geometry and repetition of sub-parallel vein structures at depth. Given our continued success in finding new veins on each drill program, I believe the odds of further discoveries in the future is great, and we will continue to grow what is already a very large, high-grade gold system.”

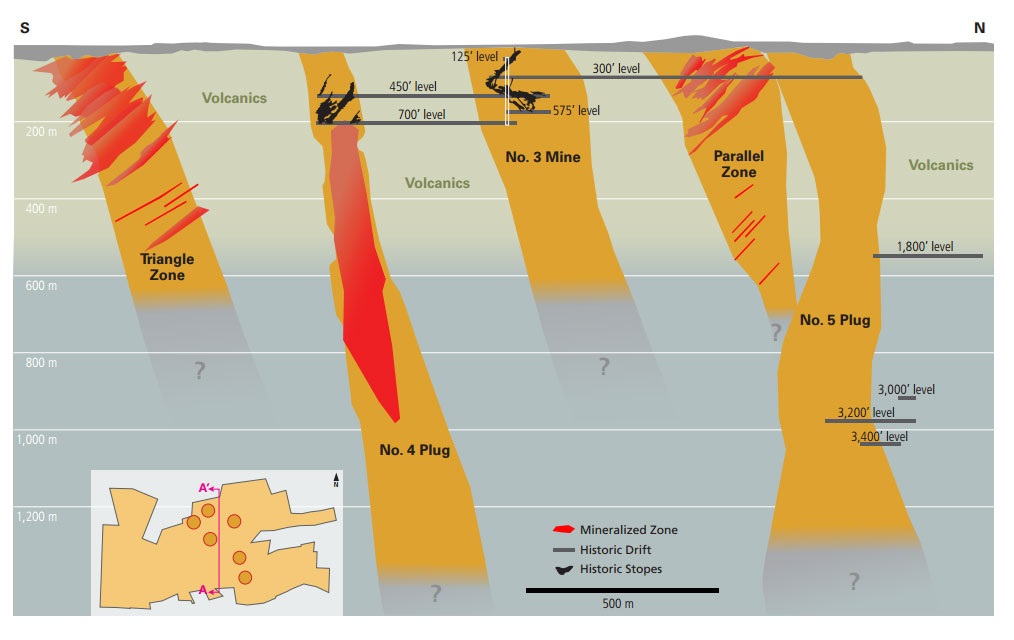

When discussing the geology, CEO Flood indicated that he sees a strong resemblance between Regnault and Lamaque Mine (Eldorado Gold, earlier Integra Gold), as the concept basically is the same: a large intrusive “plug” with series of stacked, semi parallel veins to depth. I found an old Integra Gold presentation, showing this principle, most prominent in the Triangle Zone:

Lamaque also had lots of examples of very high grade, narrow veins, which is typical for orogenic systems, which can often have nuggety effects as well, meaning isolated very high grade intercepts. Kenorland is working hard on a revised 3D model, to visualize and integrate the Lamaque concept as well. This model is also the driving force behind the concept of drilling deeper and deeper, after hitting more and more structures at increasing depths. I must say that the recent deep drill holes were quite a bold attempt in this regard, as they were trying to off-set R8, but they only hit another structure after not intercepting meaningful mineralization for 400-500m with hole 23RDD159, again narrow, high grade veins (1.20m @ 55.7g/t Au and 4.75m @ 5.97g/t Au), comparable with R5-R8. CEO Flood had an additional comment to this:

“We hit a number of structures downhole which had some individual hits along them but didn’t meet the threshold. This is not unusual for a random hole into an area with no drilling. I suspect as we step out, these structures will also be producing reportable grade/widths.”

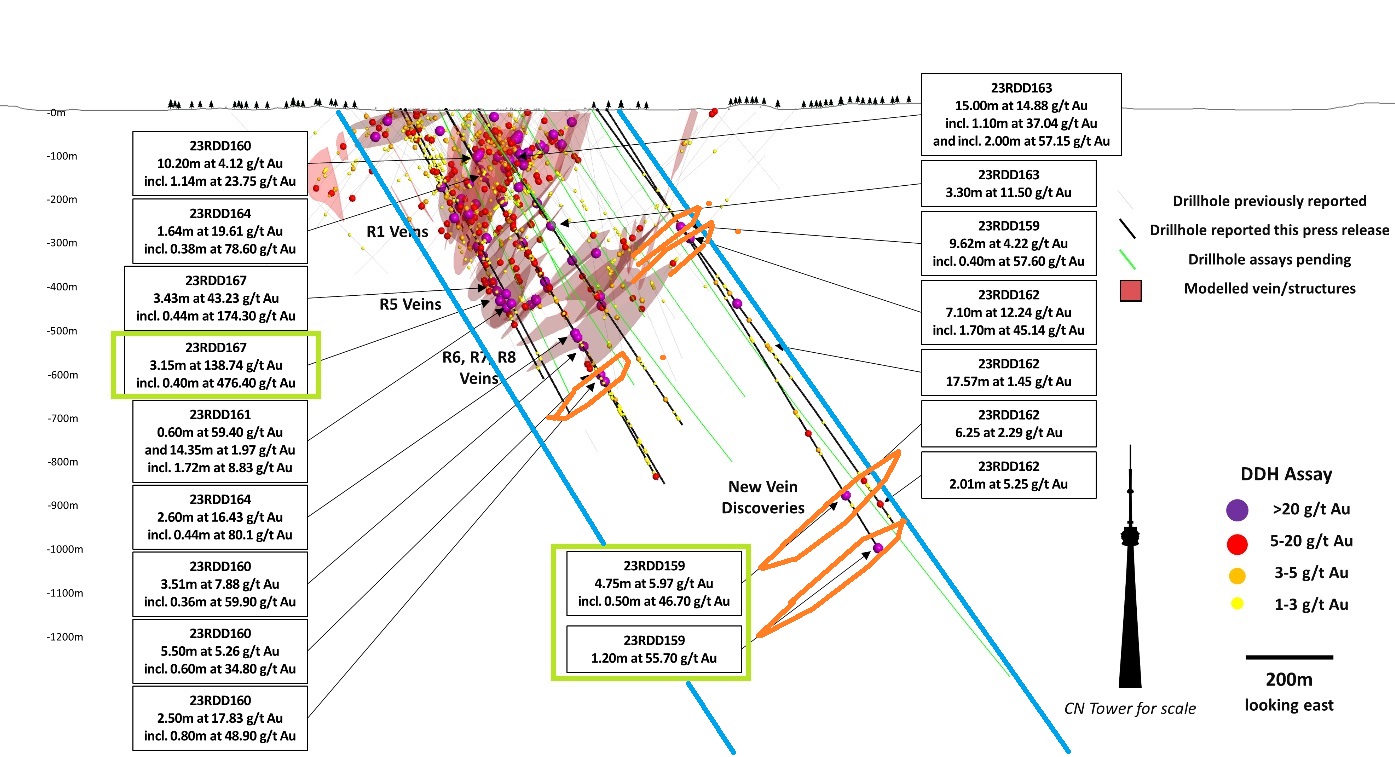

Most interestingly, they extended R5-R8 to the east, but also intercepted parallel structures right below R8 as well, and I tried to visualize all this by hand-drawn orange schematic volumes, with the blue lines indicating the estimated intrusive limits:

This summer will focus more on infill but also step-out drilling at Regnault, especially at depth, as management is aiming at following the intrusive body, which is dipping to the southeast, to depth. The R2 structure could connect to R5-R8 which would imply a strike length of 2km. along with detailed geochemical surveys including till and lake sediment sampling, to advanced ‘brownfields’ targets within the area surrounding Regnault, especially to the east. Flood believes there is still significant discovery potential in the area and look forward to advancing these targets (green square below), which will then likely be drill tested next winter. The idea of the controlling structure at Regnault is a shear body trending east to west.

JV partner Sumitomo is pleased by the results, and tends to be more interested towards an emphasis on infill drilling, as they contemplated interest in a resource estimate in the not too distant future. CEO Flood, being the explorer he is, would love to find out first how big the system could be, but also understands that Sumitomo would be satisfied with a 2.5-3Moz gold deposit, and exploration potential at depth would then be drilled during underground mining, which would be much more cost-effective, as deep drilling from surface would be very expensive.

On a sidenote, the Cressida target, which looked interesting on the till sampling heat map below (blue square), generated some modest drill results, and according to CEO Flood as they are re-evaluating regional strategies each year, they might return there in 2024.

With the current results in hand, it should be possible to update my back-of-the-envelope estimate for the mineralized potential at Regnault.

The R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be simplified as one zone. This results in an unchanged, very global back-of-the-envelope estimate on the R1 structure, and arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at an average guesstimated grade of 6g/t Au, this would mean a hypothetical 870koz Au.

The R2 back-of-the-envelope guesstimate stands unchanged at 900 x 200 x 2 x 2.75 = 990kt, at an average guesstimated grade of 8g/t Au this remains a hypothetical 255koz Au. For the R3 structure we have more visual information now, so the envelope could be estimated at 600 x 200 x 4 x 2.75 = 1.3Mt, at an average estimated grade of 7g/t this results in a hypothetical 294koz Au. The R4 structure to the north seems to be consisting of fairly narrow veins as well, 200m long and 225m deep, however not continuous from surface but separate vein structures, so the combined mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 10g/t Au this could imply a hypothetical 36koz Au. This results in a total hypothetical estimate for R1-R4 of 1.46Moz Au.

For the R5-R8 vein the data has become more complex with significant variation in average grades, even with additional structures indicated in between these veins, so I will try to estimate numbers per vein. For the R5 vein, the envelope is estimated at 700 x 75 x 5 x 2.75 = 722kt, at an average estimated grade of 10g/t this results in a hypothetical 233koz Au. The very high grade result of 3.15m @ 138.74g/t Au could lift this to 250koz Au.

I estimate the R6-8 veins to be extended for another 200m, by the results of 23RDD159 and 23RDD162. For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated now at 1000 x 75 x 6 x 2.75 = 1237kt, at an average estimated grade of 8g/t this results in a hypothetical 318koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 850 x 50 x 7 x 2.75 = 818kt, at an average estimated grade of 8g/t this results in a hypothetical 210koz Au. For the R8 vein, the envelope is estimated at 850 x 80 x 3 x 2.75 = 561kt, at an average estimated grade of 8g/t this results in a hypothetical 144koz Au.

I also noted a new structure right below R8, which I call R9. The envelope for this one is estimated conservatively at 200 x 50 x 3 x 2.75 = 82.5kt, at an average grade of 8g/t this results in a hypothetical 21koz Au. New veins were also discovered at depth, which I will call R10 and R11. Although defined by just one intercept, I will take an armwaving gamble and assume lengths for both of 400m. This would result in 400 x 50 x 2 x 2.75 = 110kt @ 10g/t = 35koz Au for R10, and 400 x 50 x 1 x 2.75 = 55kt @ 20g/t = 35koz Au for R11.

These veins result in a total, hypothetical number of 1,013koz Au.

My overall estimate would come in at an hypothetical 2.47Moz Au for now, up over 10% from my last estimate of 2.2Moz Au. For average grade I maintain an estimated 7-8g/t Au, as the high grade result was just a unique outlier until now. When listening to CEO Flood between the lines, I do believe Sumitomo will draw the line at 2.8-3Moz Au potential, and I also believe I have been conservative in my estimates, so Kenorland could be closer to having to complete a NI43-101 resource estimate than anticipated by many. The upcoming summer program might even be the last majority focused exploration/step-out drill program in my view.

That’s it for flagship Regnault for now, let’s have a look at 2 of the most important other projects. The Chebistuan Project, Quebec saw a maiden 2,170m, 7 hole diamond drill program recently completed at the Deux Orignaux target area. Results are expected in the next few weeks. This target area was defined by gold and pathfinder element anomalism in glacial overburden identified following multiple phases of systematic geochemical surveys, beginning with a regional program in 2021 covering the entire 159,690-hectare property. The Chebistuan Project is held under an earn-in agreement with Newmont.

Tanacross Project, Alaska: The recently approved 2023 exploration budget and program includes 4,500m of diamond drilling scheduled to commence in June. Drilling will focus on three target areas; East Taurus, West Taurus, and South Taurus. Results are expected late fall/early winter if drilling wraps up in September. The Tanacross Project is currently held under an earn-in agreement with Antofagasta Minerals S.A.

The company is operator for many other projects, which were updated in my last, recent article about the company, which you can find here if interested.

Finally, Kenorland holds C$14.07M in equity interests and private holdings, of which about C$10M is accounted for by a holding in LiFT Power, a lithium junior of which the CEO Francis McDonald is a founder of Kenorland and still an advisor. LiFt Power recently commenced a 45,000m drill program, and as they are working in the Northwest Territories, they don’t have to halt exploration work due to wildfires, like other provinces in Canada at the moment, potentially giving them a headstart over James Bay-oriented lithium juniors. Regarding the wildfires in Quebec, where many of Kenorland’s projects are located, according to CEO Flood most field crews are in between field programs, so the company isn’t too affected by the wildfires for now fortunately.

Conclusion

With Kenorland delineating more and more ounces at depth at Regnault, the question becomes if Sumitomo has seen enough for a resource estimate or not, shifting drilling budgets from step-out exploration to grow Regnault as big as possible to more infill drilling, in order to get to a NI43-101 compliant resource. According to my estimates, Kenorland could be very close to 2.5Moz Au, which in turn could be very close to a potential 2.5-3Moz Au threshold for Sumitomo, which doesn’t need Tier I deposits like Barrick. The summer program at Regnault will begin soon after all results of the winter program are in, which undoubtedly will increase the size of the mineralized envelope further. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals and LiFT Power. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

This newsletter/article is not meant to be investment advice, as Criticalinvestor.eu (from now on website, newsletter, and all persons or organisations directly related to it, for example but not limited to: owner, editor, the Seekingalpha author The Critical Investor, publisher, host company, employees, associates, sponsoring companies) is no registered investment advisor. Therefore it is not intended to meet your specific individual investment needs and it is not tailored to your personal financial situation. This newsletter/article reflects the personal and therefore subjective views and opinions of Criticalinvestor.eu and nothing else. The information herein may not be complete, up to date or correct. This newsletter/article is provided in good faith but without any legal responsibility or obligation to provide future updates.

Through use of this website and its newsletter viewing or using you agree to hold Criticalinvestor.eu harmless and to completely release them from any and all liability due to any and all loss (monetary or otherwise), damage (monetary or otherwise), or injury (monetary or otherwise) that you may incur.

You understand that Criticalinvestor.eu could be an investor and/or active trader, meaning that Criticalinvestor.eu could buy and sell certain securities at all times, more specific any or all of the stocks mentioned in own newsletters/articles and other own content like the Watchlist, Leveraged List, etc.

No part of this newsletter/article may be reproduced, copied, emailed, faxed, or distributed (in any form) without the express written permission of Criticalinvestor.eu. Everything contained herein is subject to international copyright protection. The full disclaimer can be found here.